Stephen F. Austin State University M

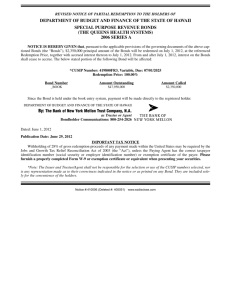

advertisement