Green Paradox or Green Unorthodoxy? by Robert D. Cairns

Green Paradox or Green Unorthodoxy? by

Robert D. Cairns

Department of Economics and Cireq

McGill University, Montreal and

James L. Smith

Edwin L. Cox School of Business

Southern Methodist University, Dallas

June 2014

Abstract. The green paradox holds that an increasing tax per unit (royalty) on oil production, aimed at tracking damages from CO2 emissions, induces an increase in aggregate (world) oil production and a decrease in price in the near term: Output is “tilted” toward the present. A secondary prediction is that a decreasing royalty induces a decrease in oil production in the short term. The predictions are based on rational responses to the royalty in a Hotelling exhaustibleresource model. The present paper simulates the decisions of a price-taking producer in response to a royalty of various shapes. In contrast to a Hotelling model, the technology of production is specified as involving sunk costs of exploration and development. A developed reserve yields output subject to natural decline at an exogenous rate: The tilt of production is not affected by the royalty. Given a price path, the time path of the royalty affects the level of development and initial production, but any form of royalty causes a reduction in initial development. Later investments in secondary recovery and total lifetime production are also affected. Any form of royalty induces large deadweight losses, and frequently the cost-benefit ratio exceeds one. In general, decisions are far more complicated, and results far more subtle, than in Hotelling models. A tentative attempt to understand some general-equilibrium effects explores a firm’s incentives when there is a rate of price change consonant with predictions of the paradox. The green paradox does not arise at the firm level, at which decisions are made, and its predictions are inconsistent with other observed price effects.

Key words: green paradox, Hotelling models, natural decline, exploration and development, sunk cost

1

Introduction

Damages from the emissions of greenhouse gases, especially carbon dioxide, are expected to increase over time. Nordhaus (2007) proposes an increasing tax on emissions as the optimal way to mitigate climate change. However, Sinclair (1992), Ulph and Ulph (1994) and Sinn (2008), among others, argue that an increasing tax on oil and other hydrocarbons, the main sources of emissions, may result in an increase in output and consumption in the near term, rather than a reduction. An increase in consumption would exacerbate the near-term damages. The projected increase in emissions resulting from a tax on their source is called the green paradox .

The green paradox is a prediction of the effects of a dynamic tax imposed on each unit of oil produced. It is based on an analysis of dynamic equilibrium in the oil market styled on a famous paper by Hotelling (1931). Hotelling’s model is the foundation of orthodox thinking in nonrenewable-resource economics. In it, equilibrium prices and quantities are determined so as to equate discounted net price (price net of marginal cost) at each future time. The imposition of an increasing tax would reduce discounted net prices more in the future than in the present.

Producers would be induced to minimize the effect of the tax by “tilting” the production profile toward the less taxed present. The new equilibrium path would exhibit a lower price at earlier dates and a higher quantity produced, as well as higher emissions. Some have proposed an initially high tax that would decrease through time as a possible means of shifting output and emissions toward the future.

In the study of non-renewable resources, a unit tax is called a royalty. In the present paper, the paradox is considered to be the prediction of a “tilt” of output toward the present resulting from the imposition of an increasing royalty, as compared to the situation without a royalty. A subsidiary effect is the difference between increasing and decreasing royalties, namely, that an increasing royalty may increase production and current emissions but that a decreasing royalty may decrease them.

1

Sinn reasons that a carbon tax is not the only policy that is subject to a green paradox. A subsidy to oil-conserving technologies or to “greener” (renewable, mainly) forms of energy, for example, would also reduce margins to oil producers in the future and lead to a tilt of production toward the present.

2

In contrast to a Hotelling model, the present model puts technological and geological features of production at the heart of the analysis. It stresses the effects of a dynamic royalty, rising or falling, on production from a single reserve by a producer who maximizes the net present value of the reserve. Decisions are simulated using a model developed by Smith (2012).

A distinguishing feature of the model is a break from the stress placed on continuous-time decisions in Hotelling analyses of oil production. Oil is found in separate, heterogeneous reserves. A discrete development investment must be made to prepare a reserve for production.

In addition to variable costs, a producing reserve incurs a sunk cost. A further development investment in enhanced oil recovery may be made at an endogenous future date if conditions warrant. A variable number of exploration wells (0, 1, 2, 3 or 4) may be drilled, resulting in a discovery of reserves of one of three possible sizes or in no discovery.

The effects of a no-royalty policy are compared herein with dynamic royalties that increase or decrease regularly. The discreteness of decisions renders aggregation over reserves difficult. In dynamic simulations of the world oil market, McGlade (2013) and Bauer et al . (2013) find wide variation in the path of price and output as a result of climate policy. Complexity of the oil market forces them (as well as other climate modelers) to make strong assumptions about the nature of the future equilibrium path. We follow them in assuming that the time path of the price is given to the producer: a full general equilibrium is not presented. Therefore, our proposals about the nature of the market equilibrium and the effects of the various forms of royalty are only tentative. Still, we argue that they are more representative than the proposals emanating from Hotelling models.

The first results presented are for a reserve that has already been discovered and is being developed. A decision to develop (invest in) the reserve results in a production pattern that is constrained by natural features. In these first results, the main prediction concerning the “tilt” resulting from imposition of a royalty is not borne out. A royalty reduces investment and hence output for rates of increase of the royalty of up to five percent. In contrast, the rate of increase of damages due to emissions is predicted to be about 1.5 percent (Nordhaus 2007).

The subsidiary prediction of the green paradox fares better: the incentive to avoid the tax leads producers to invest less if the royalty falls than if it rises. However, considerably more is

3

ultimately produced from a given reserve if the royalty decreases, largely because of later investments in enhancing reserves.

2. Development and Extraction

According to Smith (2012), the level of development of the reserve, K , determines an initial level of output at time t = 0, Q , that is proportional to the initial investment. Output,

0

Q , t > 0, is t subject to natural decline : the level of production decreases from Q at an exogenous rate that

0 depends on the geology of the reserve. Production is abandoned when the avoidable cost

(including the fixed cost), VC , exceeds the revenues from production, PQ .

The widely observed regularity, that production is constrained by natural decline, is a property of optimal extraction. Whenever such a constraint binds a producer, it has a positive shadow value,

ν(t)

, notionally what the producer would be willing to pay to relax the constraint. Aggregating the petroleum resources of Texas into a single entity subject to natural drive, Anderson, Kellogg and Salant (2014) argue that the shadow value of the constraint was positive throughout the period 1990-2007.

The reason for the positive shadow value,

ν(t)

, is that investment in productive capacity (in development) at the margin must be paid back over the producing lifetime of the reserve. If PK is the value invested in development capital K at the initial date t = 0, a necessary condition of optimality is that P

=

∫

0

T v ( t ) e

− rt dt (Cairns 2001). The shadow value is a component of the price net of marginal cost. Under mild assumptions it is positive throughout the productive life [0,T]. It can remain positive even if the price net of marginal cost rises faster than at the rate of interest, r , for short periods of time (Cairns and Davis 2007). Occasionally, however, reserves are “shut in”

(Q = 0 and thus v

=

0 for a short time). Often wells are shut in for maintenance, for which there is some flexibility of timing.

2

Although closing costs may be substantial (Muehlenbachs 2014), herein they are assumed to be zero. In a more complete model, they would constitute yet another form of lumpy, specific

“investment” that would qualitatively distinguish the model from a Hotelling model. They would be covered – as if by a sinking fund – from the net revenues from production.

4

In addition to being recovered at the margin, total investment cost must be recoverable from anticipated discounted net revenues. Variable profits must be non-negative at any time.

