Jordi Mondria University of Toronto (Very Preliminary. Comments are welcome)

advertisement

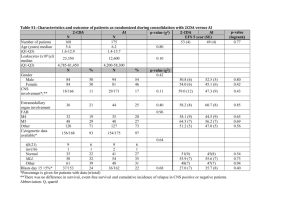

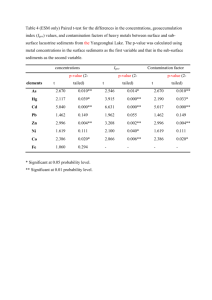

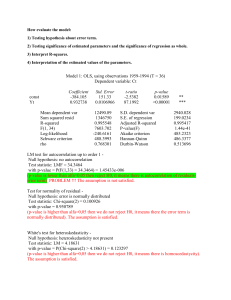

The Canadian Dollar Determination Puzzle Ali Emre Konukoglu Jordi Mondria Rotman School of Management University of Toronto (Very Preliminary. Comments are welcome) May 2008 Abstract The exchange rate determination puzzle refers to the empirical finding that nominal exchange rate models based on macroeconomic fundamentals are outperformed by a driftless random walk. Several recent papers have developed models in international macroeconomics with good performance for several currencies of developed countries, and claim the puzzle no longer exists. Others claim the puzzle is still there since there is no single standard model that is able to explain exchange rate movements of all developed currencies, even though they assert that most currencies of developed countries have a structural model with high explanatory power. In this paper, we claim there is no single traditional structural model that beats the random walk for the Canadian dollar. We asses the performance of several recent models based on macroeconomic fundamentals of nominal exchange rate as well as models based on commodity prices. The models are estimated in first-difference, dynamic OLS and error correction specifications. Their performance is evaluated at forecast horizons of 1, 2, 4, 12,16 and 20 quarters using the mean squared error ratio. The statistical significance of the results are assessed by the Diebold and Mariano (1995) t-statistics, Clark and West (2006) statistics and change of direction statistics. 1. INTRODUCTION What are the determinants of the Canadian dollar? There has been a great deal of research on identifying the relationship between macroeconomic fundamentals and exchange rates. Recently, several papers have developed structural models with macroeconomic fundamentals that are able to explain how the exchange rate values of most currencies in developed countries are determined. However, none of these fundamental variables seem to be able to predict the behavior of the Canadian exchange rate. This paper re-assess if standard macro models could significantly outperform a driftless random walk in out-ofsample forecasts of the Canadian dollar. The empirical finding that exchange rates are poorly predicted by macroeconomic fundamentals is usually called the exchange rate determination puzzle. In a seminal paper Richard Messe and Kenneth Rogoff (1983) conducted a monthly out-of -sample analysis for several exchange rates. Time series and structural models based on macroeconomic fundamentals were outperformed by a driftless random walk. Mark (1995) was the first to shed light on this puzzle. He presented evidence that long horizon changes in the exchange rate depend on the current deviation from its fundamentals. His out-of-smaple forecasts beat the random walk at the 12- and 16-quarter horizons for the Deutsche mark, Swiss franc and the yen and concluded that exchange rates are predictable at a three year horizon. However, there was no evidence that there is an economically and statistically significant component in long horizon changes of the Canadian dollar. More recently, Gourinchas and Rey (2007) have developed fundamental approach to exchange rates that beats the random walk over less than a year horizon. They generated 2 a new variable of external imbalances, which is based on an intertemporal budget constraint, in order to predict exchange rates. This new variable combines linearly components of exports, imports, assets and liabilities. It is a new measure of external imbalances that unlike the current account, it incorporates information both the trade balance and the foreign asset position. They found that this new variable beats the random walk at all horizons starting one quarter ahead. They found significant predictive power for currencies such as the US dollar against the Sterling, the Japanese yen, the German D-Mark (Euro after 1999) and the Swiss Franc. However, there was no evidence that this new measure of external imbalances had any significant predictive power for the Canadian dollar. Among others, Mark (1995) and Gourinchas and Rey (2007) have built models based on macroeconomic fundamentals that are able to predict exchange rate movements and outperform a driftless random walk for several currencies of developed countries. These empirical findings have lead some economists to say that the exchange rate determination puzzle is no longer a puzzle. Others such as Cheung, Chinn and Pascual (2005) claim the puzzle is still there since there is no single standard model that consistently explains exchange rate movements and outperforms a driftless random walk for most currencies. This paper provides empirical evidence that there is no single standard structural model that significally beats the random walk for the Canadian dollar. The traditional fundamental variables used as potential determinants of the Canadian dollar against the US dollar are the interest rate differential, output differential, inflation differential, money supply differential and productivity differential. The standard macroeconomic models are augmented with a commodity price index as in Amano and Van Norden (1995) and Chen 3 (2004) and an energy price index as in Amano and Van Norden (1995). These fundamental variables are estimated using first-difference, dynamic OLS and error correction specifications. Their performance is evaluated at forecast horizons of 1, 2, 4, 12, 16 and 20 quarters, using the mean squared error ratio. Diebold and Mariano (1995) tstatistics, Clark and West (2006) statistics and change of direction statistics are reported to assess the statistical significance of the results. The evidence in this paper supports the theory of Engel and West (2005), at least for the Canadian dollar, which suggests that fundamental variables do not help predict exchange rate values since exchange rates manifests near–random walk behavior. 2. LITERATURE REVIEW A more detailed and extensive literature review to be added. 