BER,Ppt10

advertisement

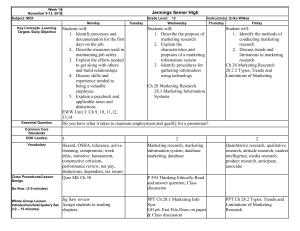

Media and Journalism Module Business and Economics For Reporters 10. Analysing financial performance BER,Ppt10.ppt This week’s lesson • Last week - basic financial documents and statements • This week - analysing a company's performance • Techniques to analyse a company’s performance: • • • • liquidity profitability use of debt return on equity • • • • • • Return on Assets/Return on investment Current ratio Acid Test Ratio Return on Equity Working capital Capital expenditure BER,Ppt10.ppt • Significant financial performance measures: Evaluating ratios BER,Ppt10.ppt A note on evaluating ratios • Last week - the entries on the balance sheet and income statement • This week - calculate financial ratios using balance sheet and income statement data to evaluate the financial health of a company BER,Ppt10.ppt A note on evaluating ratios • Need to compare the ratios with benchmark values • Provide you with the accepted “rule of thumb” figure that can help guide you to a reasonable conclusion • Techniques to consider to evaluate ratios: • Compare the company to similar firms in the same industry • Compare ratios with industry averages for similar sized firms • Good technique for smaller firms • Data from many sources – e.g. Dun and Bradstreet and industry professional associations • Compare data from the same firm through time • Changes may be caused by business cycles or management decisions • Helps you find a worthwhile story idea • Focusing on four main areas: • • • • liquidity profitability use of debt return on equity. BER,Ppt10.ppt www.dnb.com BER,Ppt10.ppt Liquidity BER,Ppt10.ppt Liquidity • A company's ability to meet its requirements for cash • Necessary to meet both expected and unexpected cash demands • Too little liquidity can stunt growth and ultimately lead to bankruptcy if debts cannot be repaid • Too much liquidity can detract from profits, because liquid assets are low returning investments. BER,Ppt10.ppt Current Ratio Current Ratio Current Assets Current Liabilitie s • Standard measure of liquidity • High quality companies have lower current ratios • these companies have easy access to capital markets if they unexpectedly require cash • Smaller companies should have higher current ratios to meet unexpected cash requirements • Current Ratio should always be > 1 to be a “liquid company” Rule of Thumb Current ratio for small companies = 2:1 Need for a level of safety to cover unforeseen cash needs from current assets Business has twice as much short-term assets compared to the current liabilities Financially safe in the short-term to meet all short-term obligations urgently BER,Ppt10.ppt YouGood Company • Fictitious company operating in a Pacific Island country • YouGood Company origins can be traced back to 1924 • The company currently produces: • fresh food from local and imported raw material – these products have a two week shelf life • manufacturing and packaging goods BER,Ppt10.ppt YouGood Company • Fictitious YouGood company example • YouGood’s Current Ratio: Current Ratio Times 2 •What does this graph tell you about YouGood Company? 1.19 1.02 1 0.89 0 2002 2003 Years BER,Ppt10.ppt 2004 YouGood Company – Current Ratio • Well under the desirable ratio for a small company • It should aim for an increase and maintain the ratio between 1.5 and 2 for a manageable level of current liabilities • Any inefficiency in managing short-term liabilities should be rectified and stronger credit terms negotiated only after it builds a capability to honourably service its financial obligations as they fall due BER,Ppt10.ppt Working Capital Working Capital Current Assets Current Liablities • Working Capital or internal liquidity is expressed in dollars • Shows whether the business has funds available to meet short-term obligations • Does not take into account that some current assets are more liquid (in cash form) than others BER,Ppt10.ppt YouGood Company Working Capital Current Assets Current Liablities Working Capital as a Percentage of Revenue Percent 10.0% 5.0% 4.5% 0.3% 0.0% 2002 •What does this graph tell you about YouGood Company? 2003-2.7% -5.0% Years Working Capital BER,Ppt10.ppt 2004 YouGood Company • YouGood Company is in trouble • It is close to being technically insolvent i.e. the company’s working capital needs to vastly improve in comparison to the revenue that it generates Insolvency is a financial condition experienced by a person or business entity when their assets no longer exceed their liabilities. Commonly referred to as 'balance-sheet' insolvency, or when the person or entity can no longer meet its debt obligations when they come due, commonly referred to as 'cash-flow' insolvency. (Wikipedia) BER,Ppt10.ppt Quick Ratio / Acid Test Quick Ratio / Acid Test= (Cash + Accounts Receivable + Short-term Investments) Current Liabilities • Measures how much liquid assets the business has to meet short-term obligations • The assets are cash, marketable securities and accounts receivables • Inventory and other short-term assets are ignored Rule of Thumb •Ratio should be maintained •between 1 and 1.5:1. BER,Ppt10.ppt YouGood Company Quick Ratio Times 1 0.63 1 0.46 0.28 •What does this graph tell you about YouGood Company? 