INDUSTRIALS SECTOR US S S C O Hugh Garside

advertisement

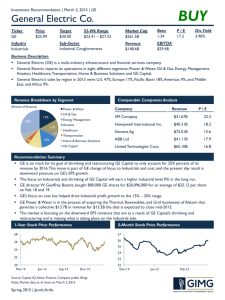

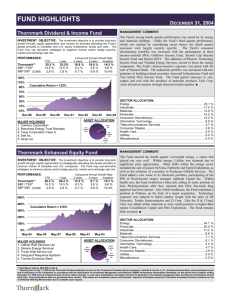

INDUSTRIALS US SS SECTOR C O Hugh Garside MBA 7225 – Student Stock Market June 24, 2014 •Sector S t Overview O i •Business Analysis y •Economic Analysis •Financial Analysis •Valuation Valuation Analysis •Recommendation 2 SECTOR OVERVIEW 3 Sector Overview Industrials Sector • Cyclical in Nature • Producing g Goods or Services used in Construction and Manufacturing • Types of Industries • Goods • • • • Aerospace and Defense Building Materials Construction Machinery and Heavy Trucks Services • • • Logistics L i ti Printing Services Data Processing 4 Sector Overview Sector Name S&P 500 C Consumer Discretionary 11.7% % Consumer Staples 9.6% Energy 11 0% 11.0% Financials 16.1% Health Care 13.2% Industrials 10.6% Information Technology 18.7% M t i l Materials 3 5% 3.5% Telecommunication Services 2.4% Utilities 3 1% 3.1% SIM 11.3% % 9.5% 9 1% 9.1% 14.8% 14.9% 7.4% 22.3% 3 0% 3.0% 2.8% 3 4% 3.4% +/-0.4% % -0.1% -1 9% -1.9% -1.4% 1.7% -3.2% 3.6% -0.5% 0 5% 0.4% 0 3% 0.3% Source: Bloomberg 5 Sector Overview Top Ten Companies in the Industrials Sector Company General Electric Co United Technologies Corp Boeing Co 3M Co United Parcel Service Inc Union Pacific Corp Honeywell Intl Inc Caterpillar p Inc Danaher Corp Emerson Electric Co Symbol GE UTX BA MMM UPS UNP HON CAT DHR EMR Subtotal Mrkt. Cap. 267.54 107.38 95.42 94.27 93.79 91.21 73.82 67.90 56.19 47.59 995.11 % 13.91% 5.58% 4.96% 4.90% 4.88% 4.74% 3.84% 3.53% 2.92% 2.47% 51.72% SIM Holdings in the Industrials Sector Company Precision Castparts Fl Fluor Corp C Total Industrials Market Cap Symbol PCP FLR Subtotal Mrkt. Cap. 38.00 12 40 12.40 50.40 % 1.98% 0 64% 0.64% 2.62% Total 1,923.88 100.00% Source: Bloomberg 6 BUSINESS ANALYSIS 7 Business Analysis Business Life Cycle Industrials 8 Business Analysis Porters Five Forces Analysis AT TTRIBUTES Force Threat Level BARRIERS TO ENTRY HIGH (+) Start up costs are extremely high due to significant capital expenditure (+) Established companies with brand awareness SUPPLIER POWER MEDIUM (+) Most raw materials are easily obtainable (+) Switching costs are low BUYER POWER LOW (-) Demand is cyclical. Need for goods is dependent upon the economy (+) Because demand is cyclical, buyer's dependence upon the industrial companies is high when economy spikes SUBSTITUTES MEDIUM (-) Products can be replicated or substituted with new technologies RIVALRY HIGH (+) Incumbent companies have established relationships with customers (+) Industrial materials (-) Consumers want lower must be readily available