NEWSFLASH 28th September 2015 We still have some availability

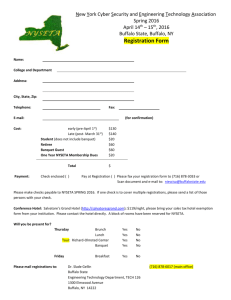

advertisement

NEWSFLASH 28th September 2015 We still have some availability for your advertising in Design Insider, The BCFA’s official directory for 2016. Please follow the link HERE for full details, booking form, media pack and a link to the previous edition. The directory is distributed to a wide and targeted selection of industry professionals and specifiers. There are also a few places left at the Manchester networking next week 7th October full details and booking form HERE If you have already booked please send your guest lists through now to mary@thebcfa.com The council-backed Mayfield Partnership has launched its search for a development partner for its Mayfield Quarter mixed-use scheme in Manchester. The Mayfield Quarter will provide 1,300 homes, more than 800,000 sq ft of office space, a 350-bedroom hotel, retail and leisure facilities and a new six-acre city park centred along the River Medlock. The chosen partner will lead the development of the currently derelict site, which the Mayfield Partnership hopes will extend the city centre westwards and regenerate the wider Piccadilly area. Legal & General has entered into a joint venture partnership with Cardiff-based developer Rightacres to deliver a prime 12-acre mixed-use city centre regeneration scheme. The Central Square scheme is located immediately to the north of Cardiff’s central train station, and will comprise 1m sq ft of development. The first phase of the project includes the development of two buildings – the proposed 150,000 sq ft BBC Wales HQ and One Central Square, a 135,000 sq ft office development that is part pre-let to national law firm, Blake Morgan, and due for completion in January 2016. Further phases will include a mix of commercial and residential buildings. Bruntwood and Select Property Group have revealed plans for a 2.5m sq ft mixed-use development on the former BBC site in Manchester city centre. The £750m scheme will include office, residential, retail and leisure space, as well as new public spaces. The first planning application submitted includes two serviced apartment buildings aimed at mature, postgraduate and international students, as well as waterside walkways which form part of the public realm within the scheme. Bruntwood and Select said this application would be closely followed by one detailing the 350,000 sq ft of commercial space. BIRMINGHAM £18.8M Bristol Road South adjacent A38 Longbridge Rounda Planning authority: Birmingham Job: Detail Plans Granted for military accommodation Client: Defence Infrastructure Organisation Developer: Glancy Nicholls Architects, The Engine Room, 2 Newhall Square, Birmingham, West Midlands, B3 1RU Tel: 0121 456 7474 ROCHDALE £1.39M Pennine Honda, Queensway Planning authority: Rochdale Job: Detail Plans Granted for car dealership building Client: Swansway Garages Developer: Pulmann Associates Architects, 18a Bridge Street, Milnrow, Rochdale, Greater Manchester, OL16 3ND Tel: 0161 427 9111 The first three construction projects in the £500m Paradise development in central Birmingham have been approved for construction. Three planning applications were passed for two new office buildings – One and Two Chamberlain Square – along with the major enhancement of public space. Demolition of existing buildings including the old Central Library and the Paradise Forum shopping centre can now start within weeks, construction on One Chamberlain Square will begin in Spring 2016. This will be followed by Two Chamberlain Square in Autumn 2016, with the refurbishment of Chamberlain Square itself taking place during this time. Carillion was appointed last year to deliver phase one enabling and infrastructure works. Designed by Eric Parry Architects, One Chamberlain Square will be an elegant, curved, seven-storey building bounded by Centenary Way, Congreve Street and Chamberlain Square. 172,000 sq ft of office space, including a large roof terrace at the sixth floor level, will be delivered along with restaurant and retail uses on the ground floor. The adjacent, seven-storey Two Chamberlain Square was designed by Glenn Howells Architects which oversaw the masterplanning for the full Paradise development. The building will complement the historic setting, with a five-storey portico fronting onto Chamberlain Square and stepping back at the sixth floor with a roof terrace. Grant Associates Landscape Architects is overseeing a dramatic refurbishment of Chamberlain Square, which include includes a new, wide pedestrian street through the centre of the development, linking the upgraded Chamberlain Square to Centenary Square. When complete, Paradise will comprise 1.8m square feet of offices, shops, cafes, restaurants and a hotel in up to 10 buildings. The Paradise redevelopment is being brought forward through Paradise Circus Limited Partnership, a private-public joint venture with Birmingham City Council, funding from Hermes Investment Management with Argent acting as development manager.The BCFA NEWSFLASH Page 1 enabling and infrastructure works, currently underway, have