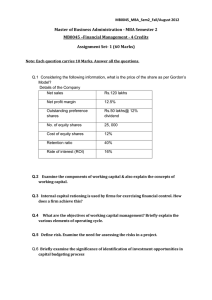

Level 2 QUESTIONS Examination Paper 2.2

advertisement

CHARTERED INSTITUTE OF STOCKBROKERS QUESTIONS Examination Paper 2.2 Corporate Finance Equity Valuation and Analysis Fixed Income Valuation and Analysis Professional Examination March 2014 Level 2 SECTION A: MULTI CHOICE QUESTIONS Corporate Finance (1 – 13) 1. Emerald Limited had an outlay of N50 million, a present value of future cash flow of N63.136 million and an NPV of N13.136 million. What is the profitability index of the project? A. 0.79 B. 1.00 C. 1.26 D. 0.66 2. Assume the cost of capital of FOB Company Limited is 10%. If the company has a capital structure that is 50% debt and 50% equity, its before-tax cost of debt is 5%. And its marginal tax rate is 20%, then its cost of equity capital is ___________ A. 14% B. 12% C. 16% D. 10% 3. GMB Assurance Plc uses the residual dividend approach in determining its dividend policy. Using the following information, what is the expected dividend? Earnings: Debt: Capital budget: Optimal capital structure: A. B. C. D. N1.6 million N20 million N1 million Debt/Equity of 1/3 N850,000 N1,260,00 N650,000 N1,350,000 4. Drogba Plc has an irredeemable debenture of N1 million with 7% rate of interest and no other fixed commitments. The company has a total profit of N250,000 per annum. What is the income gearing of the company? A. 20% B. 15% C. 39% D. 7% 5. Which of the following are factors limiting debt financing? I. II. III. IV. Legal limit imposed by a company’s article of association. The rate of interest charged. Covenant restriction issued by lender on additional debt. The effect of borrowing on return to equity. A. B. C. D. I, II and IV only. I and III only. I and IV only. All of the above. 6. Which of the dividend scenarios best reflects a stable dividend policy? A. Maintaining a constant dividend payout ratio of 40% to 50%. B. Maintaining the dividend at N1.00 per share for several years. C. Increasing the dividend at the company’ long term earnings growth rate of 5%. D. All of the above. 7. The most common motivation for a merger is the creation of _________, in which the whole of the combined company will be worth more than the sum of its parts. A. Creeping takeovers. B. Eliminating minority interest. C. Synergy. D. Golden parachutes. 8. Sunday Mba who recently won the most valuable player (MVB) at the just concluded Africa Nation’s Cup received N2,000,000 and decided to invest the whole amount in order to purchase a choice building at Lekki in 5 years time. The actuarist estimated the cost of the structure to be N3,222,100 at the time. What interest rate can he negotiate with his banker to afford the apartment? A. 9% B. 10% C. 7% D. 13% 9. A ___________ is a call option to buy a stated number of shares of stock at a specified price issued by companies in the process of raising capital. A. Convertible bond. B. Corporate bond. C. Warrant. D. Preferred stock. 10. Which of the following statements regarding capital budgeting and strategic planning is true? A. Capital budgeting and strategic planning are bottom-up processes. B. Capital budgeting and strategic planning are top down processes. C. Capital budgeting is a top-down process, while strategic planning is a bottom-up process. D. Capital budgeting is a bottom-up process, while strategic planning is a topdown process. 11. The investors may prefer companies which repurchase their shares instead of paying a cash dividend when __________ A. Capital gains are taxed at lower rates than dividends. B. Capital gains are taxed at the same rate as dividends. C. The company needs more quality equity to finance capital expenditure. D. All of the above. 12. Which of the following will affect international capital budgeting for a multinational firm? I. Foreign project appraisal. II. Political risk. III. Foreign exchange exposure. A. B. C. D. I and II only. I and III only. None of the above. All of the above. 