cost products which can creating a desire to work cause a price war with an established between companies and business to ensure shrink margins prompt delivery (+) is good for Industry (-) is bad for Industry 9 ECONOMIC ANALYSIS 10 Economic Analysis 11 Economic Analysis 12 Economic Analysis 13 FINANCIAL ANALYSIS 14 Financial Analysis Industrials S&P 500 15 Financial Analysis Revenue Growth % 2006 - 2013 20.0% 15.0% 10.0% 5 0% 5.0% 0.0% -5.0% 2006 2007 2008 2009 2010 2011 2012 2013 -10.0% -15 15.0% 0% -20.0% S&P 500 Industrials Revenue Growth Table S&P 500 2005 826 88 826.88 Industrials 198.79 2006 878 12 878.12 6.20% 212.03 6.66% 2007 951 43 951.43 8.35% 241.23 13.77% 2008 2009 990 77 903.15 990.77 903 15 4.13% -8.84% 257.33 222.14 6.67% -13.68% 2010 2011 2012 2013 CAGR 939 88 1019 939.88 1019.68 68 1064 1064.25 25 1103 1103.58 58 3 67% 3.67% 4.07% 8.49% 4.37% 3.70% 235.7 256.59 272.26 282.19 4.48% 6.10% 8.86% 6.11% 3.65% Source: Bloomberg 16 Financial Analysis Gross Margin % 2005-2013 34.00 32.00 30.00 28.00 26.00 24.00 22.00 20 00 20.00 2005 2006 2007 2008 2009 2010 S&P 500 Industrials 2011 2012 2013 Gross Margin % Table S&P 500 2005 31.27 Industrials 29.07 2006 31.11 -0.51% 28.12 -3.27% 2007 31.39 0.90% 27.60 -1.85% 2008 30.49 -2.87% 27.52 -0.29% 2009 31.69 3.94% 25.45 -7.52% 2010 32.63 2.97% 27.78 9.16% 2011 32.31 -0.98% 27.80 0.07% 2012 31.95 -1.11% 26.26 -5.54% 2013 CAGR 32.06 0.31% 0.34% 27.00 -0.92% 2.82% Source: Bloomberg 17 Financial Analysis Return on Equity 2005 to 2013 25 20 15 10 5 0 2005 2006 2007 2008 S&P 500 2009 2010 Industrials 2011 2012 2013 Return on Equity Table S&P 500 Industrials 2005 16.15 2006 2007 2008 2009 2010 2011 2012 2013 CAGR 17.89 13.51 4.29 10.91 14.21 14.97 13.55 15.28 -0.69% 10.77% -24.48% -68.25% 154.31% 30.25% 5.35% -9.49% 12.77% 16.3 18.93 19.61 16.77 13.72 16.42 18.22 17.43 19.67 2.38% 16 13% 3.59% 16.13% 3 59% -14.48% 14 48% -18.19% 18 19% 19 19.68% 68% 10 10.96% 96% -4.34% 4 34% 12.85% 12 85% Source: Bloomberg 18 VALUATION ANALYSIS 19 Valuation Analysis Absolute Values Index S&P 500 Industrials S&P 500 Industrials S&P 500 Industrials S&P 500 S& Industrials S&P 500 Industrials S&P 500 Industrials S&P 500 Industrials S&P 500 Industrials S&P 500 Industrials Valuation Ratio Price/Earnings Price/Earnings Price/Cash Flow Price/Cash Flow Price/Sales Price/Sales Price/EBITDA / Price/EBITDA Price/Book Price/Book EV/Sales EV/Sales EV/EBITDA EV/EBITDA Dividend Yield Dividend Yield Free Cash Flow Yield Free Cash Flow Yield 2005 16.90 18.57 13.60 10.21 1.51 1.46 7.100 9.01 2.73 3.02 2.43 1.64 11.43 10.09 1.80 1.89 3.85 6.13 2006 16.60 18.09 16.01 11.46 1.62 1.52 66.99 99 9.28 2.85 