Appendix for “How the Housing and Financial Wealth Effects Abstract

advertisement

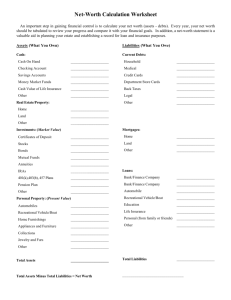

Appendix for “How the Housing and Financial Wealth Effects have changed over Time” 1 June 2011 Abstract This appendix includes results referred to in Brady and Stimel (2011) but not included in the text for brevity. Included are results from unit root tests on the variables in Brady and Stimel (2011); a figure showing the residuals on which cointegration tests were performed; impulse response functions (IRFs) generated from VAR estimation with typical standard error bands (corresponding to Figures 2 through 5 in Brady and Stimel (2011)); both linear projection IRFs and VAR IRFs of the variables in response to a shock to consumption; and results of break tests and IRFs for alternative versions of our model, for example, with labor income in place of disposable income. Ryan R. Brady Department of Economics United States Naval Academy 589 McNair Road, Stop 10D Annapolis, MD 21402-5030 410-293-6883 rbrady@usna.edu Derek Stimel Menlo College 461Brawner Hall 1000 El Camino Real Atherton, CA 94027-4301 650-543-3752 dstimel@menlo.edu 1 Brady, Ryan, and Derek Stimel (2011) “How the Housing and Financial Wealth Effects have changed over time,” United States Naval Academy Working Paper, #2011-31. Table of Contents Table A1: Unit Root Test Statistics 1952:1 to 2009:4 . . . . . . . . . . . . . . . . . . . . . . . . . 3 Table A2: Structural Breaks on Alternative Specifications: 1952:1 to 2009:4 . . . . . . . 4 Figure A1: The Residual Series . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Figure A2: Impulse Responses from a one percent shock to Consumption . . . . . . . . . 6 Figure A3: VAR-generated Impulse Responses for Comparison to Linear Projections 7 Figure A4: Impulse Response Functions with Labor Income . . . . . . . . . . . . . . . . . . . . 12 Figure A5: Impulse Response Functions with Real Estate Assets . . . . . . . . . . . . . . . . 17 Figure A6: Impulse Response Functions with Real Estate Assets and Labor Income 22 Figure A7: Impulse Response Functions with Stock Market Assets . . . . . . . . . . . . . . 27 Figure A8: Impulse Response Functions with Stock Market Assets and Labor Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 Figure A9: Impulse Response Functions with Real Estate Assets and Stock Market Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 Figure A10: Impulse Response Functions with Real Estate Assets, Stock Market Assets and Labor Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 Figure A11: Impulse Response Functions with Federal Funds Rate . . . . . . . . . . . . . . 47 2 Table A1: Unit Root Test Statistics, 1952:1 to 2009:4 Test: Ho: Variable is I(1) Variable Consumption Liabilities Tangible Assets Financial Assets Disposable Income Augmented Dickey-Fuller Test Phillips-Perron Test No No Intercept or Intercept Intercept Intercept or Intercept Intercept Trend Only and Trend Trend Only and Trend 3.43 -1.28 -2.64 9.82 -1.50 -2.44 [0.99] [0.64] [0.26] [1.00] [0.53] [0.36] 1.69 -1.52 -3.58 5.69 -1.93 -3.03 [0.98] [0.52] [0.03] [1.00] [0.32] [0.13] 1.69 -1.24 -5.18 2.66 -1.41 -2.51 [0.98] [0.66] [0.00] [1.00] [0.58] [0.32] 2.55 -0.71 -2.12 2.82 -0.74 -2.10 [0.99] [0.84] [0.53] [1.00] [0.83] [0.54] 7.13 -1.88 -2.24 7.77 -2.09 -2.14 [1.00] [0.34] [0.47] [1.00] [0.25] [0.52] Test: Ho: Variable is I(2) -1.89 -4.03 -4.15 -13.20 -14.98 -15.02 [0.06] [0.00] [0.01] [0.00] [0.00] [0.00] -1.99 -2.67 -2.80 -6.39 -9.00 -9.25 Liabilities [0.05] [0.08] [0.20] [0.00] [0.00] [0.00] -3.74 -4.14 -4.19 -8.67 -9.31 -9.40 Tangible Assets [0.00] [0.00] [0.01] [0.00] [0.00] [0.00] -11.77 -12.19 -12.16 -11.77 -12.30 -12.28 Financial Assets [0.00] [0.00] [0.00] [0.00] [0.00] [0.00] -4.39 -16.84 -17.00 -15.40 -16.86 -17.01 Disposable Income [0.00] [0.00] [0.00] [0.00] [0.00] [0.00] Notes: The null hypotheses of both unit root tests are that the series contains a unit root. Tstatistics and adjusted t-statistics with associated p-values (in brackets). Augmented Dickey-Fuller test with Schwarz criterion selection of up to 8 Lags. Phillips-Perron test with automatic bandwith selection using Newey-West bandwidth. Consumption 3 Table A2: Structural Breaks on Alternative Specifications: 1952:1 to 2009:4 Break Dates (95% Confidence Interval) With Labor Income 1966:1 (1965:4, 1966:2) 1984:4 (1983:3, 1985:1) 1997:1 (1996:4, 1997:2) With Real Estate Assets 1973:3 (1973:2, 1973:4) 1985:1 (1984:4, 1985:2) 1998:2 (1998:1, 1998:3) With Real Estate Assets and Labor Income 1972:3 (1972:2, 1972:4) 1984:1 (1983:4, 1984:2) 1997:1 (1996:4, 1997:2) With Stock Market Assets 1973:3 (1973:2, 1973:4) 1985:1 (1984:4, 1985:2) 1998:2 (1998:1, 1998:3) With Stock Market Assets and Labor Income 1973:3 (1973:2, 1973:4) 1985:1 (1984:4, 1985:2) 1998:2 (1998:1, 1998:3) With Real Estate Assets and Stock Market Assets 1973:3 (1973:2, 1973:4) 1985:1 (1984:4, 1985:2) 1998:2 (1998:1, 1998:3) With Real Estate Assets, Stock Market Assets and Labor Income 1972:3 (1972:2, 1972:4) 1984:1 (1983:4, 1984:2) 1997:1 (1996:4, 1997:2) With Federal Funds Rate 1971:1 (1969:4, 1971:2) 1984:4 (1984:3, 1985:1) 1998:4 (1998:3, 1999:1) Notes: Break dates (in bold) and associated 95 percent confidence intervals (in parantheses) are estimated using the Qu and Perron (2002) method. Each row designates a different specification with alternative variables substituted in to our main specification; for example "With Real Estate Assets and Labor Income" means the five-variable system includes consumption, labor income, liabilities, finanical wealth, and real estate wealth. The last row displays results for a six-variable system, with our main variables plus the Federal Funds rate. See main text for variable definitions and sources. 4 Figure A.1 The Residual Series 8 Consumption on Constant, Disposable Income, Net Worth 6 Consumption on Constant, Disposable Income, Total Assets Consumption on Constant, Disposable Income, Financial Assets, Tangible Assets Consumption on Constant, Disposable Income, Financial Assets, Tangible Assets, Liabilities 4 2 0 -2 -4 -6 Notes: Residuals generated from single-equation ordinary least squares regressions; the variables in each regression are listed in the legend above. The sample for each regression spans 1952 through 2009. See text for variable definitions. 5 Figure A2: Impulse Responses from a one percent shock to Consumption Percent (%) consumption 2.0 1.0 0.0 -1.0 liabilities 6 3 0 5 10 15 20 -3 Percent (%) consumption 2.5 1.5 0.5 -0.5 Percent (%) 1.5 0.5 -0.5 -1.5 5 10 15 20 liabilities 5 10 15 20 4 2 0 -2 consumption 2 0 5 10 15 20 -2 0.8 0 0.0 -0.4 -2 5 10 15 20 -1.2 1.6 0.8 0.0 -0.8 5 10 15 20 5 10 15 20 -4 5 10 15 20 5 10 15 20 financial assets 5 3 1 -1 -3 6 2 -2 -6 0 5 10 15 20 -2 3 1 5 10 15 20 -1 financial assets 0 -8 5 10 15 20 income financial assets 3 0.5 1 -1 -0.5 -3 -5 -1.5 5 10 15 20 8 5 10 15 20 income 4 2 financial assets 5 3 1 -1 -3 1998:3 to 2004 tangible assets liabilities 3 1 -1 -3 5 10 15 20 1985:2 to 1998:2 tangible assets 1.2 0.4 -0.8 5 10 15 20 1973:4 to 1985:1 tangible assets 4 liabilities consumption Percent (%) 1952 to 1973:3 tangible assets 1.2 0.4 -0.4 -1.2 5 10 15 20 5 10 15 20 income 5 10 15 20 income 5 10 15 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. See text for variable definitions. 