been funded through an approved £61m investment by the Greater Birmingham and Solihull Local Enterprise Partnership. Ashford Designer Outlet has won permission for a 100,000 sq ft extension to its Kent-based shopping mall by 2018, including 38 new shops. This is the first expansion since the centre, designed by Sir Richard Rogers, opened in 2000 - which is referred to as phase 1. The construction of phase 2 is expected to start next year. A further six new restaurants and cafes will be added, as well as a new children’s play area. Controversially, there are 40 banned restaurants which include Wetherspoons, Prezzo, Cafe Rouge, TGI Fridays, Zizzi and Nandos. Whitbread has hired Andrew Eldridge to lead a new push into the acquisition of going concerns. Eldridge will head up a new team within the acquisitions department focused on existing trading hotels to add to the Premier Inn portfolio. Currently, most Premier Inn hotels are developed as new for the brand, but Eldridge’s team will look at going concerns where the location fits Whitbread’s expansion strategy and there is scope for conversion to Premier Inn standard, the company said. The brand is also expanding into Germany, where Richard Pearson has been appointed to lead on acquisitions. The first Premier Inn is currently being developed in Frankfurt. Details of a new development in the centre of Chester have just been submitted to the local Council. The £300million Northgate Development includes a new hotel as a replacement for the existing Crowne Plaza Chester. The new hotel would include 168bedrooms, spa and conference facilities, a rooftop restaurant and public car parking. It would be built a short distance away from the existing hotel. The space it leaves behind is earmarked for department stores and additional parking space in the centre of Chester. The plan also envisages a new library. The former library space would be used for residential units plus restaurants and bars to complement the neighbouring £37million theatre, cinema and library development. A decision from Cheshire West and Chester Council is awaited Nadler Hotels will open its third London location later this year as part of the redevelopment of the Girlguiding UK headquarters in Victoria. Nadler has taken a 25 year lease at 8-10 Palace Street, which it will turn into a 73 bedroom boutique hotel. All of the company’s existing hotels were acquired on an owner-operator basis, but Girlguiding retains the freehold of the new property. The charity will continue to operate its headquarters from their office building on Buckingham Palace Road. The refurbishment of this building has just been completed as part of the reconfiguration of the existing buildings. The Nadler Victoria will be the third Nadler hotel in the capital and fourth overall, joining locations in Kensington, Soho and Liverpool. Robert Nadler, chief executive of Nadler Hotels has said that the brand is actively looking for additional locations in London and outside, with the aim of doubling its portfolio in the next three years and expanding internationally. Nadler Hotels is majority owned by Western Heritable Investment Company, a long established private property investment business, owned by the Mactaggart family. Colchester Borough Council has selected Turnstone Colchester as its development partner to deliver a new £50m sports and leisure development at Colchester’s Northern Gateway site. The site comprises 18 acres of development land, located at junction 28 of the A12. It is situated within the Northern Growth Area and is linked to Colchester town centre by the recently completed northern approach road. Designs and uses for the scheme will be subject to further discussion, but the current proposed development includes a 40,000 sq ft 12 screen cinema, 12 restaurants, an 80-bed hotel, 80,000 sq ft of other leisure uses, including extreme sports and new public realm. The council sought expressions of interest from developers to build out the scheme based on a masterplan prepared by Allies and Morrison, and granted Turnstone a leasehold interest. Starbucks launches first UK franchise - There will be 100 franchised coffee shops within five years Franchised coffee shops tend to do well as they leverage local knowledge. Serial entrepreneur Anil Patil has become the UK’s first ever Starbucks franchisee, raising £10m from private equity firm Connection Capital and RBS to roll out 16 sites, with 100 planned over the next five years. The coffee giant uses a franchise model in the US but owns its 800 stores in the UK. 23.5 Degrees founder Mr Patil, who previously owned and sold a successful 18-site Domino’s Pizza franchise, opened the first shop in Bournemouth last week. Franchises allow brands to grow at pace using local expertise to ensure the success of the new shop. More than a third of Starbucks' 12,000 US outlets are operated under license. This may be the coffee giant's first move into franchised outlets in the UK but, according to consultancy firm Allegra Strategies, this sector will grow at pace. Branded coffee chain sales are set to grow by a compound annual growth rate of 10pc and reach £5bn by 