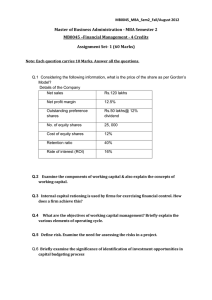

CIS SEPTEMBER 2010 Exam Diet Examination Paper 1.2: Corporate Finance

advertisement

CIS SEPTEMBER 2010 Exam Diet Examination Paper 1.2: Corporate Finance Equity Valuation and Analysis Fixed Income Valuation and Analysis Level 1 1 SECTION A Corporate Finance (Questions 1 to 20) 1. Which of the following will cause a company’s WACC to rise? A. A decrease in expected inflation B. A decrease in tax rate C. A decrease in interest rate D. A decrease in dividend rate 2. The A. B. C. D. 3. In which of the following cases would the IRR approach give the same result as the NPV method? A. Comparing mutually exclusive projects B. Evaluating a project with multiple projects C. Evaluating an independent project D. Evaluating capital intensive projects 4. What is agency relationship? A. The relationship between B. The relationship between C. The relationship between D. The relationship between 5. cost of equity capital is equal to the: Expected market return Rate of return required by stockholders Cost of retained earnings plus dividends Cost of retained earnings only shareholders and professional managers executive managers and staff the firm and its clients the firm and the society Which of these are possible objectives of a firm? I. Value maximization for shareholders II. Profit maximization III. Maximization of earnings per share IV. Maximization of return on equity A. B. C. D. I and II only I and III only I, II and III only I, II, III and IV 6. Which of the following information is not needed when computing the required rate of return for equity using the CAPM? A. The expected growth rate. B. The risk-free rate. C. The beta for the company. D. The expected market return for the time period. 7. Why A. B. C. D. are market values often used to compute the weighted average cost of capital? It is because securities are issued at market value and not at book value. It is simpler to calculate market values than to calculate book values. This is a very common mistake, especially because market values are much more volatile. This is in line with the goal of maximizing shareholder value. 2 8. A firm should invest in a new investment project only when: A. It has built sufficient internally generated funds without recourse to external borrowing. B. The expected return on the investment project is greater than the expected return on investment projects with similar risk. C. Expectations on the stock market are good and there is a high probability that new issue of shares would be fully subscribed. D. There is a reduction in general interest rate and fiscal policy is favourable to the real sector. 9. Firms with very cyclical revenues and high fixed costs usually have: A. Low asset betas. B. High asset betas. C. Asset betas of zero. D. None of the above: asset betas depend upon betas of debt and equity. 10. The risk-free rate is 5%. A new project requires an initial investment of N100 million and will be able to generate additional risky cash flows of N120 million for the next 2 years. Advise on the acceptance or rejection of the project. A. Reject the project. B. Accept the project because its NPV (Net Present Value) is positive. C. Accept the project because the IRR (Internal Rate of Return) is greater than the cost of capital. D. No answer can be given. 11. Which of the following is not a feature of convertible bond: A. It is generally regarded as an hybrid between debt and equity B. It is convertible into the equity of the issuer under agreed terms and conditions C. It attracts a lower coupon rate than a non-convertible bond D. In certain cases, holders participate in the decision making of the company 12. A perpetual bond is currently priced at N105, and has an annual coupon of 9%. If corporate tax rate is 30%, compute the cost of debt. A. 6.00% B. 6.3% C. 8.57% D. 9.00% 13. Which of the following should be taken into consideration in analyzing relevant cash flows for capital budgeting? A. Opportunity cost B. Sunk cost C. Non-incremental cost D. Interest cost Compute the weighted average cost of capital of WXY Limited from the following information: Equity N 1 billion Debt-equity ratio 2 Cost of equity 12% Cost of debt (before tax) 6% Corporate tax rate 35% 14. A. B. C. D. 6.6% 8% 9.2% 10.2% 3 15. A firm may impose on itself internal capital rationing for the following reasons except? A. To avoid dilution of ownership B. To ensure efficient utilization of available funds C. As a strategy to grow organically D. To maximally utilize expansion potentials 16. The most appropriate appraisal method for ranking indivisible but independent projects under conditions of insufficient funds is? A. Trial and error method B. Profitability index C. Payback period D. Accounting rate of return 17. The I. II. III. A. B. C. D. 18. following are implications of dividend irrelevance theory: A firm’s