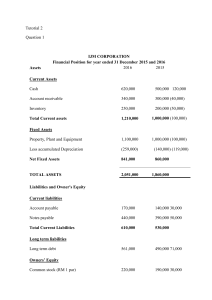

Accounting Technical Interview Questions. Source: WallStreet Prep Q. Walk me through the income statement. 01 A. The income statement or profit & loss shows a company’s profitability over a specified period of time by taking its revenue and subtracting out various expenses to arrive at net income. Although you can find various style of of reporting in Income statement among various companies but the base is same. There is also an income statement prepared for management which comprises variable and fixed costs. Standard Income Statement: Revenue Less: Cost of Goods Sold (COGS) = Gross Profit Less: Sales, General, & Administrative (SG&A) Less: Research & Development (R&D) = Earnings Before Interest, Tax, Depr & Amort. (EBITDA) Less: Depreciation and Amortization = Earnings Before Interest & Tax (EBIT) Less: Interest Expense = Earnings Before Taxes (EBT) Less: Income Tax = Profit after Tax (PAT) Less: Preference Dividend = Earnings available to equity shareholders (EAES) Divide: No. of o/s equity shareholders = Earnings per share (EPS) Q. Walk me through the balance sheet? 02 A. The balance sheet shows a company’s financial position, The carrying value of its assets, liabilities, and equity at a specific point in time. Company’s assets have to have been funded somehow, assets must always equal the sum of liabilities and shareholders’ equity. Assets: Current Assets: Highly liquid assets that can be converted into cash within a year, including cash and cash equivalents, marketable securities, accounts receivable, inventories, and prepaid expenses. Non-Current Assets: Illiquid assets that would take over a year to be converted into cash, namely plant, property, & equipment (PP&E), intangible assets, and goodwill. Liabilities: Current Liabilities: Liabilities that become due in a year or less, including accounts payable, accrued expenses, and short-term debt. Non-Current Liabilities: Liabilities that won’t become due for over a year, such as deferred revenue, deferred taxes, long-term debt, and lease obligations. Shareholders’ Equity: The capital invested into the business by owners, consisting of common stock, additional paid-in capital and preferred stock, as well as treasury stock, retained earnings, and other comprehensive income (OCI). Q. Could you give further context on what assets, liabilities, and equity each represent? 03 A. Assets: The resources of any company that can have a positive economic value and that can be exchanged for money or bring positive monetary or economical benefits in the future. Basically anything from which you can generate money be it Machines or Debtors. Liabilities: The outside sources of capital that have helped fund the company’s assets and run the operations. These represent unsettled financial obligations to other parties whether short or long. Equity: The internal sources of capital that have helped fund the company’s assets, this represents the capital that has been invested into the company. There is no obligation on the company to return them their money since it’s their company AKA The owners of the company. Q. Could you explain me briefly about the cash 04 flow statement and its components? A. The Cash Flow Statement (CFS) summarizes a company’s cash inflows and outflows over a period of time. The revenues and expenses that did actually took place (Movement) in cash form are considered here hence the Cash Flow Statement. The CFS starts with net income, and then accounts for cash flows from operations, investing, and financing to arrive at the net change in cash. Cash Flow from Operating Activities (CFO): It tells us cash generated from the core business. Starts from net income, then non-cash expenses are added back such as D&A and stock-based compensation, and then changes in net working capital. Cash Flow from Investing Activities (CFI): Captures long-term investments made by the company, primarily capital expenditures (CapEx) as well as any acquisitions or divestitures and any investment in any security or else. Cash Flow from Financing Activities (CFF): Includes the cash impact of raising capital from issuing debt or equity net of any cash used for the repurchase of shares or the repayment of debt. Dividends paid to shareholders will also be recorded as an outflow in this section. Q. How are the three financial statements connected? 05 Income Statement (I/S) ↔ Cash Flow Statement (CFS) Net income of I/S flows in as the starting line item on the CFA. Non-cash expenses such as D&A from the I/S are added back to the cash flow from operations section. Cash Flow Statement ↔ Balance Sheet (B/S): Changes in net working capital (Money for running everyday business) on the B/S are reflected in CFO. CapEx is reflected in the CFI, which impacts PP&E on the B/S. The impacts of debt or equity issuances are reflected in CFF. The ending cash on the CFS flows into the cash line item on the current period B/S. Balance Sheet ↔ Income Statement: Net income flows into retained earnings in the shareholders equity section of the B/S. Interest expense on the balance sheet is calculated based on the difference between the beginning and ending debt balances on the B/S. PP&E on the balance sheet is impacted by the depreciation expense on the balance sheet, and intangible assets are impacted by the amortization expense. Changes in common stock and treasury stock (i.e. share repurchases) impact EPS on the income statement. P.S. I know its confusing. It’s for me too, So any error can be found :( Q. How would a $10 increase in depreciation impact all the three statements? 