Discontinuous Extraction of a Nonrenewable Resource

advertisement

Discontinuous Extraction of a Nonrenewable Resource

by

Eric Iksoon Im1

Department of Economics,

College of Business & Economics, University of Hawaii at Hilo, Hilo, Hawaii

Ujjayant Chakravorty

Department of Economics, Emory University, Atlanta, Georgia

James Roumasset

Department of Economics, University of Hawaii at Manoa, Honolulu, Hawaii

Abstract

This paper examines the optimal extraction sequence of nonrenewable resources in the

presence of multiple demands. We provide conditions under which extraction of a

nonrenewable resource may be discontinuous over the course of its depletion.

JEL classification: Q3; Q4

Keywords: Backstop technology; Dynamic optimization; Energy resources; Herfindahl

principle; Multiple demands

This Version: May 2004

1

Eric Iksoon Im, 200 W. Kawili Steet, Hilo, Hawaii 96720-4091; ph: (808)974-7462; fax:

(808)974-7685; email: eim@hawaii.edu.

1

1. Introduction

A fundamental theorem of resource economics suggests that extraction of identical

deposits of a nonrenewable resource should be in the order of their cost of extraction

(e.g., Herfindahl (1967), Solow and Wan (1976), and Lewis (1982)). Gaudet, Moreaux

and Salant (2001), use a model of trash hauling between cities (in our case, demands) and

landfills with a fixed capacity (analogous to resources), to suggest that in the presence of

setup costs a city may temporarily abandon a low marginal cost site (and use a higher

cost one) and return to the former at a later date. An implication of their result is that a

nonrenewable resource may be extracted discontinuously, i.e., over two disjoint time

periods. In this paper, we show that discontinuous extraction of a nonrenewable resource

is still possible across demands, even without setup costs. That is, a resource may be used

in a particular demand, then abandoned for a time, only to be used in another demand

later in time. We provide conditions for this phenomenon to occur.

We modify the framework of dynamic optimization in Chakravorty and Krulce (1994,

henceforth CK) who consider two nonrenewable resources, oil (O) and coal (C), for two

demands, electricity (E) and transportation (T), by adding a third backstop resource (B)

with an infinite supply (e.g., solar power).2 While the assumption of a constant unit

extraction cost in CK is retained for each resource (ci, i = O , C , B ), we specify conversion

costs as both resource and energy specific ( z ij , i = O, C , B; j = E , T ) so that the net cost

of resource i for demand j is wij = ci + z ij .

The planner chooses instantaneous extraction rates of resource i for demand j, qij (t ) ,

which maximizes the discounted social surplus, W:

∑ qij

W = ∫ e − rt ∑ ∫ i D −j 1 ( x)dx − ∑ (ci + z ij )q ij (t ) − ∑ λi (t )∑ qij (t ) dt

0

i, j

i

j

0

j

∞

subject to

2

At least three resources are needed for discontinuous extraction, which is also the case in Gaudet et al.

2

qij (t ) ≥ 0; Qi (t ) ≥ 0; Q& i (t ) = −∑ qij (t )

j

where r denotes the discount rate, D −j 1 the inverse energy demand function for demand j,

Qi (t ) the initial stock (assumed known) of resource i, and λi (t ) the co-state variable for

resource i. Define the resource price for demand j as p j (t ) = D −j 1 (∑ qij (t )) and the price

i

of resource i for demand j as p ij (t ) = ci + z ij + λi (t ) ≡ wij + λi (t ) . The necessary and

sufficient conditions3 are

Q& i (t ) = −∑ qij (t )

(1)

λ&i (t ) = rλi (t )

(2)

p j (t ) ≤ pij (t ) (if < then qij (t ) = 0 )

(3)

lim e − rt λi (t ) ≥ 0 ; lim e − rt λi (t ) Qi (t ) = 0

(4)

j

t →∞

t →∞

where (2) implies λi (t ) = λi (0) e rt . Substituting (2) into (4) for nonrenewable resource i (

= C, O ), we obtain lim e − rt (λi (0) e rt ) Qi (t ) = λi (0) lim Qi (t ) which gives lim Qi (t ) = 0 .

t →∞

t →∞

t →∞

For the backstop resource ( i = B ) which is in infinite supply, Q B (t ) > 0 for all t, so that

(

)

lim e − rt λ B (0) e rt Q B (t ) = λ B (0) lim QB (t ) which yields λ B (0) = 0 , hence λ B (t ) = 0 .

t →∞

t →∞

2. Optimal Extraction Sequence

Let us consider the special case in which oil is the cheapest resource for all demands and

the backstop is the most expensive:

Assumption: 0 < wOj < wCj < wBj < ∞ .