0 2002 2003 Years Quick/Acid Ratio BER,Ppt10.ppt 2004 YouGood Company • Clearly demonstrated that YouGood company is well under the desirable ratio in this area. BER,Ppt10.ppt Cash Ratio Cash Ratio (Cash Marketable Securities ) Current Liabilitie s • The cash ratio measures the extent to which a company can quickly liquidate assets and cover short-term liabilities • For a bank this is the cash held by the bank as a proportion of deposits in the bank • Cash ratio is also called liquidity ratio or cash asset ratio Rule of Thumb •Ratio maintained at between 0.5 and 1:1. • But excess cash should not be tied up in unproductive accounts •such as bank deposits, which could be returning interest lower •than if the funds were to be invested into the business and earning more. BER,Ppt10.ppt YouGood Company (Cash Marketable Securities ) Cash Ratio Current Liabilitie s Cash Ratio Times 0.5 •What does this graph tell you about YouGood Company? 0.0 0.00 2002 0.01 2003 -0.5 Years Cash Ratio BER,Ppt10.ppt 0.05 2004 YouGood Company • Clearly demonstrates that YouGood Company is well under the desirable ratio in this area. • YouGood does not have any cash or securities to meet its liabilities BER,Ppt10.ppt Profitability BER,Ppt10.ppt Profitability • Common measures of profitability: • net profit margin • return on assets • Each measure provides a different perspective about the firm's profits BER,Ppt10.ppt Return on Assets (ROA) Net Pr ofit ROA Total Assets • ROA percentage shows how profitable a company's assets are in generating revenue • "what the company can do with what it's got“ • how many dollars of earnings they derive from each dollar of assets they control • the rate of return provided by the book value of the company's assets. • Useful for comparing competing companies in the same industry • Number will vary widely across different industries • Companies requiring large initial investments will generally have lower return on assets • EBITD - Earning Before Interest, Taxes and Depreciation • this figure ignores the depreciated value of assets during the year • EBITD does not take into account the capital or financing structure of the business assets • does include the book value of current and non-current assets • high return on assets provides a buffer for more financial risks BER,Ppt10.ppt YouGood Company ROA Net Pr ofit Total Assets Return on Assets 4% 3.4% 3.2% Percent 3% 2% 1% 0% -1% •What does this graph tell you about YouGood Company? 2002 -1.2% 2003 -2% Years Return on Assets BER,Ppt10.ppt 2004 YouGood Company • Clearly see is that the YouGood Company has been generating very low levels of return on its assets • as low as -1.2% • but it is improving from it’s worst ever point, where it had a high negative return on the assets. BER,Ppt10.ppt Net Profit Margin Net Income NPM Total Sales • An important measure of profitability - Net Profit Margin (NPM) • Indicates the percentage of each dollar of sales that the firm is able to flow to the bottom line as profit • A function of: • price of the product - sales revenue • efficiency of operations - cost of goods sold • A firm selling a unique product to a captive market may be able to charge a premium price and therefore generate greater NPM • On the other hand, a firm selling a generic product in a highly competitive market will have a low NPM – this company must be very efficient or it will not survive • A positive result indicates that the company was able to make a profit • the revenues generated during the year were more than enough to cover for all expenses • basis for determining how much company tax is owed to the government BER,Ppt10.ppt Net Income NPM Total Sales YouGood Company Net Profit Margin 10% Percent 5% 1% 1% 0% 2002 •What does this graph tell you about YouGood Company? 2003 -5% Years Net Profit Margin BER,Ppt10.ppt 1% 2004 YouGood Company • NPM is very low and in order to achieve greater profitability the company will have to reduce its expenses and increase its productivity BER,Ppt10.ppt Fixed Asset Turnover Fixed Asset Turnover Sales Total Assets • The number of times that the real assets turnover (tangible assets that are invested in and maintained by the company) • How often assets are being “financed” from revenues • Figure indicates how effectively the company generates sales from its asset base. • The more effective the company in generating sales revenue the higher the asset turnover • Differences in industries cause differences in asset structure and total asset turnover • A high turnover means that the assets are able to generate a high level of revenue as opposed to being inefficient and unproductive • An average measure and each asset needs to be considered separately to judge their performance and capabilities BER,Ppt10.ppt YouGood Company Fixed Asset Turnover Fixed Asset Turnover (Times) Times 8 •What does this graph tell you about YouGood Company? 5.4 5.8 2003 2004 4 0 Years Fixed Asset Turnover - (Times in a Year) BER,Ppt10.ppt Sales Total Assets YouGood Company • YouGood’s cannot achieve the margins /returns required for continued growth • the fixed asset turnover at its present level and would need to increase to above 10 in order to do so • For companies that have a large investment in inventory, it is useful to calculate the inventory turnover ratio, which is the cost of goods sold (from the income statement) divided by the inventory (shown on the balance sheet) • Too low a turnover indicates too much investment in inventory, whereas too high a turnover could cause lost sales due to lack of merchandise to meet customer demand. BER,Ppt10.ppt Break BER,Ppt10.ppt Use of debt BER,Ppt10.ppt Financial leverage • Financial leverage is the use of fixed cost funds such as debt or preferred stock to increase the common stockholder's return • For example, if the firm can borrow at 8% and earn a rate of return on assets (ROA) of, say 12 percent, the 4 percent above the cost of funds will