dividend policy has no effect on firm value Shareholders should be indifferent about the dividend policy of the firm Dividend policy leaves shareholders’ wealth unaffected I and II only I and III only II and III only I, II and III Which of the following statements about stock repurchase are true? I. It is an alternative method of paying cash to stockholders II. A company can repurchase its shares through a tender offer III. It can result in increased EPS IV. It can lead to a reduction in debt-equity ratio A. B. C. D. I and II only I and III only I, II and III only I, II, III and IV 19. Which of the following is not an advantage of using the conventional pay-back period as an investment appraisal technique? A. It is based on cash flows B. It is relatively simple to use and understand C. It considers the time value of money D. It supports quick return projects therefore enhances liquidity 20. Which of the following are sources of short–term financing available to a firm? I. Receivables factoring II. Bank overdraft III. Leasing IV. Warrants A. B. C. D. I and II only I and III only II and IV only I, II, III and III 4 Equity Valuation and Analysis (Questions 21 to 40) 21. The Nigerian Stock Exchange A. Provides a mechanism for mobilizing private and public savings. B. Aids in the determination of prices of securities by matching buy and sell orders. C. Provides a means for trading in existing securities, thus making the securities marketable. D. All of the above 22. An increase in which of the following variables is most likely to increase the value of a company? A. Long term sustainable growth rate B. Investors’ required return C. Dividend yield D. Interest rate Which of the following best describes a growth company? A. A company that has a rate of return on investment in excess of its WACC. B. A company with high P/E ratio. C. A company with a stock that has returned more than other stocks with similar risk characteristics. D. None of the above. 23. 24. If a low A. B. C. D. 25. A stock market index is used for which of the following purposes? I. As a measure of performance of the market as a whole. II. Investment analysts find it a useful tool in determining the factors underlying stock price movement. III. Fundamental Analysts use the stock index data to derive the intrinsic value of stocks. IV. Stock indexes are very useful in portfolio management. A. B. C. D. fund manager tries to invest in stocks which will outperform the market, using a P/E ratio as a signal to invest, what style of investing is he following? Growth. Value. Speculative. Momentum. I and II only I and III only I, II, and IV only I, II, III, and IV 26. Which of these is not an advantage of rights offering? A. It helps to expand the shareholding base of the company. B. It protects the preemptive right of shareholders. C. It is normally a low-cost alternative. D. Requirements for using margin facilities to purchase rights offerings are generally less stringent. 27. Which of the following types of mutual funds concentrate heavily on high-interest and high-dividend-yielding securities? A. Industry –specialized fund B. Income fund C. Balance fund D. Growth fund 5 28. In a I. II. III. A. B. C. D. 29. 31. I only I and II only I and III only I, II and III Which of these are the strengths of price-to-cash flow ratio as a valuation metric? I. Cash flow is a truer measure of a company's results in comparison to earnings. II. It is more difficult for managements to manipulate cash flow. III. It comprehensively captures all the major transactions in a company. A. B. C. D. 30. bear market you are likely to observe which of the following? High dividend yields as against bond yields Low earnings multiple Low price–to–book ratio I and II only I and III only II and III only I , II and III In private placement: A. Shares are offered B. Shares are offered C. Shares are offered D. Shares are offered The I. II. III. A. B. C. D. through through through through letter of offer. prospectus. brokers. investment bankers. NSE All Share Index is: Capitalization-weighted Price- weighted Chain- linked I only I and II only I and III only I, II and III 32. You are given the following information about a stock: next year’s dividend is N2, required rate of return is 10%, and growth rate is 15%. What is the market price using constant growth model? A. Indeterminable B. N20 C. N30 D. N40 33. Which of the following is correct in respect of common stock payout ratio: A. It has no impact on the rate of growth of the company. B. It can be zero for a growth company. C. It is always greater than the retention ratio. D. It measures the earnings of a share as a proportion of its market price. 34. Participating preference share is a type of instrument that embodies: A. Rights to convert to the ordinary shares of the issuer. B. All the rights of ordinary shareholders. C. Rights to acquire ordinary shares of the issuer in future under agreed terms. D. Rights to participate in further share of the profits after the ordinary shareholders have received their distribution. 