13. The market for venture capital refers to ___________ A. Private financial market place for providing equity investment for small, start-up firms. B. Bond market. C. Market for providing equity to well-established firms. D. All of the above. Equity Valuation and Analysis (14 – 26) 14. An investor gathers the following data for a company: Net profit margin Total assets Total liabilities Net income Dividends paid 2% N200m N120m N10m N2m The company’s estimated dividend growth rate (in %) is closest to __________ A. 8.0 B. 10.0 C. 12.5 D. 17.5 15. A company’s N100 par perpetual preferred stock has a dividend rate of 7% and required rate of return 11%. The company’s earnings are expected to grow at a constant rate of 3% per year. If the market price per share for the preferred stock is N75, the preferred stock is most appropriately described as being __________ A. Undervalued by N36.36 B. Overvalued by N11.36 C. Properly valued. D. Undervalued by N15.13 16. In the year just ended AB plc reported EPS of N140 and paid dividend of N40 per share. Earnings and dividends are expected to grow at 5% p.a. to infinity. You buy the company shares at N420 per share, ex-dividend. If you require a return of 15% p.a, what will be the required selling price, after holding the stock for five years, which will satisfy your expectations? A. N845 B. N676 C. N536 D. N620 17. The issue of differences in accounting conservatism between companies is best addressed when companies are compared using which of the following ratios? A. Price-to-earnings. B. Price-to-cash flow. C. Price-to-book value. D. None of the above. 18. The A. B. C. D. value of equity of a leveraged firm can be calculated by __________ Discounting free cash flows from operations using the cost of capital. Discounting free cash flows from operations using the cost of equity. Discounting free cash flows to equity using the cost of capital. Discounting free cash flows to equity using cost of equity. 19. A large manufacturing company is in a competitive industry. It has aboveaverage investment opportunities and its return on investments has been above the required rate of return. The firm retains a large portion of earnings to fund its superior investment projects. The company is best characterized as a ___________ A. Growth company. B. Cyclical company. C. Speculative company. D. None of the above. 20. All else equal, a decrease in the expected rate of inflation will most likely result in a decrease in __________ A. The real risk-free rate. B. The nominal risk-free rate. C. Both real and nominal risk-free rates. D. None of the above. 21. A company has initiated the process of selling unproductive land representing 5% of its total assets and using the proceeds to buy back its ordinary shares. Holding other factors constant, these actions by the company will most likely result in a _________ A. Higher ROE. B. Higher operating margin. C. Lower sustainable growth. D. Lower financial leverage. 22. Which of the following is the most appropriate reason for using a free-cash-flowto-equity (FCFE) model to value equity of a company? A. FCFE is a measure of the firm’s dividend paying capacity. B. FCFE models provide more accurate valuation than the dividend discount models. C. A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE. D. None of the above. 23. Data that helps to compute expected growth rates of companies are furnished below: Dividend payout ratio Company 1 37.5% Company 2 40.0% 12% 1.6 10.0% 2.0 Return on assets Financial leverage Which of the following best describes the expected growth rate of Company 1? The expected growth rate of company 1 compared to Company 2 is __________ A. Lower. B. Higher. C. The same. D. More information needed. 24. An analyst gathers the following data about a company and the market: Earnings per share-most recent year N2.00 Expected growth rate of dividends Dividend payout ratio 5.10% 60% Stock’s beta Market risk premium Risk-free rate 1.5 5.60% 4.20% Company’s weighted average cost of capital 12.00% Using the dividend discount model, what is the company’s price per share (in N) closest to? A. 16.00 B. 16.80 C. 18.28 D. 19.40 25. Koko Plc generates annual ROE of 24%. If the required return is 12% and annual growth rate is 6%, what is the current P/B? A. 2 B. 3 C. 4 D. 6 26. If the expected return of the market portfolio is 18% and a stock with a beta of 1.00 pays a dividend yield of 6%, what must the market believe is the expected rate of price appreciation (capital gain yield) of the stock? A. 18% B. 24% C. 15% D. 12% Fixed Income Valuation and Analysis (27 – 40) 27. When yield volatility __________ Callable A. Increase B. Decrease C. Increase D. Decrease increases, the values of a callable and putable bond will Putable Increase. Decrease. Decrease. Increase. 