Finance Seminar Series 2011-2012 Boston College, Carroll School of Management Date

advertisement

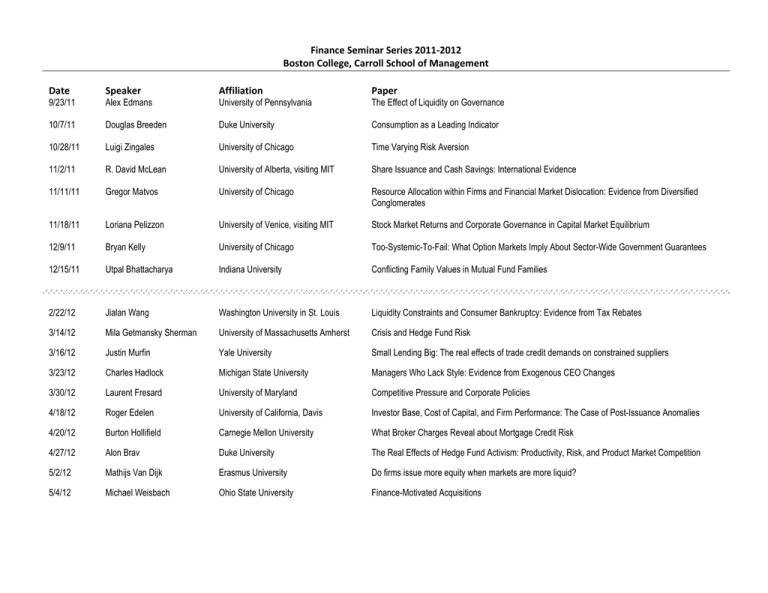

Finance Seminar Series 2011-2012 Boston College, Carroll School of Management Date Speaker Affiliation Paper 9/23/11 Alex Edmans University of Pennsylvania The Effect of Liquidity on Governance 10/7/11 Douglas Breeden Duke University Consumption as a Leading Indicator 10/28/11 Luigi Zingales University of Chicago Time Varying Risk Aversion 11/2/11 R. David McLean University of Alberta, visiting MIT Share Issuance and Cash Savings: International Evidence 11/11/11 Gregor Matvos University of Chicago Resource Allocation within Firms and Financial Market Dislocation: Evidence from Diversified Conglomerates 11/18/11 Loriana Pelizzon University of Venice, visiting MIT Stock Market Returns and Corporate Governance in Capital Market Equilibrium 12/9/11 Bryan Kelly University of Chicago Too-Systemic-To-Fail: What Option Markets Imply About Sector-Wide Government Guarantees 12/15/11 Utpal Bhattacharya Indiana University Conflicting Family Values in Mutual Fund Families 2/22/12 Jialan Wang Washington University in St. Louis Liquidity Constraints and Consumer Bankruptcy: Evidence from Tax Rebates 3/14/12 Mila Getmansky Sherman University of Massachusetts Amherst Crisis and Hedge Fund Risk 3/16/12 Justin Murfin Yale University Small Lending Big: The real effects of trade credit demands on constrained suppliers 3/23/12 Charles Hadlock Michigan State University Managers Who Lack Style: Evidence from Exogenous CEO Changes 3/30/12 Laurent Fresard University of Maryland Competitive Pressure and Corporate Policies 4/18/12 Roger Edelen University of California, Davis Investor Base, Cost of Capital, and Firm Performance: The Case of Post-Issuance Anomalies 4/20/12 Burton Hollifield Carnegie Mellon University What Broker Charges Reveal about Mortgage Credit Risk 4/27/12 Alon Brav Duke University The Real Effects of Hedge Fund Activism: Productivity, Risk, and Product Market Competition 5/2/12 Mathijs Van Dijk Erasmus University Do firms issue more equity when markets are more liquid? 5/4/12 Michael Weisbach Ohio State University Finance-Motivated Acquisitions