There is also a possibility of investing in increasing or enhancing the recovery of the reserve at a future date chosen by the producer. For simplicity, the investment cost is assumed to be the same per initial daily barrel as for development investment. It increases the reserves that remain at the time of the investment by a factor λ > 1. The fundamental decisions by a producer pertain to sunk levels of development (initial and enhanced) that circumscribe production for significant periods of time.

The model is a simplification of the problem faced by an oil producer. It is used to derive some initial indications of the effects of technology (irreversible development investment) and geology

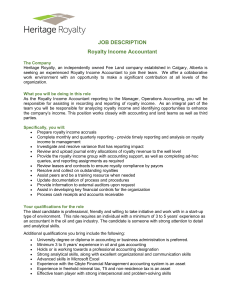

(natural decline). The initial parameters assumed for the analysis are shown in Table 1.

Variable

Price

Table 1. Basic Parameters of the Model

Symbol

P

Value

$100/bl

Output

Capital Cost

Avoidable Cost

Reserve R

Interest rate i

Enhancement factor

λ

Carbon content

Q

K

VC

$40,000 per initial daily barrel

$20 Q + 0.02

K

100 mm bbl

8%

2.5

½ tonne/bl

The comparisons made in discussions of the green paradox, in the context of a producing firm’s decisions, require that some features of exploitation be held fixed as the dynamic royalty is varied. Clearly, the initial reserve must be held fixed. However, initial extraction, the productive life of the reserve and the total, ultimate level of recovery must be allowed to vary, as the predictions about effects on production – current and cumulative — and its timing are the essence of the paradox. The firm is motivated by rents, in particular their present value, and these

5

rents must be allowed to vary as well. In particular, exploration is motivated by the prediction of the present value of rents.

To compare the effects of different, dynamic royalties, it is necessary to hold something else fixed. For comparisons of constant, increasing and decreasing royalties, the present value of the royalties is held fixed at fifty percent of the social value, gross of the social cost or damages of emissions , available before imposition of the new royalty regime. Clearly, the effects on timing are subtle and specific to a reserve. The model is sketched in Appendix 1.

A royalty may decrease fast enough to induce a firm to delay investment. The delay can be interpreted as consistent with the subsidiary prediction of the green paradox. But the delay affords reduced royalties over the producing lifetime.

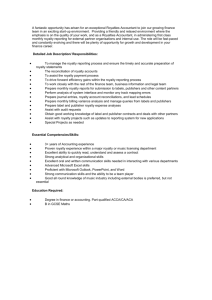

The first spreadsheet shows that the imposition of a royalty in any form has a strong effect on the output from the reserve. A pertinent comparison is between scenario 1 (no royalty) and scenario

2a, 3a or 4a. When a constant royalty of 33.90% ($33.90/bl) is imposed, the initial development investment K decreases by twenty percent. As a result, initial production Q also decreases by

0 twenty percent, from 7.5 (0.075 R ) to 6.0 mm bbl. Moreover, investment in enhanced recovery is put off from year 10 to year 16. As a result of these changes in investment and the consequent slowing of production, the life of the reserve is extended by ten years, from 44 to 54 years. Both the present value of the producer’s rents and the ultimate recovery are reduced.

Scenarios 2 (b) and (c), 3 (b) and (c) and 4 (b) and (c) compare the results when there are increases or decreases of the royalty at rates of one, three and five percent per year, while still providing the same present value to the government. As compared to the case of no royalty

(Scenario 1), in all cases but one (discussed below) a royalty results in a decrease in investment and thus in initial production, including in two cases of an increasing royalty 2(b) and 3(b). This prediction is conventional, contrary to the main prediction of the green paradox.

With a rising royalty there is higher initial investment than with a declining royalty. This comparison is consistent with the subsidiary prediction of the green paradox. However, only with a steep, five percent, rate of increase of the royalty in Scenario 4(b) does the initial production

3

Exploration is considered in Section 3 below.

6

attain the initial level when there is no royalty. (Scenario 4 (b) is considered to represent a

“steep” rate of increase because, according to an informal calculation based on a graph by

Nordhaus (2007), damages are predicted to rise at approximately 1.5 percent.) With the steep royalty, however, enhanced recovery is never undertaken and ultimate recovery is reduced by more than half. More gently rising royalties in Scenarios 2(b) and 3(b) still induce a reduction in investment as compared to the no-royalty benchmark, as well as delayed or eliminated enhanced recovery and reduced ultimate recovery.

When the royalty is initially high but decreasing, the initial extraction rate is further reduced from the benchmark of no royalty. The early reduction is in line with the prediction of the green paradox. Enhanced recovery is put off a few years, and the life of the reserve is lengthened.

Ultimate recovery is increased for the royalties declining at three and five percent, however, even as compared with the no-royalty scenario. The increase in recovery, with an increase in emissions in the long term, is subtler than a “stock effect” and is not foreseen in Hotelling models of the green paradox.

There is a significantly higher loss of discounted rent to the producing company, and hence of social value, for both increasing and decreasing royalties as compared to a constant royalty or no royalty. (Recall that the present value of the government’s revenue is held fixed.) The rising royalty induces the greatest decrease in social value. The reason is not a decrease in quality as the reserve is depleted, as in the stock effect, but of the timing and level of investment in enhanced recovery, if any.

The present value of ultimate recovery measures the discounted physical volume of production, not its monetary value. It is a rough indicator of timing of production. All royalty scenarios have similar values of between 42 and 47, about ¾ of the level without a royalty.

The cost per barrel of reduced recovery and per barrel equivalent in columns 16 and 17 suggest that a royalty, especially a rising royalty, is a costly way to reduce carbon emissions. According to column 17, the least costly royalty is the constant royalty.

The second spreadsheet shows the same types of comparison for reserves with higher development and variable costs. To leave fifty percent of the social value in the government’s

7

hands, royalty rates must be lower.

For any type of royalty, initial production never attains that of the no-royalty scenario. As compared to a decreasing royalty, an increasing royalty exhibits higher initial production, lower ultimate recovery and a shorter life of reserves (with no enhanced recovery) than a decreasing royalty but a (slightly) higher net present value to the company.

The third spreadsheet depicts a different comparison, with the total rent kept (close to) fixed over the different forms of royalty. There is greater investment when the royalty is increasing (at 3%), in keeping with the main prediction of the green paradox, but a substantially lower ultimate recovery.

3. Exploration and Price Change

Two important features of oil markets are neglected in the results above. First, exploration is neglected. Second, price is assumed constant at $100/bl. These features are addressed in the fourth and fifth spreadsheets.

Exploration is viewed as the drilling of a series of wells aimed at revealing the presence and size of a reserve (Smith 2012). Successful exploration provides a reserve of uncertain size that can be exploited at a profit. The size of such a reserve is assumed to take values of (i) 25 million barrels with probability 0.5, (ii) 100 mm bbl w.p. 0.35, or (iii) 750 mm bbl w.p. 0.15. If dry holes are drilled (w.p. 0.65 for the first hole), the probability that there is a reserve is revised using Bayes’s rule. As more dry holes are drilled, the probability of a find decreases until ultimately the prospect is abandoned. Two scenarios are represented with different relative weights placed on prior geological knowledge and on experience from drilling.

Because anticipated rents provide the firm’s incentive to explore, the institution of a royalty reduces exploration. Although the effect is muted by the fact that exploration expenditure is a discrete variable, it can be discerned in the results. In Scenario A, a royalty with any tilt reduces the maximum number of wells a firm is willing to drill from four to three, except if price

4

For the case studied ($60,000 development cost per initial barrel of production and avoidable costs of $40 per unit plus two percent of development cost), a royalty of just over one quarter is used rather than nearly one third.