3.24 2.56 1.67 11.06 10.20 1.77 1.92 3.50 4.99 2007 2008 2009 2010 2011 2012 2013 Current 17.35 15.40 18.37 15.10 12.79 14.10 17.05 17.95 17.24 9.97 16.81 17.21 13.56 14.03 18.06 18.63 15.92 5.71 8.73 8.32 6.98 8.41 9.21 9.75 10.40 6.20 8.66 10.02 8.88 9.74 11.74 11.97 1.54 0.91 1.23 1.34 1.23 1.34 1.67 1.76 1.47 0.81 1.09 1.28 1.14 1.21 1.60 1.65 66.69 69 4.94 9 66.57 5 66.95 95 66.488 7.155 88.68 68 99.05 05 9.21 5.20 7.98 8.21 7.15 7.73 9.67 9.83 2.77 2.00 2.16 2.18 2.06 2.14 2.58 2.73 3.31 2.27 2.47 2.75 2.65 2.62 3.19 3.30 2.53 1.47 1.68 1.77 1.60 1.69 2.02 2.11 1.61 1.37 1.22 1.39 1.26 1.35 1.74 1.83 10.96 7.98 8.91 9.21 8.42 9.02 10.45 10.86 10.11 8.84 8.91 8.95 7.91 8.65 10.48 10.89 1.93 3.15 2.12 1.88 2.12 2.24 1.89 1.91 1.95 3.63 2.48 1.98 2.38 2.43 1.87 1.95 2.11 10.25 6.83 7.87 9.11 6.77 6.94 6.50 5.80 9.60 7.75 6.70 6.90 5.69 5.19 5.16 Avg 16.16 16.22 10.26 9.93 1.42 1.32 7.06 06 8.33 2.42 2.88 1.99 1.51 9.83 9.50 2.08 2.25 6.37 6.39 CAGR 0.67% 0.04% -3.63% 1.78% 1.72% 1.37% 2.73% 3% 0.97% 0.00% 0.99% -1.56% 1.56% 1.23% -0.57% 0.85% 0.66% 0.35% 5.99% -1.90% Source: Bloomberg 20 Valuation Analysis Industrials Relative to S & P 500 Valuation Ratio 2005 2006 2007 2008 2009 2010 2011 2012 2013 High Price/Earnings 1 10 1.09 1.10 1 09 0.99 0 99 0.65 0 65 0.92 0 92 1.14 1 14 1.06 1 06 1.00 1 00 1.06 1 06 1.14 1 14 Price/Cash Flow 0.75 0.72 0.65 1.09 0.99 1.20 1.27 1.16 1.27 1.27 Price/Sales 0.97 0.94 0.95 0.89 0.89 0.96 0.93 0.90 0.96 0.97 Price/EBITDA 1 27 1.33 1.27 1 33 1.38 1 38 1.05 1 05 1.21 1 21 1.18 1 18 1.10 1 10 1.08 1 08 1.11 1 11 1.38 1 38 Price/Book 1.11 1.14 1.19 1.14 1.14 1.26 1.29 1.22 1.24 1.29 EV/Sales 0.67 0.65 0.64 0.93 0.73 0.79 0.79 0.80 0.86 0.93 EV/EBITDA 0 88 0.92 0.88 0 92 0.92 0 92 1.11 1 11 1.00 1 00 0.97 0 97 0.94 0 94 0.96 0 96 1.00 1 00 1.11 1 11 Divident Yield 1.05 1.08 1.01 1.15 1.17 1.05 1.12 1.08 0.99 1.17 Free Cash Flow Yield 1.59 1.43 2.75 0.94 1.13 0.85 0.76 0.84 0.75 2.75 Low Median Current 0 65 0.65 1 00 1.04 1.00 1 04 0.65 1.01 1.23 0.89 0.93 0.94 1 05 1.05 1 19 1.09 1.19 1 09 1.11 1.19 1.21 0.64 0.76 0.87 0 88 0.88 0 97 1.00 0.97 1 00 0.99 1.08 1.02 0.75 1.23 0.79 Source: Bloomberg 21 Recommendation 22 Recommendation • • • SIM is currently 320 basis points underweight; therefore portfolio should be balanced Reasons to consider increasing g the weight g • Industrials are cyclical and tied to a strong economy • Positive economic indicators • Unemployment contracting • GDP growing • Maintain diversification of portfolio Reasons to consider maintaining the weight • More M expensive i th than the th S & P 500 on mostt indicators • Economic indicators could be wrong 23