6 35. If all other factors remain unchanged, which of the following events would most likely reduce a firm’s price-to-earnings (P/E) ratio? A. Investors become less risk averse. B. The dividend payout ratio increases. C. The yield on Treasury bills increases. D. The market becomes bullish. 36. Which of the following is not an active participant in the secondary market of the Stock Exchange? A. NSE. B. CSCS. C. Registrar. D. Reporting Accountant. 37. A stock whose return is exactly equal to the market rate of return is most likely to have: A. Beta of zero. B. Beta of 1. C. Beta of 2. D. Negative beta. 38. Stable plc has an estimated beta of -0.2. The risk free rate of return is 4.5 %, and the equity risk-premium is estimated to be 7.5%. Using the CAPM, compute the required rate of return for investors in the company. A. 3% B. 4.5% C. 7.5% D. 10% 39. Which of the following is not a method of raising fresh funds from the capital market? A. Initial public offer. B. Private placement C. Capitalization issue. D. Tender offer. 40. Which of the following is not a right of equity shareholder? A. Right to vote at the AGM of the company. B. Right to share profit in the form of dividends. Right to receive a copy of the statutory report. C. D. Right to have first claim in case of winding up of the company. Fixed Income Valuation and Analysis (Questions 41 to 60) 41. Which of the following is not a limitation of current yield? A. It only considers the coupon flows B. It ignores the timing of cash flows C. It assumes the coupon can be reinvested at the current yield till maturity D. None of the above 42. In relation to bonds, prepayment risk means: A. The total risk involved in bond investment B. The hidden risk in the bond C. The risk of unexpected change in cash flow structure D. Risk that principal will not be repaid when due 7 43. Which of the following is the most likely reason for an inverted yield curve? A. Investors buying long-dated bonds due to interest rate expectations B. Liquidity factors C. Risk factors D. None of the above 44. What is marketability risk of a bond? A. The market risk which affects all bonds B. Variations caused by difficulty in selling bonds C. The failure to pay the agreed value of the bond by the issuer D. Systematic risk that affects all securities 45. The I. II. III. 46. value of a bond depends on: The coupon rate Years to maturity Expected yield to maturity A. I and II only B. I and III only C. II and III only D. I ,II and III Bond duration measures: A. Time structure of the bond B. Interest rate risk C. Time structure and market risk D. Time structure and interest rate risk 47. Sinking funds are most likely to: A. Reduce default risk B. Increase liquidity risk C. Negatively affect bond rating D. Increase prepayment risk 48. ’’The back A. B. C. D. 49. A short term unsecured promissory note that is issued in the open market and represents the obligation of the issuing company is called: A. Commercial paper B. Bankers acceptance C. Treasury note D. Collateralized debt obligation sale of a security with the commitment by the seller to buy the same security at a specified price at a designated future date’’, best describes: Commitment bond Repurchase agreement An adjustable price issue Inverse floater 8 50. Ego plc industrial bonds have a yield-to-maturity (YTM) of 7.45%. If a similar maturity FGN Treasury bond exhibits a YTM of 6.90%: A. The yield ratio is 1.08 and the relative yield spread is 0.08 B. The absolute yield spread is 55 basis points and the relative yield spread is 1.08 C. The absolute yield spread is 55 basis point and the relative yield spread is 0.93 D. None of the above 51. The present value of a N1,000 par value, zero-coupon bond with a three-year maturity, assuming an annual discount rate of 6 percent compounded semiannually is closest to: A. N837.48 B. N839.62 C. N943.40 D. N955.50 52. Riding the yield curve means: A. Switching from short term bonds to long term when the latter yields better. B. Switching from bond to stock. C. Switching from long term bonds to short term bonds to get more yield. D. Switching to short term bonds from long term bonds when yield curve is downward sloping. 53. Which of the following bonds will give the greatest re-investment risk , given the same yield to maturity for all the bonds? A. 10-year 5% coupon B. 10-year 2% coupon C. 20- year zero coupon D. 30-year zero coupon 54. A bond’s indenture: A. Pledges it as collateral B. Contains its covenants C. Is the same as a debenture D. Relates only to its interest and principal payments. 