2020, according to the company's calculations. The investment will provide working capital for 23.5 Degrees' roll-out of new stores across various UK regions. STOKE-ON-TRENT £3.36M Land south of Etruria Road, West Of Potteries Way East Of Twemlow Street Hanley Planning authority: Stoke-On-Trent Job: Detail Plans Granted for 3 restaurants & 1 public house Client: Characin Developments Ltd Developer: SEL Design, PO Box 8130, Alfreton, Derbyshire, DE55 2DS Tel: 01773 515435 Highest London Occupancy for a Decade and UK Levels at Record Highs - Growth is in the Air - PwC’s UK Hotels Forecast to 2016 Highest London occupancy for a decade and UK levels at record highs BCFA NEWSFLASH Page 2 Double digit RevPAR growth for a number of regional cities Record year for UK deal activity in 2015 The Rugby World Cup – up or under? London hoteliers saw a record 2014 but so far 2015 hasn’t replicated this stellar performance, according to new PwC analysis. While average performance metrics are still very high by most global city standards, the pace of growth in London in the first half of 2015 has been mixed. Demand is still strong but the falling Euro is a key issue. Overall for 2015, PwC expects London to see occupancy growth of 1% taking occupancy to 84%. ADR growth is forecast to be 1.8%, taking ADR to £142. The increase in occupancy and ADR is partly due to the Rugby World Cup in the second half of 2015. This drives RevPAR growth of 2.7%, taking RevPAR to £119. Looking ahead to 2016, we forecast more growth but at a slower pace with marginal occupancy growth of 0.3% that will keep occupancy at 84% and a 2.2% growth in ADR which will mean rates of £145. This combination will drive RevPAR growth of 2.3% to take yields to £122. The regions The regions have experienced a very good-year-to-date. Around the country, most cities have continued to see very strong RevPAR growth. Growth has come from a mix of occupancy and ADR, but particularly from rates. Exceptions include Aberdeen, which has seen both occupancy and ADR falls drive an 18% RevPAR decline to June. Many cities continue to see double digit RevPAR growth, including Belfast, Bristol, Birmingham, Coventry, Liverpool, Nottingham, Plymouth and Southampton. Overall strong trading and low supply mean that for 2015 PwC expects 1.6% occupancy growth, taking occupancy to 76% and ADR growth of 4.6%, taking rates to £67. This mean RevPAR growth will be 6.3%, nudging RevPAR to £51. PwC forecasts further growth in 2016, but just not at the same pace with a 0.6% gain taking occupancy to 77%. ADR growth is predicted to fall to 3.5%, taking rates too£69. This means RevPAR growth of 4.2%, taking RevPAR to £53. The Rugby World Cup – up or under? The Rugby World Cup starts this month and will provide a fillip for UK hoteliers. The event will be held across the country in Birmingham, Brighton, Exeter, Cardiff, Gloucester, Milton Keynes, Leicester, Leeds, Newcastle and Manchester as well as London. With a third of matches set to be played on a Sunday - traditionally a low occupancy night - the event is a great opportunity for hotels, although, there are fears the event could put off the corporate market at a traditionally busy time. The rise and rise of shared space The rise of shared accommodation platforms for business and leisure has meant more travellers are aware of the brands and the opportunities of experiencing staying in shared space. Looking ahead, it will be interesting to see how much of a threat sharing economy platforms pose to hotels and if shared platforms will take the ‘cream off the milk’ at the times of peak demand. Like the branded budget hotels 30 years ago, will rental sites create a new stream of demand for destinations and allow hotels to capitalise on a new type of customer. 2015 to set new record for UK deal activity Deal volume has increased exponentially in 2015 and is forecast to reach £10 billion. Year to July 2015, we have already seen £6 billion of transactions, marginally ahead of 2014’s total volume. Regional transactions have been the most active, where both continued RevPAR growth and reduced inflation pressure on operating costs are resulting in improved profitability. Despite London RevPAR growth of only 2.7% forecast in 2015, demand from investors remains high; however a lack of supply has meant few major transactions year-to-date. The PwC hotels forecast is based on quarterly econometric analysis of the hotel sector, using an updated PwC macroeconomic forecast released in September and historical statistics supplied by STR Global and other data providers. PwC expects real gross domestic product to increase by around 2.6% in 2015, and then further growth of around 2.4% in 2016. Tottenham Hotspur Football Club (Spurs) has revealed further details of the transformation of its White Hart Lane stadium into a 61,000 multi-purpose stadium – set to become the largest club stadium in London. Plans show the £400m project will include four asymmetrical stands, a stadium wrapped in a sculptured mesh and a glass facade to the new home end. Spurs are also planning to establish an entertainment district around the stadium, with plans in place for