Internet Appendix for “A Comparison of New Factor Models”

advertisement

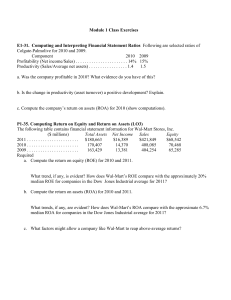

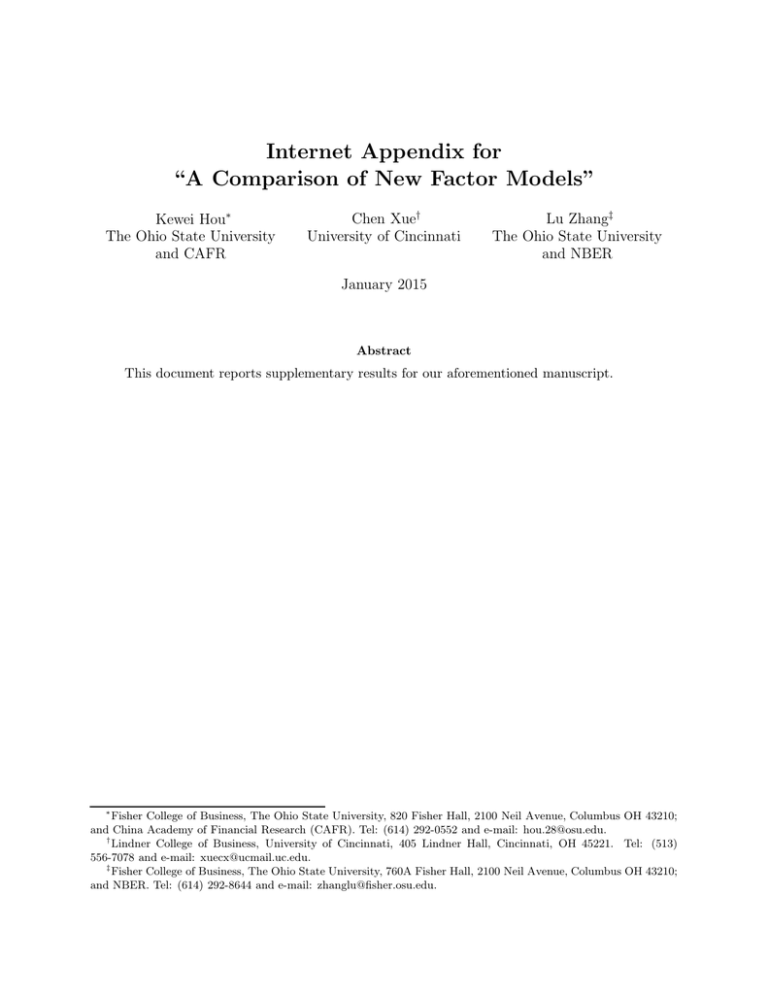

Internet Appendix for “A Comparison of New Factor Models” Kewei Hou∗ The Ohio State University and CAFR Chen Xue† University of Cincinnati Lu Zhang‡ The Ohio State University and NBER January 2015 Abstract This document reports supplementary results for our aforementioned manuscript. ∗ Fisher College of Business, The Ohio State University, 820 Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and China Academy of Financial Research (CAFR). Tel: (614) 292-0552 and e-mail: hou.28@osu.edu. † Lindner College of Business, University of Cincinnati, 405 Lindner Hall, Cincinnati, OH 45221. Tel: (513) 556-7078 and e-mail: xuecx@ucmail.uc.edu. ‡ Fisher College of Business, The Ohio State University, 760A Fisher Hall, 2100 Neil Avenue, Columbus OH 43210; and NBER. Tel: (614) 292-8644 and e-mail: zhanglu@fisher.osu.edu. 1 Empirical Properties, 18 Size-I/A-ROE Benchmark Portfolios For completeness, Table 1 reports the descriptive statistics, including the mean and volatility of monthly excess returns, the average number of firms, as well as portfolio size, investment-to-assets, and ROE for the 18 benchmark portfolios underlying the q-factors. The table shows that the largest average return spread between the low and high I/A portfolios, 0.77% per month, resides in the small-low ROE stocks. In contrast, the spread is only 0.09% in the big-high ROE stocks. The largest average return spread between the high and low ROE portfolios, 1.14%, is in the small-high I/A stocks. In contrast, the spread is only 0.08% in the big-low I/A stocks. 2 Scaling Earnings with Book Assets in Constructing q-Factors In the benchmark q-factors, we scale earnings by lagged book equity (not lagged book assets). We do so because Compustat quarterly files have a broader coverage on book equity than total assets before 1980. FF (2014a) also use book equity as the scaler in operating profitability when constructing RMW. In this appendix, we show that replacing the ROE factor with a factor formed on ROA (earnings scaled by one-quarter-lagged book assets) has little impact on the performance of the q-factor model. If anything, the ROA factor in fact improves slightly the model’s performance. Specifically, we measure return on assets (ROA) as income before extraordinary items (Compustat quarterly item IBQ) divided by one-quarter-lagged assets (item ATQ). Before 1976, the sample coverage of assets