28. Which of the following statements regarding mortgage-backed securities (MBs) and collateralized mortgage obligations (CMOs) is most likely correct? A. MBs are created from CMOs. B. Creating CMOs does not reduce the overall prepayment risk of a mortgage pass through security. C. The prepayment option of an MBs benefits the security holder. D. The cash flows received on the MBs are quite similar to those of a callable company bond. 29. The liquidity theory of the term structure of interest rates projects that the normal shape of the yield curve will be __________ A. Upward sloping. B. Downward sloping. C. Flat. D. Variable. 30. Which ratio group measures the firm’s ability to generate enough cash flow through its earnings to meet its debt and lease obligations? A. Short-term solvency ratios. B. Capitalization ratios. C. Coverage ratios. D. Profitability ratios. 31. Which of the following statements regarding indenture covenant is false? A. Indenture may restrict borrowings by subsidiaries. B. Limitations on stock repurchases may be included in indentures. C. Covenants generally are structures to restrict the payment of cash and stock dividends. D. A negative covenant may place a limitation on the amount of money used to repurchase stock. 32. An endowment’s fixed income portfolio comprises three bonds whose market values, par values, coupon rates, and durations are given in the following table: Bond 1 Bond 2 Bond 3 Market value N500,000 N1,200,000 N300,000 Par value N580,000 N1,100,000 N320,000 Coupon rate Duration 11.0% 6.2 6.9% 8.1 9.0% 2.9 What is the portfolio’s duration closest to? A. 5.73 B. 6.31 C. 6.85 D. 7.54 33. Jasper Ltd sold its receivables to a special purpose vehicle, JTL Ltd, created by Jasper for that purpose. If JTL sells securities backed by the receivables, the credit rating associated with those securities will most likely be based on the _________ A. Creditworthiness of JTL. B. Creditworthiness of Jasper. C. Collateral and credit enhancement mechanisms used. D. None of the above. 34. If the value of a Treasury bond was lower than the value of the sum of its part (stripped cash flows) you could ___________ A. Profit by buying the stripped cash flows and reconstituting the bond. B. Not profit by buying the stripped cash flows and reconstituting the bond. C. Profit by buying the bond and creating strips. D. (B) and (C) above. 35. Which of the following statement is correct about floating rates note? A. A floating rate note has a duration that is close to zero. B. A floating rate has high interest rate risk. C. An inverse floating rate note is positively related to reference rate. D. The coupon rate of a floater is equalled to the reference rate only. 36. You want to immunize a liability occurring in 10 years with two bonds; bond K has a maturity of 5 years and duration of 4 years; bond P has a maturity of 15 years and duration of 12 years. The weight of the portfolio invested in bond K, respectively P are _________ and __________ A. B. C. D. K 75% 50% 25% 40% P 25% 50% 75% 60% 37. You manage a bond portfolio. Your client wants to reduce the reinvestment risk over time. If he does not have any definite forecast over the future movements of interest rates, what strategy will you apply? A. Barbell strategy. B. Bullet strategy. C. Butterfly strategy. D. Ladder strategy. 38. The redeemable bond issuance of XYZ Limited has a modified duration of 11. Which one of the following statements regarding the bond is true? A. If the market yield increases by 1% the bond's price will decrease by N55 B. If the market yield increases by 1% the bond's price will increase by N55 C. If the market yield increases by 1% the bond's price will decrease by N110 D. If the market yield increases by 1% the bond's price will increase by N110 39. Consider a five year bond with a 7% coupon that has a present YTM of 8%. If interest rates remain constant, one year from now the price of this bond will be ___________ A. Higher. B. Lower. C. The same. D. Cannot be determined. 