accrue directly to the common shareholders • Conversely, if earnings decline and the company's return on assets falls below 8 percent, the deficit must be borne entirely by the common shareholders • Using debt in the firm produces a stream of earnings that has greater risk than would occur in the same firm if it had less debt Rule of Thumb There is no rule of thumb to indicate the proper amount of debt for a firm. BER,Ppt10.ppt Financial leverage • Major factors: • management's willingness to accept financial risk • earnings predictability • company whose earnings stream is predictable can have a higher debt ratio and try to take advantage of the leverage it provides • tax advantage of using debt • (remember that interest expense is tax deductible for the firm while preferred and common dividends are not • Some debt is considered advantageous for a company • Two debt ratios: • debt to total assets ratio, or the debt ratio: • debt ratio = the sum of all the liability accounts divided by total assets • equity multiplier: • equity multiplier = total assets divided by the common equity account • a firm totally financed by equity will have a multiplier of 1.00 • the larger the number the more highly leveraged is the firm BER,Ppt10.ppt Return on equity BER,Ppt10.ppt Return on Equity (ROE) • The level of after tax profits the shareholders were able to earn on their book value shareholding in the company • ROE represents the rate of return the company earned on the book value of its equity investment • The higher the number, the greater the return the company is earning for its shareholders • If you are investigating a company remember that ROE should be considered a relative measure and evaluate it along with the opportunity cost of capital or the returns on investments that could have been earned on alternative investments of similar risk profile BER,Ppt10.ppt YouGood Company Return on Equity 8% 7.3% 7% Percent 6% 5% 5.1% 4.4% 4% 3% 2% 1% •What does this graph tell you about YouGood Company? 0% 2002 2003 2004 Years Return on Ow ner's Equity (ROE) - End of Year BER,Ppt10.ppt YouGood Company • Follows a similar pattern to that of its ROA • assets are not generating adequate profits (as opposed to generating revenue) BER,Ppt10.ppt Capital Expenditures • Funds spent on real assets that are necessary for the business and are expected to generate revenue from its operations • Capital expenditures are necessary: • to replace aging assets • for maintenance of existing assets • investing in new assets due to changes in technology • capacity for generating additional revenue can be increased as part of the ongoing business activities or during the expansionary phase of a business BER,Ppt10.ppt YouGood Company Capital expenditues (net of disposals) $1,400,000 $1,259,693 $1,200,000 Dollars $1,000,000 $800,000 $600,000 $435,848 $400,000 •What does this graph tell you about YouGood Company? $200,000 $2004 2003 Years BER,Ppt10.ppt YouGood Company • Depreciation is the non-cash expense item that accounts for the aging, obsolescence and wear and tear of the physical assets of a business • Historically, the company has had its assets depreciated annually in the region of $500,000 to $700,000 • Its current replenishment of assets are falling in book value each year • Does not seem adequate for maintaining or growing the business BER,Ppt10.ppt What does it all mean? BER,Ppt10.ppt Putting it all together? • A lot of very detailed and specific information about financial analysis • Don’t be alarmed by all this information you are not expected to be a financial expert • Making you aware of the depth of information available in financial statements • Motivate you to further study by using one of the many texts available about financial analysis BER,Ppt10.ppt Putting it all together? • As journalists you can access the findings of financial analysts and those preparing investment advice for potential shareholders • They can perform some of the hard work for you but: • they look at the company from a financial perspective • not as a journalist • their motivation is profit, not news! BER,Ppt10.ppt Putting it all together? • Knowledge of terms familiar to the chief executive or chief financial officer will: • increase your credibility • help you to develop questions • structure interviews to get the best possible information for a story • Always ask experts to help you understand and interpret the numbers you might calculate • Your job as a business journalist is to get behind the numbers and interpret what they tell you about the firm in order to get a good story BER,Ppt10.ppt Closure The important thing is not to stop questioning. Albert Einstein BER,Ppt10.ppt Summary • Furthering financial analysis skills • not intended to make you financial analysts • provide you with information to perform effectively as business journalists • We discussed a method of analysing a company by considering: • • • • liquidity profitability use of debt return on equity. • • • • • • Return on Assets/Return on investment Current ratio Acid Test Ratio Return on Equity Working capital Capital expenditure. • Significant financial performance measures, including: BER,Ppt10.ppt Coming up! • The sharemarket: • what are the significance of price changes • how it works • what conclusions you can draw from findings • Specifically we are going to examine: • Stocks, bonds and mutual funds: how they are bought and sold • how prices are determined • how to read stock tables for business journalism BER,Ppt10.ppt BER,Ppt10.ppt http://www.guardian.co.tt/archives/2005-03-10/bussguardian11.html