8

decreases at two percent, when there is no change. In Scenario B, in which more stress is placed on geological knowledge, the effect is more pronounced.

The effects on initial output and ultimate recovery, conditional on a discovery, are broadly similar to those found above, without exploration. Conditional on a discovery, the decision of the firm is changed only to the extent that the expected size of the field is used rather than the 100 mm bbl assumed earlier. The assumptions above imply that the rents anticipated by the firm are proportional to the initial investment, K , and hence of initial output Q and the initial size of the

0 discovery R .

4. On Price

The presentation herein is a faithful, if highly simplified, rendering of the decisions made by a typical oil producer with respect to a single reserve. The strength of the analysis is also its weakness. It is set in a partial equilibrium: the path of oil prices is given to the firm and is not endogenous to the model. Even if one maintains that all firms are price takers, as is customary in work on the paradox, a royalty imposed following an international climate agreement would change all firms’ choices, and thereby the path of prices. A basic tenet of the model is not valid.

Through its assumption of a competitive equilibrium, a Hotelling model is able to meld microeconomic decisions of firms and macroeconomic effects: sectorial results are derived from decisions applied to aggregates over reserves rather than distinct reserves. Some important properties of a competitive equilibrium can be characterized. For example, Anderson et al .

(2014) examine price determination under the assumption that the resource (undeveloped prospects) and the reserve (developed prospects) are each consolidated into single entities. The resource and reserve are homogeneous. Exploration and development (which they combine into drilling ) and production are continuous. The only cost is drilling cost, the aggregate of which over all producers is continuous through time. Even given these strong assumptions, the solution of the model is intricate: It requires following an iterative procedure to determine the key shadow value of undeveloped prospects, and then for the paths of drilling, output and price.

9

A model of price determination that would incorporate discrete exploration and development expenditures, avoidable fixed and variable costs of production, heterogeneity of reserves, a dynamic equilibrium among producers involving the choice of entry dates and levels according to physical properties of the reserves, would be extremely complicated. To do justice to the myriad micro decisions that are made in the industry would require a simulation beyond the capabilities of the present model or of the most sophisticated integrated assessment models of climate change.

In a Hotelling-style competitive model ( with an endogenous price ) the green paradox predicts that when a rising royalty is introduced, in the short term more aggregate output is produced

(output is tilted toward the present) so that the price drops, yielding more emissions. Thereafter, the price is predicted to rise more quickly than in the original equilibrium. Other students of climate change also presume that there will be an increasing price of oil through time. The reason that they give is a resort to costlier sources of supply and a stock effect. The two effects are not the same. Empirically, then, the green paradox would be hard to discern using data on price.

It is possible to simulate the effects of changes in price on a producer’s decisions; changes between -2% and 2% per year are simulated. The results of spreadsheet 4 remain comparable to those from the simulations with a constant price and without exploration in spreadsheets 1, 2 and

3: A royalty increasing at three percent results in a higher initial production than one falling at three percent. It also results in a lower ultimate recovery and a shorter life of the reserve. A falling royalty leads to greater ultimate output than a rising royalty. Total rent is higher for the increasing royalty.

A “strong green paradox” is said to hold if a royalty induces an increase, not just in short-term emissions, but also in the present value of emissions. Since price is given, the simulations compare situations in which aggregate supply from other sources is assumed not to change as the royalty is varied. Even under such a restrictive and unrealistic assumption, the exercise points out

5

At that, the results would be highly dependent on assumptions about properties of discovered

6 and undiscovered reserves.

With an increase in price, the single-firm results are qualitatively unchanged from the results with a constant price.

10

some of the complexity of the effects of the tax. Output for the firm at any time is reduced under any royalty; thus, emissions and their present value are unambiguously reduced. A further key effect is on the investment in enhanced recovery. The rising royalty has a greater disincentive to enhanced recovery, which is a low-margin investment. While enhanced recovery produces the same emissions per unit output, it is in the future and heavily discounted. Because of the timing of the reductions, the increasing royalty has lower costs per unit reduction in emissions than the decreasing royalty. It also provides higher discounted rent to the firm. Given a price path, then, a firm prefers the increasing royalty to a decreasing royalty. Given predictions of rising damages, an increasing royalty is closer to the Pigovian ideal.

These results are for firms contemplating investment in exploration and development at the time of introduction of the royalty. Current output by firms that have already developed their reserves is not affected. The decision about whether and when to invest in enhanced recovery in the future, however, is affected. Imposition of a royalty discourages such investment, more so for an increasing royalty.

Given these partial-equilibrium results, the presumed drop in price of the green paradox in general equilibrium has to be explained in some way other than through the decisions of pricetaking firms to given price paths. Since firms cut back on investment with the introduction of a royalty, realization of the green paradox (an initial fall in price and rise in aggregate output) requires that other firms increase their investments in current development and perhaps in current exploration. The effect of a “rush” to bring already discovered reserves to earlier development would have to be strong to overcome the depressing effects of the royalty on sunk investments at individual firms. An early decrease in price is a further disincentive to exploration and development.

Anderson, Kellogg and Salant (2014: 14-15) document that there tend to be sharp changes in rental rates for drilling rigs when the price of oil rises . Suppose, however, that, in contrast with their findings and in accordance with the green paradox, there is new investment in development that causes a fall in price. The new investment requires renting additional rigs. Available, excess capacity tends to be older rigs that are less efficient. Thus, drilling costs rise, again contrary to finding of Anderson et al ., namely, that rental rates for rigs are positively correlated with the price of oil. Moreover, the bidding up of costs of rigs reduces anticipated rents, a discouragement

11

to development. Any increase in output from known but undeveloped reserves at the time of imposition of the tax is, then, limited.

Expanding exploration to find new reserves also requires renting scarce drilling capacity.

Successes at marginal prospects decline because of the use of older, less effective rigs. This effect is not explicitly modeled but is implicit in the simulations of exploration with higher costs as well as development with higher investment costs.

Scenario 6 in spreadsheet 5 is calculated on the assumption that the changes predicted by the green paradox are realized. It examines as regimes with constant, increasing and decreasing royalties. The benchmark is an increase of the oil price of 1.5% per year and no royalty. The benchmark rate of increase is assumed for both the no-royalty and constant-royalty (held at

36.1%). According to the paradox an increasing royalty causes the price to be lower and initial output to be higher than when there is no royalty. Over time the equilibrium price increases more quickly. A 3% increase in the royalty is assumed to induce a rate of price rise of 1%. The opposite holds for a royalty decreasing at 3%: output increases early on and price rises faster, at an assumed rate of 2%. The response of the firm is in columns after column 5. For comparability, meaning that the government’s receipts are approximately equal, the increasing royalty must start lower and the decreasing royalty, higher. As in the other scenarios, the number of drilling attempts is lower than with no royalty and the initial rate of extraction (level of development) is lower. Again, the oil company prefers the rising royalty.

Scenarios 6 and 7 attempt to hold constant some variables in order to make valid comparisons, but there are several divergences – in rents and consequently incentives, in damages, etc. They display some instances of a strong green paradox (greater present value of emissions with a royalty than without). These strongly paradoxical effects are concentrated at the low rate of discount (the 1.4% recommended in the Stern Review) and for the decreasing royalty. The reason is that there is greater recovery under the decreasing royalty, almost as much as with no royalty but well into the future, which is not heavily discounted at this rate. Only for a few results, for a rising royalty with damages evaluated at low discount rates, does any policy pass a cost-benefit test. The decreasing and royalties do not pass a cost-benefit test in any instance. The conventional problem with a royalty is that it has high deadweight losses. The problem is borne

12

out strongly in the results: in many cases, the benefits of reducing carbon emissions do not overcome the deadweight loss of the royalty.