3. EMPIRICAL RESULTS Throughout the paper three specifications of various theoretical models are estimated: (1) an error correction specification, (2) Dynamic OLS (DOLS) specification and (3) first differences specification. Estimation with cointegrated variables raises concerns about spurious regression bias and Engle and Granger (1987) representation theorem shows the use of error correction specification for cointegrated variables, which has been widely used in the exchange rate forecasting literature (Amano and Norden (1993) and Cheung, Chinn and Pascual (2002)). Although our commodity and energy price indices don’t show unit roots (Appendix A) and unit roots for other macro variables are not considered 4 by the previous literature we are still using the error correction specification with the primary goal of being consistent with the previous literature. Similarly, DOLS procedure, proposed by Stock and Watson (1993) produces efficient estimates of the cointegrating vector and we are employing it as the alternative estimation method in this study as in Chen (2004). The first differences specification basically estimates the differenced series of the nominal exchange rates with the differenced series of the explanatory variables. It is used by the previous literature as an alternative to error correction specification (Cheung, Chinn and Pascal (2002) and Chinn and Meese (1995) ) and therefore we include it in our analysis. For all three specifications we report in-sample results as well as out-of-sample forecasts. In-sample tests are conducted for the whole sample (1972Q1-2002Q4) and for the subsample of 1983Q1 to 2002Q4 to account for the end of monetary targeting in US as also done in the previous literature (Cheung, Chinn and Pascual (2002)). We should clearly state that we don’t hold a stance against the existence for a structural break in the CDN/USD exchange rate series and we keep it out of our main goal of evaluating the outof-sample forecasting power of the empirical exchange rate models. To our knowledge Issa, Lafrance and Murray (2006) is the only paper that specifically deals with the issue of a structural break in the CDN/USD exchange rate series and our results don’t explicitly deal with it. The out-of-sample forecasting is done for two alternative out-of-sample intervals and with constant moving window of in-sample regressions. For the out-of-sample window that starts in 1981Q1 we start our first observation at 1972Q1 and use the next 39 observations to forecast the nth observation in the out-of-sample. For the next forecast in 5 the out-of-sample we move the in-sample estimation forward by one observation. We use six different values of n starting from one quarter up to twenty quarters out-of-sample to evaluate the forecasting power of the model at different horizons. We also use an alternative out-of-sample window that starts in 1991Q1 with an in-sample estimation period that starts in 1981Q1 to test the out-of-sample forecasting power of the empirical models in the later subsample. The forecasting power at out-of-sample are evaluated with two methods: Mean Squared Error (MSE) ratios are reported for the out-of-sample forecasting period as the ratio of the MSE of the random walk over the MSE of the empirical model that is being tested. A MSE ratio that is significantly less than one shows the superior forecasting power of the empirical model with respect to the benchmark of random walk forecasts. The statistical significance of the MSE ratios is evaluated with two alternative t-statistics as done in the previous literature. We report the Diebold and Mariano (1995) t-statistics as well as Clark and West (2006) statistic for that purpose. Clark-West (2006) statistics basically adjusts the Diebold and Mariano (1995) statistics for the finite sample bias by the squared sum of the predicted values of the model and is also used by Gourinchas and Rey (2007). In addition to MSE ratios we also use the change of direction statistics that is used by Cheung, Chinn and Pascual (2002). Change of direction statistics measures the number of times the empirical model forecasts the direction of change in the nominal exchange rate correctly in the out-of-sample. It is a useful measure in terms of giving an indication of whether the empirical model can be used to time the future exchange rate changes. A change of direction measure that is greater than 0.5 means that the model performs better than the random walk in the out-of-sample. 6 3.1. Error Correction Specification 3.1.1. Amano and Norden (1993) Specification This section follows the Amano and Norden (1993) specification that uses to explain real CDN/USD exchange rate with the terms of trade and real exchange rates. The basic idea behind that study is to use stationary and non-stationary variables together to explain the differences in the real exchange rate series. / us Δε tcdn / us = α + β1ε tcdn + β 2 ft −1 + ε t −1 (1) As stated by Equation 1, the forward difference in log CDN/USD exchange rate series is estimated using the lagged value of the log exchange rate as well as the lagged values of the log commodity and price indices and the difference in real interest rates between US and Canada. This study modifies the Amano and Norden (1993) framework in two dimensions: Firstly, we use the nominal CDN/USD exchange rate series since the paper is about the nominal CDN/USD exchange rate. And secondly, we extend the Amano and Norden (1993) study for the out-of-sample forecast results. In-sample results, reported in Table3, clearly show the poor performance of the explanatory variables for the whole sample period. Low R-squared values and insignificant coefficient estimates suggest the poor fit of the Amano and Norden (1993) specification for the nominal CDN/USD exchange rate series. One issue of having very poor in-sample explanatory power of the model is the difficulty of interpreting the out-ofsample results relative to random walk specification. Poor in-sample results such as in Table 3 signals the possibility of comparing noise with random walk at out-of-sample and we fully consider it below while discussing the out-of-sample results. 7 The subsample results show significantly stronger explanatory power of the Amano and Norden (1993) specification for the later part of the sample (Table 4). One important result is the positive coefficient estimate for energy price index, which has been reported previously as a counterintuitive Canada being a net exporter of energy products like crude oil and natural gas. The out-of-sample results are documented in Tables 5 and 6. Both tables show that terms of trade specification doesn’t have superior forecasting power compared to the random walk. The out-of-sample forecasts starting from 1981Q1 seem to be better than the shorter sample that starts in 1991Q1 but considering the poor in-sample results we can’t make much out of the MSE ratios that are significantly less than one. Change of direction statistics are also significantly less than 0.5 showing inferior predictability compared to random walk. The results collectively show that the terms of trade specification suggested by Amano and Norden (1993) performs poorly in the out-of-sample for our sample period. 