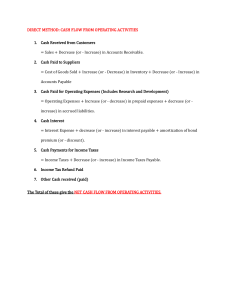

BSM 100: Week 11 Forms of business ownership 1. Sole proprietorships 2. Partnerships 3. Corporations 4. Franchise 1. Sole proprietorship: a business owned by one person - One person owning and operating a business, without informing a corporation - The business and the owner are a single entity - Almost ¼ of all registered businesses in canada fall under this form of ownership - Its the easiest and most popular form of business ownership - It is the least regulated form of business ownership Unlimited liability: when the owner is responsible for the companies debts Advantages - Easy to start up - Ease of management - Owner keeps the profits - Owner does not have to pay separate business income tax Disadvantages - Unlimited liability - Limited access to raising financial capital - Small size may have limited inventory - Limited managerial experiences - Difficulty attracting qualified employees Liability - Another word for debt/the responsibility to pay all normal debts - Unlimited liability: any debts pr damages incurred by the business are your debts, and you must pay them - Biggest disadvantage of sole proprietorship is financial 2. Partnership (owned by two or more people) General partnership: all partners are jointly responsible for management and debts Limited partnership: one or more partners are not active in the running of the business, and whos liability for the partnerships debt is restricted to the amount invested in that business General partner: an owner (partner) who has unlimited liability and is active in managing the firm Limited partner: an owner who invests money in the business but does not have any management responsibility or liability for losses beyond the investment 3. Corporations - A separate legal entity apart from its owners which receives the right to exist from the state in which it is incorporated Types of corporations 1. Private: not trades on any stock exchange, limited to 50 or fewer stock holders 2. Public: shares are trades on one or more stock exchanges 3. Non profit: performs public service, has special tax considerations to encourage formation Starting Business from Scatch PROS 1. Its all you: concept, decisions, structure 2. You dont have to deal with the prior owners bad decisions CONS 1. Its all you: alot of pressure 2. Can be hard to get credit 3. Challenging logistics 4. Takes time, money, and sweat to build a customer base Buying an established business PROS 1. Concept, organizational structure, and operating practices are in place 2. Established relationships 3. Obtaining financing is less challenging CONS 1. Working with someone elses idea may not be fun 2. You may inherit old mistakes Franchising: proven methods at a price Franchising: not a form of ownership but an operation option (ie tim hortons) - The franchise uses the brand name, trademark, and practices of the franchisor Franchisor licneses its trademark and method of doing business to another business or individual in exchange for a franchise fee and an ongoing royalty payment Franchisor: actual owner of the business that lets other investors rent or lease its name, business profile, and way of dong business Franchisee: investor who rents or leases the business model from the franchisor and then hope to recoup his/her investments by selling the franchisors goods or services To avoid franchise disaster 1. Research officers and their buisness experiences 2. Get summary of any bankruptcy and litigation 3. Estimate all costs to set up a franchise 4. Review franchise contrac and three most recent financial statements Key financial statements (review) 1. Balance sheet - Details what the company owns and owes on a CERTAIN DAY 2. Income statement - Shows the revenue a firm earned selling its products compared to its selling costs (profit or loss) over a specific period of time 3. Cash Flow statement - Highlights the difference between cash coming in and cash going out of a business 1.BALANCE SHEET EQUATION ASSETS = LIABILITIES + OWNERS EQUITY In accounting, this equation must always be balanced. 1. Assets - Economic resources (things of value) that are owned by a firm 2. Liabilities - what the business owes to others (debts) 3. Equity - All that the owners have invested in the company BALANCE SHEET (2) Assets and Liquidity - Assets are listed on the firms balance sheet according to their liquidity - Liquidity refers to how fast an asset is expected to be converted into cash - Assets are divided into three categories according to how quickly they can be turned into cash 1. Current assets - Items that can or will be converted into cash within one year 2. Capital assets - Items that are relatively permanent goods (land, buildings) 3. Intangible assets - Long term assets that have no real physical form but do have value BALANCE SHEET (3) Liabilites - Liabilities are what the business owes to others (debts) - Current liabilities are debts due in one year or less; - Long term liabilities are debts not due for one year or more 1. Current liabilities - Such as accounts payable, are involving money owed to other for merchandise or services purchased on credit but not yet paid 2. Short term / long term liabilities - Such as notes payable, can be loans from banks that a business promises to repay by a certain date 3. Long term liabilities - Or bonds payable are that represent money lent to the firm that must be paid back BALANCE SHEET (4) Current assets examples - - - - - - Cash and cash equivalents: physical currency, bank balances, and highly liqid investments with a maturity of 3 months or less Short term investments: investments that are easily convertible to cash within a short period, such as marketable securities or certificates of deposit Accounts receivable: accounts owed to the company by customers for goods and services sold on credit. This is a claim that is expected to be converted into cash within a short timeframe Inventory: the value of goods or raw materials held by the company for production or resale. This includes finished goods, work in progress, and raw martrerials Prepaid expenses: payments made in advance for goods or services that will be received in the future. Ie prepaid rent, insurance, subscirption fees Short term notes receivable: promissory notes or loans that are due for payment within one year Balancing act - Achieving the right balance is key - Regular monitoring and adjustments to long term asset management practices help ensure that the companies capital is effectively deployed for sustainable growth and profitability Liabilities - Current liabilities: accounts payable (amounts owed to suppliers for goods and services purchased on credit); short term loans (borrowings with a maturity of less than one year) - Long term liabilities: long term debt (borrowings with a maturity exceeding one year, including bonds, mortgages, and long term loans) - Operating liabilities: trade payables (amounts owed to suppliers for goods and services) ; rent payable (obligaitons related to rented properties); utilities payable (amounts owed for utilities like electricity, water, and gas) - Employee related liabilities: wages payable (salaries and wages owed to employees); employee benefits payable (liabilities related to employee benefits, including vacation pay and bonuses) Liabilities: low or high - - - - - Accounts payable: having a balance in accounts payavble is standard business practice, allowing companies to maintain positive relationships with suppliers by taking advantage of trade credit Long term debt: having a reasonable amount of long term debt can be beneficial for financing capital intensive projects or expansion. It allows companies to spread the cost over a extended period Wages payable and employee benefits: having balances in these liabilities is typical and necessary for meeting payroll obligations Short term loans and unearned revenue: excessive reliance on short term borrowing may indicate liquidity challenges, and unearned revenue may suggest a potential inability to deliver on commitments Trades payable and other operating liabilties: while having balances in trade payables is normal, excessively high levels may indicate cash flow issues or strained relationships with suppliers Equity - Retained earnings: the cumulative net earnings retained in the company after paying dividends to shareholders. It represents the accumulated profits that have not been distributed as dividends - Total shareholders equity: the sum of common stock, preferred stock, retained earnings, and additional equity components. It represents the total ownership interest in the compan - Accumulated deficit: if a company has a history of losses, it may have a negative retained earnings balance, referred to as an accumulated deficit 2. INCOME STATEMENT - - - - The income statement (statement of earnings) shows a firms bottom line (profit or loss) after costs, expenses, and taxes Reports the firms financial operations over a period of time, usually a year, quarte of a year, or a month Reveals whether the business is actually earning a profit or losing money Includes valuable information for shareholders, lenders, potential investors, employees, and the gov. SALES (REVENUE) - EXPENSES = PROFITS (INCOME) (1) - Revenues: the value of what is received from goods sold and services rendered, and other financial sources. Note that there is a differences between revenue and sales, but there could be other sources of revenue, such as rents received - Cost of goods sold (COGS): cost of merchandise sold or cost of raw materials and supplies used for producing items for resale - Gross profit: how much the firm earned by buying or selling merchandise. When you subtract the cost of goods sold fromm net sales, you get gross profit, or gross margin. - Operating expenses: cost incurred in operating a business. Examples include rent, salaries, supplies, utilities, insurance, research, and even more amoritization of equipment - Net income after taxes: profit or loss over a specific period after subtracting all costs and expenses, including taxes Basic Components of an income statement - Revenues (sales): the total income generated from selling goods or services - Cost of goods sold (COGS): the direct costs associated with producing goods or services - Gross profit: calculated as revenues minus COGS - Operating expenses: calculated as gross profit minus operating expenses - operating income (or loss): calculated as gross profit minus operating expenses. - Other income and expenses: any additional income or expenses not directly related to operations - Net income (or loss): the final profit or loss calculated as operating income plus other income minus other expenses The income statement starts with sales (revenues) Sales (revenue) MINUS COST OF GOODS SOLD EQUALS GROSS PROFIT COGS - COGS is determined by - The cost of producing or acquiring a single unit of the firms products or services - The number of units sold - Cost of goods = cost per unit X number of units sold - Ex $50 x 10,000 = 500,000 INCOME STATEMENT (2) - next computer operating income (earnings before interest and taxes) SALES REVENUE MINUS COGS EQUALS GROSS PROFIT MINUS OPERATING EXPENSES EQUALS OPERATING INCOME What are operating expenses - - - In addition to the COGS, you need to convince someone to buy what you are selling. You will have - Market expenses And you have operating overhead — the light bill must be paid. So you will have - General and administrative expenses And if you have equipment and buildings, you will have - Depreciation OPERATING EXPENSES = 1. MARKET EXPENSES 2. GENERAL AND ADMIN EXPENSES 3. DEPRECIATION OPERATING INCOME: is the tootal profit a firm makes from running the business before paying creditors (interest expense) for the use of debt and paying income taxes to the gov. - Operating income is the best profit indicator of how well a company is doing in its business INCOME STATEMENT (3) From operating income, subtract interest expense to obtain earnings before taxes OPERATING INCOME MINUS INTEREST EXPENSES EQUALS EARNINGS BEFORE TAXES INCOME STATEMENT (4) INTEREST expense: the cost of borrowing money - Lender charges interest to loan money, which is shown as interest expense in the income statement of the borrower. - The interest expense is a result of the interest rate and the amount owed INTEREST RATE X AMOUNT BORROWED = INTEREST EXPENSE FINALLY, WE CALCULATE NET INCOME O OPERATING INCOME MINUS INTEREST EXPENSES EQUALS EARNINGS BEFORE TAXES MINUS INCOME TAXES EQUALS NET INCOME CASH FLOW STATEMENT “CASH IS KING” - Cash flow problem are a major reason for small firms failing — even at times when the business is profitable Run out of cash, business fails Why profits and cash flow are NOT the same thing - The differences between profits and cash flows can result from: 1. Sales reported on the income statement include cash and credit sales 2. Some purchases are finances by credit – so no cash is involved 3. Income tax on the income statement may be accrued and paid in later periods Cash flow statement answers the question = “ where did the cash come from and where did the cash go?” Cash inflows and outflows result from 3 activities 1. Operating activities - Cahs flow from normal operations 2. Investment activities - Cash flow related to the investment in or sale of assets 3. Financing activities - Cash flow related to financing the firm