06 A. The 3 income statements are interlinked with each other. For Ex: Increase in Interest payment > Lowers PAT (I/S) > Less Retained Earnings (B/S) > Low CFO (CFS)> Cash outflow from CFF. The depreciation case: Income Statement: A $10 depreciation expense is recognized on the income statement, which reduces EBIT by $10. Assuming a 20% tax rate, net income would decrease by $8 [$10 - ( 10 * 20%)]. Cash Flow Statement: The $8 decrease in net income flows into the top of the cash flow statement, where the $10 depreciation expense is then added back to the cash flow from operations since it is a non-cash expense. Thus, the ending cash balance increases by $2. Balance Sheet: The $2 increase in cash flows to the top of the balance sheet, but PP&E is decreased by $10 due to depreciation, so the assets side declines by $8. The $8 decrease in assets is matched by the $8 decrease in retained earnings due to net income decreasing by that amount, thereby the two sides remain in balance. Q. If you have a balance sheet and must choose between the income statement or the cash flow statement, which would you pick? 07 If I have the beginning and end of period balance sheets, I would choose the income statement since I can reconcile the cash flow statement using the other statements. Cash Flow Statement is prepared with the inputs from the I/S and B/S hence we should select these two statements and prepare accordingly. Q. How would a $10 increase in depreciation impact all the three statements? Cost of Goods Sold: Represents direct costs that are associated with the production of the goods that the company sells or the services it delivers. You have to incur these costs to manufacture the good and bring it to a tangible form. It’s main components are Materials, Labor & Manufacturing overheads. Operating Expenses: The costs incurred to make the product available to the customers and run the operations smoothly. EBITDA comes after this. Often called indirect costs, operating expenses refer to the costs that are not directly associated with the production or manufacturing of goods or services. Common types include SG&A and R&D. Q. What is working capital? 08 The working capital metric measures the liquidity of a company, i.e. its ability to pay off its current liabilities using its current assets. It’s basically the capital needed to run the everyday operations of the company. You must invest this much money in your company as WC to keep it going. If a company has more working capital, then it will have less liquidity risk – all else being equal. Working Capital = Current Assets – Current Liabilities Note that the formula shown above is the “textbook” definition of working capital. In practice, the working capital metric excludes cash and cash equivalents like marketable securities, as well as debt and any interest-bearing liabilities with debt-like characteristics. Working capital need increases as AR rises by rise in credit sales. Suppose sales are increasing and your AR (credit sales) are increasing at a higher rate it means you aren’t able to recover your debtors which is bad. Working Capital needs to be managed very efficiently. Q. What are some of the most common margins used to measure profitability? 09 Gross Margin: The percentage of revenue remaining after subtracting the company’s direct costs (COGS). Gross Margin = (Revenue – COGS) / (Revenue) Operating Margin: The percentage of revenue remaining after subtracting operating expenses such as SG&A from gross profit. Operating Margin = (Gross Profit – OpEx) / (Revenue) EBITDA Margin: The most commonly used margin is due to its usefulness in comparing companies with different capital structures (i.e. interest) and tax jurisdictions. EBITDA Margin = (EBIT + D&A) / (Revenue) Net Profit Margin: The percentage of revenue remaining after accounting for all of the company’s expenses. Unlike other margins, taxes and capital structure have an impact on the net profit margin. Net Margin = (EBT – Taxes) / (Revenue) Q. Explain the difference between Accrual vs Cash Basis of Accounting? 10 These are two types of recording accounting transactions in the books. Most of the companies follow the former one. The difference is based when the company actually record the sale (money inflow) or purchase (money outflow) in the books. Cash Basis: Record transactions only when cash is actually received or paid Example situation: You purchased 100 units of a product and will pay for it next month. No transaction recorded Accrual Basis: Record transactions when it occurs, even if cash is not received or paid In earlier example The Transaction will be recorded through an accounts payable (liability) account. 11 Q. Explain in brief difference between Deferred revenue and expenses Vs Accrued? Deferred Revenue & Expenses: When cash is received prior to earning revenue by delivering goods or services, the company records to recognize unearned revenue. Ex: Gift cards, Byju’s Reveune, Airline miles, Subscriptions to newspaper and magazines. Deferred Expenses is the amount paid in advance before using the assets that will benefit for more than one period. Like Prepayment of advertising, insurance, or rent becomes used up over time. Accrued Revenue & Expenses: When revenues are earned but not yet recorded at the end of the accounting period because cash changes hands after the service is performed or goods delivered. Ex: A company earned interest revenue from the bank on its checking account and had not yet recorded it Accrued expenses is the process of recognizing expenses before the cash is paid. For Ex: Utility bill received in the mail for the month just completed. Q. What is a bank reconciliation statement and 12 what are the factors affecting it? A bank reconciliation statement is a summary of matching entries in bank statements of a company with its balances in the cash book. The factors affecting it are: Interest received from the bank but not entered in the company's cash book Cheques issued but not presented in the bank Dishonoured cheques Q. What is the difference between depreciation and amortization? Amortization and depreciation are two methods of calculating the value for business assets over time. Depreciation is the loss of value of tangible assets, like furniture and fixtures, machinery, buildings, computers and electronic material. It is like dividing the cost of the product over the useful life of the product. Amortization is writing off intangible assets, such as patents, loans and goodwill. The two accounting approaches also differ in how salvage value is used, whether accelerated expensing is done, or how each are shown on the financial statements. Posts every alternate Day Faizan Nezami Want more cool insights? Then Follow