6 Figure A3: VAR-generated Impulse Responses: A one percent shock to Consumption 1952:1 to 1973:3 Percent (%) Consumption 2.0 1.5 1.0 0.5 0.0 -0.5 Liabilities Tangible Assets 2 1 0 -1 5 10 15 20 -2 5 10 15 20 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 Financial Assets Income 2 2.0 1 1.0 0 0.0 -1 5 10 15 20 -2 5 10 15 20 -1.0 5 10 15 20 15 20 15 20 15 20 1973:4 to 1985:1 Percent (%) Consumption 4 3 2 1 0 -1 -2 Liabilities Tangible Assets 8 4 0 5 10 15 20 -4 5 10 15 20 8 6 4 2 0 -2 5 10 15 Financial Assets 20 3 2 1 0 -1 -2 Income 3 1 -1 5 10 15 20 -3 5 10 1985:2 to 1998:2 Percent (%) Consumption 3 2 1 0 -1 -2 5 10 15 Liabilities 20 Tangible Assets 2 2 0 -2 -2 -6 -4 5 10 15 20 -10 5 10 15 Financial Assets 20 8 4 0 -4 -8 -12 Income 2 0 -2 5 10 15 20 -4 5 10 1998:3 to 2009:4 Percent (%) Consumption 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 15 Liabilities 20 3 2 1 0 -1 -2 -3 5 10 15 Tangible Assets 20 6 4 2 0 -2 -4 -6 5 10 15 Financial Assets 20 4 2 0 -2 -4 -6 Income 1.0 0.5 0.0 -0.5 5 10 15 20 -1.0 5 10 Notes: Impulse responses generated from a five-variable VAR with short run restrictions imposed (variable order is as shown across the columns). The solid line represents the IRF, the dashed lines represent the asymptotic plus and minus two-standard error bands. The horizon is measured in quarters. See text for variable definitions and sample divisions. Each sub-sample estimated with two lags. 7 Figure A3 continued: A one percent shock to Liabilities 1952:1 to 1973:3 Percent (%) Consumption 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 15 Liabilities 20 3.0 2.5 2.0 1.5 1.0 0.5 5 10 15 Tangible Assets 20 0.8 0.4 0.0 -0.4 -0.8 -1.2 5 10 15 Financial Assets 20 2.0 1.5 1.0 0.5 0.0 -0.5 5 10 15 Income 20 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 15 20 15 20 15 20 15 20 1973:4 to 1985:1 Percent (%) Consumption 2 1 0 -1 -2 -3 -4 Liabilities Tangible Assets 2 -2 -6 5 10 15 20 -10 5 10 15 20 4 2 0 -2 -4 -6 -8 5 10 15 Financial Assets 20 2 1 0 -1 -2 -3 Income 2 0 -2 5 10 15 20 -4 5 10 1985:2 to 1998:2 Percent (%) Consumption 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 15 Liabilities 20 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 5 10 15 Tangible Assets 20 4 3 2 1 0 -1 -2 Financial Assets Income 4 2 0 5 10 15 20 -2 5 10 15 20 1.6 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 1998:3 to 2009:4 Percent (%) Consumption .6 .4 .2 .0 -.2 -.4 -.6 5 10 15 Liabilities 20 2 1 0 -1 -2 -3 5 10 15 Tangible Assets 20 1 0 -1 -2 -3 -4 5 10 15 Financial Assets 20 3 2 1 0 -1 -2 -3 Income .6 .2 -.2 5 10 15 20 -.6 5 10 Notes: See notes to Figure A3. 8 Figure A3 continued: A one percent shock to Tangible Assets 1952:1 to 1972:3 Percent (%) Consumption 0.5 0.0 -0.5 -1.0 -1.5 -2.0 Liabilities Tangible Assets 1 0 -1 -2 5 10 15 -3 20 Financial Assets 1.0 0.5 0.0 -0.5 -1.0 5 10 15 20 5 10 15 20 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0 5 10 15 Income 20 0.5 0.0 -0.5 -1.0 -1.5 -2.0 5 10 15 20 15 20 15 20 15 20 1973:4 to 1985:1 Percent (%) Consumption 1.6 1.2 0.8 0.4 0.0 -0.4 5 10 15 Liabilities 20 4 3 2 1 0 -1 -2 Tangible Assets 3 2 1 0 5 10 15 20 -1 5 10 15 Financial Assets 1.2 0.8 0.4 0.0 -0.4 -0.8 20 5 10 15 Income 1.5 1.0 0.5 0.0 -0.5 -1.0 20 5 10 1985:2 to 1998:2 Consumption Liabilities Percent (%) 0.5 0.0 -0.5 -1.0 -1.5 5 10 15 20 2 1 0 -1 -2 -3 5 10 15 Tangible Assets 20 3 2 1 0 -1 -2 -3 5 10 15 Financial Assets 20 4 2 0 -2 -4 -6 5 10 15 Income 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0 20 5 10 1998:3 to 2009:4 Percent (%) Consumption .8 .6 .4 .2 .0 -.2 Tangible Assets Liabilities Financial Assets 2.8 4 2.0 10 15 2 2 1.2 5 Income 3 1 0.4 0 0 -0.4 20 -2 -1 5 10 15 20 5 10 15 20 5 10 15 20 .6 .4 .2 .0 -.2 -.4 5 10 Notes: See notes to Figure A3. 9 Figure A3 continued: A one percent shock to Financial Assets 1952:1 to 1973:3 Percent (%) Consumption .4 .3 .2 .1 .0 -.1 -.2 5 10 15 Liabilities 20 .6 .4 .2 .0 -.2 -.4 5 10 15 Tangible Assets 20 .4 .3 .2 .1 .0 -.1 Financial Assets Income 1.2 .4 0.8 .2 0.4 5 10 15 20 0.0 .0 -0.4 -.2 5 10 15 20 5 10 15 20 15 20 15 20 15 20 1973:4 to 1985:1 Percent (%) Consumption .4 .2 .0 -.2 -.4 -.6 5 10 15 Liabilities 20 0.8 0.4 0.0 -0.4 -0.8 -1.2 5 10 15 Tangible Assets 20 Financial Assets 0.4 1.5 0.0 1.0 -0.4 0.5 -0.8 0.0 -1.2 -0.5 5 10 15 20 5 10 15 Income 20 .4 .2 .0 -.2 -.4 -.6 5 10 1985:2 to 1998:2 Percent (%) Consumption .8 .6 .4 .2 .0 -.2 -.4 5 10 15 Liabilities 20 1.2 0.8 0.4 0.0 -0.4 -0.8 Tangible Assets Financial Assets 2.0 1.0 0.0 5 10 15 20 -1.0 5 10 15 20 3 2 1 0 -1 -2 5 10 15 Income 20 1.2 0.8 0.4 0.0 -0.4 -0.8 5 10 1998:3 to 2009:4 Percent (%) Consumption Liabilities .04 -.04 -.12 -.20 5 10 15 20 .4 .2 .0 -.2 -.4 -.6 -.8 5 10 15 Tangible Assets 20 0.8 0.4 0.0 -0.4 -0.8 -1.2 5 10 15 Financial Assets 20 1.5 1.0 0.5 0.0 -0.5 -1.0 Income .08 .00 -.08 5 10 15 20 -.16 5 10 Notes: See notes to Figure A3. 10 Figure A3 continued: A one percent shock to Income 1952:1 to 1973:3 Consumption Liabilities Tangible Assets Percent (%) 1.0 0.5 0.5 -0.5 0.0 -1.5 -0.5 -1.0 5 10 15 20 -2.5 5 10 15 20 1.5 1.0 0.5 0.0 -0.5 -1.0 5 10 15 Financial Assets 20 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 5 10 15 Income 20 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 5 10 15 20 15 20 15 20 15 20 1973:4 to 1985:1 Percent (%) Consumption 0.8 0.4 0.0 -0.4 -0.8 -1.2 5 10 15 Liabilities 20 2 1 0 -1 -2 -3 Tangible Assets Financial Assets 2 1 0 -1 5 10 15 20 -2 5 10 15 20 0.8 0.4 0.0 -0.4 -0.8 -1.2 5 10 15 Income 20 1.5 1.0 0.5 0.0 -0.5 -1.0 5 10 1985:2 to 1998:2 Percent (%) Consumption Liabilities 1.6 0.8 0.0 -0.8 5 10 15 20 4 3 2 1 0 -1 -2 Tangible Assets Financial Assets 6 4 2 0 5 10 15 20 -2 5 10 15 20 8 6 4 2 0 -2 -4 Income 3 2 1 0 5 10 15 20 -1 5 10 1998:3 to 2009:4 Percent (%) Consumption Liabilities 0.8 0.4 0.0 -0.4 5 10 15 20 4 3 2 1 0 -1 Tangible Assets Financial Assets 4 2 0 5 10 15 20 -2 5 10 15 20 4 2 0 -2 -4 -6 Income 1.2 0.8 0.4 0.0 5 10 15 20 -0.4 5 10 Notes: See notes to Figure A3. 11 Figure A4: Impulse Responses with Labor Income: A one percent shock to Consumption Percent (%) consumption liabilities 2.0 5 1.2 0.4 -0.4 3 1 -1 10 20 Percent (%) consumption 8 1.6 0.4 -0.8 4 0 -4 20 Percent (%) consumption 1.2 0.8 0.4 0.0 -0.4 10 10 Percent (%) 10 20 1.50 1.00 0.50 0.00 -0.50 20 10 20 20 4 0 -4 10 20 1985:1 to 1997:1 tangible assets 20 0.5 -0.5 -1.5 -2.5 10 20 8 0 10 financial assets 20 -8 10 20 labor income 3 3 1 1 -1 10 20 -1 financial assets 8 4 0 -4 -8 10 20 10 20 labor income 5 3 1 -1 -3 10 20 financial assets labor income 5 1.2 3 0.4 1 -0.4 -1 -3 -1.2 10 20 10 20 1997:2 to 2009:4 tangible assets liabilities 3 1 -1 -3 10 1966:2 to 1984:4 tangible assets 8 liabilities consumption 1.5 0.5 -0.5 -1.5 10 0.5 -0.5 -1.5 20 liabilities 2.8 10 1952:1 to 1966:1 tangible assets 1.5 financial assets 12 4 -4 -12 labor income 2 0 10 20 -2 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. Labor Income is used in place of disposable income in the five-variable system. Labor income is defined as compensation of employees, available from the Bureau of Labor Statistics. See text for additional variable definitions. 