Industrials Sector Stock Presentation Saniya Mussinova Daniel Pierce Michael Royer

advertisement

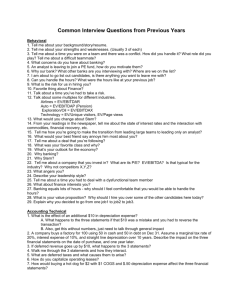

Industrials Sector Stock Presentation Saniya Mussinova Daniel Pierce Michael Royer Nicholas Stuart Zane Stephens Sector Recap Weighting the sector 12 bps over S&P Adding 25 bps to portfolio Industrials have outperformed S&P Remain cautiously optimistic going forward Current Holdings (DHR) 3.10% (FLS) 3.94% (GD) 4.05% 11.09% Stock Recommendations Sell 405 bps of GD Buy 105 bps of DHR Buy 325 bps of UTX Hold 394 bps of FLS Flowserve Corp Market cap: $7.38 billion Current Price: $117 Target Price: $134 (15% upside) Recommendation: Hold Recent Developments: ◦ Quarterly cash dividend of $0.32 per share Positives Bookings and aftermarket growth Stock price has grown by 35% in 1 year Repurchasing plan of up to $2 mln shares Segment restructuring Good purchasing decisions: ◦ Purchase of FEDD Wireless (Intelligent Process Solutions) in 2011 ◦ Purchase of Valbart in 2010 Stable growth in emerging markets Q4 anticipating strong shipment – bring down backlog Negatives Recent increase in backlog (8.4% vs prior year) Decrease in margins 7.2% increase in DSO (AR/Sales) over prior year quarter Long cycle market continues to be choppy and competitive Nuclear projects being delayed: nuclear power outlook under scrutiny as countries re-evaluate nuclear strategy Recommendation: Increase 105 BP Current Price: $53.72 Target Price: $60.00 (11.7% upside) Overview: ◦ Designs, manufactures and markets professional, medical, industrial and commercial products and services ◦ Operates in five segments: Test & Measurement; Environmental; Life Sciences & Diagnostics; Dental, and Industrial Technologies ◦ Outperforming the S&P 500 Industrials Group YTD ◦ Growth derives from both segment core expansion and frequent external acquisitions DHR Relative to Sector 2.5 2 1.5 High Low Median 1 Current 0.5 0 P/Trailing E P/Forward E P/B P/S P/CF P/EBITDA DHR Overview Positives: ◦ Increasing sales in foreign markets, notably those with growing economies ◦ Experienced management knowledgeable in the Danaher Business System, a proven lean production method ◦ Strong sales and margin growth, including double digit core growth in Industrial Technologies and Test & Measurement segments. Margins now above 20% in both segments ◦ With purchase of Beckman Coulter, decreased exposure to potential economic decline Manufactures and markets biomedical testing instrument systems, tests and supplies Operates in two segments: ◦ Clinical Diagnostics - Products physicians use to diagnose disease, make treatment decisions and monitor patients. Approx. 87% of revenues ◦ Life Science - Products used by scientists to study complex biological problems, including the causes of disease, identifying new therapies and testing new drugs. Approx. 13% of revenues DHR Overview Concerns: ◦ Other companies are acquiring former Danaher managers, possibly acquiring key information about Danaher’s vital lean production system ◦ Over 70% of sales growth in the last 5 years has come from acquisitions ◦ With the $6.8 billion purchase of Beckman Coulter, Danaher is reducing funds for acquisitions from roughly $2 billion to $300 million for remainder of year Company Overview Aerospace •Designs, manufactures and outfits mid- and large-cabin business-jet aircraft and provides maintenance, refurbishment, outfitting and aircraft services for a variety of business-jet customers. Combat Systems •Provides design, development, production, support and enhancement of tracked and wheeled military vehicles, weapons systems and munitions for the United States and its allies. Sector (S&P): Industrial Industry (S&P): Aerospace, Defense Market Cap: 27.27B Shares Outstanding: 373M Avg. Daily Vol: 2.05M YTD Return: 2.92% 52 Week Range: 55.46 – 78.27 Dividend Yield: $0.47 (2.57%) Marine Systems •Designs, builds and supports submarines and surface ships for the United States Navy and commercial ships for Jones Act customers Information Systems and Technology •Provides technologies, products and services that support a range of Government and commercial digital-communication and informationsharing needs Business Analysis FY 2010 (Millions) Segment Aerospace Combat Systems Marine Systems Information Systems Revenue 5,299 8,878 6,677 11,612 32,466 % Revenue Earnings % Earnings Operating Margin 16.32% 860 21.35% 16.23% 27.35% 1,275 31.65% 14.36% 20.57% 674 16.73% 10.09% 35.77% 1,219 30.26% 10.50% 100.00% 4,028 100.00% Business Analysis Strengths Diverse business segments Incumbent status with certain products Success with acquisitions Improving economy Weaknesses Uncertain defense spending Fixed price contracts High energy costs Slow economic recovery GD VS Industry VS Sector DCF Valuation General Dynamics (GD) Analyst: Michael Royer 5/22/2011 Terminal Discount Rate = Terminal FCF Growth = Year 2011E Revenue 34,094 % Grow th 2012E 35,803 5.0% Operating Income 4,035 Operating Margin