5. Conclusion

Contrary to the underlying vision of the green paradox, the “tilt” of output from an oil reservoir

(and hence in the aggregate) does not depend on whether there is a royalty or whether the royalty itself has an increasing, constant or decreasing “tilt”. Instead, the tilt of production is exogenous in all cases, equal to the rate of natural decline of the reserve.

The main change with a royalty is the level of initial production. It is constrained by the level of developmental investment sunk by the firm at the outset of production. A royalty tends to lead to a reduction in the level of development because the present values of the rents available to the firm are reduced. Any form of royalty has qualitatively similar, strong effects on extraction and timing of extraction, namely, lower investment and initial production, delays and reductions in enhanced recovery, reduced rents, and, in most cases but with some exceptions, reduced discounted carbon damages and reduced overall recovery.

Changes in the tilt of the royalty – increasing or decreasing – induce less striking but notable variations in these effects. The incentive to reduce initial investment tends to be stronger for a decreasing royalty than an increasing royalty. On the other hand, an increasing royalty discourages and may preclude investment in enhanced production, thereby reducing the total level of output from the reserve as well as the length of production.

For predictions of the green paradox to be realized, the depressing effect of the royalty on sunk investments in exploration and development would have to be overcome through earlier development of known but undeveloped reserves. Ultimate production from all reserves would be unambiguously lower.

Even though different potential price paths can be simulated, with some guidance from the predictions of the paradox, the present analysis is limited to a partial equilibrium of a single reserve. For a single reserve, there is no set of parameters among the many background variables that can be held fixed in order to make all scenarios comparable.

13

The sectorial equilibrium involves the outcomes of such decisions at tens of thousands of heterogeneous developed and undeveloped properties and undiscovered resources. Simulating the equilibrium would involve heroic assumptions. It is clear from the analysis that common simplifying assumptions, such as that marginal costs are equalized across reserves, that all discovered reserves are in production and that all resources can be aggregated into discovered and undiscovered reserves, can be expected to mislead. Hotelling models are oversimplified for policy applications.

Furthermore, if the sectorial analysis were to be relevant to policy rather than a theoretic exercise, it would also have to include behavioral assumptions about the prevalent state-owned oil companies, whose motivations are more subtle than the maximization of discounted profit and likely changing over time.

Assumptions, simulations and predictions can always be improved. The results are not definitive but they do suggest what needs to be explained about effects of carbon taxes on emissions.

Additional scenarios involving an exogenous price path may be the indicated next series of steps.

There appears to be little reason to believe that the green paradox would be the outcome of a tax on carbon producers. The main objection to the royalty is the high cost, in terms of natural resources, of the environmental policy. The deadweight losses of the instrument render it in many cases a socially inefficient way to reduce carbon emissions.

14

Appendix. Simplified Symbolic Representation of the Model

As an indication of the complexity of the model as compared to the Hotelling model, this appendix indicates the main considerations of the model, abstracting from the possibility of enhanced recovery.

The following assumptions are maintained in the model, for time t > 0:

1.

The interest rate is denoted by r.

2.

Price is denoted by p(t) and rises or falls at rate π.

3.

Output is denoted by q(t) in barrels (bbl) and falls through time at rate a.

4.

The royalty is denoted by τ(t) and rises or falls at rate ρ.

5.

The damages of carbon emissions are denoted by d(t) per ton ne and rise at rate γ. Carbon content is ½ tonne per barrel.

6.

The capital cost is sunk and is denoted by K = 40,000 q(0).

7.

The avoidable cost of output is denoted by c(t) = 20q(t) + 0.02K = 20q(t) + 800q(0), comprising fixed and variable components.

8.

Exploration expenditures are denoted by E

≥

0 .

In scenarios where exploration is considered, the realized exploration expenditure depends on the number of holes drilled until exploration is abandoned without success or a reserve, R, which may take one of three values, is discovered. Given (expected) exploration investment of investment K > 0, the (expected) net present value to the firm is given by

E

≥

0 and development

V ( K , T )

= −

E

−

K

+ t

T ∑

=

1

{ p ( t ) q ( t )

−

[ 20 q ( t )

+

800 q ( 0 )]

− τ

( t )[ 1

2 q ( t )]} e

− rt .

The net present value, V(K,T), depends on the level of exploration and the success of exploration at stated probabilities. If exploration is unsuccessful, development does not take place. Given discovery of a reserve, the expression for V(K,T) is simplified and maximized with respect to K (or to q(0)) and T, subject to the resource constraint that

∑

q ( t )

≤

R

.

Carbon damages are given by

D ( K , T )

= t

T ∑

=

1 d ( t ) q ( t ) e

− rt .

When the royalty is positive (when τ (0) > 0), the present value of royalties obtained by the government is given by

Θ

( K , T )

= t

T ∑

=

1

τ

( t ) q ( t ) e

− rt .

The value Θ(K,T) is held fixed across different values of τ(0) and ρ for comparisons of the effects of increasing, decreasing and constant royalties.

15

The imposition of a royalty changes the willingness of the firm to engage in exploration and causes a change in K and hence q(0) for discovered reserves. If there is a development investment (K > 0), the imposition of a royalty induces a change from the ne utral value V(K,T) (with τ(0) = 0) to V(K’,T’) +

Θ(K’,T’). The change in net social value is denoted by Γ = V(K’,T’) + Θ(K’,T’) – V(K,T) and the change in the damages is given by Δ = D(K’,T’) – D(K,T). The cost per unit change in damages is given by Γ/Δ.

In addition, the firm may invest in enhanced recovery. The timing and cost of that investment are endogenous to the solution and increase the available reserve at that time by the factor λ > 1.

References

Anderson, Soren T., Ryan Kellogg and Stephen W. Salant (2014), “Hotelling Under Pressure”, working paper, Department of Economics, University of Michigan.

Bauer, Nico, Ioanna Mouratiadou, Gunnar Luderer, Lavinia Baumstark, Robert J. Brecha, Ottmar

Edenhofer and Edmund Kriegler (2013), “Global Fossil Energy Markets and Climate Change Mitigation

– An Analysis with REMIND”, Climatic Change, October

Cairns, Robert D. (2001), “Capacity Choice and the Theory of the Mine”, Environmental and Resource

Economics , 18: 129-148

Cairns, Robert D. and Graham A. Davis (2007), “Strike when the Force is with You: Optimal Stopping with Application to Resource Equilibria”, American Journal of Agricultural Economics 89, 2: 461-472.

Hotelling, Harold (1931), “The Economics of Exhaustible Resources”, Journal of Political Economy ,

139–175.

McGlade, Christophe (2013), “A Bottum-up Assessment of Oil Field Production in the Medium Term:

An Introduction to the BUEGO Model”, working paper, University College London Energy Institute, 36 pp.

16

Nordhaus, William (2007), “Critical Assumptions in the Stern Review on Climate Change”, Policy

Forum, Science 317: 201-202.

Sinclair, Peter (1992), “High Does Nothing and Rising is Worse: Carbon Taxes Should Keep Declining to

Cut Harmful Emissions”, Manchester School LX, 1: 41-52.

Sinn, Hans-Werner (2008), “Public Policies against Global Warming: A Supply Side Approach”,

International Tax Policy and Public Finance 15: 360-394.