3. 1.2. Cheung, Chinn and Pascual (2002) Specification This section uses the two-step error-correction specification for predicting the differences in CDN/USD exchange rates. The 1st step estimates the coefficients using the levels of exchange rates and fundamentals. The estimated coefficients are then used to predict the change in the exchange rates for k periods ahead: 8 1st step: ε tcdn / us = α + β ft + ε t (2) 2nd step: / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k (3) In error-correction model the choice of k is crucial and since we don’t have a specific model for the choice of k we are conducting the tests for four different levels. Also two sets of macroeconomic fundamentals are used in the estimation: The first model uses the sticky price monetary model as the basis and uses the log differences in real output levels and money stocks as well as differences in real interest and inflation rates as explanatory variables in the first and second steps. The in-sample results of the second step for the whole sample are reported in Table 7. We can clearly see that the in-sample explanatory power increases in k. The subsample starting 1983Q1 shows better in-sample predictive power like in previous section (Table 8). The out-of-sample results (Tables 9 and 10) indicate poor out-of-sample forecasting power of the error correction specification for sticky price monetary model. 1 out of 24 MSE ratios are significantly less than one for the longer out-of-sample period of 1981Q12002Q4 and only 4 out of 24 MSE ratios are significantly less than one for the later outof-sample period of 1991Q1-2002Q4. Change of direction also confirm the poor out-ofsample forecasting power, none of them is greater than 0.5. Another important observation from this section is that the MSE ratios are decreasing in k, meaning that the model performs better in differences in CDN/USD exchange rate in longer periods. 9 The second model is the generic productivity differential exchange rate equation from Chinn, Cheung and Pascual (2002), which uses differences in log real output levels, money stocks and productivity levels and differences in real interest rates between Canada and US. The in-sample and out-of-sample performances of the productivity differential model are also similar to the ones of sticky price monetary model (Tables 1114). Only 1 out of 24 MSE ratios is significantly less than one for the out-of-sample period of 1981Q1-2002Q4 and 3 out of 24 for the shorter out-of-sample period of 1991Q1-2002Q4. 3.2. Chen (2004) Specification In DOLS specification the levels of CDN/USD nominal exchange rates are estimated using the levels of macroeconomic and terms of trade variables and their lagged and forward differences to control for cointegration. Given the single unit root in CDN/USD nominal exchange rates and no unit root in energy and commodity price indices we have decided to include the current, one forward and one lagged differences in fundamentals (DOLS(1,-1)). Equation 4 summarizes the idea behind the DOLS specification: ε p cdn / us t = α + β ft + ∑ Δft −i +ε t (4) i =− p In this section we are testing three different empirical models: First model is a modified version of the asset approach which uses log commodity and energy price indices in addition to log differences in money stocks and real output levels as the explanatory variables. The modified flex-price monetary model adds the log differences in money stocks as the additional explanatory variable. And thirdly, sticky price monetary model 10 uses the log differences in money stocks in addition to the variables used in modified flex-price model. The additional use of energy and commodity price indices in this section should be seen as an attempt to improve the in-sample and out-of-sample performances of the conventional models that have been documented to perform poorly for nominal CDN/USD exchange rate by the previous literature. The in-sample results are summarized in Table 15 for the whole sample (1972Q12002Q4) and in Table 16 for the later subsample (1983Q1-2002Q4). The in-sample performances of all three models are pretty strong and even stronger in the latter half of the sample. Another important observation from Tables 15 and 16 is that the additional explanatory variables improve the in-sample explanatory powers of the models. Also the sign of the log differences in output levels reverses sign in the latter subsample, which may signal a structural break in the data. Surprisingly, the out-of-sample predictive power of the models is very poor. For none of the models the MSE ratios are less than one at any out-of-sample forecast horizon. The change of direction values are also very low (Table 17 for the larger out-of-sample and Table 18 for the latter out-of-sample). 11 3.3. First Differences Specification First-differences specification predicts the first differences in nominal CDN/USD exchange rate with first differences of the macroeconomic fundamentals and terms of trade variables. Equation 5 shows the first-differences empirical equation. Δε tcdn / us = α + βΔft + ε t (5) In this section we are testing two empirical models: (1) Classical sticky-price model and (2) modified sticky-price model. Given the in-sample success of the modified sticky-price model with the DOLS specification we decided to concentrate on it for the firstdifferences specification as well. For the classical sticky-price model Table 19 reports the in-sample result for the whole sample and Table 20 for the latter subsample. In-sample fit seems to be better than errorcorrection specification in Section 1 and like in all the other results in the paper the latter subsample shows a better fit of the model. Tables 20 and 21 summarize the out-of-sample predictive power of the classical stickyprice model. For neither out-of-sample the first-differences specification seems to produce MSE ratios that are significantly less than 1. The change of direction criteria also confirms the poor out-of-sample power of the model. For the modified sticky-price model the in-sample results show that the addition of the energy and commodity price indices don’t add on the explanatory power of the model (Tables 22 and 23). Out-of-sample forecasts also confirm the poor performance of the modified sticky-price model with first-differences specification. 12 4. CONCLUSION This paper shows that there is no nominal exchange rate determination model based on macroeconomic fundamental variables that is able to explain changes in the Canadian dollar and outperform a driftless random walk in out-of sample forecasts. This empirical evidence either supports the theory of Engel and West (2005), which suggests that exchange rates behave as a near–random walk or raises the question about the Canadian dollar having a unique characteristic not yet analyzed. 