Document 10983492

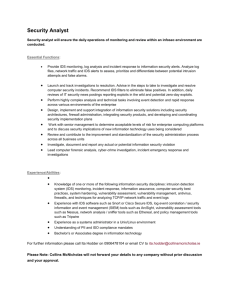

advertisement