Smith, James L. (2012), “Modeling the Impact of Taxes on Petroleum Exploration and Development”,

Working Paper, Fiscal Affairs Department, International Monetary Fund, November, 45 pp.

Ulph, Alistair and David Ulph (1994), “The Optimal Time Path of a Carbon Tax”, Oxford Economic

Papers 46: 857-868.

17

3a

3b

3c

2a

2b

2c

Development & Extraction Subject to Dynamic Royalty

Backround parameters: P=$100, VC=$20*Q+2% capex,i=8%,R=100 mmb, capcoef=$40K/initial daily bbl, lambda=2.5,delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(1)

Scenario

1a

(2) (3) (4) (5) initial royalty rate

%

0.00% royalty growth rate

%

0.00% extraction rate

%

7.5% onset of

EOR year

10

(6) (7) (8) (9) (10) (11) initial prod ultimate recovery end of life mm bbl mm bbl year

7.50

166 44 present value ultimate recovery mm bbl

61 overall recovery factor

%

55.3%

NPV

Company

Profit

$ mm

$3,445

(12)

NPV Govt.

Revenue

$ mm

$0

(13) (14) (15)

HG Share of Max

Rents

%

IOC Share of Max

Rents

%

Overall

Rent

Capture

%

0.0% 100.0% 100.0%

(16)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

(17)

PV Cost per "PBE" of

Reduced

Recovery

$/bbl na

4a

4b

4c

33.90%

31.00%

38.91%

33.90%

30.35%

51.60%

33.90%

27.02%

60.20%

0.00%

1.00%

-1.00%

0.00%

3.00%

-3.00%

0.00%

5.00%

-5.00%

6.0%

6.5%

5.5%

6.0%

7.0%

4.5%

6.0%

7.5%

4.5%

16

18

16

16 na

15

16 na

14

6.00

6.50

5.50

6.00

7.00

4.50

6.00

7.50

4.50

150

136

157

150

86

172

150

79

176

54

46

63

54

27

80

54

20

79

47

47

45

47

42

42

47

43

43

50.0%

45.3%

52.3%

50.0%

28.7%

57.3%

50.0%

26.3%

58.7%

$1,472

$1,451

$1,406

$1,472

$1,212

$1,245

$1,472

$1,165

$1,284

$1,722

$1,722

$1,722

$1,722

$1,722

$1,722

$1,722

$1,722

$1,722

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

42.7%

42.1%

40.8%

42.7%

35.2%

36.1%

42.7%

33.8%

37.3%

92.7%

92.1%

90.8%

92.7%

85.2%

92.7%

83.8%

$15.69

$9.07

$35.22

$15.69

$6.39

86.1% -$79.67

$15.69

$6.41

87.3% -$43.90

$17.93

$19.43

$19.81

$17.93

$26.89

$25.16

$17.93

$31.00

$24.39

3a

3b

3c

2a

2b

2c

4a

4b

4c

Hi Cost Development & Extraction Subject to Dynamic Royalty

Backround parameters: P=$100, VC=$40*Q+2% capex,i=8%,R=100 mmb, capcoef=$60K/initial daily bbl, lambda=2.5,delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(1)

Scenario

1a

(2) (3) (4) (5) initial royalty rate

%

0.00% royalty growth rate

%

0.00% extraction rate

%

5.5% onset of

EOR year

18

(6) (7) (8) (9) (10) (11) initial prod ultimate recovery end of life mm bbl mm bbl year

5.50

148 58 present value ultimate recovery mm bbl

44 overall recovery factor

%

49.3%

NPV

Company

Profit

$ mm

$1,763

(12)

NPV Govt.

Revenue

$ mm

$0.0

(13) (14) (15)

HG Share of Max

Rents

%

IOC Share of Max

Rents

%

Overall

Rent

Capture

%

0.0% 100.0% 100.0%

(16)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

(17)

PV Cost per "PBE" of

Reduced

Recovery

$/bbl na

25.34%

22.45%

27.37%

25.34%

19.20%

35.11%

25.34%

16.27%

41.29%

0.00%

1.00%

-1.00%

0.00%

3.00%

-3.00%

0.00%

5.00%

-5.00%

4.0%

4.5%

4.0%

4.0%

4.5%

3.5%

4.0%

5.0%

3.5%

31 na

23

31 na

27

31 na

22

4.00

4.50

4.00

4.00

4.50

3.50

4.00

5.00

3.50

134

91

143

134

78

156

134

71

159

78

33

85

78

53

83

78

24

85

32

33

32

32

33

33

32

34

32

44.7%

30.3%

47.7%

44.7%

26.0%

52.0%

44.7%

23.7%

53.0%

$721

$740

$742

$721

$713

$691

$721

$699

$698

$881.5

$881.6

$881.4

$881.5

$881.3

$881.4

$881.5

$881.6

$881.4

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

50.0%

40.9%

42.0%

42.1%

40.9%

40.4%

39.2%

40.9%

39.6%

39.6%

90.9%

92.0%

92.1%

$11.46

$2.48

$27.92

90.9%

90.4%

$11.46

$2.41

89.2% -$23.83

90.9% $11.46

89.7% $2.37

89.6% -$16.69

$13.38

$12.85

$12.69

$13.38

$15.34

$15.88

$13.38

$18.24

$15.30

Scenario

1a

2a

2b

2c

3a

3b

3c

4a

4b

4c

Equal Rent

(1)

Development & Extraction Subject to Dynamic Royalty

Backround parameters: P=$100, VC=$20*Q+2% capex,i=8%,R=100 mmb, capcoef=$40K/initial daily bbl, lambda=2.5,delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(2) (3) (4) (5) initial royalty rate

%

0.00% royalty growth rate

%

0.00% extraction rate

%

7.5% onset of

EOR year

10

(6) (7) (8) (9) (10) (11) initial prod ultimate recovery end of life mm bbl mm bbl

7.50

166 year

44 present value ultimate recovery mm bbl

61 overall recovery factor

%

55.3%

NPV

Company

Profit

$ mm

$3,445

(12)

NPV Govt.

Revenue

$ mm

$0

(13) (14) (15)

HG Share of Max

Rents

IOC Share of Max

Rents

Overall

Rent

Capture

% % %

0.0% 100.0% 100.0%

(16)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

(17)

PV Cost per "PBE" of

Reduced

Recovery

$/bbl na

39.00%

20.15%

50.70%

0.00%

3.00%

-3.00%

5.5%

8.0%

4.5%

18 na

15

5.50

8.00

4.50

148

93

172

59

32

80

44

46

42

49.3%

31.0%

57.3%

$1,223

$1,816

$1,275

$1,833.6

$1,235.0

$1,692.3

53.2%

35.8%

49.1%

35.5%

52.7%

37.0%

88.7%

88.6%

$21.58

$5.40

86.1% -$79.62

$22.85

$26.27

$25.14

5*

5a

5b

5c

4*

4a

4b

4c

3*

3a

3b

3c

2*

2a

2b

2c

Full Cycle Explo & Development Subject to Dynamic Royalty

3/29/2014

Starting royalty rates calibrated to produce equal HG Take (column 13).