12 Figure A4 continued: Impulse Responses with Labor Income: A one percent shock to Liabilities Percent (%) consumption 0.8 2 0.0 0 -0.8 10 20 -2 Percent (%) consumption 1.6 0.8 0.0 -0.8 -1.6 liabilities 2 -1 20 -4 Percent (%) consumption 1.0 0.6 0.2 -0.2 -0.6 10 10 0.8 0.0 -0.8 20 20 10 20 10 10 20 1997:2 to 2009:4 tangible assets 6 20 2 -2 -6 10 20 1.5 0.5 -0.5 -1.5 20 financial assets 2 -2 1 -1 -6 10 20 -3 financial assets -2 10 20 20 10 20 labor income .8 .4 .0 -.4 -.8 financial assets 10 20 labor income 6 1.5 2 -2 -6 0.5 -0.5 -1.5 20 10 10 labor income 3 0 -1.2 labor income 6 -0.4 0 -2 10 2 liabilities 20 1 -1 -3 1.2 0.4 2 10 20 financial assets 3 1985:1 to 1997:1 tangible assets 1.0 0.4 -0.2 -0.8 10 1966:2 to 1984:4 tangible assets 5 3 1 -1 -3 20 10 20 liabilities 1.2 0.8 0.4 0.0 -0.4 consumption Percent (%) 10 5 10 1952:1 to 1966:1 tangible assets 1.6 liabilities 10 20 Notes: See notes to Figure A4. 13 Figure A4 continued: Impulse Responses with Labor Income: A one percent shock to Tangible Assets Percent (%) consumption 0.50 0.00 -0.50 -1.00 -1.50 10 liabilities 20 1.5 0.5 -0.5 -1.5 -2.5 Percent (%) consumption .8 .4 .0 -.4 -.8 10 20 Percent (%) Percent (%) -3 -1 0 -3 10 20 -3 10 10 20 1985:1 to 1997:1 tangible assets 20 1.2 0.4 -0.4 -1.2 20 -2 10 financial assets -1 20 -3 10 20 10 20 labor income 1.0 0.0 -1.0 -2.0 20 1 10 0.5 -0.5 -1.5 -2.5 10 20 labor income .4 .0 -.4 -.8 10 20 1997:2 to 2009:4 tangible assets liabilities 3 1 -1 -3 10 10 labor income financial assets -1 -1.2 20 20 2 liabilities 20 10 1 1 -0.4 10 -1.2 1966:2 to 1984:4 tangible assets 1.2 0.4 10 -1 financial assets 1 consumption .8 .4 .0 -.4 -.8 20 liabilities consumption .4 .0 -.4 -.8 10 1952:1 to 1966:1 tangible assets 1.2 0.4 -0.4 20 6 2 -2 -6 10 financial assets labor income 6 1.6 0.8 2 0.0 -2 -0.8 -6 -1.6 20 10 20 10 20 Notes: See notes to Figure A4. 14 Figure A4 continued: Impulse Responses with Labor Income: A one percent shock to Financial Assets Percent (%) consumption .6 .4 .2 .0 -.2 10 liabilities 20 1.00 0.50 0.00 -0.50 Percent (%) consumption .3 .1 -.1 -.3 Percent (%) 1966:4 to 1984:4 tangible assets liabilities -0.4 10 20 -1.0 .20 .10 .00 10 10 20 20 .24 .16 .08 .00 -.08 20 -.3 -.16 -.5 20 20 10 20 -1.5 10 0.0 -0.6 20 0.2 -0.2 -0.6 -1.0 10 20 20 financial assets 1.2 0.6 -.2 10 labor income .6 .2 -.2 .0 1997:2 2009:4 tangible assets .1 -.1 -.08 10 .2 10 financial assets 1.5 0.5 -0.5 1985:1 to 1997:1 tangible assets liabilities .08 .00 10 .8 .4 .0 -.4 -.8 liabilities consumption Percent (%) 20 0.8 0.2 consumption -.10 10 1952:1 to 1966:1 tangible assets financial assets labor income .5 1.6 1.0 0.6 .2 0.8 0.2 -.1 0.0 -0.2 -.4 -0.8 -0.6 10 20 10 20 10 20 10 20 -.6 10 20 20 labor income .15 .05 -.05 -.15 financial assets 1.2 0.4 -0.4 -1.2 10 10 20 labor income .15 .05 -.05 -.15 -.25 10 20 Notes: See notes to Figure A4. 15 Figure A4 continued: Impulse Responses with Labor Income: A one percent shock to Labor Income Percent (%) consumption .4 .0 -.4 -.8 -0.5 10 -1.5 20 10 Percent (%) consumption 10 20 -1 -3 10 10 Percent (%) 10 10 20 -1 -3 20 10 20 10 20 20 20 -1.2 -1 -3 10 -1.0 -2.5 20 financial assets 10 20 -0.4 0 0.0 -1.2 10 20 -2 -6 10 20 -2 10 20 -0.6 financial assets 4 0 -4 -8 10 20 10 20 labor income 2 1997:2 to 2009:4 tangible assets 20 10 1.2 0.6 6 2 10 -0.4 1.2 0.4 liabilities 2.0 1.0 0.0 -1.0 -2.0 labor income 1.2 0.4 0.8 0.0 -0.8 -1.6 1985:1 to 1997:1 tangible assets liabilities 1.2 0.8 0.4 0.0 -0.4 20 financial assets 1966:2 to 1984:4 tangible assets financial assets labor income 3 3 2.0 1 1 0.5 liabilities consumption Percent (%) 20 3 1 consumption .8 .4 .0 -.4 -.8 .6 .2 -.2 -.6 0.5 1.00 0.50 0.00 -0.50 -1.00 0.8 0.4 0.0 -0.4 1952:1 to 1966:1 tangible assets liabilities 10 20 labor income 1.0 0.0 -1.0 -2.0 10 20 Notes: See notes to Figure A4. 16 Figure A5: Impulse Responses with Real Estate Assets: A one percent shock to Consumption Percent (%) consumption 2.5 1.5 0.5 -0.5 -1.5 liabilities 6 3 10 20 0 -3 Percent (%) consumption 2.0 1.0 10 20 4 2 0 -2 Percent (%) consumption 10 20 4 2 0 -2 1.0 1 0.0 0.0 -1 10 20 -1.0 1.6 0.8 0.0 -0.8 10 20 3 1 -1 -3 10 20 10 20 1985:2 to 1998:2 real estate assets 0.8 -0.8 10 financial assets 5 3 1 -1 -3 1973:4 to 1985:1 real estate assets liabilities consumption Percent (%) 10 1.5 0.5 -0.5 -1.5 20 liabilities 3.0 0.0 1952:1 to 1973:3 real estate assets 20 -3 10 20 10 20 financial assets 6 4 2 0 -2 disposable income 3 1 -1 -3 10 20 disposable income 3 1 10 20 financial assets 2 0 -2 -4 -1 10 20 disposable income 0.5 -0.5 10 20 -1.5 10 20 1998:3 to 2009:4 liabilities real estate assets financial assets disposable income 10 1.2 8 6 0.4 2 0 -0.4 -2 -6 -8 -1.2 10 20 10 20 10 20 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Real Estate Assets” is used in place of tangible assets in the five-variable system. Real Estate Assets is defined from tangible assets excluding durables and software and equipment of non-profit organizations (Table B.100 in the Flow of Funds). See text for additional variable definitions. 17 Figure A5 continued: Impulse Responses with Real Estate Assets: A one percent shock to Liabilities Percent (%) consumption 2.4 1.6 0.8 0.0 -0.8 10 20 4 2 0 -2 Percent (%) consumption 3 1 -0.8 -1.6 -1 -3 20 Percent (%) consumption 1.2 0.4 0.0 10 20 -0.4 -1.2 Percent (%) consumption 0.6 0.2 -0.2 -0.6 -1.0 10 liabilities 0.8 -0.8 10 liabilities 1 -1 10 1973:4 to 1985:1 real estate assets liabilities 0.8 0.0 10 1952:1 to 1973:3 liabilities real estate assets financial assets 2.0 4 1.0 2 0.0 0 -1.0 -2 10 20 10 20 10 20 20 -3 10 20 3 1 -1 -3 10 20 1985:2 to 1998:2 real estate assets 2.0 1.0 0.0 -1.0 -2.0 20 10 20 1998:3 to 2009:4 real estate assets 4 0 -4 -8 20 10 20 financial assets 0.5 -0.5 -1.5 -2.5 10 20 financial assets 4 2 0 -2 10 20 disposable income 2 0 -2 10 20 disposable income 0.5 -0.5 -1.5 -2.5 10 20 disposable income 1.2 0.4 -0.4 -1.2 10 20 financial assets 6 2 -2 -6 10 disposable income 1.2 0.4 -0.4 -1.2 20 10 20 Notes: See notes to Figure A5. 18 Figure A5 continued: Impulse Responses with Real Estate Assets: A one percent shock to Real Estate Assets Percent (%) consumption liabilities 0.8 0.0 -0.8 -1.6 10 20 1.5 0.5 -0.5 -1.5 -2.5 Percent (%) consumption .4 .0 -.4 -.8 Percent (%) Percent (%) 0.0 10 20 10 20 -1.5 10 20 0.0 20 -0.8 10 20 0 20 -2 10 -0.8 10 20 1.0 0.0 -1.0 -2.0 10 20 -2.0 20 6 2 -2 -6 10 -4 10 1 -2 20 .4 .0 -.4 -.8 10 20 20 -1.2 10 20 financial assets 4 10 20 disposable income financial assets disposable income 2 0.4 0 -0.4 -2 1998:3 to 2009:4 real estate assets liabilities 2 10 10 1985:2 to 1998:2 real estate assets liabilities 0.8 10 -0.8 financial assets disposable income 1.2 0.4 0.0 -0.4 -1.2 -1.2 -2.4 -2.0 20 10 20 10 20 1973:4 to 1985:1 real estate assets financial assets 1.6 1.0 0.8 0.0 0.0 -1.0 1.5 0.5 -0.5 consumption .6 .2 -.2 -.6 0.8 liabilities consumption .6 .2 -.2 -.6 1952:1 to 1973:3 real estate assets -5 10 disposable income 0.6 0.2 -0.2 -0.6 -1.0 20 10 20 Notes: See notes to Figure A5. 