40. The coupon of a convertible bond is, in general, lower than the coupon of a straight bond. Why? A. Because a convertible is less risky. B. Because normally, the rating of convertible bond is higher. C. Because the lower coupon is compensated by the premium of the conversion’s option. D. None of the above answers is correct. Total = 40 marks SECTION B: SHORT ANSWER QUESTIONS Question 2 – Corporate Finance IBTT Limited is the target of a takeover bid by TransNations Limited. What are the potential benefits and drawbacks to the shareholders of IBTT Limited, if TransNations Limited succeeds in its bid, and decides to finance the takeover by issuing its shares to the shareholders of IBTT Limited? (3 marks) Question 3 – Equity Valuation and Analysis ‘A negative Economic Value Added (EVA) for the year implies that the firm has not earned enough during the year to cover its cost of capital, and the value of the firm has declined’. Do you agree with this statement? Briefly justify. (3 marks) Question 4 – Fixed Income Valuation and Analysis Because of financial stress, the bonds of Connect Telecoms Ltd have been downgraded by Moody’s from A to BBB. What is the predicted effect on the bonds’ price, and the bonds’ yield to maturity? Justify. (4 marks) SECTION C: ESSAY TYPE, CALCULATION AND/OR CASE STUDY QUESTIONS Question 5 – Corporate Finance Tissan Limited is a new entrant into the Nigerian Automobile Industry. The company seeks to position itself strongly in the market in the next few years to take advantage of the huge opportunities in the sector in view of the recent automobile policy of the Federal Government that provides a range of incentives for new entrants into the industry. Mike Sule, ACS, is the company’s Financial Analyst and has the responsibility of assessing the various options available for the company to raise capital in the very near future. He therefore needs some initial information. Mike has calculated the asset betas of Tissan, and of similar companies in the industry. They all have an asset beta (βs) of 1.3. However, while all other companies in the industry are debt-free, Tissan currently had a Debt/ Equity ratio of 62%. 5(a) Assume that Tissan targets a Debt/Equity ratio of 35% for its capital structure and given that riskless interest rate is 2.5%; equity risk premium is 5%; loan interest rate is 5% and marginal corporate tax rate is 42%, calculate an appropriate weighted average cost of capital (WACC) for the company. (5 marks) 5(b) Mike’s approach is to use Tissan’s internal earnings forecasts to calculate an appropriate share price for the company. He has estimated the company’s Free Cash Flows (FCF) for a 5-year period from 2014 to 2018 (in N’ million) as summarized below: 2014 -1,342 2015 -1,107 2016 -730 2017 -140 2018 396 5(b1) Assuming a WACC of 9.0%, find the present value (as of 31 December 2013) of the FCF for the period 2014 to 2018. (2 marks) 5(b2) To calculate residual value (terminal value), Mike assumed a FCF growth rate of 5% from 2019 onwards. Find the present value of the residual value (as of 31 December 2013). (2 marks) 5(b3) Find an appropriate theoretical share price for Tissan. Assume there are no surplus funds, and the company currently has 15 million ordinary shares in issue. (3 marks) 5(c) From his analysis, Mike concludes that it is not desirable to raise additional equity capital at the current share price level. Describe two fundraising options for Tissan other than additional equity capital, taking into account its current capital structure. Discuss both the rationality of and the risk associated with those options. (4 marks) Question 6 –Equity Valuation and Analysis Yaro Soundhead, an analyst, is assigned the responsibility of placing value on Model Furniture Ltd (MFL). MFL specializes in producing bespoke office and home furniture for the “high and mighty” throughout the country and along the ECOWAS sub-region. Your investment firm has been offered 60% stake in the company – hence the need for valuation. You have collected the following financial data of MFL for the most recent two years: Table 1 Model furniture Ltd Summary Statement of Income Year ended 31 December (₦’000 except for share data) 2013 Revenues 194,850 8,425 2012 171,930 - Depreciation - - Other Operating costs -124,500 -119,270 61,925 44,715 