55. The A. B. C. D. 56. What is bond indexing? A. Designing a portfolio some equity index B. Designing a portfolio some bond index C. Designing a portfolio D. Designing a portfolio 57. minimum value of a convertible bond is: Its conversion value Its straight value The greater of its conversion value and its straight value The lower of its conversion value and its straight value so that its performance will match the performance of so that its performance will match the performance of to outperform some bond index to outperform some equity index Under the pure expectation theory, an inverted yield curve is interpreted as evidence that: A. Demand for long term bonds is falling B. Inflation is expected to rise in the future C. Short-term rates are expected to fall in the future D. Investors have very little demand for liquidity 9 58. From the perspective of the bondholder, which of the following pairs of options would add value to a straight (option –free) bond? A. Call option and conversion option B. Put option and conversion option C. Prepayment option and put option D. Call option and prepayment option 59. A treasury security is quoted at 92-28 and has par value of N100,000. Which of the following is its quoted Naira price? A. N92,000 B. N92,280 C. 92,875 D. N100,000 60. Which of the following statements concerning leverage is false? Leverage magnifies: A. Total returns to stockholders, either positive or negative B. Risk to shareholders C. Risk to bondholders D. Return to bondholders 10 SECTION B Question 2 - Corporate Finance 2(a) List four ways by which companies could reduce the ‘agency problem’. (2 marks) 2(b) What is the conclusion of Modigliani and Miller’s theory on capital structure when there is taxation? (1 mark) Question 3 - Equity Valuation and Analysis 3(a) Mention two ways by which a firm can increase its sustainable growth rate. (1 mark) 3(b) Using book value to measure profitability and to value a company’s stock has limitations. List four of them. (2 marks) 3(c) List 2 benefits of privatization of government-owned enterprises. (1 mark) Question 4 - Fixed Income Valuation and Analysis 4(a) What is the relevance of ‘yield to worst’ in bond valuation? (1 mark) 4(b) Mention four practical ways by which the Nigerian bond market could be made more vibrant. (2 marks) 11 SECTION C Question 5 - Corporate Finance A box-making company is considering the purchase of a new computer-operated machine. It will cost N500,000 to install. The company estimates that the new machine will add 1.2 million units to production at a net profit value of 20kobo each. Assume a five-year life of the machine with the capital cost at the beginning of the first period and revenue accruing at the end of each period. Assume also 30% profits tax payable annually in arrears and a linear depreciation allowance charged in each period. The interest rate is 10%. a) Calculate the NPV of the project. Should the company go ahead? b) What is the payback period of the project? (7 marks) (3 marks) Question 6 - Equity Valuation and Analysis a) One of the major clients of your investment banking firm has approached you to give a professional advice on its proposed investment in a quoted company, Flamingo Plc. You were able to gather the following information about the company: Current stock price Current dividend Growth rate of dividend The company’s beta Risk-free interest rate Market risk premium N50 N1.50 5% annually 0.85 4.5 % 6% a1) Calculate the projected dividend for next year? a2) What is Flamingo’s required rate of return based on CAPM? (1 mark) (1½ marks) a3) Using the Gordon’s growth model, what is the value of Flamingo Plc’s shares? Based on your result, what advice would you give your client? (2 marks) a4) Assuming the Gordon’s model is valid, what dividend growth rate would result in a model value of Flamingo Plc equal to its market price? (3 marks) One of your colleagues has criticized you for using the dividend discount model for valuing companies in spite of its ‘many weaknesses’. b) Respond to your colleagues’ comment. Clearly identify the weaknesses he referred to in your response. (2½ marks) 12 Question 7 - Fixed Income Valuation and Analysis a) Bonds of Bintu Corporation with a par value of N1000 sell for N960, mature in five years , and have a 7% annual coupon rate paid semi annually. a1) Calculate the i. Current yield ii. Yield to maturity (to the nearest whole percentage) iii. Horizon yield (total return) (½ mark) (2 marks) (1 mark) a2) Give one major shortcoming each of yield-to-maturity and horizon yield. (1 mark) b) Consider the following portfolio: Bond W X Y Z Market Value N13 million N27 million N60 million N40 million b1) What is the portfolio’s duration? Duration 2 7 8 14 (1½ marks) b2) If interest rates for all maturities change by 50 basis points, what is the approximate percentage change in the value of the portfolio? (2 marks) b3) What is the relevance of duration in bond analysis and portfolio management? (2 marks) 13