3

The proof of sufficiency is essentially the same as in CK, hence suppressed.

3

Then, as shown by Chakravorty, Krulce, and Roumasset (2003), the ordering of the

shadow prices is exactly the reverse of the ordering of net costs wij , i.e.,

λO (t ) > λC (t ) > λ B (t ) = 0 . Note that since both oil and coal are nonrenewable resources,

they will eventually be exhausted and the backstop will be used for both demands. By

Proposition 7 of their paper, the order of extraction in each demand must be in the order

of the net costs (OCB), i.e., oil followed by coal and then by the backstop (as illustrated

in Fig. 1), although not every resource need be extracted for each demand.

3. Conditions for Discontinuous Resource Extraction

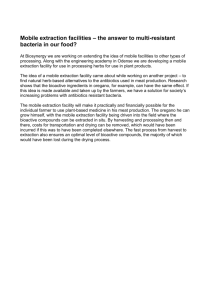

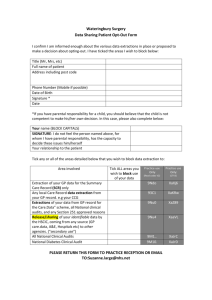

In this section, we demonstrate graphically the possibility of discontinuous extraction of a

nonrenewable resource, and then provide necessary and sufficient conditions for the

discontinuity to occur. In Fig.1, the (energy) resource price for each demand is depicted

as an envelope curve: in bold solid for transportation and in bold dash for electricity.

Note that coal is extracted in phase II, and again in phase IV. There is no extraction of

coal in the intermediate phase III.

<Figure 1 here>

The switch point sequence for Fig. 1 is S1: 0 < t1E < t 2 E < t1T <t 2T < ∞ . Note that if the

pOE (t ) curve in the lower part of Fig. 1 shifts up, oil may not be used in electricity, but

coal extraction will remain discontinuous but with an altered switch point sequence S2:

t1E ≤ 0 < t 2 E < t1T <t 2T < ∞ . Either S1 or S2 is equivalent to the following three

inequalities:

(i ). 0 < t 2 E ; (ii ). t 2 E < t1T ; (iii ). t1 j < t 2 j ,

j = E, T .

(5)

4

Under these two sequences, coal is extracted first for electricity and then for

transportation. We can now state

PROPOSITION 1: Coal is extracted discontinuously, first for electricity (E) and then

for transportation (T) after a time delay, iff

(a). λC (0) < wBE − wCE ;

wCj − wOj λO (0)

w − wOT

(b). 1 + max

,

< 1 + CT

<

wBE − wCE

wBj − wCj λC (0)

j = E, T . 4

Proof: At the switch points for demand j, pOj = pCj and pCj = p Bj , which gives:

wCj − wOj

1

1 wBj − wCj

t1 j = ln

.

; t 2 j = ln

r λO (0) − λC (0)

r

λC (0)

(6)

In view of (5), it suffices to show that (i), (ii) and (iii) are equivalent to conditions (a) and

(b).

Since 0 < λC (0) < λO (0) < ∞ in light of the Assumption in Section 2,

(i ). 0 < t 2 E

⇔ (a). λ C (0) < wBE − wCE ;

(ii ). t 2 E < t1T

⇔ (b1).

4

λ O ( 0)

w − wOT

;

< 1 + CT

λ C ( 0)

wBE − wCE

There exists a subset of w = ( wOE , wCE , wBE , wOT , wCT , wBT ) which admits conditions (a) and (b) ,

e.g., w = ( 4,5,6,1,4,6) . Given w ,

λO (0)

and

λC (0)

still depend on other factors such as the initial

stocks of resources, the discount rate and the magnitude of demands, hence are not determined solely by

w.

5

(iii ). t1 j < t 2 j

wCj − wOj

⇔

λO (0) − λC (0)

<

wBj − wCj

λC (0)

⇔ (b2).

wCj − wOj

λO (0)

> 1 + max

.

λC (0)

wBj − wCj

Noting that (b1) and (b2) jointly are equivalent to (b) in Proposition 1 completes the

proof.

Q.E.D.

