THE DAIRY INDUSTRY IN KENYA: THE POST-LIBERALIZATION AGENDA By

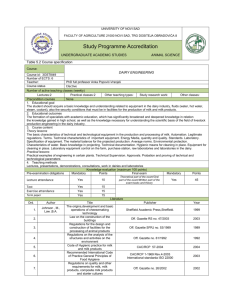

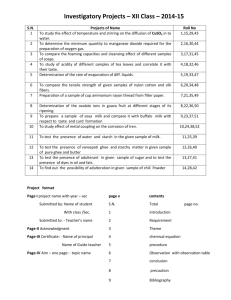

advertisement