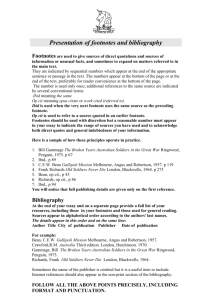

By

advertisement