Chapter 1 An Overview of Managerial Finance

advertisement

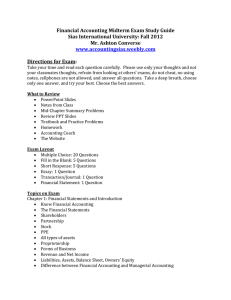

Fin 220 Dr. B. Asiri Sept 2010 Chapter 1 An Overview of Managerial Finance © 2005 Thomson/South-Western Career Opportunities in Finance Financial Markets and Institutions Investments Managerial Finance 2 Alternative Forms of Business Organization Proprietorship Partnership Corporation 3 Proprietorship Advantages: Ease of formation Subject to few government regulations No corporate income taxes Limitations: Unlimited personal liability Difficult to raise capital Transferring ownership is difficult Limited life 4 Partnership Like a proprietorship, except two or more owners A partnership has roughly the same advantages and limitations as a proprietorship 5 Corporation Advantages: Unlimited life Easy transfer of ownership Limited liability Ease of raising capital Disadvantages: Double taxation Cost of set-up and report filing 6 Finance in the Organizational Structure of the Firm Board of Directors President Vice-President: Sales Vice-President: Operations Treasurer Credit Manager Inventory Manager Director of Capital Budgeting Vice-President: Finance Vice-President: Information Systems Controller Cost Financial Tax Accounting Accounting Department7 The Financial Manager’s Responsibilities Forecasting and planning Major investment and financing decisions Coordination and control Dealing with financial markets 8 Goals of the Corporation Primary goal: stockholder wealth maximization maximizing stock price Managerial incentives Social responsibility SP max. and social welfare: Requires efficient low-cost plant high quality goods produce goods needed by people new: tech, goods, jobs efficient services, well-located businesses, etc… 9 Managerial Actions to Maximize Stockholder Wealth Capital Structure Decisions Capital Budgeting Decisions Dividend Policy Decisions 10 Factors Influenced by Managers that Affect Stock Price Projected earnings per share Timing of earnings streams Riskiness of projected earnings Use of debt (capital structure) Dividend policy 11 Agency Relationships An agency relationship exists whenever a principal hires an agent to act on their behalf. Within corporations, agency relationships exist between: Stockholders and managers, and Stockholders and creditors. 12 Stockholders versus Managers Managers are naturally inclined to act in their own best interests. But the following factors affect managerial behavior: The threat of firing The threat of takeover Structuring managerial incentives 13 Stockholders versus Creditors Stockholders (through managers) could take actions to maximize stock price that are detrimental to creditors. In the long run, such actions will raise the cost of debt and ultimately lower stock price. 14 Summary of Major Factors Affecting Stock Prices External Constraints: Level of Economic Activity and Corporate Taxes 2. Environmental Regulations Strategic Policy Decisions Controlled by Management 3. Product and Workplace Safety Regulations 1. Types of products and services produced 4. Employment Practices Rules 2. Production methods used Timing of Cash Flows 5. Federal Reserve Policy 3. Relative use of debt financing Degrees of Risk 6. International Developments 4. Dividend policy 1. Antitrust Laws Stock Market Conditions Expected Profitability Stock Price 15