Document 10622926

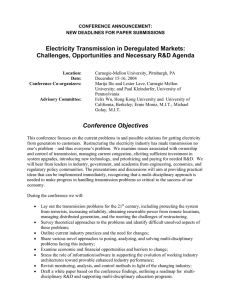

advertisement