Backround parameters: α =50%, P=$100, VC=$20*Q+2% capex, i=8%, R=rand, capcoef=$40K/initial daily bbl, lambda=2.5, delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

Scenario

1*

1a

1b

1c

Initial

Royalty

Rate

%

0.00%

42.30%

33.00%

26.40%

Price

Growth

Rate

%

-2%

-2%

-2%

-2%

Royalty

Growth

Rate

% na

-3%

0%

3%

Extraction

Rate

%

9.4%

5.9%

6.5%

7.1%

Onset of

EOR year na na na na

Expected Expected

Initial

Prod

Ultimate

Recovery mm bbl mm bbl

104 10.36

6.40

7.05

7.70

100

97

89

End of

Life year

29

41

33

23

Max

Explo

Wells

#

6

5

5

5

(11) (12)

Expected

Recovery

Factor

%

31.7%

30.7%

29.5%

27.0%

Expected

IOC NPV

$ mm

$2,438.0

$821.0

$904.0

$942.0

(13) (14)

Expected

HG NPV HG "Take"

$ mm

$0.0

0%

$1,344.0

$1,344.0

$1,344.0

62%

60%

59%

(15) (16) (17)

HG Share of Max

Rents

%

0%

55%

55%

55%

IOC Share of Max

Rents

%

100%

34%

37%

39%

Overall

Rent

Capture

%

$2,438

88.8%

92.2%

93.8%

(18)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

$ 61.76

$ 26.17

$ 9.88

(19)

IP Falling

/ Rising

Royalty

%

Total Prod

Falling /

Rising

Royalty

%

IOC NPV

Falling /

Rising

Royalty

%

83%

(20)

112%

(21)

87%

0.00%

40.97%

33.00%

25.89%

0.00%

47.13%

33.00%

29.02%

0%

0%

0%

0%

-1%

-1%

-1%

-1% na

-3%

0%

3% na

-3%

0%

3%

8.0%

5.6%

6.6%

7.3%

7.5%

5.0%

6.0%

7.2%

10

15

16 na

12

17 na na

8.89

6.08

7.16

7.92

8.33

5.51

6.62

7.81

166

160

101

93

185

184

166

95

44

72

54

28

38

53

40

26

7

6

6

5

7

5

5

5

49.5%

49.3%

30.9%

29.0%

55.7%

55.8%

50.4%

29.3%

$2,872.0

$1,127.0

$1,097.0

$1,145.0

$3,455.0

$1,271.0

$1,394.0

$1,151.0

$0.0

$1,457.0

$1,457.0

$1,457.0

$0.0

$1,787.0

$1,787.0

$1,763.0

0%

56%

57%

56%

0%

58%

56%

61%

0%

51%

51%

51%

0%

52%

52%

51%

100%

39%

38%

40%

100%

37%

40%

33%

$2,872

90.0%

88.9%

90.6%

$3,455

88.5%

92.1%

84.3% na

$ 51.25

$ 4.92

$ 3.72

na

$ 543.84

$ 14.50

$ 6.03

77%

71%

172%

194%

98%

110%

0.00%

49.96%

33.00%

24.05%

0.00%

51.43%

33.00%

21.99%

2%

2%

2%

2%

1%

1%

1%

1% na

-3%

0%

3% na

-3%

0%

3%

7.2%

4.7%

5.7%

7.0%

6.8%

4.5%

5.5%

6.7%

9

12

12

12

10

13

13

15

8.00

5.18

6.28

7.72

7.56

4.96

6.06

7.39

192

198

187

150

204

204

197

171

69

85

85

41

55

85

68

36

7

6

6

6

6

6

7

6

57.4%

60.0%

56.3%

45.3%

61.2%

61.5%

59.7%

51.9%

$4,175.0

$1,624.0

$1,814.0

$1,740.0

$5,061.0

$2,146.0

$2,357.0

$2,390.0

$0.0

$2,113.0

$2,113.0

$2,113.0

$0.0

$2,429.0

$2,429.0

$2,429.0

0%

57%

54%

55%

0%

53%

51%

50%

0%

51%

51%

51%

0%

48%

48%

48%

100%

39%

43%

42%

100%

42%

47%

47%

$4,175

89.5%

94.1%

92.3%

$5,061

90.4%

94.6%

95.2%

$

$ 52.54

$ 7.71

$ na

(64.41) na

(900.00)

$ 38.73

$ 7.44

67%

67%

132%

119%

93%

90%

5*

5a

5b

5c

4*

4a

4b

4c

3*

3a

3b

3c

2*

2a

2b

2c

Full Cycle Explo & Development Subject to Dynamic Royalty

3/29/2014

Starting royalty rates calibrated to produce equal HG Take (column 13).

Backround parameters: α =70%, P=$100, VC=$20*Q+2% capex, i=8%, R=rand, capcoef=$40K/initial daily bbl, lambda=2.5, delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

Scenario

1*

1a

1b

1c

Initial

Royalty

Rate

%

0.00%

42.30%

33.00%

26.40%

Price

Growth

Rate

%

-2%

-2%

-2%

-2%

Royalty

Growth

Rate

% na

-3%

0%

3%

Extraction

Rate

%

9.4%

5.9%

6.5%

7.1%

Onset of

EOR year na na na na

Expected Expected

Initial

Prod

Ultimate

Recovery mm bbl mm bbl

73 7.32

4.59

5.06

5.53

71

69

64

End of

Life year

29

41

33

23

Max

Explo

Wells

#

3

3

3

3

(11) (12)

Expected

Recovery

Factor

%

31.7%

30.7%

29.5%

27.0%

Expected

IOC NPV

$ mm

$1,758.0

$589.0

$649.0

$677.0

(13) (14)

Expected

HG NPV HG "Take"

$ mm

$0.0

0%

$982.0

$982.0

$982.0

63%

60%

59%

(15) (16) (17)

HG Share of Max

Rents

%

0%

56%

56%

56%

IOC Share of Max

Rents

%

100%

34%

37%

39%

Overall

Rent

Capture

%

$1,758

89.4%

92.8%

94.4%

(18)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

$ 94.44

$ 31.59

$ 10.04

(19)

IP Falling

/ Rising

Royalty

%

Total Prod

Falling /

Rising

Royalty

%

IOC NPV

Falling /

Rising

Royalty

%

83%

(20)

112%

(21)

87%

0.00%

40.97%

33.00%

25.89%

0.00%

47.13%

33.00%

29.02%

0%

0%

0%

0%

-1%

-1%

-1%

-1% na

-3%

0%

3% na

-3%

0%

3%

8.0%

5.6%

6.6%

7.3%

7.5%

5.0%

6.0%

7.2%

10

15

16 na

12

17 na na

6.35

4.36

5.14

5.68

5.95

3.89

4.67

5.60

119

115

73

67

132

130

117

68

44

72

54

28

38

53

40

26

4

3

3

3

4

3

3

3

49.5%

49.3%

30.9%

29.0%

55.7%

55.8%

50.4%

29.3%

$2,075.0

$812.0

$790.0

$825.0

$2,499.0

$917.0

$1,006.0

$830.0

$0.0

$1,064.0

$1,064.0

$1,065.0

$0.0

$1,288.0

$1,288.0

$1,288.0

0%

57%

57%

56%

0%

58%

56%

61%

0%

51%

51%

51%

0%

52%

52%

52%

100%

39%

38%

40%

100%

37%

40%

33%

$2,075

90.4%

89.3%

91.1%

$2,499

88.2%

91.8%

84.8% na

$ 57.35

$ 4.83

$ 3.59

na

$ 147.00

$ 13.82

$ 5.98

77%

69%

172%

190%

98%

110%

0.00%

49.96%

33.00%

24.05%

0.00%

51.43%

33.00%

21.99%

2%

2%

2%

2%

1%

1%

1%

1% na

-3%

0%

3% na

-3%

0%

3%

7.2%

4.7%

5.7%

7.0%

6.8%

4.5%

5.5%

6.7%

9

12

12

12

10

13

13

15

5.71

3.66

4.44

5.45

5.40

3.50

4.28

5.22

137

140

132

106

146

144

139

121

69

85

85

41

55

85

68

36

4

3

3

3

3

3

4

3

57.4%

60.0%

56.3%

45.3%

61.2%

61.5%

59.7%

51.9%

$3,024.0

$1,171.0

$1,309.0

$1,255.0

$3,670.0

$1,548.0

$1,700.0

$1,724.0

$0.0

$1,523.0

$1,523.0

$1,523.0

$0.0

$1,751.0

$1,751.0

$1,751.0

0%

57%

54%

55%

0%

53%

51%

50%

0%

50%

50%

50%

0%

48%

48%

48%

100%

39%

43%

42%

100%

42%

46%

47%

$3,024

89.1%

93.7%

91.9%

$3,670

89.9%

94.0%

94.7%

$ na

(101.23)