19 Figure A5 continued: Impulse Responses with Real Estate Assets: A one percent shock to Financial Assets Percent (%) consumption .6 .2 -.2 -.6 1.2 0.4 -0.4 10 20 -1.2 Percent (%) consumption 10 20 -0.8 Percent (%) 10 20 liabilities .2 .0 10 20 -.2 liabilities .10 .00 .2 .0 -.10 -.20 -.2 -.4 10 20 10 10 -.4 10 20 -1.2 10 20 1973:4 to 1985:1 real estate assets financial assets 1.2 1.0 0.4 0.0 -0.4 0.0 consumption Percent (%) 20 0.8 consumption .12 .04 -.04 -.12 10 liabilities .6 .2 -.2 -.6 1952:1 to 1973:3 real estate assets financial assets .8 1.2 .4 0.4 .0 -0.4 liabilities 20 -1.2 10 20 -1.0 10 20 1985:2 to 1998:2 real estate assets financial assets .6 1.2 0.8 .3 0.4 .0 0.0 -.3 -0.4 10 20 10 20 1998:3 to 2009:4 real estate assets 0.6 0.2 -0.2 -0.6 -1.0 20 10 20 financial assets 1.2 0.4 -0.4 -1.2 10 20 disposable income .8 .4 .0 -.4 -.8 10 20 disposable income .4 .0 -.4 -.8 10 20 disposable income .2 .0 -.2 10 20 disposable income .10 .00 -.10 -.20 10 20 Notes: See notes to Figure A5. 20 Figure A5 continued: Impulse Responses with Real Estate Assets: A one percent shock to Disposable Income Percent (%) consumption liabilities 1.5 0.5 -0.5 -1.5 10 20 1.2 1 -1 0.4 -1 -3 Percent (%) liabilities 20 -1.5 Percent (%) consumption .6 .4 .2 .0 -.2 10 20 Percent (%) .6 .2 10 20 10 -0.4 20 0.8 0.4 0.0 -0.4 0.8 0.0 10 10 20 -3 10 1985:2 to 1998:2 financial assets 20 -0.8 10 financial assets disposable income 2.5 1.2 1.5 0.8 0.5 0.4 -0.5 0.0 -1.5 -0.4 20 10 20 10 20 1998:3 to 2009:4 financial assets liabilities 3.5 2.5 1.5 0.5 -0.5 10 disposable income 2.0 1.0 0.0 -1.0 -2.0 20 10 20 1973:4 to 1985:1 financial assets financial assets disposable income 1.2 1.6 1.2 0.8 0.4 0.4 0.0 -0.4 -0.4 -0.8 -1.2 -1.6 -1.2 20 10 20 10 20 10 20 liabilities consumption -.2 10 1.5 0.5 -0.5 10 financial assets 1 consumption .8 .4 .0 -.4 -.8 1952:1 to 1973:3 financial assets 20 6 4 2 0 10 20 financial assets 5 2 -1 -4 10 disposable income 1.2 0.8 0.4 0.0 -0.4 20 10 20 Notes: See notes to Figure A5. 21 Figure A6: Impulse Responses with Real Estate Assets and Labor Income: A one percent shock to Consumption Percent (%) consumption liabilities 1 -1 -3 10 20 6 2 -2 -6 10 Percent (%) consumption 4 1.5 0.5 2 0 10 20 -2 Percent (%) consumption 1.2 0.8 0.4 0.0 -0.4 10 10 Percent (%) 10 20 20 20 3 1 -1 -3 1.2 0.4 0 -0.4 -2 -1.2 10 liabilities 3 1 -1 -3 10 10 20 1984:2 to 1997:1 real estate assets liabilities consumption 1.5 0.5 -0.5 -1.5 1972:4 to 1984:1 real estate assets liabilities 2.5 -0.5 1952:1 to 1972:3 real estate assets financial assets 1.6 4 2 0.8 0 0.0 -2 -0.8 -4 20 10 20 10 20 20 -4 10 20 labor income 2 0 -2 -4 financial assets 5 3 1 -1 -3 10 20 labor income 2 0 10 20 -2 financial assets 3 1 -1 -3 10 20 labor income 0.5 -0.5 10 20 -1.5 10 20 1997:2 to 2009:4 real estate assets financial assets labor income 10 12 2 4 4 0 -2 -4 -8 -12 -2 20 10 20 10 20 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Real Estate Assets” is used in place of tangible assets in the five-variable system. Real Estate Assets is defined from tangible assets excluding durables and software and equipment of non-profit organizations (Table B.100 in the Flow of Funds). Labor Income is used in place of disposable income in the fivevariable system. Labor income is defined as compensation of employees, available from the Bureau of Labor Statistics. See text for additional variable definitions. 22 Figure A6 continued: Impulse Responses with Real Estate Assets and Labor Income: A one percent shock to Liabilities Percent (%) consumption 3.5 2.5 1.5 0.5 -0.5 8 10 20 4 0 -4 Percent (%) consumption 2.0 1.0 0.0 -1.0 -2.0 10 3 1 -1 -3 Percent (%) consumption 20 1.2 0.8 0.4 0.0 -0.4 Percent (%) consumption .6 .2 -.2 -.6 2 0 10 10 1.2 0.4 -0.4 -1.2 20 20 -2 10 financial assets 6 10 20 1972:4 to 1984:1 real estate assets 6 4 2 0 -2 20 10 20 liabilities -.2 10 10 liabilities 20 .6 .2 -.6 1952:1 to 1972:3 real estate assets liabilities 20 3 0 -3 10 20 labor income 4 2 0 -2 financial assets labor income 2 2 0 -1 -4 10 20 -2 1.2 0.6 0.0 0.0 0.0 10 20 20 5 1984:2 to 1997:1 real estate assets financial assets 2.0 2.4 1.0 1.2 -1.0 10 -1.2 10 20 10 20 labor income -0.6 10 20 1997:2 to 2009:4 liabilities real estate assets financial assets labor income 6 6 1.0 2 2 0.0 -2 -2 -6 -6 -1.0 10 20 10 20 10 20 10 20 Notes: See notes to Figure A6. 23 Figure A6 continued: Impulse Responses with Real Estate Assets and Labor Income: A one percent shock to Real Estate Assets Percent (%) consumption 0.8 0.0 -0.8 -1.6 10 20 3 1 -1 -3 Percent (%) consumption .6 .3 .0 -.3 10 20 Percent (%) consumption -.4 0.0 10 20 -0.8 Percent (%) consumption .6 .2 -.2 -.6 0.8 0.0 10 20 10 liabilities -2 10 20 1 -1 -3 10 labor income 1.5 0.5 -0.5 -1.5 -2.5 20 1972:4 to 1984:1 real estate assets 0.4 0 20 10 1.2 2 10 -0.8 20 10 -0.4 10 financial assets 1.00 0.50 0.00 -0.50 -1.00 20 10 20 20 1.6 0.8 0.0 -0.8 10 financial assets 2.0 1.0 0.0 -1.0 -2.0 20 10 20 10 20 labor income .5 .3 .1 -.1 -.3 1984:2 to 1997:1 real estate assets liabilities 0.8 financial assets 3 liabilities .8 .4 .0 -.4 .4 .0 -.8 1952:1 to 1972:3 real estate assets liabilities 10 20 labor income .8 .4 .0 -.4 -.8 10 20 1997:2 to 2009:4 real estate assets financial assets labor income 8 5 1.5 4 2 0.5 0 -1 -0.5 -4 -4 -1.5 20 10 20 10 20 10 20 Notes: See notes to Figure A6. 24 Figure A6 continued: Impulse Responses with Real Estate Assets and Labor Income: A one percent shock to Financial Assets Percent (%) consumption .6 .2 -.2 -.6 1.5 0.5 -0.5 10 20 -1.5 Percent (%) consumption .0 10 20 .6 .2 -.2 -.6 Percent (%) consumption .00 10 20 .20 .10 .00 -.10 Percent (%) consumption 10 10 liabilities .08 .00 .1 -.1 -.08 -.3 -.16 -.5 10 10 20 20 10 -.3 10 20 20 .6 .2 -.2 -.6 10 20 1984:2 to 1997:1 real estate assets 20 .3 .1 -.1 -.3 -1.5 10 20 20 1997:2 to 2009:4 real estate assets 0.4 0.0 -0.4 -0.8 -1.2 20 10 20 0.8 -0.8 financial assets .4 0.0 .0 -0.8 10 20 financial assets 1.2 0.6 -0.6 10 20 financial assets 1.5 0.5 -0.5 -1.5 10 20 10 20 labor income 0.8 0.0 10 labor income 0.0 -0.5 1972:4 to 1984:1 real estate assets liabilities .20 .10 -.10 .0 liabilities .4 .2 -.2 1952:1 to 1972:3 real estate assets financial assets .6 1.5 .3 0.5 liabilities -.4 10 20 labor income .20 .12 .04 -.04 -.12 10 20 labor income .15 .05 -.05 -.15 -.25 10 20 Notes: See notes to Figure A6. 25 Figure A6 continued: Impulse Responses with Real Estate Assets and Labor Income: A one percent shock to Labor Income Percent (%) consumption 0.8 0.0 -0.8 -1.6 10 liabilities 20 2 0 -2 -4 Percent (%) consumption .8 .4 .0 -.4 -.8 10 liabilities 20 1.5 0.5 -0.5 -1.5 Percent (%) consumption 1.2 0.8 0.4 0.0 -0.4 10 Percent (%) 10 liabilities 20 1.2 0.8 0.4 0.0 -0.4 consumption .6 .2 -.2 -.6 10 10 1952:1 to 1972:3 real estate assets financial assets labor income .8 2.0 1 .4 0.5 .0 -1 -1.0 -.4 -.8 -3 -2.5 20 10 20 10 20 10 20 1972:4 to 1984:1 real estate assets 3.0 2.0 1.0 0.0 -1.0 20 10 20 1997:2 to 2009:4 real estate assets 5 2 liabilities -0.4 20 -1.6 -1 10 0.8 0.0 -0.8 -1.6 labor income 1.5 0.5 -0.5 10 20 -1.5 10 20 1984:2 to 1997:1 real estate assets financial assets labor income 1.5 2.0 0.8 1.0 0.5 0.0 0.0 -0.5 -1.0 -1.5 -2.0 -0.8 20 10 20 10 20 10 20 2.0 0.8 10 financial assets 20 -4 financial assets 6 2 -2 10 20 -6 labor income 1.5 0.5 -0.5 10 20 -1.5 10 20 Notes: See notes to Figure A6. 