is limited in Compustat quarterly files. To expand the coverage before 1976, we first supplement the coverage of assets for fiscal quarter four with assets from Compustat annual files (item AT). We then replace missing one-quarter-lagged assets with the latest lagged assets from up to four quarters ago to ensure that all 18 benchmark portfolios underlying the q-factors have at least ten firms. In addition, due to the lack of coverage for quarterly earnings announcement dates, prior to 1972, we use the most recent ROA from fiscal quarters ending at least four months ago. Starting from 1972, we use the ROA associated with the most recent earnings announcement 1 dates (item RDQ). For a firm to enter the factor construction, we require the end of the fiscal quarter that corresponds to its announced earnings to be within six months prior to the portfolio formation month. Doing so excludes stale information on earnings. All other aspects of the factor construction are identical to those in the benchmark q-factor construction. Table 2 reports the properties of the q-factors with ROE replaced by ROA. From Panel A, the average returns of the size, investment, and ROA factors are 0.33%, 0.45%, and 0.54% per month (t = 2.43, 5.19, and 5.18), respectively, which are close to those for the benchmark q-factors. The Carhart alphas and the FF five-factor alphas for the investment and ROA factors are all significantly positive. Panel B shows that the RMW and CMA alphas in the q-factor model formed with ROA are 0.05% (t = 0.58) and −0.01 (t = −0.16), respectively. Panel C shows further that the UMD alpha in the ROA q-factor model is only −0.03% (t = −0.15). Table 3 reports factor regressions with the ROA q-factor model, using testing portfolios formed on the 36 significant anomaly variables under NYSE-VW. Without going through the details, we can report that the ROA q-factor model does slightly better than the benchmark q-factor model with ROE. The average magnitude of the high-minus-low alphas drops from 0.20% per month to 0.19%, and the number of significant high-minus-low alphas at the 5% level drops from seven to five. The mean absolute alpha across all the testing deciles falls from 0.11% to 0.10%, and the number of rejections by the GRS test falls from 25 to only 20. Table 4 reports factor regressions with testing portfolios formed on the 50 significant anomaly variables under ABM-EW. The average magnitude of the high-minus-low alphas drops from 0.24% per month to 0.22%, and the number of significant high-minus-low alphas at the 5% level remains at 16. The mean absolute alpha across all the testing deciles remains at 0.14%, and the number of rejections by the GRS test falls from 37 to only 35. 