Interest and Other Interest % of Sales Taxes Plus/(minus) Changes WC % of Sales 3.9% 4,412 40,643 4.1% 4,593 42,188 3.8% 4,725 2017E 43,664 3.5% 4,847 2018E 44,974 3.0% 4,992 2019E 46,099 2.5% 5,163 2020E 47,251 2.5% 5,292 2021E 48,551 2.8% 5,438 11.3% 11.3% 11.2% 11.1% 11.1% 11.2% 11.2% 11.2% 170 179 169 176 183 190 196 202 207 213 218 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 2,666 % of Sales 4,476 39,043 2016E 11.9% % Grow th Add Depreciation/Amort 5.0% 2015E 12.0% 31.0% Net Income 37,577 2014E 11.8% 1,198 Tax Rate 4,283 2013E 10.5% 2.75% 1,272 31.0% 2,832 1,335 31.0% 2,972 1,313 31.0% 2,923 1,367 31.0% 3,043 1,406 31.0% 3,129 1,442 31.0% 3,209 1,485 31.0% 3,305 1,536 31.0% 3,419 1,575 31.0% 3,505 1,618 31.0% 3,601 6.2% 5.0% -1.6% 4.1% 2.8% 2.5% 3.0% 3.5% 2.5% 2.8% 648 680 733 664 691 717 742 765 784 803 825 1.9% 1.9% 2.0% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% (534) (435) (451) (449) (491) (473) (451) (398) (340) (348) (394) -1.6% -1.2% -1.2% -1.1% -1.2% -1.1% -1.0% -0.9% -0.7% -0.7% -0.8% Subtract Cap Ex 511 501 451 664 691 717 742 765 784 803 825 Capex % of sales 1.5% 1.4% 1.2% 1.4% 1.4% 1.4% 1.4% 1.4% 1.5% 1.5% 1.5% Free Cash Flow 2,269 % Grow th 13.5% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 16,596 15,669 32,265 8.06% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 10.6 12.1 6.1 7.0 Shares Outstanding Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share 2,576 385 $ $ 73.03 83.75 14.7% 3,203 2,613 6.78 2,802 8.8% 51% 49% 100% 2,474 -11.7% 2,551 3.1% 2,657 4.1% 2,758 3.8% 2,907 5.4% 3,080 5.9% 3,157 2.5% Terminal Value Free Cash Yield 9.9 11.4 5.8 6.6 9.5 10.9 5.5 6.3 3,208 1.6% 42,526 7.54% Terminal P/E 11.8 10-year 16.0 Terminal EV/EBITDA 6.9 9.6 Multiples Valuation Absolute Valuation High Low Median P/ Forward E P/S P/B P/EBITDA P/CF 19.7 1.8 4.7 12.3 18.2 6.5 0.6 1.6 3.93 5.5 15.1 1.2 3.1 9.52 13.9 Your Target E, Target S, B, Current Multiple etc/Share 10.1 0.8 2 6.12 8.6 12 0.95 2.2 7 10.5 7.11 90.92 40 12 8 Your Target Price $ $ $ $ $ 85.32 86.37 88.00 84.00 84.00 Average Multiples Target Price = $85.54 DCF Target Price = $83.75 Weighted Average Target Price = (.80 * 83.75) + (.20 * 85.54) = $84.11 (15.17% upside) Recommendation Deciding Factors High energy costs Government dependence Slow economic recovery Sell 405 Basis Points of General Dynamics UTX Overview Aerospace & Defense Beta 1.01 Dividend yield 2.2%, very few in industry UTX outperformed the S&P by 6.7% History of steady growth in earnings and dividends over the past 10 years Strong balance sheet ◦ Cash represents 7% of assets ◦ Long-term debt 30% Segments Pratt- major supplier of jet engine to commercial, business and military aircraft, 25% operating profit, 52% international Otis-world’s largest maker of elevators and escalators, freight mover, 32% operating profit, 82% international Carrier- #1 marker of HVAC systems- provides installation, service, parts, 25% operating profit, 52% international Sikorsky- largest manufacturer of helicopters, aftermarket products and services, 9% operating profit, 33% international UTC Fire & Security- global provider of fire and safety security products, 9% operating profit, 84% international Hamilton- advanced industrial products, power generation, propeller systems, environmental control units, etc, 12% operating profit, 49% international 1 Year Price Movement 5 Year Price Movement Risks Double dip recession Sustained rise in the dollar Increasing prices of energy dampening airline industry Lack of recovery in housing sector, residential and commercial construction Insider selling as of April High price/book ratio Historic trends For the past 10 years, annual compounded rates were: ◦ Sales growth of 7.4% ◦ Income from continuing operations growth of 9.2% ◦ 10.3% Earnings per share ◦ ROC 16.2%, S&P average 15.8% ◦ FCF growth of 9.2%, S&P average 6.7% UTX vs. competitors Future Catalysts Large backlogs of commercial aircraft from Boeing and Airbus hope to provide steady sales and production levels the next three years, Development of Boeing 787 and Airbus 350 Continued strong growth of emerging markets UTC Fire & Security: purchased GE Security in March 2010 Increased OEM demand, aerospace aftermarket recovery Developing CH-35K for USMC Current Financials Diluted EPS 5.36 Last year’s sales growth- 10% TTM P/E is 17.78, industry average 28.27 ROE 22.55%, average of Manufactured Industrials is 7.33% Last quarter EPS $1.11, beating $1.07 estimate Current ratio 1.3, well below Aerospace average 2.8 Days of sale inventory 78 days, 123 industry (TTM) Qtrly Rev Growth Revenue Gross Margin Operating Margin Diluted EPS P/E UTX 10.80% 55.63B 28.21% 14.35% 4.92 17.40 BA -2% 64B 19.14% 7.06% 4.53 16.66 GE 6.20% 152.46B 37.76% 13.31% 1.20% 15.94 Valuations DCF using consensus estimates, updated earnings ◦ $100 EBITDA value driver, multiple 9x ◦ $96 Recommendation: ◦ BUY 325 basis points UTX Questions? Appendix A: Danaher DCF Appendix B: Flowserve DCF Appendix C: UTX DCF