26 Figure A7: Impulse Responses with Stock Market Assets: A one percent shock to Consumption Percent (%) consumption 2.0 1.0 0.0 -1.0 10 liabilities 20 6 4 2 0 -2 Percent (%) consumption 2.5 1.5 0.5 -0.5 10 20 4 2 0 -2 Percent (%) consumption 0.8 0.0 0.0 10 20 -0.8 Percent (%) consumption 0.0 10 10 1985:2 to 1998:2 tangible assets 1.0 0.0 -1.0 -2.0 -3.0 20 10 20 liabilities 1.0 -1.0 1973:4 to 1985:1 liabilities tangible assets 4 2 0 -2 10 20 10 20 liabilities 0.8 -0.8 10 1952:1 to 1973:3 tangible assets 2.0 1.2 0.4 -0.4 -1.2 20 10 20 20 3 1 -1 -3 10 20 stock market assets disposable income 5 4 2 2 -1 -4 10 20 0 -2 10 20 stock market assets disposable income 4 3 0 1 -4 10 20 -1 10 20 stock market assets disposable income 2 0.5 -2 -0.5 -6 10 20 -1.5 10 20 1998:3 to 2009:4 tangible assets stock market assets disposable income 8 20 1.5 4 10 0.5 0 0 -0.5 -4 -8 -10 -1.5 10 20 10 20 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Stock Market Assets” is used in place of financial assets in the five-variable system. Stock Market Assets is defined from financial assets excluding household deposits and credit market instruments (Table B.100 in the Flow of Funds). See text for additional variable definitions. 27 Figure A7 continued: Impulse Responses with Stock Market Assets: A one percent shock to Liabilities Percent (%) consumption 2.0 1.0 0.0 -1.0 10 20 4 2 0 -2 Percent (%) consumption liabilities 1.0 0.0 -1.0 -2.0 10 20 2 0 -2 -4 Percent (%) consumption 0.8 1.0 0.0 0.0 -0.8 10 20 -1.0 consumption Percent (%) 1952:1 to 1973:3 liabilities tangible assets stock market assets disposable income 1.6 6 2.4 4 0.8 1.2 2 0.0 0.0 0 -0.8 -2 -1.2 10 20 10 20 10 20 10 20 10 1973:4 to 1985:1 tangible assets stock market assets disposable income 3 0.8 2 1 -0.4 0 -1 -1.6 -2 -3 -4 -2.8 20 10 20 10 20 10 20 1985:2 to 1998:2 liabilities tangible assets 2.0 1.0 0.0 -1.0 -2.0 10 20 10 20 liabilities 1 -1 -0.4 -1.2 10 20 -3 10 -4 10 20 -1.2 10 20 1998:3 to 2009:4 tangible assets stock market assets disposable income 10 2 1.2 4 -2 0.4 -2 -6 -0.4 3 0.4 stock market assets disposable income 1.2 4 0.4 0 -0.4 20 -10 10 20 -8 10 -1.2 20 10 20 Notes: See notes to Figure A7. 28 Figure A7 continued: Impulse Responses with Stock Market Assets: A one percent shock to Tangible Assets Percent (%) consumption 0.4 -0.4 -1.2 -2.0 liabilities 1 -1 10 20 -3 Percent (%) consumption 1.00 0.50 0.00 -0.50 -1.00 10 20 1.5 0.5 -0.5 -1.5 -2.5 Percent (%) Percent (%) 10 -0.5 -1.5 20 -0.8 10 liabilities 3 1 -1 10 20 -3 10 10 10 20 1985:2 to 1998:2 tangible assets 1.5 0.5 -0.5 stock market assets disposable income 4 0.8 1 0.0 -2 -1.5 -5 0.0 20 20 -1.5 -2.5 20 stock market assets disposable income 1.2 1 0.4 -1 -0.4 -3 -1.2 10 20 10 20 0.8 10 10 -2 -4 1973:4 to 1985:1 tangible assets 2.0 1.0 0.0 -1.0 20 10 20 liabilities consumption .8 .4 .0 -.4 -.8 10 liabilities consumption .6 .2 -.2 -.6 1952:1 to 1973:3 tangible assets stock market assets disposable income 1.5 2 0.5 0.5 0 -0.5 20 10 20 10 20 -0.8 10 20 1998:3 to 2009:4 tangible assets stock market assets disposable income 8 6 0.4 4 2 0 -0.4 -2 -4 -6 -8 -1.2 20 10 20 10 20 10 20 Notes: See notes to Figure A7. 29 Figure A7 continued: Impulse Responses with Stock Market Assets: A one percent shock to Stock Market Assets Percent (%) consumption .3 .1 -.1 -.3 liabilities 0.8 0.2 -0.4 10 20 -1.0 Percent (%) consumption .2 .0 -.2 -.4 10 20 -.6 Percent (%) .00 10 20 .08 .00 10 20 10 20 .15 .05 -.05 -.15 10 20 10 .0 -.2 10 0.4 -0.4 10 20 -1.2 10 20 stock market assets 0.8 0.0 -0.8 10 20 -.6 10 20 disposable income .3 .0 -.3 -.6 10 20 stock market assets disposable income 1.2 .15 0.6 .05 0.0 -.05 -0.6 -.15 20 10 20 10 20 1998:3 to 2009:4 tangible assets liabilities .2 .0 -.2 -.4 -.6 stock market assets disposable income 1.2 .6 0.4 .2 -0.4 -.2 1985:2 to 1998:2 tangible assets .4 .2 liabilities consumption Percent (%) 1973:4 to 1985:1 tangible assets .6 .2 -.2 .6 .2 -.2 .08 -.08 -.16 20 liabilities consumption -.08 10 1952:1 to 1973:3 tangible assets .5 .3 .1 -.1 -.3 10 20 20 -1.2 10 stock market assets disposable income 1.5 .08 0.5 .00 -0.5 -.08 -1.5 -.16 20 10 20 10 20 Notes: See notes to Figure A7. 30 Figure A7 continued: Impulse Responses with Stock Market Assets: A one percent shock to Disposable Income Percent (%) consumption 1.2 0.4 -0.4 -1.2 1 -1 10 20 -3 Percent (%) consumption 1.0 0.6 0.2 -0.2 -0.6 liabilities 1.5 0.5 10 20 -0.5 -1.5 Percent (%) consumption .6 .3 .0 -.3 10 20 Percent (%) .6 .2 10 20 10 1973:4 to 1985:1 tangible assets 1.00 0.50 0.00 -0.50 -1.00 20 10 20 1985:2 to 1998:2 tangible assets liabilities 0.8 0.4 0.0 -0.4 consumption -.2 1952:1 to 1973:3 liabilities tangible assets 1.2 0.8 0.4 0.0 -0.4 10 20 10 20 10 20 liabilities 2.5 1.5 0.5 -0.5 10 20 stock market assets disposable income 3 1.5 1 0.5 -1 -3 -1 -3 0.0 0 20 1998:3 to 2009:4 tangible assets 7 5 3 1 -1 10 20 20 10 20 -0.4 -1.2 10 20 stock market assets 2 10 10 stock market assets disposable income 3 1.2 1 0.4 0.8 -0.8 10 -0.5 -1.5 20 -2 10 disposable income 1.2 0.8 0.4 0.0 -0.4 20 10 20 stock market assets disposable income 6 1.2 2 0.6 -2 0.0 -6 10 20 -0.6 10 20 Notes: See notes to Figure A7. 31 Figure A8: Impulse Responses with Stock Market Assets and Labor Income: A one percent shock to Consumption Percent (%) consumption 2.4 1.2 0.0 -1.2 4 0 10 20 -4 Percent (%) consumption Percent (%) 10 1.0 0.0 -1.0 20 2.4 2 1.2 0 0.0 -1.2 10 20 -2 0.0 10 20 1.0 0.6 0.2 -0.2 -0.6 consumption 1.2 0.4 -0.4 -1.2 10 20 -2 20 10 20 10 10 20 2 0 -2 10 20 0.8 0.0 -0.8 -1.6 -2.4 10 20 -6 10 20 -2 stock market assets 10 20 2 -2 -0.8 -6 10 20 20 -1.6 10 2 -4 0 0 10 20 -10 10 20 20 10 20 labor income 4 -12 10 labor income 0.8 0.0 1998:3 to 2009:4 tangible assets stock market assets liabilities 4 2 0 -2 -4 20 1985:2 to 1998:2 tangible assets liabilities 1.2 0.6 -0.6 10 10 2 -1 -4 1973:4 to 1985:1 tangible assets stock market assets labor income 6 2 2 2 0 0 -2 liabilities consumption Percent (%) 1952:1 to 1973:3 tangible assets stock market assets labor income 2.0 5 4 liabilities -2 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Stock Market Assets” is used in place of financial assets in the five-variable system. Stock Market Assets is defined from financial assets excluding household deposits and credit market instruments (Table B.100 in the Flow of Funds). Labor Income is used in place of disposable income in the five-variable system. Labor income is defined as compensation of employees, available from the Bureau of Labor Statistics. See text for additional variable definitions. 32 Figure A8 continued: Impulse Responses with Stock Market Assets and Labor Income: A one percent shock to Liabilities Percent (%) consumption 2.5 1.5 0.5 -0.5 liabilities 7 10 20 4 1 -2 Percent (%) consumption liabilities 1 -1 -3 10 20 3 1 -1 -3 -5 10 Percent (%) consumption 1973:4 to 1985:1 tangible assets 4 2 0 -2 -4 20 10 20 1985:2 to 1998:2 tangible assets liabilities 0.8 0.8 1.5 0.5 0.0 0.0 -0.5 -0.8 10 20 -0.8 consumption Percent (%) 10 1952:1 to 1973:3 tangible assets stock market assets labor income 8 5 1.5 4 3 0.5 0 1 -0.5 -4 -1 20 10 20 10 20 10 20 1.0 0.6 0.2 -0.2 -0.6 10 liabilities 2 0 10 20 -2 10 20 -1.5 10 20 stock market assets labor income 6 2 2 0 -2 -2 -6 -4 10 20 10 20 stock market assets 4 0 -4 10 20 labor income 1.5 0.5 -0.5 -1.5 10 20 1998:3 to 2009:4 tangible assets stock market assets labor income 6 10 1.5 6 2 0.5 2 -2 -0.5 -2 -6 -6 -1.5 20 10 20 10 20 10 20 Notes: See notes to Figure A8. 