2 Table 1 : Empirical Properties of the 18 Benchmark Size, I/A, and ROE Portfolios underlying the q-Factors, January 1967–December 2013, 564 Months 3 Size is price per share times shares outstanding. Investment-to-assets (I/A) is the annual change in total assets (Compustat annual item AT) divided by lagged total assets. ROE is income before extraordinary items (Compustat quarterly item IBQ) divided by one-quarter-lagged book equity. Book equity is the shareholders’ equity, plus balance sheet deferred taxes and investment tax credit (item TXDITCQ) if available, minus the book value of preferred stock. Depending on availability, we use the stockholders’ equity (item SEQQ), or common equity (item CEQQ) plus the carrying value of preferred stock (item PSTKQ), or total assets (item ATQ) minus liabilities (item LTQ) in that order as the shareholders’ equity. We use redemption value (item PSTKRQ) if available, or carrying value for the book value of preferred stock. At the end of June of each year t, we use the median NYSE size at the end of June to split NYSE, Amex, and NASDAQ stocks into two groups, small and big. Independently, at the end of June of each year t, we also sort stocks into three I/A groups using the NYSE breakpoints for the low 30%, middle 40%, and high 30% of the ranked I/A for the fiscal year ending in calendar year t − 1. Also, independently, at the beginning of each month, we sort stocks into three groups based on NYSE breakpoints for the low 30%, middle 40%, and high 30% of the ranked ROE. Earnings data in Compustat quarterly files are used in the sorts in the months immediately after the most recent public quarterly earnings announcement dates (item RDQ). Taking the intersections of the two size, three I/A, and three ROE groups, we form 18 portfolios. Monthly value-weighted returns on the 18 portfolios are calculated for the current month, and the portfolios are rebalanced monthly. Portfolio size is the value-weighted market capitalization (in billions of dollars) across all firms in the portfolio. Portfolio I/A (in percent) is the sum of changes in assets across all firms in the portfolio divided by the sum of their one-year-lagged assets. Portfolio ROE (in percent) is the sum of the latest announced quarterly earnings across all firms in the portfolio divided by the sum of their one-quarter-lagged book equity. Small