$ 39.43

$ 7.93

$ na

296.80

$ 32.93

$ 7.92

67%

67%

132%

119%

93%

90%

Full Cycle Explo & Development Subject to Dynamic Royalty

6/6/2014

Starting royalty rates calibrated to produce equal HG Take (column 13).

Backround parameters: α =70%, P=$100, VC=$20*Q+2% capex, i=8%, R=rand, capcoef=$40K/initial daily bbl, lambda=2.5, delay=0

No Income Tax; no other fiscal burdens besides the royalty.

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) (17)

Scenario

1*

1a

1b

1c

3*

3a

3b

3c

2*

2a

2b

2c

Initial

Royalty

Rate

%

0.00%

40.36%

31.92%

25.58%

0.00%

44.40%

35.19%

27.31%

0.00%

49.00%

34.14%

30.15%

Price

Growth

Rate

%

-2%

-2%

-2%

-2%

Royalty

Growth

Rate

% na

-3%

0%

3%

Extraction

Rate

%

9.4%

6.1%

6.6%

7.2%

Onset of

EOR year na na na na

Expected

Initial

Prod

Expected

Ultimate

Recovery mm bbl mm bbl

7.32

4.75

5.14

5.60

73

72

70

64

-1%

-1%

-1%

-1%

0%

0%

0%

0% na

-3%

0%

3% na

-3%

0%

3%

8.0%

5.3%

6.4%

7.2%

7.5%

4.9%

5.9%

7.1%

12

17 na na

10

15

16 na

6.35

4.13

4.98

5.60

5.95

3.81

4.59

5.53

119

117

132

131

118

73

67

67

End of

Life year

29

40

33

23

Max Explo

Wells

#

3

3

3

3

Expected

Recovery

Factor

%

31.3%

30.7%

29.7%

27.3%

Expected

IOC NPV

$ mm

$1,758.0

$634.0

$682.0

$707.0

Expected

HG NPV HG "Take"

$ mm

$0.0

$959.0

$959.0

$959.0

0%

60%

58%

58%

HG Share of Max

Rents

%

0%

55%

55%

55%

IOC Share of Max

Rents

%

100%

36%

39%

40%

Overall

Rent

Capture

%

$1,758

90.6%

93.3%

94.8%

38

55

41

26

44

74

55

27

4

3

3

3

4

3

3

3

49.7%

49.3%

31.0%

28.7%

55.3%

55.7%

50.0%

29.3%

$2,075.0

$724.0

$720.0

$767.0

$2,499.0

$867.0

$962.0

$780.0

$0.0

$1,115.0

$1,115.0

$1,115.0

$0.0

$1,323.0

$1,323.0

$1,323.0

0%

61%

61%

59%

0%

60%

58%

63%

4*

4a

4b

4c

0.00%

55.43%

35.77%

25.89%

1%

1%

1%

1% na

-3%

0%

3%

7.2%

4.4%

5.5%

7.0%

10

14

14

16

5.71

3.42

4.28

5.45

137

139

130

101

55

85

72

34

3

3

4

3

57.3%

60.0%

56.7%

45.3%

$3,024.0

$1,011.0

$1,185.0

$1,140.0

$0.0

$1,581.0

$1,581.0

$1,582.0

0%

61%

57%

58%

5*

5a

5b

5c

0.00%

60.66%

37.68%

24.92%

2%

2%

2%

2% na

-3%

0%

3%

6.8%

4.1%

5.2%

6.7%

9

13

13

13

5.40

3.19

4.05

5.22

146

143

137

115

141

136

103

69

85

85

38

3

3

4

3

61.0%

61.7%

59.3%

51.7%

$3,670.0

$1,249.0

$1,457.0

$1,493.0

The following royalty scenarios are calibrated to capture 50% of the pre-tax rent available in scenario 6* (P0=$100 growing at 1.5% p.a.)

6* 0.00% 1.5% na 7.0% 9 5.55

143 60 4 60.3% $3,332.0

6a

6b

6c

47.85%

36.10%

28.36%

1.0%

1.5%

2.0%

-3%

0%

3%

5.1%

5.4%

6.3%

12

13

16

3.97

4.20

4.90

85

82

35

3

3

3

61.7%

59.3%

51.7%

$1,227.0

$1,343.0

$1,222.0

$0.0

$1,899.0

$1,899.0

$1,899.0

$0.0

$1,575.0

$1,733.0

$1,938.0

0%

60%

57%

56%

0%

56%

56%

61%

The following royalty scenarios are like those immediately above, but calibrated to capture 50% of the pre-tax rent available in each of the given price scenarios.

7* 0.00% 1.5% na 7.0% 9 5.55

143 60 4 60.3% $3,332.0

$0.0

0%

7a

7b

7c

47.85%

36.10%

23.13%

1.0%

1.5%

2.0%

-3%

0%

3%

4.7%

5.4%

6.3%

13

13

13

3.66

4.20

4.90

140

136

118

85

82

40

3

3

3

60.0%

59.3%

50.0%

$993.0

$1,343.0

$1,625.0

$1,702.0

$1,733.0

$1,769.0

63%

56%

52%

0%

54%

54%

54%

0%

53%

53%

53%

0%

52%

52%

52%

0%

52%

52%

52%

0%

47%

52%

58%

0%

56%

52%

51%

100%

35%

35%

37%

100%

35%

38%

31%

$2,075

88.6%

88.4%

90.7%

$2,499

87.6%

91.4%

84.2%

100%

33%

37%

33%

100%

27%

37%

44%

100%

33%

39%

38%

100%

34%

40%

41%

$3,332

80.7%

88.6%

91.5%

$3,332

83.4%

88.6%

95.2%

$3,024

85.7%

91.5%

90.0%

$3,670

85.8%

91.4%

92.4%

$ na

(241.34)

$ 40.57

$ 8.34

$ na

199.24

$ 37.88

$ 9.00

na

$ 162.44

$ 42.67

$ 7.39

na

$ 111.35

$ 42.67

$ 6.29

(18)

PV Cost per Barrel of

Reduced

Recovery

$/bbl na

$

$

90.16

31.37

$ 9.67

(19)

IP Falling

/ Rising

Royalty

%

Total Prod

Falling /

Rising

Royalty

%

IOC NPV

Falling /

Rising

Royalty

%

85%

(20)

112%

(21)

90%

(22) (23) (24) (25) (26) (27) (28) (29) (30) (31) (32) (33) (34)

Emission Damages ($ million) given: $25/bbl + 1.5% p.a.

1.4% discounted at:

6.0%

$ 1,802

$ 1,764

$ 1,714

$ 1,568

$

$

$

$

1,211

1,034

1,057

1,047

8.0%

$ 1,048

$ 862

$ 890

$ 901

Emission Damages ($ million) given: $25/bbl + 3.0% p.a.