33 Figure A8 continued: Impulse Responses with Stock Market Assets and Labor Income: A one percent shock to Tangible Assets Percent (%) consumption 1.0 0.0 -1.0 -2.0 liabilities 4 10 20 1 -2 -5 Percent (%) consumption 2.0 1.2 0.4 -0.4 -1.2 0.0 10 20 Percent (%) consumption .6 .2 -.2 -.6 10 20 1.0 0.6 0.2 -0.2 -0.6 Percent (%) 0.8 0.0 10 10 20 0.8 0.0 -1 0.0 -0.8 20 20 -0.4 liabilities 3 1 -1 -3 10 1985:2 to 1998:2 tangible assets 10 20 labor income 1 1.2 0.4 10 stock market assets 1.6 0.8 liabilities consumption -0.8 1973:4 to 1985:1 tangible assets liabilities 0.8 -0.8 10 1952:1 to 1973:3 tangible assets stock market assets labor income 4 2 1.5 2 0 0.5 0 -2 -0.5 -2 -1.5 -4 -4 20 10 20 10 20 10 20 -1.2 10 20 -3 10 20 -0.8 10 20 stock market assets labor income 4 1.00 0.50 1 0.00 -2 -0.50 -5 -1.00 10 20 10 20 1998:3 to 2009:4 tangible assets stock market assets labor income 8 1.6 6 0.8 2 2 0.0 -4 -2 -0.8 -6 -10 -1.6 20 10 20 10 20 10 20 Notes: See notes to Figure A8. 34 Figure A8 continued: Impulse Responses with Stock Market Assets and Labor Income: A one percent shock to Stock Market Assets Percent (%) consumption .3 .1 -.1 -.3 10 20 0.4 .4 .2 -0.4 .0 -1.2 Percent (%) consumption -.1 10 20 .5 .3 .1 -.1 -.3 Percent (%) consumption .08 .00 .00 10 20 -.08 Percent (%) consumption .04 -.04 -.2 10 -.2 10 10 10 20 -.4 10 stock market assets labor income 1.2 .6 0.4 .2 -0.4 -.2 -1.2 -.6 20 10 20 10 20 1973:4 to 1985:1 tangible assets 20 0.8 .0 0.0 -.3 10 20 1985:2 to 1998:2 tangible assets 20 .15 .05 -.05 -.15 .4 .0 -.4 -.8 -0.8 10 20 0.0 10 20 10 20 labor income .5 .3 .1 -.1 -.3 stock market assets 0.8 1998:3 to 2009:4 tangible assets 20 stock market assets .6 .3 liabilities .2 .0 -.12 20 liabilities .16 .08 -.08 10 liabilities .3 .1 -.3 1952:1 to 1973:3 tangible assets liabilities -0.8 10 20 10 20 20 labor income .20 .10 .00 -.10 -.20 stock market assets 1.2 0.4 -0.4 -1.2 10 10 20 labor income .15 .05 -.05 -.15 -.25 10 20 Notes: See notes to Figure A8. 35 Figure A8 continued: Impulse Responses with Stock Market Assets and Labor Income: A one percent shock to Labor Income Percent (%) consumption 1.5 0.5 -0.5 -1.5 10 20 2 0 -2 -4 Percent (%) consumption .8 .4 .0 -.4 -.8 10 10 20 2.5 1.5 0.5 -0.5 -1.5 20 Percent (%) 1.0 0.6 0.2 -0.2 Percent (%) 2 0 10 -0.8 20 10 20 -2 10 10 20 -3 10 -2.0 20 10 20 1973:4 to 1985:1 tangible assets 20 2.5 1.5 0.5 -0.5 -1.5 10 stock market assets labor income 2.0 1.2 0.8 0.4 -0.4 -0.4 -1.6 -1.2 20 10 20 10 20 1985:2 to 1998:2 tangible assets liabilities consumption .6 .2 -.2 -.6 10 liabilities consumption 1.2 0.8 0.4 0.0 -0.4 1952:1 to 1973:3 tangible assets stock market assets labor income 3 1.0 0.8 1 0.0 0.0 -1 -1.0 liabilities 20 1.2 0.4 -0.4 -1.2 10 20 stock market assets 3 1 -1 -3 labor income 0.8 0.0 10 20 -0.8 10 20 1998:3 to 2009:4 liabilities tangible assets stock market assets labor income 6 4 1.0 2 0 0.0 -2 -4 -1.0 -6 -8 -2.0 10 20 10 20 10 20 10 20 Notes: See notes to Figure A8. 36 Figure A9: Impulse Responses with Real Estate Assets and Stock Market Assets: A one percent shock to Consumption Percent (%) consumption 2.5 1.5 0.5 -0.5 -1.5 6 3 10 20 0 -3 Percent (%) consumption 3.0 2.0 1.0 0.0 10 20 4 2 0 -2 Percent (%) 0.0 20 1.2 0.4 -0.4 -1.2 Percent (%) consumption 0.0 10 20 10 20 3 1 -1 -3 4 2 0 -2 10 20 1985:2 to 1998:2 real estate assets 20 0.8 -0.4 -1.6 -2.8 10 20 1998:3 to 2009:4 real estate assets 10 4 liabilities 1.6 0.8 -0.8 10 liabilities 0.8 10 1973:4 to 1985:1 real estate assets stock market assets disposable income liabilities consumption -0.8 1952:1 to 1973:3 liabilities real estate assets stock market assets disposable income 5 1.5 3 2 0.5 1 -1 -0.5 -1 -1.5 -4 -3 10 20 10 20 10 20 10 20 20 -8 3 0 1 -4 10 20 10 20 -1 10 20 stock market assets disposable income 4 0.8 2 0.0 0 -0.8 -2 -4 -1.6 10 20 10 20 stock market assets disposable income 10 0 -2 10 4 -10 10 20 1.2 0.4 -0.4 -1.2 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Real Estate Assets” is used in place of tangible assets in the five-variable system. Real Estate Assets is defined from tangible assets excluding durables and software and equipment of non-profit organizations (Table B.100 in the Flow of Funds). The variable “Stock Market Assets” is used in place of financial assets in the five-variable system. Stock Market Assets is defined from financial assets excluding household deposits and credit market instruments (Table B.100 in the Flow of Funds). See text for additional variable definitions. 37 Figure A9 continued: Impulse Responses with Real Estate Assets and Stock Market Assets: A one percent shock to Liabilities Percent (%) consumption 2.0 1.0 0.0 -1.0 10 20 4 2 0 -2 Percent (%) consumption liabilities 0.8 0.0 3 1 -0.8 -1.6 -1 -3 10 20 Percent (%) consumption 1.2 0.4 0.8 0.0 -0.8 10 20 -0.4 -1.2 Percent (%) consumption 0.6 0.2 -0.2 -0.6 -1.0 1 -1 10 1952:1 to 1973:3 liabilities real estate assets stock market assets disposable income 2.0 5 3 3 1.0 1 1 0.0 -1 -1.0 -3 -1 10 20 10 20 10 20 10 20 20 -3 10 1973:4 to 1985:1 real estate assets stock market assets disposable income 3 0.8 3 0.0 1 1 -0.8 -1 -1 -1.6 -3 -3 -2.4 20 10 20 10 20 10 20 1985:2 to 1998:2 liabilities real estate assets 2.0 1.0 0.0 -1.0 -2.0 10 20 10 20 stock market assets disposable income 6 1.2 3 0.4 0 -3 10 20 -0.4 -1.2 10 20 1998:3 to 2009:4 liabilities real estate assets stock market assets disposable income 8 1.2 2 4 0.4 -2 0 -0.4 -6 -4 -10 -8 -1.2 10 20 10 20 10 20 10 20 Notes: See notes to Figure A9. 38 Figure A9 continued: Impulse Responses with Real Estate Assets and Stock Market Assets: A one percent shock to Real Estate Assets Percent (%) consumption 0.8 0.0 -0.8 -1.6 10 20 1.5 0.5 -0.5 -1.5 -2.5 Percent (%) consumption .4 .0 -.4 -.8 0.5 -0.5 10 20 -1.5 Percent (%) 20 10 20 -0.8 10 liabilities 2 0 10 20 -2 10 1.6 0.8 0.0 -0.8 10 stock market assets 1.5 0.5 -0.5 -1.5 -2.5 20 10 20 1985:2 to 1998:2 real estate assets 1.0 0.4 -0.2 consumption Percent (%) 10 liabilities .8 .4 .0 .6 .2 -.2 -.6 1973:4 to 1985:1 real estate assets liabilities consumption -.4 1952:1 to 1973:3 liabilities real estate assets stock market assets disposable income 1.6 1.5 1.0 0.5 0.8 0.0 -0.5 0.0 -1.0 -1.5 -0.8 -2.5 -2.0 10 20 10 20 10 20 10 20 20 0.8 0.0 -0.8 -1.6 10 20 disposable income .8 .4 .0 -.4 -.8 10 20 stock market assets disposable income 3 1.00 1 0.50 -1 0.00 -3 -0.50 -5 -1.00 10 20 10 20 1998:3 to 2009:4 real estate assets stock market assets disposable income 8 0.6 4 0.2 4 0 -0.2 0 -4 -0.6 -4 -8 -1.0 20 10 20 10 20 10 20 Notes: See notes to Figure A9. 