5. REFERENCES Amano, R. and S. Norden, 1993, A forecasting equation for the Canada-U.S dollar exchange rate, in The Exchange Rate and the Economy, 201-65 (Bank of Canada, Ottawa). Chen, Y., 2004, Exchange Rate and Fundamentals: Evidence from Commodity Economies, University of Washington Working Paper. Cheung, Y., Chinn, M. and A. Pascual, 2002, Empirical exchange rate models of the nineties: Are any fit to survive?, NBER Working Paper 9393. Chinn, M. and R. Meese, 1995, Banking on Currency Forecasts: How Predictable Is Change in Money? , Journal of International Economics 38, 161-178. Clark, T. and K. West, 2006, Using out-of-sample mean squared prediction errors to test the martingale difference hypothesis, Journal of Financial Econometrics, 135, 155-186. Diebold, F. and Mariano R., 1995, Comparing Predictive Accuracy, Journal of Business and Economic Statistics, 13, 253-265 Djoudad R., J. Murray, T. Chan and J. Daw, 2000, The role of chartists and fundamentalists in currency markets: the experience of Australia, Canada and New Zealand, in Revisiting the Case for Flexible Exchange Rates, proceedings of a conference held at the Bank of Canada, Engel, C., K. West, 2005, Exchange Rates and Fundamentals, Journal of Political Economy, 113, 485-517. Engle, R and C. Granger,1987, Cointegration and Error Correction: Representation, Estimation and Testing, Econometrica, 55. 251-276 Issa, R., R. Lafrance and J. Murray, 2006, The turning black tide: Energy prices and Canadian dollar, Bank of Canada Working paper. 13 Gourinchas, P. and H. Rey, 2007, International Financial Adjustment, NBER working paper Mark, N., 1995, Exchange rates and fundamentals: evidence on long-horizon prediction, American Economic Review, 85, 201-218. Messe, R., K. Rogoff, 1983, Empirical Exchange rate models of the Seventies: Do they fit out of sample, Journal of International Economics, 14, 3-24. 6. APPENDICES Data Appendix End of period quarterly nominal exchange rates for CDN/USD are taken from IMF’s International Financial Statistics (IFS) for the period 1972Q1 to 2002Q4. Short term Interest Rates: 3-month US and Canadian Treasury bill rates are taken from IFS. Consumer Price Index (CPI): Quarterly consumer prices are taken from IFS. Money Stock (M1): M1 series are taken from IFS. Real Output: GDP volume (1995=100) is taken from IFS. Commodity and Energy Prices: The country specific commodity and energy export price indices are constructed by using the weights in Djoudad, Murray, Chan and Daw (2001) and world market prices in US dollar from IFS. Productivity: The productivity series are labor productivity indices, measured as real GDP per employee (converted to indices (1995=100)). The data are drawn from CANSIM and IFS. Description of variable symbols: ε tcdn / us : Quarterly CDN/USD exchange rate pteng : Quarterly Canadian energy index ptcom : Quarterly Canadian commodity index rt cdn : Quarterly Canadian short term interest rates rtus : Quarterly US short term interest rates m1tcdn : Quarterly Canadian M1 base m1us t : Quarterly US M1 base ytus : Quarterly US GDP cdn t y : Quarterly Canadian GDP us t cpi : Quarterly US CPI cpitcdn : Quarterly Canadian CPI π tus : Quarterly US inflation π tcdn : Quarterly Canadian inflation 14 prod tus : Quarterly US labor productivity index (1995=100) prod tcdn : Quarterly Canadian labor productivity index (1995=100) VARIABLE ε cdn / us t MEAN MEDIAN ST-DEV SKEWNESS KURTOSIS MIN MAX 1.2528 1.2324 0.1685 0.0463 -0.8392 0.9664 1.5870 pteng 0.0143 0.0134 0.0038 0.5869 -0.5217 0.0072 0.0241 com t 0.4428 0.4294 0.0442 0.9606 0.4597 0.3593 0.5732 8.0584 8.1400 3.6200 0.7375 0.4610 2.0000 19.3500 6.5131 5.7400 2.7841 1.1463 1.7781 1.6300 15.6600 711.2845 743.8000 336.3540 0.0355 -1.5734 231.7000 1203.5000 m1 88.9434 82.3600 66.4691 0.9132 -0.0956 17.7600 263.4900 ytus 5080.7504 4695.8000 2789.2710 0.3459 -1.0691 1192.5000 10486.1000 551.5889 536.9350 297.1366 0.2009 -1.0717 103.52000 1138.2100 cpi 74.1433 74.2300 27.9146 -0.1527 -1.2192 27.0900 118.5200 cpitcdn p rt cdn rtus us t m1 cdn t cdn t y us t 73.8113 77.9000 28.3215 -0.3267 -1.2925 24.5500 115.0900 π us t 0.0122 0.0097 0.0084 1.0854 0.7855 -0.00283 0.0391 π cdn t 0.1279 0.0109 0.0094 0.4018 -0.5762 -0.0088 0.0341 prod tus 73.8909 72.9763 30.6037 0.0439 -1.1942 24.5473 128.5064 prod tcdn 71.5074 71.5240 31.2967 -0.0648 -1.1715 18.8108 125.3481 Table 1: Summary statistics for the variables used in the study. All the variables are measured quarterly for 1972Q1-2002Q4 period. CDN/US exchange rate gives the value of CDN with respect to one USD. 15 Appendix A Time Series Persistence of CDN/USD exchange rate and commodity and energy price indices: To answer whether CDN/USD exchange rate and commodity and energy price indices contain unit roots we are using Adjusted Dickey Fuller (ADF). Equation 1 describes the basic idea behind the ADF. n Δyt = α + β1 yt −1 + β 2t + ∑ γ k Δyt −k + ε t (1a) k =1 According to ADF if yt has unit root or a stochastic trend the joint hypothesis of β1 =0 and β2 =0 should not be rejected. The lags of differenced yt series are used to control for the time series persistence of the differenced series and the number of lags for the differenced series is determined depending on the time series persistence of yt . Table 2 reports the ADF results for CDN/USD exchange rate and commodity and energy price indices. The results suggest the existence of a single unit root for the exchange rate series (Table 2-Panel A). For commodity and energy price indices ADF tests couldn’t detect unit roots for neither series (Table 2-Panels B and C). Since commodity and energy price indices show no unit roots further tests of cointegration are omitted in this section. Table 2-Panel A: ADF test for ε tcdn / us α parameter estimate 0.0039 t-value 1.08 p-value 0.28 -1.77 0.08 1.17 1.55 0.24 0.12 ε -0.0479 cdn / us Δε t −1 0.1081 t 0.0002 Joint significance of β1 β 2 F-stats = 1.57 Pr>F=0.21 cdn / us t −1 Adj- R 2 0.01 F-stats 1.34 Pr>F 0.27 Table 2-Panel B: ADF test for ptcom α parameter estimate -0.1415 t-value -2.86 p-value 0.01 ptcom −1 -0.1930 -2.93 0.00 -0.3000 -0.0003 -3.45 -1.74 0.00 0.09 Δptcom −1 t Joint significance of β1 β 2 F-stats = 4.33 Pr>F=0.02 16 Adj- R 2 0.20 F-stats 10.89 Pr>F 0.00 Table 2-Panel C: ADF test for pteng α parameter estimate -0.7280 t-value -3.43 p-value 0.00 pteng −1 -0.1800 -3.50 0.00 0.0548 t -0.0006 Joint significance of β1 β 2 0.60 -1.58 0.60 0.12 Δp eng t −1 Adj- R 2 0.07 F-stats 0.01 Pr>F 0.00 