1.4% discounted at:

6.0%

$ 2,065

$ 2,158

$ 2,041

$ 1,795

$

$

$

$

1,349

1,195

1,206

1,171

8.0%

$ 1,156

$ 978

$ 1,002

$ 998

Change in

Mineral

Rents ( Γ )

Change in

Damages

( ∆)

Change in

Damages

( ∆)

Change in

Damages

( ∆)

Change in

Damages

( ∆)

Change in

Damages

( ∆)

Change in

Damages

( ∆) per (22) per (23) per (24) per (25) per (26) per (27)

-$165.0

-$117.0

-$92.0

$

$

$

(38)

(88)

(234)

$

$

$

(177)

(154)

(164)

$

$

$

(186)

(158)

(147)

$

$

$

93

(24)

(270)

$

$

$

(154)

(143)

(178)

$

$

$

(178)

(154)

(158)

$ na

146.58

$

$

5.23

3.72

$ na

297.12

$ 15.21

$ 6.11

74%

69%

175%

195%

94%

111%

$ 2,921

$ 2,906

$ 1,791

$ 1,638

$ 1,604

$ 1,285

$ 1,059

$ 1,069

$ 1,300

$ 989

$ 884

$ 914

$ 3,639

$ 4,047

$ 2,186

$ 1,895

$ 1,895

$ 1,603

$ 1,220

$ 1,203

$ 1,508

$ 1,193

$ 1,002

$ 1,018

$

$

$

$

3,253

3,262

2,925

1,651

$

$

$

$

1,728

1,334

1,351

1,068

$

$

$

1,386

1,010

1,053

$ 911

$

$

$

$

4,121

4,801

3,994

1,918

$

$

$

$

2,060

1,693

1,666

1,204

$

$

$

$

1,621

1,233

1,258

1,016

-$236.0

-$240.0

-$193.0

-$309.0

-$214.0

$

$

$

(15)

(1,130)

(1,283)

$

$

9

(328)

-$396.0

$ (1,602)

$ (319)

$ (545)

$ (535)

$ (311)

$ (416)

$ (386)

$ (394)

$ (377)

$ (660)

$ (376)

$ (333)

$ (475)

$ 408

$ (1,453)

$ (1,744)

$ 680

$ (127)

$ (2,203)

$ (292)

$ (675)

$ (692)

$ (367)

$ (394)

$ (856)

$ (315)

$ (506)

$ (490)

$ (388)

$ (363)

$ (605)

63%

61%

138%

125%

89%

84%

$ 3,379

$ 3,463

$ 3,245

$ 2,485

$ 1,728

$ 1,331

$ 1,412

$ 1,348

$ 1,376

$ 994

$ 1,085

$ 1,090

$ 4,386

$ 5,323

$ 4,619

$ 3,111

$ 2,078

$ 1,712

$ 1,765

$ 1,598

$ 1,618

$ 1,226

$ 1,310

$ 1,266

$ 3,599

$ 3,573

$ 3,419

$ 2,834

$ 1,789

$ 1,339

$ 1,437

$ 1,476

$ 1,416

$ 993

$ 1,096

$ 1,176

$ 4,773

$ 5,568

$ 5,004

$ 3,607

$ 2,164

$ 1,734

$ 1,809

$ 1,771

$ 1,672

$ 1,232

$ 1,331

$ 1,382

-$432.0

-$258.0

-$302.0

-$522.0

-$314.0

-$278.0

$ 84

$ (134)

$ (894)

$ (26)

$ (180)

$ (765)

$ (397)

$ (316)

$ (380)

$ (450)

$ (352)

$ (313)

$ (382)

$ (291)

$ (286)

$ (423)

$ (320)

$ (240)

$

$

$ (1,275)

$

$

$

937

233

795

231

(1,166)

$

$

$

$

$

$

(366)

(313)

(480)

(430)

(355)

(393)

$

$

$

$

$

$

(392)

(308)

(352)

(440)

(341)

(290)

81%

75%

137%

119%

100%

61%

$

$

$

3,517

$ 3,573

$ 3,379

$ 2,549

3,517

$ 3,495

$ 3,379

2,915

$

$

1,476

$ 1,339

$ 1,450

$ 1,324

1,476

$ 1,398

$ 1,450

$ 1,467

$

$

1,124

$ 993

$ 1,111

$ 1,056

1,124

$ 1,054

$ 1,111

$ 1,158

$

$

5,152

$ 5,568

$ 4,879

$ 3,250

5,152

$ 5,256

$ 4,879

$ 3,770

$

$

1,860

$ 1,734

$ 1,817

$ 1,589

1,860

$ 1,782

$ 1,817

$ 1,776

$

$

1,367

$ 1,232

$ 1,345

$ 1,240

1,367

$ 1,291

$ 1,345

$ 1,370

-$868.0

-$594.0

-$510.0

$ (1,050)

-$975.0

-$594.0

-$276.0

$

$

(26)

(220)

$ (104)

$ (220)

$ (684)

$ (450)

$ (339)

$ (465)

$ (391)

$ (339)

$ (322)

$ (423)

$ (305)

$ (360)

$ (362)

$ (305)

$ (258)

$ 795

$ 106

$ (1,523)

$

$

$

483

106

(1,003)

$ (430)

$ (347)

$ (575)

$

$

$

(382)

(347)

(388)

$ (440)

$ (327)

$ (432)

$

$

$

(381)

(327)

(302)

(35) (36) (37) (38) (39) (40)

Cost/Unit

Change in

Cost/Unit

Change in

Cost/Unit

Change in

Cost/Unit

Change in

Cost/Unit

Change in

Cost/Unit

Change in

Damages Damages Damages Damages Damages Damages

( Γ / ∆ ) ( Γ / ∆ ) ( Γ / ∆ ) ( Γ / ∆ ) ( Γ / ∆ ) ( Γ / ∆ ) per (22) per (23) per (24) per (25) per (26) per (27)

$4.34

$1.33

$0.39

$0.93

$0.76

$0.56

$0.89

$0.74

$0.63

($1.77)

$4.88

$0.34

$1.07

$0.82

$0.52

$0.93

$0.76

$0.58

$15.73

$0.21

$0.15

$0.74

$0.44

$0.36

$0.76

$0.58

$0.50

($0.58)

$0.17

$0.11

$0.81

$0.36

$0.28

$0.75

$0.47

$0.39

($34.33)

$0.65

$0.25

$0.78

$0.57

$0.60

$0.82

$0.64

$0.83

($0.45)

$1.69

$0.18

$0.84

$0.54

$0.46

$0.80

$0.59

$0.65

($5.14)

$1.93

$0.34

$1.09

$0.82

$0.79

$1.13

$0.89

$1.06

($0.46)

($1.11)

$0.24

$1.18

$0.82

$0.63

$1.10

$0.84

$0.86

$20.08

$1.74

$0.36

$1.16

$0.89

$0.89

$1.23

$0.98

$1.16

($0.66)

($1.36)

$0.24

$1.21

$0.88

$0.71

$1.19

$0.92

$0.96

$33.38

$2.70

$0.49

$1.93

$1.75

$1.10

$2.05

$1.95

$1.42

($1.09)

($5.60)

$0.33

$2.02

$1.71

$0.89

$1.97

$1.82

$1.18

$9.38

$2.70

$0.40

$2.49

$1.75

$0.86

$2.69

$1.95

$1.07

($2.02)

($5.60)

$0.28

$2.55

$1.71

$0.71

$2.56

$1.82

$0.91