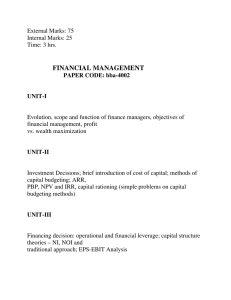

Master of Business Administration - MBA Semester 2

advertisement

MB0045_MBA_Sem2_Fall/August 2012 Master of Business Administration - MBA Semester 2 MB0045 –Financial Management - 4 Credits Assignment Set- 1 (60 Marks) Note: Each question carries 10 Marks. Answer all the questions. Q.1 Considering the following information, what is the price of the share as per Gordon’s Model? Details of the Company Net sales Rs.120 lakhs Net profit margin 12.5% Outstanding preference shares Rs.50 lakhs@ 12% dividend No. of equity shares 25, 000 Cost of equity shares 12% Retention ratio 40% Rate of interest (ROI) 16% Q.2 Examine the components of working capital & also explain the concepts of working capital. Q.3 Internal capital rationing is used by firms for exercising financial control. How does a firm achieve this? Q.4 What are the objectives of working capital management? Briefly explain the various elements of operating cycle. Q.5 Define risk. Examine the need for assessing the risks in a project. Q.6 Briefly examine the significance of identification of investment opportunities in capital budgeting process MB0045_MBA_Sem2_Fall/August 2012 Master of Business Administration - MBA Semester 2 MB0045 – Financial Management - 4 Credits Assignment Set- 2 (60 Marks) Note: Each question carries 10 Marks. Answer all the questions. Q.1 Examine the reasons for holding inventories by a firm & also discuss the techniques of inventory control. Q.2 a.) A bond of Rs. 1000 value carries a coupon rate of 10% and has a maturity period of 6 years. Interest is payable semi-annually. If the required rate of return is 12%, calculate the value of the bond. ( 5marks) b.) A bond whose par value is Rs. 500 bearing a coupon rate of 10% and has a maturity of 3 years. The required rate of return is 8%. What should be the price of the bond? ( 5marks) Q.3 Examine the features & evaluation of decision-tree approaches. Q.4 If the EPS is Rs.5, dividend pay-out ratio is 50%, cost of equity is 20% and growth rate in the ROI is 15%. What is the value of the stock as per Gordon’s Dividend Equalisation Model? Q.5 Critically examine the pay-back period as a technique of approval of projects. Q.6 Two companies are identical in all aspects except in the debt-equity profile. Company X has 14% debentures worth Rs. 25,00,000 whereas company Y does not have any debt. Both companies earn 20% before interest and taxes on their total assets of Rs. 50,00,000. Assuming a tax rate of 40% and cost of equity capital to be 22%, find out the value of the companies X and Y using NOI approach.