KASHIF MAHMOOD S/o TARIQ MAHMOOD Rawalpindi – Pakistan

advertisement

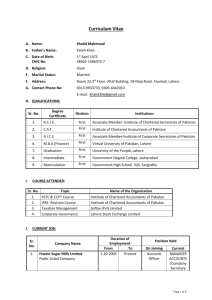

KASHIF MAHMOOD S/o TARIQ MAHMOOD Rawalpindi – Pakistan. Contact: +92-300-9867866 (Cell) +92-331-5049397 (Res) E-mail: kashif_doctorb@hotmail.com VISION To associate myself with a team which places professionalism at the root of all business endeavors, offering abundant opportunities for growth and the work environment which is ripe with challenges. MISSION To work diligently and effectively so as to build a market niche for the institution I work in. VALUES I am a confident, enthusiastic and energetic person with the ability to learn and adapt quickly to changing circumstances, accepting challenges and tackle them even in situations under pressure. I do possess good communication skills, which enable me to maintain good customer relationship. PROFESSIONAL QUALIFICATIONS ACA Institute of Chartered Accountants of Pakistan (ICAP) Bachelors of Business Administration (Final Project Result Pending) University of the Central Punjab EXPERIENCE (MAY 2005 TO DATE) Doing extensive training programme of more than 5 years as required by the Institute of Chartered Accountants of Pakistan with Khalid Majid Rehman (KMR) Chartered Accountants Islamabad, previously a member firm of world recognized Deloitte Touché Tohmatsu (DTT) and Moores Rowland International (MRI). My experience at KMR Chartered Accountants covers multifaceted concerns ranging from both the Public and the Private sectors of the economy. Areas of my professional experience encompass Taxation Advisory & Advocacy, Audit and Assurance including financial analysis & reporting. AUDIT AND ASSURANCE I have been involved in preparation of Audit Planning Memorandum, Meeting with clients, developing audit programs and giving conclusions thereon to Audit Manager. Provided Auditing and Assurance services to various clients, identified and reported to management, control weaknesses in accounting and internal control system keeping in view the requirements of International Accounting Standards and Companies Ordinance, 1984. Banking Sector: Zarai Taraqiati Bank Limited (ZTBL) erstwhile Agricultural Development Bank of Pakistan (ADBP) is the premier financial institution geared towards the development of agriculture sector through provision of financial services and technical knowhow. Annual Statutory Audit for the year ended December 31, 2006 as a team member covering; Head Office More than 10 branches located in Punjab & Sindh. Oil & Gas Sector: Oil & Gas Development Company Limited (OGDCL) Pakistan’s largest E & P company with more than 170 concessions. Annual audit of Shakardara, Gurgalot & Bitricism concessions as a team member. Non-Government Sector (NGOs): Children Global Network (CGN) supported by United States Agency for International Development (USAID) worked as team member on audit of Fund Accountability Statement for the year ended December 31, 2008. Information & Broadcasting Sector: Shalimar Recording & Broadcasting Company Limited (SRBCL) a public unlisted company with more than 70% of shares held by Pakistan Television Corporation (Parent Company of SRBCL) providing information and broadcasting services within and outside Pakistan. Worked as a team member during annual audit for the year ended June 30, 2009. TAXATION ADVISORY & ADVOCACY: I have more than two years of experience in taxation advisory & advocacy services to corporate & non-corporate sector. Worked as assistant in close liaison with Mr. Khalid Majid, FCA during hearing proceedings at appellate forums. I have been responsible for the following tasks assigned from the management of KMR tax department; Preparation and filing/e-filing of annual tax returns. Attendance/ hearing before assessing authorities during assessment and tax audit proceedings. Preparation and filing of appeals at appellate forums e.g. Commissioner of Income Tax (Appeals) and the Income Tax Appellate Tribunal (ITAT). Assistance to senior partner and manager in hearing proceedings before appellate authorities. Maintaining the tax history and status of all clients including confirmation of latest tax assessments to auditors. Preparation of deferred tax workings and tax provisioning for corporate clients. Preparation and electronic filing of monthly and annual statements of withholding taxes. Preparation and filing of rectification applications, refund applications, stay applications, miscellaneous applications and replies to various statutory notices of taxation authorities. Preparation and filing of applications for tax exemption and follow up thereof. Preparation and drafting of expert (professional) opinions on taxation matters and finalization in consultation with supervisor and manager. Calculation and intimation of quarterly payments of advance tax. Meeting and advisory to clients regarding taxation matters. Liaison with income tax department and clients during tax audit proceedings. MAJOR CLIENTS I have provided taxation services to following clients within the firm; Oil & Gas Development Company Limited (OGDCL) Pirkoh Gas Company Limited (PGCL) Government Holdings (Private) Limited (GHPL) National Telecommunication Corporation LMK Resources Pakistan (Pvt.) Ltd Interstate Gas Systems (Pvt.) Ltd Shifa International Hospitals Ltd Shalimar Recording & Broadcasting Company Ltd Capital Publications (Pvt.) Ltd L.T. Engineering & Trade Services (Pvt.) Ltd Zarai Taraqiati Bank Ltd Pakistan Mobile Number Portability Database (Guarantee) Ltd Habib Bank Ltd (AJK Branches) Pakistan Mineral Development Corporation Orient Petroleum International Inc. Bow Energy Resources (Pakistan) SRL I Engineering Pakistan (Pvt.) Ltd Zaver Petroleum Corporation Ltd Sindh Employees Social Security Institution Various NGOs e.g. Al-Shifa Trust, Childrens’ Global Network etc. and, Various individual clients Pak Telecom Mobile Limited (Ufone) I have been assigned as the job incharge on the special tax assignment of Ufone. This assignment included following services; Calculation of withholding tax deducted at source from Pakistan and AJK operations. Preparation of payment advices Payment of tax in designated branches of Pakistan and AJK. Preparation and submission of monthly sales tax returns Special purpose assignments I have also performed the following special purpose assignments during my professional experience; TRAINING Preparation and filing of registration documents of provident funds and gratuity funds and follow up thereof. Preparation of detailed budget brief on annual federal budget. Preparation and filing of applications for national tax number and follow up thereof. Assistance to billing department in billing to clients. Certificate Course on Computer Practical Training under the Guide Lines laid by the Institute of Chartered Accountants of Pakistan. Attended successfully Presentation Skills Certification Course (PSTC) and Computer Course Practical Training (CCPT) duly recommended by Institute of Chartered Accountants of Pakistan Attended various seminars organized by Institute of Chartered Accountants of Pakistan Attended various lectures and training sessions on Income Tax within the firm. Attended various seminars organized by the Federal Board of Revenue (FBR) and Income Tax Department. EXTRA QUALIFICATION MS Office (Word & Excel). Hardware & software (Installation & removal). Windows 98, 2000 & XP. Internet operations (Surfing, browsing, downloading, sending & receiving e-mails). English Urdu Punjabi LANGUAGES Fluent Fluent Fluent INTERESTS & ACTIVITIES Travelling Poetry Cricket PERSONAL INFORMATION Date of birth: NIC No: Nationality: Marital Status: July 18, 1987 37406-2714979-3 Pakistani Single REFERENCES Will be furnished upon request.