F-stats = 6.14 Pr>F=0.00 Table 2: ADF test results for log nominal CDN/USD series, log total commodity and log energy price indices for 1972Q1-2002Q4. / us Δε tcdn / us = α + β1ε tcdn + β 2 ft −1 + ε t −1 ft = ⎡⎣ coefficient estimate 0.0302 α ε rt cdn − rtus ptcom pteng ⎤⎦ t-value 1.03 p-value 0.30 cdn / us t −1 -0.0145 -1.03 0.31 com t −1 -0.0212 -1 0.31 0.0089 1.21 0.18 -0.1576 -1.63 0.11 p eng t −1 p −r cdn t −1 us t −1 r Adj- R 2 0.01 F-stats 1.20 Pr>F 0.3163 Table 3: In-sample results for Amano and Norden (1993) specification are reported for the time period 1972Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the lagged values of the log nominal CDN/USD exchange rate, log commodity price index, log energy price index and the difference between US and Canadian real short term interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. / us Δε tcdn / us = α + β1ε tcdn + β 2 ft −1 + ε t −1 ft = ⎡⎣ coefficient estimate 0.0274 α ε ptcom pteng ⎤⎦ t-value 0.79 p-value 0.43 cdn / us t −1 -0.0826 -2.52 0.01 ptcom −1 -0.0829 -2.66 0.01 0.0147 1.69 0.09 -0.4806 -3.01 -3.01 eng t −1 p cdn t −1 r rt cdn − rtus −r us t −1 Adj- R 2 0.11 F-stats 3.48 Table 4: In-sample results for Amano and Norden (1993) specification are reported for the time period 1983Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the lagged values of the log nominal CDN/USD exchange rate, log commodity price index, log energy price index and the difference between US and Canadian real short term interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. 17 Pr>F / us Δε tcdn / us = α + β1ε tcdn + β 2 ft −1 + ε t −1 Forecast horizon RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of Direction t-stats p-value 1 0.00041 0.00041 1.003 -0.036 0.97 1.935 0.06 0.239 4.550 0.00 ft = ⎡⎣ rtcdn − rtus ptcom pteng ⎤⎦ 2 4 12 16 0.00038 0.00038 0.00040 0.00039 0.00036 0.00038 0.00048 0.00049 1.201 1.239 0.956 0.985 0.499 1.699 -2.372 -2.340 0.62 0.09 0.02 0.02 2.218 2.887 -0.718 -0.993 0.03 0.01 0.48 0.32 0.259 0.254 0.194 0.194 4.924 4.737 3.986 3.986 0.00 0.00 0.00 0.00 20 0.00042 0.00050 1.214 -2.419 0.02 -1.026 0.31 0.206 4.015 0.00 Table 5: Out-of-sample results for Amano and Norden (1993) specification are reported for the time period 1982Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the lagged values of the log nominal CDN/USD exchange rate, log commodity price index, log energy price index and the difference between US and Canadian real short term interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. / us Δε tcdn / us = α + β1ε tcdn + β 2 ft −1 + ε t −1 Forecast horizon RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 1 0.00042 0.00041 0.982 0.159 0.88 1.321 0.20 0.111 1.803 0.08 ft = ⎡⎣ rtcdn − rtus ptcom pteng ⎤⎦ 2 4 12 16 0.00043 0.00029 0.00033 0.00037 0.00045 0.00040 0.00041 0.00040 1.045 1.020 1.224 1.099 -0.316 0.889 -1.500 -0.564 0.75 0.38 0.15 0.58 0.720 1.699 -0.286 0.342 0.48 0.10 0.78 0.74 0.185 0.185 0.148 0.148 2.431 2.431 2.126 2.126 0.02 0.02 0.04 0.04 20 0.00040 0.00048 1.2 -1.256 0.11 -0.320 0.76 0.148 2.126 0.04 Table 6: Out-of-sample results for Amano and Norden (1993) specification are reported for the time period 1991Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the lagged values of the log nominal CDN/USD exchange rate, log commodity price index, log energy price index and the difference between US and Canadian real short term interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. 18 / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus K δ0 δ1 Adj- R 2 F-stats Pr>F 1 0.004 (2.28) -0.028 (-1.14) 0.00 1.31 0.26 rt cdn − rtus 2 0.008 (3.02) -0.062 (-1.71) 0.02 2.93 0.09 m1tcdn − m1tus π tcdn − π tus ⎤⎦ 4 0.016 (4.05) -0.129 (-2.35) 0.04 5.50 0.02 12 0.048 (6.48) -0.464 (-4.50) 0.15 20.25 0.00 Table 7: In-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1972Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step are log differences in US and Canadian real GDP levels and M1 money stocks as well as the differences in US and Canadian inflation and real interest rates. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted.. / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus K δ0 δ1 Adj- R 2 F-stats Pr>F 1 0.003 (1.44) -0.097 (-2.27) 0.05 5.17 0.03 rt cdn − rtus 2 0.005 (1.83) -0.193 (-3.34) 0.11 11.15 0.00 m1tcdn − m1tus π tcdn − π tus ⎤⎦ 4 0.011 (2.50) -0.417 (-4.78) 0.22 22.81 0.00 12 0.027 (3.60) -1.350 (-9.30) 0.55 86.41 0.00 Table 8: In-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1983Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step are log differences in US and Canadian real GDP levels and M1 money stocks as well as the differences in US and Canadian inflation and real interest rates. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted.. 19 / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus rt cdn − rtus cdn − π tus ⎤⎦ m1tcdn − m1us t πt K n=1 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 1 2 4 12 0.00041 0.00043 1.049 -0.806 0.42 0.187 0.85 0.134 3.542 0.00 0.00086 0.00089 1.038 -0.514 0.61 0.955 0.34 0.207 4.603 0.00 0.00209 0.00206 0.986 0.167 0.87 1.972 0.05 0.207 4.603 0.00 0.00931 0.00874 0.939 0.645 0.52 3.121 0.00 0.049 2.038 0.04 n=2 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00039 0.00041 1.063 -1.011 0.32 -0.002 0.99 0.136 3.546 0.00 0.00080 0.00089 1.105 -1.169 0.25 0.103 0.92 0.173 4.089 0.00 0.00207 0.00215 1.040 -0.482 0.63 1.347 0.18 0.173 4.089 0.00 0.00933 0.00939 1.006 -0.064 0.95 2.426 0.02 0.049 2.039 0.04 n=4 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00038 0.00042 1.083 -1.316 0.19 -0.363 0.72 0.114 3.167 0.00 0.00081 0.00091 1.129 -1.903 0.06 -0.422 0.67 0.152 3.738 0.00 0.00209 0.00235 1.127 -1.896 0.06 0.023 0.98 0.139 3.552 0.00 0.00949 0.01049 1.106 -1.109 0.27 1.455 0.15 0.051 2.040 0.04 n=12 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00041 0.00045 1.102 -2.313 0.02 -1.525 0.13 0.099 2.767 0.01 0.00084 0.00103 1.226 -3.925 0.00 -3.121 0.00 0.113 2.981 0.00 0.00214 0.00280 1.308 -4.441 0.00 -3.636 0.00 0.113 2.981 0.00 0.01000 0.01400 1.402 -2.955 0.00 -1.593 0.12 0.028 1.424 0.16 n=16 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00039 0.00042 1.059 -1.257 0.21 -0.482 0.63 0.134 3.200 0.02 0.00082 0.00093 1.127 -1.947 0.06 -1.111 0.27 0.179 3.795 0.00 0.00205 0.00242 1.181 -2.271 0.03 -1.351 0.18 0.179 3.795 0.00 0.01000 0.01328 1.344 -2.564 0.01 -1.019 0.31 0 0 1 20 n=20 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00042 0.00043 1.033 -0.722 0.47 0.042 0.97 0.095 2.555 0.01 0.00087 0.00092 1.059 -1.180 0.24 -0.052 0.96 0.159 3.420 0.00 0.00217 0.00246 1.134 -2.445 0.02 -1.030 0.31 0.127 3.003 0.00 0.00960 0.01301 1.353 -3.046 0.00 -1.237 0.22 0 