The New Role of the World Bank

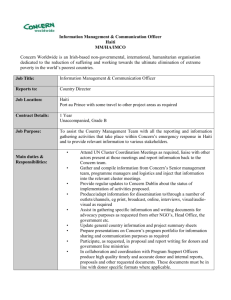

advertisement