Low ROE Big 2 High ROE Low ROE Small 2 High ROE Low ROE 2 High ROE Mean excess returns Low I/A 2 High I/A 0.68 1.13 0.62 0.93 −0.09 0.54 1.41 1.35 1.05 7.41 5.68 6.39 5.23 7.69 6.31 6.43 5.78 6.85 0.63 0.63 0.43 0.55 0.04 0.38 0.71 0.58 0.62 0.28 0.33 0.31 0.35 0.38 0.38 434 232 286 172 218 216 120 125 197 5.59 4.48 5.28 4.31 6.37 5.43 44 55 45 2 High ROE 0.35 0.39 0.39 11.57 15.06 14.60 27.73 24.68 27.69 28.54 48.59 48.31 −4.46 −3.77 7.06 7.49 37.16 31.04 −4.17 8.12 28.91 I/A (percent per annum) 4.76 4.34 5.45 −8.54 −6.03 7.30 7.70 40.56 33.19 Average number of firms Low I/A 2 High I/A Low ROE Size (billions of dollars) Volatility of excess returns Low I/A 2 High I/A Big −7.73 7.88 36.50 ROE (percent per quarter) 61 129 91 40 98 113 −3.08 −1.54 −2.80 2.66 2.75 2.82 7.24 6.29 6.46 −0.86 −0.07 −0.84 2.73 2.79 2.90 6.39 6.03 6.14 Table 2 : Empirical Properties of the q-Factors Formed with ROA, January 1967 to December 2013 rME , rI/A , and rROA are the size, investment, ROA factors, respectively. We calculate MKT as the valueweighted market return minus the one-month Treasury bill rate from CRSP. SMB, HML, RMW, and CMA are the size, value, profitability, and investment factors from the FF five-factor model (from 2 × 3 sorts), respectively. The data for SMB and HML in the three-factor model, SMB, HML, RMW, and CMA in the five-factor model, as well as UMD are from Kenneth French’s Web site. m is the average return, α is either the FF three-factor alpha or the Carhart alpha, αq is the q-model alpha, and a is the five-factor alpha, and b, s, h, r, and c are factor loadings in the five-factor model. Panel A: The q-factors rME rI/A rROA rME rI/A rROA α β MKT β SMB β HML 0.33 (2.43) 0.03 (0.93) 0.00 (0.01) 0.36 (5.82) 0.31 (4.67) 0.79 (8.74) 0.54 (6.38) 0.00 (0.02) 0.01 (0.65) −0.08 (−5.35) −0.07 (−5.24) −0.13 (−3.49) −0.08 (−2.82) 0.99 (57.53) 0.99 (64.69) −0.04 (−1.57) −0.04 (−1.68) −0.30 (−6.07) −0.30 (−4.44) 0.15 (7.30) 0.16 (7.92) 0.38 (13.98) 0.40 (13.75) −0.28 (−3.75) −0.19 (−2.98) 0.27 (7.04) 0.46 a b s h r c R2 0.05 (1.52) 0.15 (4.00) 0.49 (6.29) −0.00 (−0.32) −0.00 (−0.13) −0.08 (−2.76) 0.98 (64.76) −0.05 (−2.79) −0.12 (−3.06) 0.01 (0.46) 0.02 (0.79) −0.32 (−4.90) −0.03 (−1.08) 0.06 (2.30) 0.71 (12.88) 0.04 (1.16) 0.82 (25.76) 0.15 (1.57) 0.96 0.45 (5.19) 0.54 (5.18) β UMD R2 m 0.94 0.03 (2.34) 0.94 0.50 0.05 (1.84) 0.51 0.26 0.85 0.54 Panel B: The FF five factors SMB HML RMW CMA m αq β MKT β ME β I/A β ROA R2 0.28 (2.02) 0.37 (2.63) 0.27 (2.58) 0.36 (3.68) 0.05 (1.47) 0.10 (0.79) 0.05 (0.58) −0.01 (−0.16) −0.00 (−0.20) −0.06 (−1.54) −0.01 (−0.50) −0.04 (−3.32) 0.95 (52.07) −0.03 (−0.36) −0.13 (−1.65) 0.04 (1.62) −0.08 (−4.86) 0.99 (9.77) −0.02 (−0.25) 0.95 (36.40) −0.08 (−5.52) −0.23 (−2.93) 0.51 (8.63) −0.10 (−3.76) 0.96 0.49 0.46 0.85 Panel C: UMD UMD m αq β MKT β ME β I/A β ROA R2 0.68 (3.65) −0.03 (−0.15) −0.02 (−0.30) 0.29 (2.05) 0.15 (0.85) 1.03 (6.75) 0.32 4 Table 3 : Significant Anomalies with NYSE Breakpoints and Value-weighted Returns, The q-Factor Model Formed with ROA For each anomaly variable, αq is the q-model alpha for the high-minus-low decile, and tq is the t-statistics adjusted for heteroscedasticity and autocorrelations. |αq | is the average magnitude of the q-model alphas, and pq is the p-values of the GRS test that all the alphas are jointly zero across a given set of deciles. Table 4 in the manuscript provides a brief description of the symbols. 5 SUE-1 Abr-1 Abr-6 αq 0.14 0.66 tq 1.11 4.51 |αq | 0.05 0.13 pq 0.49 0.00 β MKT −0.07 −0.05 β ME 0.08 0.06 β I/A 0.07 −0.13 β ROA 0.46 0.26 tβ MKT −1.68 −1.23 1.64 0.59 tβ ME 0.70 −1.36 tβ I/A 5.71 3.08 tβ ROA 0.26 2.35 0.07 0.01 −0.03 0.08 −0.16 0.18 −1.03 1.75 −2.19 3.03 0.05 0.19 0.12 0.13 −0.01 −0.18 0.18 1.34 −0.14 −2.21 0.96 9.49 CEI IvG IvC −0.25 −0.26 0.04 −1.87 −1.92 0.30 0.10 0.11 0.10 0.03 0.02 0.11 0.01 0.22 −0.04 0.17 0.26 0.06 −0.76 −1.02 −0.97 −0.34 −0.10 0.01 0.28 5.93 −1.08 2.26 3.73 1.54 −6.95 −11.41 −12.11 −4.32 −1.35 0.17 −0.26 −1.79 0.07 0.51 0.04 0.00 −0.71 0.18 1.16 −0.09 −6.21 2.00 IG αq tq |αq | pq β MKT β ME β I/A β ROA tβ MKT tβ ME tβ I/A tβ ROA 0.02 0.17 0.08 0.05 −0.03 −0.14 −0.76 −0.07 −1.10 −2.37 −9.71 −1.07 NSI RE-1 RE-6 R6-6 −0.06 0.05 −0.28 0.17 0.12 0.11 0.01 0.00 −0.01 −0.02 −0.16 0.28 0.04 0.15 1.16 1.16 −0.21 −0.24 −1.91 1.59 0.24 0.73 9.94 6.70 OA R11-1 I-Mom B/M 0.07 0.18 0.17 0.00 −0.04 0.39 0.30 1.64 −0.43 1.86 1.01 6.93 POA −0.48 −0.07 −3.18 −0.49 0.12 0.11 0.01 0.01 0.06 −0.02 0.26 0.13 −0.08 −0.95 0.23 0.05 1.63 −0.79 4.24 3.14 −0.68 −11.02 3.18 1.02 −0.07 −0.27 0.10 0.02 −0.03 0.28 0.18 0.89 −0.51 1.78 0.85 5.77 0.25 1.23 0.13 0.01 −0.13 0.16 0.93 −0.36 −2.13 1.45 5.92 −2.75 PTA ROE ROA GP/A RS −0.04 −0.31 0.10 0.04 −0.04 −0.40 0.12 1.50 −1.07 −5.73 1.05 19.84 −0.15 −0.81 0.08 0.33 0.06 −0.63 −1.17 0.71 1.17 −7.77 −9.68 7.34 E/P CF/P NO/P 0.23 1.03 0.11 0.11 −0.10 0.24 0.93 −0.22 −1.66 1.80 5.03 −1.55 −0.14 −0.97 0.08 0.03 0.05 0.16 −0.87 0.05 1.27 2.49 −8.46 0.75 0.26 1.45 0.09 0.18 −0.03 0.44 1.32 −0.62 −0.66 5.00 10.80 −7.17 Rev 0.35 2.37 0.11 0.02 −0.17 −0.33 1.04 0.01 −3.67 −4.27 9.28 0.14 