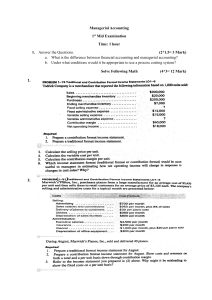

Financial and Managerial Accounting

Financial and Managerial Accounting

Course for the Master’s Level

Course description

The course provides a decision-maker perspective on accounting and finance with the goal of helping students develop a framework for understanding financial, managerial, and tax reports

First part of the course covers the following topics: Accounting Concepts, Principles, Bases and

Policies; Double Entry Accounting, Secondary Books, Trial Balance and Final Accounts.

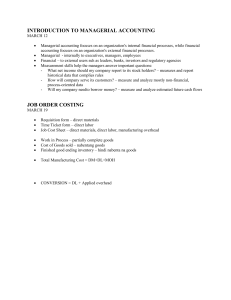

Management or managerial accounting is used by managers to make decisions concerning the day-to-day operations of a business. It is based not on past performance, but on current and future trends, which does not allow for exact numbers. This part of the course includes the following topics: Introduction to management Accounting; Financial Statement Analysis; Funds and Cash Flow Analysis; Costing and Budgetary Control.

Course objectives

After the course completion students should know

Business transactions and double entry bookkeeping

Reconciliation and preparing the trial balance

The nature and purpose of cost and management accounting

How to record and classify costs

How to use spreadsheets

How to make decisions involving alternative choices.

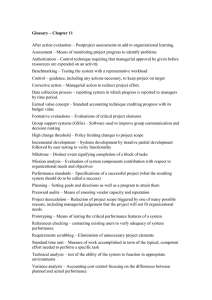

Assessment

The student’s performance in the FMA course will be evaluated on the basis of the following:

Paper analyses, essays, individual tasks on selective topics (30%).

Participation in lectures and practice sessions including answers to questions, case study, discussions, short presentations of homework exercises or reading assignments (30%).

Course project (40%).

Main reading

Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso. Financial & Managerial Accounting, 2nd

Edition. Wiley, 2014/