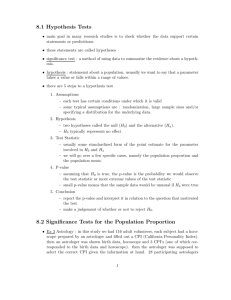

How evaluate the model: 1) Testing hypothesis about error term. 2

advertisement

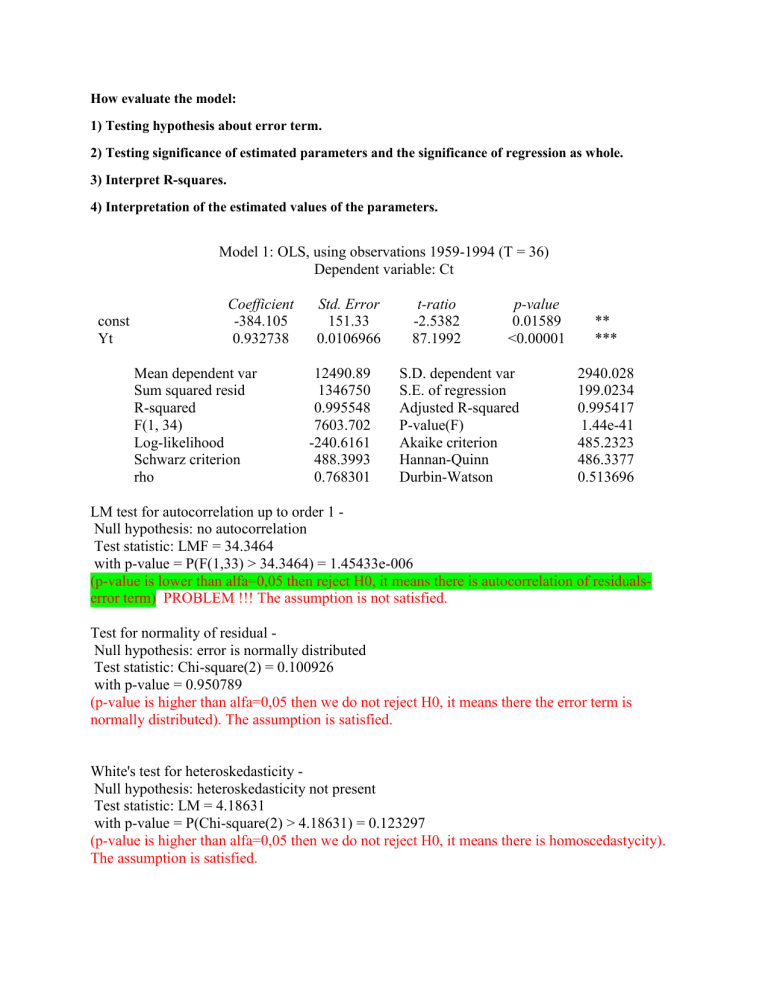

How evaluate the model: 1) Testing hypothesis about error term. 2) Testing significance of estimated parameters and the significance of regression as whole. 3) Interpret R-squares. 4) Interpretation of the estimated values of the parameters. Model 1: OLS, using observations 1959-1994 (T = 36) Dependent variable: Ct const Yt Coefficient -384.105 0.932738 Mean dependent var Sum squared resid R-squared F(1, 34) Log-likelihood Schwarz criterion rho Std. Error 151.33 0.0106966 12490.89 1346750 0.995548 7603.702 -240.6161 488.3993 0.768301 t-ratio -2.5382 87.1992 p-value 0.01589 <0.00001 S.D. dependent var S.E. of regression Adjusted R-squared P-value(F) Akaike criterion Hannan-Quinn Durbin-Watson ** *** 2940.028 199.0234 0.995417 1.44e-41 485.2323 486.3377 0.513696 LM test for autocorrelation up to order 1 Null hypothesis: no autocorrelation Test statistic: LMF = 34.3464 with p-value = P(F(1,33) > 34.3464) = 1.45433e-006 (p-value is lower than alfa=0,05 then reject H0, it means there is autocorrelation of residualserror term) PROBLEM !!! The assumption is not satisfied. Test for normality of residual Null hypothesis: error is normally distributed Test statistic: Chi-square(2) = 0.100926 with p-value = 0.950789 (p-value is higher than alfa=0,05 then we do not reject H0, it means there the error term is normally distributed). The assumption is satisfied. White's test for heteroskedasticity Null hypothesis: heteroskedasticity not present Test statistic: LM = 4.18631 with p-value = P(Chi-square(2) > 4.18631) = 0.123297 (p-value is higher than alfa=0,05 then we do not reject H0, it means there is homoscedastycity). The assumption is satisfied.