Dur −0.27 −1.36 0.09 0.25 0.087 −0.22 −0.79 0.35 1.364 −1.57 −5.54 2.88 ACI I/A NOA △PI/A −0.15 0.12 −0.28 −0.93 0.98 −1.56 0.12 0.10 0.09 0.01 0.00 0.03 0.00 0.01 −0.03 −0.29 −0.13 0.07 0.11 −1.40 −0.15 −0.21 0.15 −0.09 0.00 0.52 −0.65 −5.13 −2.41 0.60 0.92 −16.57 −1.06 −2.34 2.26 −1.17 NEI OC/A Ad/M RD/M −0.02 0.08 0.14 0.13 0.11 0.19 −0.14 0.59 0.97 1.24 0.89 0.68 0.07 0.09 0.08 0.09 0.09 0.11 0.64 0.54 0.14 0.06 0.07 0.11 −0.08 0.07 −0.01 0.04 −0.07 0.03 −0.36 0.09 −0.12 −0.07 0.24 0.45 0.04 −0.23 −0.31 −0.25 0.30 1.36 1.39 0.66 0.66 0.69 0.54 −0.36 −2.63 1.76 −0.25 1.61 −2.21 0.37 −6.80 2.05 −2.19 −2.00 5.57 2.45 0.51 −2.45 −3.50 −3.61 2.87 5.53 18.37 8.77 8.89 12.49 6.58 −1.80 −0.21 −1.72 0.11 0.03 0.03 −0.08 −0.81 0.16 1.04 −1.58 −8.30 2.00 OL Svol 0.61 0.06 2.48 0.34 0.25 0.09 0.00 0.21 0.14 −0.02 0.64 0.27 0.19 0.10 −0.59 0.50 2.14 −0.49 6.33 2.66 1.05 0.80 −4.08 4.39 −0.35 −1.41 0.10 0.21 0.03 0.33 −0.25 −0.38 0.45 2.37 −1.51 −3.14 Table 4 : Significant Anomalies with All-but-micro Breakpoints and Equal-weighted Returns, The q-Factor Model Formed with ROA For each anomaly variable, αq is the q-model alpha for the high-minus-low decile, and tq is the t-statistics adjusted for heteroscedasticity and autocorrelations. |αq | is the average magnitude of the q-model alphas, and pq is the p-values of the GRS test that all the alphas are jointly zero across a given set of deciles. SUE-1 SUE-6 αq tq |αq | pq β MKT β ME β I/A β ROA tβMKT tβME tβI/A tβROA 0.30 2.87 0.11 0.00 0.01 0.01 0.18 0.63 0.18 0.17 3.01 8.19 NO/P αq tq |αq | pq β MKT β ME β I/A β ROA tβMKT tβME tβI/A tβROA αq tq |αq | pq β MKT β ME β I/A β ROA tβMKT tβME tβI/A tβROA αq tq |αq | pq β MKT β ME β I/A β ROA tβMKT tβME tβI/A tβROA Abr-1 Abr-6 RE-1 RE-6 R6-1 R6-6 R11-1 I-Mom B/M −0.07 0.84 0.30 0.27 −0.89 5.84 2.06 1.53 0.11 0.20 0.18 0.12 0.01 0.00 0.00 0.01 0.02 −0.06 0.00 0.04 −0.02 0.10 0.13 0.04 0.11 0.03 −0.03 −0.09 0.58 0.23 0.27 0.95 1.08 −1.61 −0.02 0.92 −0.80 1.31 2.11 0.79 2.21 0.27 −0.28 −0.75 12.27 3.07 3.25 8.47 −0.07 0.23 −0.43 0.62 0.14 0.17 0.02 0.00 0.06 −0.16 0.00 0.57 −0.03 0.11 0.89 1.26 1.38 −1.54 −0.05 1.96 −0.31 0.31 10.50 4.81 −0.08 0.21 0.05 0.12 −0.22 0.55 0.20 0.49 0.15 0.11 0.07 0.16 0.00 0.00 0.19 0.14 0.02 −0.02 −0.03 −0.15 0.50 0.58 0.36 0.07 0.24 0.08 0.24 1.78 1.32 1.50 0.76 −0.17 0.28 −0.19 −0.38 −2.66 2.45 2.33 2.04 0.58 0.82 0.26 1.08 7.05 5.84 6.16 4.76 −0.90 Dur A/ME Rev ACI 0.20 1.32 0.12 0.06 −0.20 −0.27 1.11 0.25 −6.11 −5.62 8.53 2.33 −0.06 −0.28 0.12 0.07 0.20 −0.03 −1.15 −0.28 2.85 −0.22 −6.09 −1.47 −0.01 −0.04 0.16 0.06 −0.03 −0.01 1.86 −0.25 −0.51 −0.06 6.69 −1.21 −0.26 −1.63 0.09 0.12 0.06 −0.36 −1.15 0.41 1.36 −5.90 −8.71 3.96 −0.10 −0.98 0.12 0.09 0.00 −0.15 −0.17 −0.18 −0.18 −4.10 −2.39 −2.76 IvC OA POA TA PTA −0.37 −3.15 0.13 0.00 0.05 0.09 −0.60 0.14 2.49 2.10 −6.54 2.69 −0.50 −3.55 0.17 0.00 0.01 0.20 −0.20 0.40 0.33 3.42 −1.57 4.31 −0.14 −1.43 0.17 0.00 −0.01 0.19 −0.76 −0.01 −0.35 5.44 −10.94 −0.17 −0.42 −3.73 0.14 0.00 0.06 0.04 −0.67 0.40 1.84 0.84 −7.48 4.77 I/A NOA △PI/A IG NSI −0.28 −2.39 0.17 0.00 0.08 0.00 −0.87 −0.02 2.77 −0.08 −9.35 −0.26 −0.02 −0.16 0.14 0.38 −0.01 0.02 −0.79 −0.08 −0.61 0.53 −11.57 −1.47 −0.23 −1.66 0.14 0.00 0.09 0.07 −0.94 −0.45 2.94 1.22 −8.02 −4.84 ROE ROA GP/A RS −0.25 −2.15 0.15 0.02 0.05 0.02 −1.30 0.13 2.54 0.43 −15.37 1.81 −0.55 −2.62 0.16 0.00 0.10 −0.08 −0.12 0.04 1.64 −0.50 −0.71 0.39 −0.34 0.14 0.12 −3.72 0.92 0.78 0.16 0.13 0.14 0.00 0.00 0.00 0.08 0.02 0.00 0.09 −0.15 −0.13 −0.59 0.25 0.21 0.04 1.46 1.41 3.49 0.46 0.09 2.21 −1.23 −1.26 −9.36 1.89 1.66 0.81 18.86 17.87 O OC/A Ad/M RD/M H/N −0.13 0.35 −0.12 0.69 −0.91 2.68 −0.40 2.39 0.15 0.18 0.24 0.32 0.11 0.00 0.12 0.01 0.12 −0.15 −0.097 0.11 0.14 0.02 0.07 0.65 0.21 0.07 1.63 0.33 −0.64 0.07 0.13 −0.28 3.42 −5.65 −1.248 1.68 2.55 0.43 0.45 4.51 1.91 0.56 7.32 1.21 −7.21 0.76 0.67 −1.56 −0.03 −0.28 0.13 0.01 0.05 0.11 −1.17 −0.02 1.93 2.87 −14.41 −0.20 OL Svol −0.03 −0.14 −0.17 −0.70 0.14 0.15 0.09 0.037 −0.05 −0.01 0.24 0.185 0.31 −0.22 0.45 −0.49 −1.046 −0.23 3.40 1.204 2.42 −1.18 4.41 −3.88 −0.11 −0.70 0.16 0.01 0.14 0.25 0.28 0.88 3.59 2.71 1.97 8.30 0.33 1.65 0.09 0.33 −0.21 −0.04 1.10 −0.10 −3.64 −0.37 6.59 −0.78 0.30 1.36 0.08 0.14 −0.18 −0.05 1.26 −0.07 −2.73 −0.34 6.35 −0.41 CEI NXF IvG −0.29 −2.04 0.13 0.00 0.23 0.30 −0.94 −0.30 6.67 6.49 −8.94 −3.23 −0.18 −1.37 0.14 0.00 0.17 0.23 −0.96 −0.40 6.41 5.08 −8.07 −4.39 −0.23 −2.06 0.11 0.00 0.06 0.07 −0.72 0.02 2.54 1.73 −8.31 0.28 NEI CTO F TES 0.22 2.13 0.10 0.01 0.00 −0.11 −0.11 0.78 0.04 −2.48 −1.73 13.84 0.03 0.44 0.12 0.00 0.05 −0.03 −0.04 0.81 2.60 −0.89 −0.90 24.39 −0.12 −0.67 0.14 0.01 0.16 0.43 −0.18 0.63 3.13 3.68 −1.39 7.00 MDR S-Rev Disp Dvol −0.06 −0.42 0.09 0.42 0.25 0.30 −0.20 −1.03 6.18 4.18 −2.50 −14.11 0.02 0.16 0.13 0.00 0.25 −0.62 −0.75 0.03 6.56 −6.12 −7.95 0.41 −0.23 −1.03 0.13 0.03 0.48 0.72 −1.17 −0.69 7.31 4.55 −5.62 −3.87 −0.74 −2.17 0.22 0.00 −0.26 0.08 0.26 0.28 −2.60 0.33 0.95 1.55 E/P CF/P 0.28 0.04 1.36 0.35 0.13 0.10 0.04 0.62 −0.28 0.15 −0.24 0.09 0.40 −0.29 0.65 0.52 −5.00 5.23 −3.20 1.94 2.29 −2.63 4.99 7.00