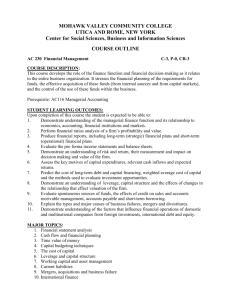

S R E P

advertisement