EBIT - Interest expense Income before taxes - Taxes at 30% Profit after tax (PAT) - 2,425 - 7,945 - 715 59,500 44,000 -17,850 -13200 41,650 30,800 Table 2 Model Furniture Ltd Statement of Financial Position (₦’000) Assets Non – Current assets 2013 32,500 2012 20,231 9,750 11,645 Inventory 15,476 13,940 Cash and bank 11,775 9,920 69,501 55,736 Receivables Liabilities and Equity Short term loan (payable within 12 months) 1,500 2,000 Accounts payable 2,040 4,250 Non-Current Loan 4,511 9,745 Total Liabilities 8,051 15,995 61,450 39,741 69,501 55,736 EPS ₦4.17 ₦3.08 DPS ₦1.50 ₦1.50 Equity The number of shares has remained constant over the last five years and dividend per share has also remained constant at N1.50 over the period. 6(a) Determine whether using the Gordon dividend growth model to value MFL’s equity is appropriate or inappropriate. Justify your response on the assumptions of the Gordon growth model and other relevant information in the scenario. (2 marks) 6(b) The Managing director of the investment firm is of the view that Yaro should make use of the free cash flow to the firm (FCFF) model, based on a singlestage annual growth rate of cash flow. He recommends the following formula to value MFL’s equity: (Vo) as of 31 December 2013: FCFFo x (1+g) Vo = - BVDo r-g FCFFo = free cash flow to the firm in 2013 g = constant annual growth rate of cash flow r = required rate of return for equity BVDo = book value of debt as at December 2013 Required: Indicate whether Yaro’s use of each of the following two variables: (i) r and (ii) BVDo in the above formula for Vo is appropriate or inappropriate. (2 marks) 6(c) State, for any inappropriate variable, the variable that Yaro should use in his formula for Vo (1 mark) 6(d) It is finally decided that Yaro should make use of the free cash flow to equity (FCFE) model. Calculate MFL’s free cash flow to equity (FCFE) for 2013 (show all workings). (4 marks) 6(e) You have now collected the following additional information relevant for the valuation: Risk free rate Market risk premium Target debt-to-asset ratio 4% 8% D 0.2 E+D Appropriate asset beta Effective tax rate Beta of debt 0.64 30% 0 6(e1) Using the target debt-to-asset ratio, compute the appropriate rate of return needed for the valuation of MFL (Round your answer to nearest 1% and Show your workings). (3 marks) 6(e2) Assuming the FCFE in December 2013 is N20 million. The FCFE will grow at 15% for the following 4 years (i.e. 2014, 2015, 2016 and 2017) and 2.50% p.a. for the indefinite future. What is the total value of MFL’s equity using the FCFE valuation approach? Note: if you could not calculate the appropriate rate of return in 6(e1) above, assume a rate of 10% (4 marks) Question 7 – Fixed Income Valuation and Analysis One of your very important clients works with a highly respected private company in kano. He is due for retirement in 10 years. At the point of his retirement, it is projected that the balance of his mortgage will be N23,078,999. He plans to pay off the mortgage on retirement. To fund the payment, he has been investing on series of zero-coupon bonds each with face value of N3,000,000. Five different bonds are involved. The bonds are designed to mature at interval of every 2 years commencing from the end of 2nd year for the next 10 years (total of 5 receipts). Assume that the market yield for all instruments and for all maturities is 10% p.a 7(a) Explain very carefully why zero-coupon bond is often considered an ideal financial instrument for immunizing a future liability. (3 marks) 7(b) Calculate the present value of the given assets and liability of your client. What is the net surplus today? (5 marks) 7(c) Determine the modified duration of the assets and the liability. (3 marks) 7(d) Assuming 75 basis points reduction in market yield, what will be the appropriate change in the net value of your client’s assets and liability? Comment on your result. (3 marks) 7(e) Looking at your calculation of surplus in 7(b) above, your client is not comfortable with the figure. After punching the calculator, he tells you that he requires a minimum surplus of N198,000. Calculate the approximate percentage change in yield that will guarantee such a surplus. Be precise as to the direction of the change. (4 marks)