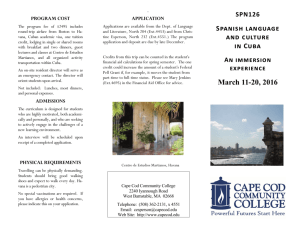

Real Estate Investment Opportunities in Cuba &

advertisement