39 Figure A9 continued: Impulse Responses with Real Estate Assets and Stock Market Assets: A one percent shock to Stock Market Assets Percent (%) consumption .4 .2 .0 -.2 -.4 liabilities 0.8 0.2 -0.4 10 20 -1.0 Percent (%) consumption 10 20 -.6 Percent (%) 20 liabilities .00 10 20 .00 -.10 consumption Percent (%) 10 .20 .10 .08 .04 -.04 -.12 1973:4 to 1985:1 real estate assets .6 .2 -.2 consumption -.08 20 liabilities .3 .1 -.1 -.3 10 10 20 10 20 10 .6 .2 -.2 -.6 20 stock market assets disposable income 1.2 .6 0.4 .2 -0.4 -.2 -1.2 10 20 stock market assets 0.8 0.0 10 20 -0.8 10 20 -.6 10 20 disposable income .3 .1 -.1 -.3 -.5 10 20 1985:2 to 1998:2 real estate assets stock market assets disposable income .4 1.2 .20 .12 .2 0.6 .04 .0 0.0 -.04 -.2 -0.6 -.12 10 20 10 20 10 20 1998:3 to 2009:4 real estate assets liabilities .2 .0 -.2 -.4 1952:1 to 1973:3 real estate assets .5 .3 .1 -.1 -.3 10 20 .4 .0 -.4 -.8 10 20 stock market assets disposable income 1.2 .15 0.4 .05 -0.4 -1.2 10 20 -.05 -.15 10 20 Notes: See notes to Figure A9. 40 Figure A9 continued: Impulse Responses with Real Estate Assets and Stock Market Assets: A one percent shock to Disposable Income Percent (%) consumption 1.5 0.5 -0.5 -1.5 1 -1 10 20 -3 Percent (%) consumption .8 .4 .0 -.4 -.8 liabilities 1.5 0.5 -0.5 10 20 -1.5 Percent (%) consumption .6 .4 .2 .0 -.2 10 20 Percent (%) 1.0 0.6 10 10 20 0.8 0.4 0.0 -0.4 20 10 20 liabilities 3.5 2.5 1.5 0.5 -0.5 10 1973:4 to 1985:1 real estate assets 1.2 0.4 -0.4 stock market assets disposable income 3 1.2 1 0.4 -1 -0.4 -1.2 -3 10 20 1985:2 to 1998:2 real estate assets liabilities consumption 0.2 -0.2 1952:1 to 1973:3 liabilities real estate assets stock market assets disposable income 3 2.0 1.00 1.0 1 0.50 0.0 -1 0.00 -1.0 -0.50 -3 -2.0 10 20 10 20 10 20 10 20 20 2 0.0 0 10 20 1998:3 to 2009:4 real estate assets 8 6 4 2 0 10 20 20 -1.2 10 20 stock market assets 0.8 -0.8 10 -2 10 disposable income 1.2 0.8 0.4 0.0 -0.4 20 10 20 stock market assets disposable income 6 1.2 2 0.6 -2 -6 10 20 0.0 -0.6 10 20 Notes: See notes to Figure A9. 41 Figure A10: Impulse Responses with Real Estate Assets, Stock Market Assets and Labor Income: A one percent shock to Consumption Percent (%) consumption liabilities 1 -1 -3 10 20 6 2 -2 -6 10 Percent (%) consumption liabilities 2.5 4 1.5 0.5 2 0 -0.5 10 20 -2 Percent (%) consumption 1.2 0.8 0.4 0.0 -0.4 10 10 Percent (%) 1972:4 to 1984:1 real estate assets 5 3 1 -1 -3 20 10 20 1984:2 to 1997:1 real estate assets liabilities 20 20 stock market assets labor income 4 2 0 0 -4 10 20 -2 stock market assets 0 4 0.5 -0.4 -2 0 -0.5 -1.2 10 20 10 20 8 0 10 -4 10 20 -1.5 1997:2 to 2009:4 real estate assets stock market assets liabilities 5 3 1 -1 -3 -4 20 -8 10 20 12 4 -4 -12 10 20 labor income 1.2 0.4 consumption 1.5 0.5 -0.5 -1.5 10 1952:1 to 1972:3 real estate assets stock market assets labor income 1.6 4 2 0.8 1 0 0.0 -2 -2 -0.8 -5 -4 20 10 20 10 20 10 20 10 20 labor income 2 0 10 20 -2 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The variable “Real Estate Assets” is used in place of tangible assets in the five-variable system. Real Estate Assets is defined from tangible assets excluding durables and software and equipment of non-profit organizations (Table B.100 in the Flow of Funds). The variable “Stock Market Assets” is used in place of financial assets in the five-variable system. Stock Market Assets is defined from financial assets excluding household deposits and credit market instruments (Table B.100 in the Flow of Funds). Labor income is defined as compensation of employees, available from the Bureau of Labor Statistics. See text for additional variable definitions. 42 Figure A10 continued: Impulse Responses with Real Estate Assets, Stock Market Assets and Labor Income: A one percent shock to Liabilities Percent (%) consumption 3.5 2.5 1.5 0.5 -0.5 8 10 20 4 0 -4 10 Percent (%) consumption liabilities 1.6 0.4 -0.8 -2.0 10 20 3 1 -1 -3 Percent (%) consumption -.2 10 20 1.2 0.8 0.4 0.0 -0.4 Percent (%) consumption .6 .2 -.2 -.6 2 0 10 10 0.8 0.0 -0.8 20 20 -2 10 20 1972:4 to 1984:1 real estate assets 6 4 2 0 -2 20 10 20 1984:2 to 1997:1 real estate assets 2.0 1.0 liabilities .6 .2 -.6 1952:1 to 1972:3 real estate assets stock market assets 1.6 8 liabilities 0.0 10 20 -1.0 10 20 4 0 -4 10 20 labor income 4 2 0 -2 stock market assets 6 2 -2 -6 10 20 labor income 2 0 10 20 -2 10 20 stock market assets labor income 4 1.0 0.6 2 0.2 0 -0.2 -2 -0.6 10 20 10 20 1997:2 to 2009:4 liabilities real estate assets stock market assets labor income 6 6 1.2 2 2 0.4 -2 -2 -0.4 -6 -6 -1.2 10 20 10 20 10 20 10 20 Notes: See notes to Figure A10. 43 Figure A10 continued: Impulse Responses with Real Estate Assets, Stock Market Assets and Labor Income: A one percent shock to Real Estate Assets Percent (%) consumption liabilities 0.5 -0.5 -1.5 10 20 3 1 -1 -3 Percent (%) consumption .6 .3 .8 .4 1.2 .0 .0 0.4 -.3 10 -.4 20 10 20 -0.4 .4 .0 0.8 -.4 0.0 0.0 -.8 -0.8 -0.8 10 20 .6 .2 -.2 -.6 10 20 0 20 -2 10 20 0 10 stock market assets labor income 3 .4 1 .0 -1 -.4 -3 -.8 10 20 10 20 1997:2 to 2009:4 real estate assets stock market assets labor income 8 6 1.5 4 2 0.5 liabilities 2 10 10 stock market assets labor income 1.5 .5 .3 0.5 .1 -0.5 -.1 -1.5 -.3 20 10 20 10 20 1984:2 to 1997:1 real estate assets 1.6 0.8 liabilities consumption Percent (%) 1972:4 to 1984:1 real estate assets liabilities consumption Percent (%) 10 1952:1 to 1972:3 real estate assets stock market assets labor income 3 1.5 0.8 0.5 1 -0.5 0.0 -1 -1.5 -0.8 -3 -2.5 20 10 20 10 20 10 20 20 -4 -2 10 20 -6 -0.5 10 -1.5 20 10 20 Notes: See notes to Figure A10. 44 Figure A10 continued: Impulse Responses with Real Estate Assets, Stock Market Assets and Labor Income: A one percent shock to Stock Market Assets Percent (%) consumption .5 .2 1.2 0.4 -.1 -0.4 -.4 10 20 -1.2 Percent (%) consumption .25 .15 .05 -.05 -.15 10 20 .5 .3 .1 -.1 -.3 Percent (%) .08 .00 .00 20 -.08 Percent (%) consumption -.04 10 10 20 .05 -.05 -.15 -.25 -.35 10 .3 .1 -.1 -.3 10 stock market assets labor income 1.2 .6 0.4 .2 -0.4 -.2 -1.2 -.6 20 10 20 10 20 1972:4 to 1984:1 real estate assets stock market assets labor income .5 1.2 .3 .2 0.6 .1 -.1 0.0 -.1 -.4 -0.6 -.3 20 10 20 10 20 10 20 1984:2 to 1997:1 real estate assets 20 .24 .12 .00 -.12 10 stock market assets labor income 1.2 .16 0.8 .08 0.4 .00 0.0 -0.4 -.08 20 10 20 10 20 1997:2 to 2009:4 real estate assets liabilities .04 -.12 10 20 liabilities .16 .08 10 10 liabilities consumption -.08 1952:1 to 1972:3 real estate assets liabilities 20 0.2 -0.2 -0.6 -1.0 stock market assets labor income 1.2 .10 0.4 .00 -0.4 10 20 -1.2 -.10 10 20 -.20 10 20 Notes: See notes to Figure A10. 45 Figure A10 continued: Impulse Responses with Real Estate Assets, Stock Market Assets and Labor Income: A one percent shock to Labor Income Percent (%) consumption 1.0 0.0 -1.0 -2.0 10 20 2 0 -2 -4 10 Percent (%) consumption liabilities 0.8 2.0 0.8 0.0 -0.4 -0.8 10 20 -1.6 10 Percent (%) consumption 1.2 0.8 0.4 0.0 -0.4 10 Percent (%) 0.4 -0.2 -0.8 20 20 1.2 0.8 0.4 0.0 -0.4 -0.5 10 20 -0.5 -2.0 -1.5 10 20 1997:2 to 2009:4 real estate assets 6 2 liabilities 20 20 1984:2 to 1997:1 real estate assets 1.5 0.5 2.5 1.0 10 10 1972:4 to 1984:1 real estate assets 3.0 2.0 1.0 0.0 -1.0 20 10 20 liabilities consumption .8 .4 .0 -.4 -.8 1952:1 to 1972:3 real estate assets stock market assets 1.0 3 liabilities -2 10 20 -6 10 20 1 -1 -3 labor income 1 -1 10 20 -3 10 20 stock market assets labor income 1.6 1.5 0.4 0.5 -0.8 -2.0 -0.5 10 20 -1.5 10 20 stock market assets labor income 3 0.8 1 0.0 -1 -3 10 20 -0.8 10 20 stock market assets labor income 8 1.5 4 0.5 0 -0.5 -4 -8 -1.5 10 20 10 20 Notes: See notes to Figure A10. 