REFORM OF GOVERNMENT’S PROCUREMENT REGIME A Green Paper

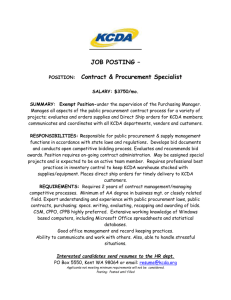

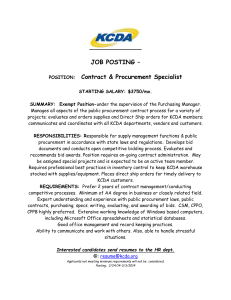

advertisement