0 1 Table 9: Out-of-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1972Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step and second-step are log differences in US and Canadian real GDP levels and M1 money stocks as well as the differences in US and Canadian inflation and real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus K n=1 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value n=2 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value n=4 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value rt cdn − rtus cdn − π tus ⎤⎦ m1tcdn − m1us t πt 1 0.00041 0.00040 0.968 0.411 0.68 1.221 0.23 0.071 1.776 0.08 2 0.00088 0.00083 0.946 0.584 0.56 1.832 0.07 0.071 1.776 0.08 4 0.00222 0.00205 0.922 1.015 0.32 2.798 0.01 0.071 1.776 0.08 12 0.00865 0.00733 0.848 1.173 0.25 3.111 0.00 0 0 1 0.00042 0.00042 0.995 0.064 0.95 0.828 0.41 0.073 1.777 0.08 0.00086 0.00087 1.020 ‐0.188 0.85 1.067 0.29 0.049 1.432 0.16 0.00223 0.00222 0.998 0.028 0.98 1.823 0.07 0.049 1.432 0.16 0.00886 0.00812 0.917 0.607 0.55 2.433 0.02 0 0 1 0.00039 0.00040 1.020 ‐0.230 0.82 0.507 0.62 0.051 1.433 0.16 0.00079 0.00085 1.082 ‐0.858 0.40 0.431 0.67 0.026 1 0.33 0.00193 0.00210 1.088 ‐1.131 0.27 0.908 0.37 0.026 1 0.33 0.00907 0.00934 1.030 ‐0.224 0.82 1.691 0.10 0 0 1 21 n=12 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00036 0.00034 0.947 1.012 0.32 1.381 0.18 0.161 2.402 0.02 0.00073 0.00069 0.944 1.057 0.30 1.617 0.12 0.161 2.402 0.02 0.00142 0.00130 0.922 1.223 0.23 2.103 0.04 0.161 2.402 0.02 0.00947 0.00568 1.665 ‐2.945 0.01 ‐2.011 0.05 0 0 1 n=16 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00037 0.00035 0.945 0.928 0.36 1.136 0.26 0.148 2.126 0.04 0.00072 0.00066 0.925 1.177 0.25 1.578 0.13 0.111 1.803 0.08 0.00158 0.00134 0.846 3.082 0.00 3.504 0.00 0.148 2.126 0.04 0.00420 0.00660 1.570 ‐1.730 0.10 ‐0.411 0.69 0 0 1 n=20 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00043 0.00044 1.014 ‐0.370 0.72 ‐0.220 0.82 0.043 1 0.33 0.00083 0.00087 1.040 ‐0.723 0.48 ‐0.494 0.63 0 0 1 0.00180 0.00193 1.067 ‐1.298 0.21 ‐0.978 0.34 0 0 1 0.00431 0.00556 1.289 ‐1.008 0.32 0.445 0.66 0 0 1 Table 10: Out-of-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1982Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step and second-step are log differences in US and Canadian real GDP levels and M1 money stocks as well as the differences in US and Canadian inflation and real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. 22 / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus K δ0 rt cdn − rtus 1 0.004 (2.37) -0.023 (-0.94) 0.00 0.8 0.89 δ1 Adj- R 2 F-stats Pr>F cdn m1tcdn − m1us − prod tus ⎤⎦ t prod t 2 0.008 (3.03) -0.047 (-1.31) 0.01 1.71 0.20 4 0.016 (4.03) -0.105 (-1.95) 0.02 3.80 0.05 12 0.048 (6.51) -0.460 (-4.59) 0.16 21.08 0.00 Table 11: In-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1972Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step are log differences in US and Canadian real GDP levels, productivity levels and M1 money stocks as well as the differences in US and Canadian real interest rates. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted. / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus K δ0 δ1 Adj- R 2 F-stats Pr>F rt cdn − rtus 1 0.003 (1.54) -0.103 (-2.45) 0.06 5.98 0.02 cdn m1tcdn − m1us − prod tus ⎤⎦ t prod t 2 0.006 (1.91) -0.213 (-3.70) 0.14 13.66 0.00 4 0.011 (2.65) -0.458 (-5.37) 0.26 28.80 0.00 12 0.028 (3.80) -1.396 (-9.79) 0.58 95.76 0.00 Table 12: In-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1972Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step are log differences in US and Canadian real GDP levels, productivity levels and M1 money stocks as well as the differences in US and Canadian real interest rates. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted. 23 / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus rt cdn − rtus cdn m1tcdn − m1us − prod tus ⎤⎦ t prod t K N=1 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 1 0.00040 0.00043 1.080 ‐1.249 0.22 ‐0.195 0.85 0.136 3.546 0.00 2 0.00086 0.00091 1.057 ‐0.743 0.46 0.889 0.38 0.146 3.726 0.00 4 0.00209 0.00210 1.006 ‐0.066 0.95 1.995 0.05 0.170 4.084 0.00 12 0.00931 0.00878 0.943 0.616 0.54 2.963 0.00 0.024 1.423 0.16 N=2 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00039 0.00042 1.088 ‐1.298 0.20 ‐0.279 0.78 0.136 3.546 0.00 0.00080 0.00092 1.144 ‐1.517 0.13 ‐0.145 0.89 0.124 3.357 0.00 0.00207 0.00220 1.064 ‐0.778 0.44 1.186 0.24 0.148 3.730 0.00 0.00933 0.00934 1.000 ‐0.004 0.99 2.362 0.02 0.025 1.423 0.16 0.00038 0.00042 1.100 ‐1.536 0.13 ‐0.473 0.64 0.114 3.167 0.00 0.00081 0.00094 1.158 ‐2.206 0.03 ‐0.650 0.52 0.101 2.965 0.00 0.00209 0.00244 1.169 ‐2.370 0.02 ‐0.359 0.72 0.114 3.167 0.00 0.00949 0.01033 1.089 ‐0.969 0.34 1.495 0.14 0.025 1.423 0.16 N=12 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00041 0.00045 1.109 ‐2.342 0.02 ‐1.427 0.16 0.099 2.767 0.01 0.00084 0.00106 1.264 ‐4.043 0.00 ‐3.005 0.00 0.099 2.767 0.01 0.00214 0.00294 1.376 ‐4.617 0.00 ‐3.693 0.00 0.099 2.767 0.01 0.01000 0.01400 1.405 ‐3.201 0.00 ‐1.884 0.06 0 0 1 N=16 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00039 0.00041 1.050 ‐1.000 0.33 ‐0.130 0.90 0.149 3.403 0.00 0.00082 0.00097 1.174 ‐2.351 0.02 ‐1.351 0.18 0.119 2.992 0.00 0.00205 0.00026 1.273 ‐3.144 0.00 ‐2.128 0.04 0.119 2.992 0.00 0.00989 0.01339 1.355 ‐2.734 0.01 ‐1.288 0.20 0 0 1 N=4 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 24 N=20 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00042 0.00043 1.033 ‐0.652 0.52 0.149 0.88 0.127 3.003 0.00 0.00087 0.00096 1.112 ‐1.870 0.07 ‐0.613 0.54 0.111 2.784 0.01 0.00217 0.00259 1.193 ‐3.050 0.00 ‐1.539 0.13 0.095 2.555 0.01 0.00961 0.01262 1.313 ‐2.694 0.01 ‐1.012 0.32 0 0 1 Table 13: Out-of-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1982Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step and second-step are log differences in US and Canadian real GDP levels, productivity levels and M1 money stocks as well as the differences in US and Canadian real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. / us / us ε tcdn / us − ε tcdn = δ 0 + δ1 (ε tcdn − βˆ ft ) +ν t −k −k ft = ⎡⎣ ytcdn − ytus rt cdn − rtus cdn m1tcdn − m1us − prod tus ⎤⎦ t prod t K N=1 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 1 0.00040 0.00041 1.004 ‐0.041 0.97 0.866 0.39 0.049 1.432 0.16 2 0.00088 0.00085 0.971 0.286 0.78 1.678 0.11 0.049 1.432 0.16 4 0.00222 0.00212 0.953 0.540 0.59 2.453 0.02 0.071 1.776 0.08 12 0.00719 0.00865 0.831 1.266 0.21 3.188 0.00 0 0 1 N=2 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00042 0.00042 1.002 ‐0.022 0.98 0.808 0.42 0.049 1.432 0.16 0.00086 0.00090 1.047 ‐0.400 