46 Percent (%) Percent (%) Percent (%) Figure A11: Impulse Responses with Federal Funds Rate: A one percent shock to Consumption federal funds rate consumption 1.2 1.2 0.4 0.4 -0.4 -0.4 -1.2 -1.2 10 20 10 20 federal funds rate 4 2 0 -2 -4 10 20 2.0 1.2 0.4 -0.4 -1.2 consumption 2.5 1.5 0.5 -0.5 10 20 4 2 0 -2 10 20 1.2 0.4 -0.4 -1.2 10 20 1971:2 to 1984:4 liabilities tangible assets 4 2 0 -2 10 20 10 20 1985:1 to 1998:4 federal funds rate consumption lia bilities tangible assets 1.0 1.2 1.0 0.8 0.0 0.0 0.6 -1.0 0.0 -1.0 0.0 -2.0 -2.0 -0.6 -0.8 -3.0 10 20 10 20 10 20 10 20 federal funds rate Percent (%) 1954:1 to 1971:1 lia bilities tangible assets 1.2 0.4 -0.4 -1.2 10 20 consumption 1.6 0.8 0.0 -0.8 10 20 financial assets 2 0 -2 -4 10 20 financial assets 5 2 -1 -4 10 20 income 1.2 0.4 -0.4 -1.2 -2.0 10 20 1999:1 to 2009:4 lia bilities tangible assets financial assets 10 12 2 6 4 2 0 -4 -2 -2 -6 -12 10 20 10 20 10 20 20 income 2 0 -2 financial assets 2 0 -2 -4 10 10 20 income 1.2 0.4 -0.4 -1.2 10 20 income 2.0 1.0 0.0 -1.0 -2.0 10 20 Notes: The impulse response functions (IRFs) are estimated using Jordà's (2005) linear projection technique. The solid line represents the impulse response function; the dashed lines are Jordà’s (2009) 95 percent conditional confidence bands. The horizon for each IRF is measured in quarters. The Federal funds rate is added to our main specification reported in the paper. The sample for this model begins in 1954—based on availability of the Federal Funds rate—later than the main model in the paper. See text for variable definitions. 47 Figure A11: Impulse Responses with Federal Funds Rate: A one percent shock to Liabilities Percent (%) federal fun ds rate 0.8 consumption 1.2 0.0 0.4 -0.8 -0.4 10 20 Percent (%) Percent (%) Percent (%) federal funds rate 2 0 -2 10 20 10 20 3.0 2.0 1.0 0.0 1971:2 to 1984:4 liabilities tangible assets consumption 2.0 1.0 0.0 -1.0 10 20 federal funds rate consumption 1.2 1.2 0.4 0.6 -0.4 0.0 -1.2 -0.6 10 20 10 20 federal funds rate consumption 0.6 0.8 0.2 -0.2 0.0 -0.6 -1.0 -0.8 10 20 10 20 1954:1 to 1971:1 liabilities tangible assets 1.0 0.6 0.2 -0.2 -0.6 10 20 10 20 3 1 -1 -3 2 0 10 20 -2 10 20 1985:1 to 1998:4 lia bilities tangible assets 1.6 0.8 0.0 -0.8 1.0 0.0 -1.0 -2.0 2 0 10 20 -2 10 20 1999:1 to 2009:4 lia bilities tangible assets 3 0 -3 -6 10 20 10 20 financial assets 4 2 0 -2 10 20 financial assets 6 4 2 0 -2 10 20 income 2.4 1.6 0.8 0.0 -0.8 1.5 0.5 -0.5 -1.5 financial assets 10 20 20 income financial assets 4 0.8 2 0.0 0 -2 -0.8 10 20 4 0 -4 -8 10 10 20 income 10 20 income 1.2 0.4 -0.4 -1.2 10 20 Notes: See notes to Figure A11. 48 Percent (%) Percent (%) Figure A11 continued: Impulse Responses with Federal Funds Rate: A one percent shock to Tangible Assets federa l funds rate consump tion .4 0.6 0.2 .0 -0.2 -.4 -0.6 -1.0 -.8 10 20 10 20 federal funds rate consumption 2.0 0.8 1.0 0.4 0.0 0.0 -1.0 -0.4 10 20 10 20 Percent (%) Percent (%) federal funds rate 1.2 0.4 -0.4 -1.2 10 20 2.0 1.0 0.0 -1.0 1.5 0.5 -0.5 -1.5 financia l assets 1.5 0.5 -0.5 -1.5 -2.5 10 20 1971:2 to 1984:4 lia bilities tangible assets financial assets 10 20 0.8 0.0 10 20 1.2 0.4 -0.4 -1.2 2 0 10 20 -2 1985:1 to 1998:4 liabilities tangible ass ets consumption .6 .2 -.2 -.6 1954:1 to 1971:1 liabilities ta ngible assets 1.2 0.4 -0.4 -1.2 10 20 10 20 -0.8 federal funds rate co nsumption 1.00 .6 2.0 0.50 .2 1.0 0.00 -.2 0.0 -0.50 -1.00 -.6 -1.0 10 20 10 20 10 20 0.8 0.0 -0.8 -1.6 10 20 20 -1 10 20 10 20 -3 10 20 10 20 20 10 20 income 1.00 0.50 0.00 -0.50 -1.00 financial assets 4 0 -4 -8 10 income 1.0 0.4 -0.2 -0.8 financial assets 1 1999:1 to 2009:4 liab ilities tangible assets 6 2 -2 -6 10 income 0.8 0.0 -0.8 -1.6 10 20 income .6 .2 -.2 -.6 10 20 Notes: See notes to Figure A11. 49 Percent (%) Percent (%) Figure A11 continued: Impulse Responses with Federal Funds Rate: A one percent shock to Financial Assets federal funds rate .3 .1 -.1 -.3 10 20 .2 .0 -.2 -.4 Percent (%) 10 20 .3 .1 -.1 -.3 -.5 financial assets in come .4 10 20 .1 0.8 -.1 0.0 -.3 10 20 .1 -.2 -0.8 10 20 1971:2 to 1984:4 liabilities tangible assets financial assets .6 1.6 federal funds rate consump tion .4 .5 .4 -.5 .2 0.8 -.2 .1 .0 -.2 0.0 .0 -.5 -.1 -.4 -.6 -0.8 -.3 20 .3 .1 -.1 -.3 10 20 .1 -.3 10 20 20 consump tion .25 .15 .05 -.05 -.15 federa l funds rate -.1 10 10 20 .25 .15 .05 -.05 -.15 10 20 20 10 20 1985:1 to 1998:4 liabilities ta ngible assets .5 .3 .1 -.1 -.3 10 20 10 20 1999:1 to 2009:4 liabilities ta ngible assets consump tion .10 .00 -.10 -.20 10 .2 .0 -.2 -.4 0.4 -0.4 10 20 -1.2 10 20 20 in come .3 10 10 .6 .1 federa l funds rate Percent (%) 1954:1 to 1971:1 liabilities tangible assets consump tion .3 10 20 financia l assets 1.2 .3 0.6 .1 0.0 -.1 -0.6 -.3 10 20 financia l assets 0.8 0.0 -0.8 -1.6 10 20 10 20 income 10 20 income .20 .10 .00 -.10 -.20 10 20 Notes: See notes to Figure A11. 50 Percent (%) Percent (%) Figure A11 continued: Impulse Responses with Federal Funds Rate: A one percent shock to Income federa l funds rate financia l assets .5 0.8 .2 0.0 -.1 -0.8 -.4 10 20 10 20 Percent (%) 1.2 0.4 -0.4 -1.2 10 20 .6 .2 -.2 -.6 10 20 1971:2 to 1984:4 federal funds rate financial assets lia bilities tangible assets 0.6 .6 1.00 1.2 0.2 0.50 .2 0.4 -0.2 0.00 -.2 -0.4 -0.6 -0.50 -1.0 -.6 -1.00 -1.2 10 20 10 20 10 20 10 20 fed eral funds rate Percent (%) 1954:1 to 1971:1 liabilities ta ngible assets .6 .2 -.2 -.6 10 20 fina ncial assets .6 .3 .0 -.3 10 20 federa l funds rate financia l assets .8 .6 .4 .0 .2 -.4 -.2 -.8 10 20 10 20 .7 .4 .1 -.2 1985:1 to 1998:4 liabilities tangible assets .8 .4 .0 -.4 -.8 10 20 10 20 1999:1 to 2009:4 liabilities ta ngible assets 2.0 1.2 0.4 -0.4 3 1 10 20 -1 10 20 financia l assets 1.0 0.0 -1.0 -2.0 10 20 income 1.2 0.4 -0.4 -1.2 financial assets 0.5 -0.5 -1.5 -2.5 10 20 10 20 financia l assets 4 2 0 -2 -4 10 20 20 income 1.2 0.4 -0.4 -1.2 financial assets 1.5 0.5 -0.5 -1.5 10 10 20 income 1.2 0.8 0.4 0.0 -0.4 10 20 income 1.2 0.8 0.4 0.0 -0.4 10 20 Notes: See notes to Figure A11. 51 Percent (%) Figure A11 continued: Impulse Responses with Federal Funds Rate: A 0.5 percent shock to the Federal Funds Rate federa l funds rate consump tion .8 0.6 .4 0.2 .0 -0.2 -.4 -0.6 -1.0 -.8 10 20 10 20 .2 -.1 Percent (%) -.2 -.3 -.6 Percent (%) 0.0 -0.8 10 20 federal funds rate 1.2 0.8 0.4 0.0 -0.4 10 20 20 .2 -.1 0.8 10 .1 .0 20 20 .6 -.4 10 10 .4 .0 -.4 -.8 .3 consump tion federal funds rate Percent (%) 1.2 0.4 -0.4 -1.2 1971:2 to 1984:4 liabilities tangible assets .5 federal funds rate .4 1954:1 to 1971:1 liabilities ta ngible assets 10 20 consumption .4 .2 .0 -.2 10 20 .8 .4 .0 -.4 consumption .6 .2 1.0 0.4 -.2 -.6 -0.2 -0.8 10 20 10 20 -.4 10 20 1985:1 to 1998:4 lia bilities tangible assets 1.4 1.0 0.6 0.2 -0.2 10 20 10 20 1999:1 to 2009:4 liabilities tangible ass ets 3 1 10 20 -1 -3 10 20 financia l assets 3 1 -1 -3 10 20 income 0.8 0.0 -0.8 -1.6 financial assets 0.2 -0.2 -0.6 -1.0 10 20 financial assets 0 -4 10 20 20 in come .4 .2 .0 -.2 -.4 financial assets 2.0 .8 1.2 .4 0.4 .0 -0.4 -.4 10 20 8 4 10 10 20 income 10 20 income 1.00 0.50 0.00 -0.50 -1.00 10 20 Notes: See notes to Figure A11. 52