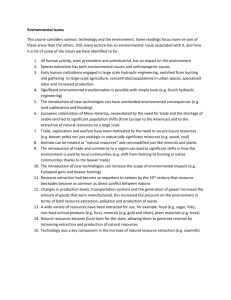

The conditions in Proposition 1 can be re-expressed as three simple inequality constraints

for λC (0) and λC (0) : λC (0) < α , λO (0) < β λC (0) , and λO (0) > γ λC (0) where

α ≡ wBE − wCE > 0 ;

β ≡ 1+

wCT − wOT

> 1 ; and

wBE − wCE

wCj − wOj

> 1,

wBj − wCj

γ ≡ 1 + max

which are graphed in Fig. 2. The entire grey area represents an open set of

{((λC (0), λO (0)) | 0 < λC (0), λO (0) < ∞}

which satisfies the conditions for either S1 or S2

to occur. The only difference between the two sequences is that 0 < t1E for S1 and

t1E ≤ 0 for S2.

Setting t1E = 0 in (6), we obtain λO (0) = µ + λC (0) where

µ ≡ wCE − wOE > 0 . Hence, we can restate the difference in terms of λC (0) and λO (0) :

λO (0) > µ + λC (0) for S1 and λO (0) < µ + λC (0) for S2. In Fig. 2, the line

λO (0) = µ + λC (0) splits the grey area into two. The dark grey area, an open set, is the

domain of (λC (0), λO (0) ) which admits sequence S1, and the light grey area which is

inclusive of the splitting line is the domain of (λC (0), λO (0) ) for sequence S2. If

µ ≥ µ * ≡ α ( β − 1) , there exists no (λC (0), λO (0) ) which admits sequence S1, and the

entire grey area is the domain for sequence S2.

6

<Figure 2 here>

Note that Fig. 1 is symmetric with respect to E and T. That is, if E and T were

interchanged, coal would still be extracted discontinuously with the altered switch point

sequences S1′ : 0 < t1T < t 2T < t1E <t 2 E < ∞ and S 2′ :

t1T ≤ 0 < t 2T < t1E <t 2 E < ∞ which

are identical to S1 and S2. Proposition 1 will continue to hold in this case. Since {S1, S2,

S1′ , S 2′ } is the complete set of switch point sequences which admits discontinuous coal

extraction, we may then generalize Proposition 1 (without proof) as

PROPOSITION 2 (General): Coal is extracted discontinuously iff

(a) λC (0) < wBj − wCj ;

wCj * − wOj *

w − wOh λO (0)

< 1+

(b) 1 + max Ch

<

wBj − wCj

wBh − wCh λC (0)

( j , j * = E or T ; j ≠ j * ; h = j , j * ) .

4. Conclusion

This paper provides conditions under which a nonrenewable resource can be extracted

discontinuously in a model with two resources and a renewable backstop resource. Given

that the Herfindahl principle (least cost first) must be preserved within each demand, a

total of three resources are necessary for the discontinuous extraction to occur. In a

typical economy with multiple demands for resources with different grades, an observed

pattern of discontinuous resource extraction may appear chaotic, but may actually be a

result of optimal behavior as suggested in this paper.

7

References

Chakravorty, U. and D. L. Krulce, 1994, “Heterogeneous Demand and Order of Resource

Extraction,” Econometrica 62, 1445-1452.

Chakravorty, U., D.L. Krulce, and J. Roumasset, 2003, “Specialization and

Nonrenewable Resources: Ricardo meets Ricardo,” (Unpublished), Department of

Economics, Emory University.

Gaudet, G., Moreaux, M., Salant, S., 2001, “Intertemporal Depletion of Resource Sites

by Spatially Distributed Users,” American Economic Review 91 (4), 1149-59.

Herfindahl, O.C., 1967, “Depletion and Economic Theory,” in M. Gaffney, ed.,

Extractive Resources and Taxation, (University of Wisconsin Press), 63-90.

Lewis, T. R., 1982, “Sufficient Conditions for Extracting Least Cost Resource First,”

Econometrica 50, 1081-1083.

Solow R., Wan, F.Y., 1976, “Extraction Costs in the Theory of Exhaustible Resources,”

The Bell Journal of Economics 7, 359-370.

8

pT (t ) : Energy price for transportation

p E (t ) : Energy price for electricity

pOT (t )

pCT (t )

p B T (t )

backstop

coal

oil

pCE (t )

pOE (t )

p B E (t )

backstop

coal

oil

t1 E

0

I

t2E

II

t 2T

t1T

III

IV

t

V

Fig. 1: Discontinuous Coal Extraction: Coal is extracted in phase II and IV, but not in III.

9

λO (0)

µ * + λC (0)

β λC (0)

µ + λC (0)

45 0

γ λC (0)

µ*

µ

λC (0) = α

0

α

Fig. 2: Coal Extraction is Discontinuous in the Shaded Open Set

λC (0)