0.69 0.888 0.38 0.049 1.432 0.16 0.00223 0.00227 1.020 ‐0.210 0.83 1.512 0.14 0.049 1.432 0.16 0.00886 0.00793 0.895 0.752 0.46 2.572 0.01 0 0 1 0.00039 0.00040 1.017 ‐0.188 0.85 0.609 0.55 0.051 1.433 0.16 0.00079 0.00085 1.086 ‐0.870 0.39 0.393 0.70 0.026 1 0.33 0.00193 0.00213 1.108 ‐1.250 0.22 0.645 0.53 0.026 1 0.33 0.00907 0.00916 1.009 ‐0.068 0.95 1.813 0.08 0 0 1 N=4 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 25 N=12 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00036 0.00033 0.931 1.138 0.26 1.669 0.11 0.161 2.402 0.02 0.00073 0.00068 0.929 1.164 0.25 1.941 0.06 0.194 2.683 0.01 0.00142 0.00126 0.893 1.507 0.14 2.691 0.01 0.226 2.958 0.01 0.00568 0.00963 1.694 ‐3.151 0.00 ‐2.184 0.04 0 0 1 N=16 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00037 0.00034 0.924 1.000 0.33 1.269 0.22 0.111 1.803 0.08 0.00072 0.00064 0.892 1.171 0.25 1.539 0.14 0.111 1.803 0.08 0.00158 0.00127 0.806 2.855 0.01 3.219 0.00 0.185 2.431 0.02 0.00420 0.00690 1.642 ‐1.923 0.07 ‐0.577 0.57 0 0 1 N=20 RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value 0.00043 0.00044 1.018 ‐0.294 0.77 ‐0.036 0.97 0.043 1 0.33 0.00083 0.00087 1.039 ‐0.502 0.62 ‐0.157 0.88 0 0 1 0.00180 0.00193 1.072 ‐1.117 0.28 ‐0.620 0.54 0 0 1 0.00431 0.00561 1.302 ‐0.976 0.34 0.520 0.61 0 0 1 Table 14: Out-of-sample results for Cheung, Chinn and Pascual (2002) specification are reported for the time period 1982Q1-2002Q4. Differences in log nominal CDN/USD exchange rates k periods ahead are estimated using estimated using the long-run cointegrating relation estimated in the first-step (Equation (2)). The variables used in the first-step and second-step are log differences in US and Canadian real GDP levels, productivity levels and M1 money stocks as well as the differences in US and Canadian real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. 26 p ε tcdn / us = α + β ft + ∑ Δft −i +ε t i =− p Asset approachprice flex monetary 0.8893 (5.41) Flex-price monetary 2.6111 (7.92) sticky price monetary 3.7850 (8.69) ptcom 0.0644 (0.53) 0.3964 (3.76) 0.1839 (1.53) pteng 0.0171 (0.53) -0.0451 (-1.21) -0.0621 (-1.75) 0.2333 (8.06) 0.3542 (11.05) 0.2647 (6.90) α m1tcdn − m1us t rt cdn − rtus -3.5788 (-3.84) π tcdn − π tus ytcdn − ytus Adj- R 2 F-stats Pr>F 0.5575 (3.98) 0.60 11.01 0.00 -3.3782 (-1.88) -4.2281 (-2.47) 0.6670 (4.86) 0.71 15.45 0.00 1.3692 (6.10) 0.74 15.19 0.00 Table 15: In-sample results for Chen (2004) specification are reported for the time period 1972Q1-2002Q4. Log nominal CDN/USD exchange rates are estimated using the macroeconomic fundamentals and terms of trade variables. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted. 27 p ε tcdn / us = α + β ft + ∑ Δft −i +ε t i =− p Asset approachprice flex monetary 1.2372 (6.19) Flex-price monetary -1.6849 (-3.80) Sticky price monetary -1.2249 (-2.18) ptcom 0.3448 (3.00) -0.255 (-0.25) -0.0387 (-0.33) pteng -0.0257 (-0.70) 0.0799 (2.97) 0.0720 (2.78) 0.3821 (11.40) 0.1190 (4.42) 0.0951 (3.31) α m1tcdn − m1us t rt cdn − rtus -1.493 (-1.48) π tcdn − π tus ytcdn − ytus Adj- R 2 F-stats Pr>F -0.8456 (-2.34) 0.65 19.59 0.00 -0.2285 (-0.12) -0.5179 (-0.30) -1.1571 (-6.43) 0.78 15.25 0.00 -0.9148 (-3.39) 0.81 14.84 0.00 Table 16: In-sample results for Chen (2004) specification are reported for the time period 1982Q1-2002Q4. Log nominal CDN/USD exchange rates are estimated using the macroeconomic fundamentals and terms of trade variables. T-statistics are reported in parenthesis below the coefficient estimates. The coefficient estimates that are statistically significant at 5% are highlighted. 28 p ε tcdn / us = α + β ft + ∑ Δft −i +ε t i =− p Asset Approach Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value Flex-Price Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value Sticky-Price Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value ft = ⎡⎣ p pteng m1tcdn − m1us ytcdn − ytus ⎤⎦ t 1 2 4 12 16 20 0.00041 0.00084 0.00225 0.01044 0.01334 0.01588 0.00416 0.00507 0.00699 0.01262 0.01317 0.01384 10.243 6.066 3.111 1.209 0.988 0.872 -5.342 -5.120 -4.443 -1.535 0.118 1.342 0.00 0.00 0.00 0.13 0.91 0.18 0.317 0.179 0.209 0.224 0.269 0.269 5.970 3.795 4.175 4.363 4.924 4.924 0.00 0.00 0.00 0.00 0.00 0.00 com t ft = ⎡⎣ ptcom pteng cdn − ytus m1tcdn − m1us t yt π tcdn − π tus ⎤⎦ 1 2 4 12 16 20 0.00041 0.00084 0.00225 0.01044 0.01334 0.01588 0.00166 0.00226 0.00386 0.01151 0.01340 0.01505 4.096 2.708 1.715 1.025 1.005 0.948 -6.190 -6.061 -4.541 -1.217 -0.076 0.827 0.00 0.00 0.00 0.23 0.94 0.41 0.134 0.149 0.194 0.269 0.313 0.286 3.200 3.403 3.986 4.924 5.489 4.98 0.00 0.00 0.00 0.00 0.00 0.00 ft = ⎡⎣ ptcom pteng cdn m1tcdn − m1us − ytus t yt π tcdn − π tus rtcdn − rtus 1 2 4 12 16 20 0.00041 0.00084 0.00225 0.01044 0.01334 0.01588 0.00123 0.00184 0.00328 0.01117 0.01344 0.01534 3.027 2.205 1.459 1.071 1.008 0.966 -6.035 -5.530 -3.435 -1.064 -0.141 0.692 0.00 0.00 0.00 0.29 0.89 0.49 0.119 0.149 0.194 0.269 0.299 0.270 2.992 3.403 3.986 4.924 5.230 4.787 0.00 0.00 0.00 0.00 0.00 0.00 Table 17: Out-of-sample results for Chen (2004) specification are reported for the time period 1981Q1-2002Q4. Log nominal CDN/USD exchange rates are estimated using the macroeconomic fundamentals and terms of trade variables. MSE ratios those are significantly less than one according to the Diebold and Mariano (1995) t-statistics at 5% are highlighted as well as the significant change of direction statistics. ⎤⎦ 29 p ε tcdn / us = α + β ft + ∑ Δft −i +ε t i =− p Asset Approach Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value Flex-Price Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value Sticky-Price Forecast horizons RW The Model Ratio t-stats p-value Change of dir t-stats p-value ft = ⎡⎣ p pteng m1tcdn − m1us ytcdn − ytus ⎤⎦ t 1 2 4 12 16 20 0.01065 0.00042 0.00097 0.00225 0.00621 0.00834 0.00212 0.00290 0.00506 0.01010 0.01422 0.02161 5.083 2.998 2.250 1.767 1.705 1.572 -4.478 -4.379 -3.697 -3.902 -4.356 -4.268 0.00 0.00 0.00 0.00 0.00 0.00 0.304 0.185 0.077 0.296 0.370 0.333 3.102 2.431 11.907 3.309 3.911 3.606 0.01 0.02 0.00 0.00 0.00 0.00 com t ft = ⎡⎣ ptcom pteng cdn − ytus m1tcdn − m1us t yt π tcdn − π tus ⎤⎦ 1 2 4 12 16 20 0.00042 0.00097 0.00225 0.00621 0.00834 0.01065 0.00105 0.00154 0.00294 0.00851 0.01082 0.01742 2.527 1.593 1.310 1.370 1.298 1.266 -2.719 -2.059 -2.012 -2.522 -3.305 -3.382 0.01 0.05 0.05 0.02 0.00 0.00 0.222 0.259 0.296 0.370 0.333 0.304 2.726 3.017 3.309 3.911 3.606 3.104 0.01 0.01 0.00 0.00 0.00 0.01 ft = ⎡⎣ ptcom pteng cdn m1tcdn − m1us − ytus t yt π tcdn − π tus rtcdn − rtus 1 2 4 12 16 20 0.00042 0.00097 0.00225 0.00621 0.00834 0.01065 0.00102 0.00177 0.00300 0.00785 0.00991 0.01158 2.451 1.829 1.335 1.264 1.189 1.087 -3.294 -3.124 -2.121 -2.542 -2.516 -2.325 0.00 0.00 0.04 0.02 0.02 0.03 0.148 0.222 0.296 0.333 0.333 0.333 2.126 2.726 3.309 3.606 3.606 3.606 0.04 0.01 0.00 0.00 0.00 0.00 Table 18: Out-of-sample results for Chen (2004) specification are reported for the time period 1991Q1-2002Q4. Log nominal CDN/USD exchange rates are estimated using the macroeconomic fundamentals and terms of trade variables. MSE ratios those are significantly less than one according to the Diebold and Mariano (1995) t-statistics at 5% are highlighted as well as the significant change of direction statistics. ⎤⎦ 30 Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rt cdn − rtus π tcdn − π tus m1tcdn − m1ust parameter estimate t-value p-value Adj- R 2 0.11 0.0052 3.02 0.00 α us rt cdn −1 − rt −1 0.3431 1.88 0.06 − m1 -0.0339 -0.70 0.48 cdn t y us t −y -0.6212 -3.92 0.00 π cdn t −π us t 0.5397 1.59 0.11 cdn t m1 us t ⎤⎦ F-stats 4.72 Pr>F 0.00 Table 19: In-sample results for first-differences specification are reported for the time period 1972Q1-2002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rt cdn − rtus π tcdn − π tus m1tcdn − m1ust parameter estimate t-value p-value Adj- R 2 0.0029 1.39 0.17 0.22 α cdn t −1 r − rtus−1 m1tcdn − m1us t 0.6871 2.82 0.01 -0.0056 -0.09 0.93 us t -0.9807 -3.84 0.00 us t 0.9432 2.15 0.03 cdn t y −y π cdn t −π ⎤⎦ F-stats 6.71 Table 20: In-sample results for first-differences specification are reported for the time period 1983Q1-2002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. 31 Pr>F 0.00 Δε tcdn / us = α + βΔft + ε t Forecast horizon RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value ft = ⎡⎣ ytcdn − ytus rt cdn − rtus π tcdn − π tus m1tcdn − m1ust 1 2 4 12 16 0.00041 0.00038 0.00038 0.00040 0.00039 0.00048 0.00050 0.00044 0.00052 0.00049 1.189 1.320 1.167 1.303 1.252 -1.415 -2.234 0.760 -1.987 -1.795 0.16 0.02 0.45 0.05 0.07 0.523 -0.440 2.562 -0.335 0.0715 0.60 0.66 0.01 0.74 0.94 0.045 0.075 0.075 0.060 0.075 1.759 2.307 2.307 2.047 2.307 0.08 0.02 0.02 0.04 0.02 ⎤⎦ 20 0.00042 0.00059 1.420 -3.758 0.00 -1.770 0.08 0.048 1.761 0.08 Table 21: Out-of-sample results for first-differences specification are reported for the out-of-sample period 1981Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. Δε tcdn / us = α + βΔft + ε t Forecast horizon RW The Model MSE Ratio t-stats p-value CW t-stats p-value Change of direction t-stats p-value ft = ⎡⎣ ytcdn − ytus rt cdn − rtus π tcdn − π tus m1tcdn − m1ust 1 2 4 12 16 0.00042 0.00043 0.00039 0.00033 0.00037 0.00050 0.00058 0.00047 0.00041 0.00049 1.193 1.365 1.207 1.244 1.335 -0.763 -1.504 0.451 -0.919 -1.081 0.45 0.14 0.66 0.37 0.29 0.366 -0.463 1.594 0.437 -0.070 0.72 0.65 0.12 0.67 0.94 0.111 0 0.074 0.111 0.074 1.803 0 1.442 1.803 1.442 0.08 1 0.16 0.08 0.16 ⎤⎦ 20 0.00043 0.00063 1.469 -2.211 0.04 -1.163 0.26 0.043 1 0.33 Table 22: Out-of-sample results for first-differences specification are reported for the out-of-sample period 1991Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) t-statistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. 32 Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rt cdn − rtus parameter estimate 0.0053 α ptcom −1 eng t −1 p −r cdn t −1 us t −1 r ptcom pteng π tcdn − π tus t-value 3.05 p-value 0.00 0.0216 0.79 0.43 0.0017 0.13 0.90 0.3538 1.93 0.06 cdn t − m1tus -0.0351 -0.71 0.48 cdn t y us t −y -0.6484 -3.85 0.00 π cdn t −π us t 0.5465 1.60 0.11 m1 m1tcdn − m1us t Adj- R 2 0.10 ⎤⎦ F-stats 3.23 Pr>F 0.01 Table 23: In-sample results for first-differences specification are reported for the time period 1972Q1-2002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log energy and commodity price indices, log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rt cdn − rtus parameter estimate -0.0077 α ptcom −1 eng t −1 p cdn t −1 r −r us t −1 ptcom pteng π tcdn − π tus t-value -1.14 p-value 0.2583 0.0430 0.35 0.7304 0.6672 0.49 0.6268 1.026 2.94 0.0043 cdn t − m1 -0.00027 -2.19 0.0319 cdn t y us t −y -0.00014 -1.74 0.0858 π cdn t − π tus 0.43089 0.86 0.3931 m1 us t m1tcdn − m1us t Adj- R 2 0.12 ⎤⎦ F-stats 2.84 Pr>F 0.0151 Table 24: In-sample results for first-differences specification are reported for the time period 1983Q1-2002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log energy and commodity price indices, log differences in real output levels, money stocks and differences in inflation rates and short-term real interest rates. The coefficient estimates that are statistically significant at 5% are highlighted. 33 Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rtcdn − rtus ptcom pteng π tcdn − π tus 1 2 4 12 Forecast horizon 0.00041 0.00039 0.00038 0.00041 RW 0.00051 0.00051 0.00045 0.00055 The Model 1.243 1.332 1.177 1.343 MSE Ratio -1.713 -2.282 0.985 -1.684 t-stats 0.09 0.03 0.33 0.10 p-value 0.275 -0.280 2.891 -0.334 CW t-stats 0.75 0.78 0.01 0.74 p-value 0.106 0.108 0.111 0.109 Change of direction 2.777 2.779 2.784 2.571 t-stats 0.07 0.07 0.01 0.01 p-value ⎤⎦ 20 0.00042 0.00055 1.293 -2.324 0.02 -0.413 0.68 0.085 2.069 0.04 m1tcdn − m1us t 16 0.00039 0.00055 1.404 -2.356 0.02 -0.819 0.42 0.118 2.582 0.01 Table 25: Out-of-sample results for first-differences specification are reported for the out-of-sample period 1991Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log energy and commodity price indices, log differences in real output levels, money stocks and differences in inflation rates and shortterm real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) tstatistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. Δε tcdn / us = α + βΔft + ε t ft = ⎡⎣ ytcdn − ytus rtcdn − rtus ptcom pteng π tcdn − π tus 1 2 4 12 Forecast horizon 0.00042 0.00043 0.00039 0.00033 RW 0.00051 0.00060 0.00050 0.00045 The Model 1.218 1.407 1.300 1.378 MSE Ratio -0.828 -1.573 0.281 -1.118 t-stats 0.42 0.13 0.78 0.27 p-value 0.501 -0.350 1.610 0.280 CW t-stats 0.62 0.73 0.12 0.78 p-value 0.074 0 0.037 0.074 Change of direction 1.442 0 1 1.442 t-stats 0.16 1 0.33 0.16 p-value ⎤⎦ 20 0.00043 0.00068 1.577 -2.464 0.02 -1.300 0.21 0.043 1 0.33 m1tcdn − m1us t 16 0.00037 0.00051 1.385 -1.141 0.26 -0.002 0.99 0.037 1 0.33 Table 26: Out-of-sample results for first-differences specification are reported for the out-of-sample period 1991Q12002Q4. Quarterly differences in log nominal CDN/USD exchange rate series are estimated using the log energy and commodity price indices, log differences in real output levels, money stocks and differences in inflation rates and shortterm real interest rates. The MSE ratio estimates that are statistically significant according to Clark and West (2006) tstatistics at 5% are highlighted as well as Change or Direction estimates that are significant at 5%. 34