Working Paper Number 90 July 2006

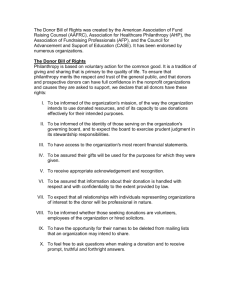

advertisement