a 180-room hotel, an extreme sports centre, a “Sky Walk” adrenaline attraction on the roof of the stadium and a “Tottenham Experience” – a permanent visitor attraction and museum charting the club’s history. Sports architects Populous have been appointed to design the stadium, the hotel and the visitor attractions, while Allies & Morrison will be responsible for the design of the new homes. Donald Insall Associates have been named as heritage architects. Construction work has already begun on preparation works and the stadium is set to open in time for the 2018-19 season. A £215m extension for London’s Tate Modern will open next year, the gallery’s director has said. The announcement should assuage fears that construction work for the popular visitor attraction was running behind schedule. The designs have been on the table since 2008, and the extension was originally slated to open in time for the capital’s 2012 Olympic Games. The 11-storey addition, designed by acclaimed architecture firm Herzog & de Meuron, will officially open on 17th June 2016, according to Sir Nicholas Serota, director of the Tate Modern. The 65m-tall (213ft) building is set to add 21,500sq m (230,400sq ft) to the gallery's existing 35,000sq m (377,000sq ft), increasing the size of the attraction by 60 per cent, and two public spaces – a piazza and a childfriendly garden. An £80million project to build a new indoor water park and hotel at the West Midlands Safari Park in Bewdley has been granted outline planning permission by local councillors. The hotel will be entirely independent of the water park. It will include around 250 bedrooms, a conference centre and a spa. The water park will include waterslides, a splash area, wave pool, external river BCFA NEWSFLASH Page 3 rapids and a restaurant. No date has been set for the start of construction but an opening date for the new waterpark has been set at 2017. Manchester Cathedral is planning a £7million extension to the west end of the building as part of a £15million refurbishment programme. Work includes the installation of a new organ plus new lighting and sound installation. It also includes possible new exhibition space together with at least two rooms offering multi-purpose learning and meeting space. Moor Hall in Aughton, West Lancashire is a Grade II-listed manor house dating from the mid-sixteenth century and set in five acres of gardens overlooking a lake. It is currently undergoing a major renovation and will open in 2016 as a 50-seat restaurant with seven bedrooms - five in the main house and two in the gatehouse nearby. There will also be a private dining room for 12 guests. Budget hotel operator Travelodge has exchanged contracts with Orbit Developments for two new hotels in Greater Manchester, costing a total of £9m. The first hotel, in Stockport, located in a section of office block Regent House, will feature 86 bedrooms, while a 67-bedroom hotel will be developed within a four-storey 1980s office building in Sale. Together, the two hotels will create 45 jobs. Planning applications have been submitted, with both hotels due to open at the end of next year. Travelodge, which currently has 522 hotels, is looking for seven more sites in Greater Manchester, representing an investment of £35m. Le Bistrot Pierre is looking to expand its chain of 14 restaurants with further sites next year. The company was established in 1994 and the restaurants offers provincial French cooking made with authentic, fresh ingredients. The latest outlet to open this year is in the Oyster Wharf project in Mumbles, Swansea, and this followed an opening in Bath. Brighton and Hove Albion Foodtball Club has submitted a planning application to build a £16mhotel and specialist cancer treatment centre next to the American Express Community Stadium. The 150-bed hotel would be known as the Brighton Aloft. The plans have gone before Brighton and Hove City Council and Lewes District Council because the site straddles both local authority areas. Global technology giant Apple has agreed a deal to lease the whole of 21 Glasshouse Street in London’s Soho. The company is understood to be under offer to occupy 25,000 sq ft at the six-storey building, which is managed by the Crown Estate and has been recently redeveloped. Apple’s European headquarters is at 1 Hanover Street, also in London’s West End, and the space in Glasshouse Street is understood to be in addition to its existing London presence. Glasshouse Street, along with the adjoining streets Brewer Street and Sherwood Street, is part of the Crown Estate’s £1bn regeneration of the Regent Street area. Developer Quintain has released 750,000 sq ft of space for office development at its flagship Wembley Park development. The developer has appointed agents at Colliers International and Cushman & Wakefield to market the new campus, which it hopes will rival other developments like Stratford and Croydon with prices at less than £40/ sq ft. More than 4,000 people already work at Wembley Park’s campus-style site. Companies will be able to design their own office blocks and move in within 24 months. The buildings will range in size from 70,000 sq ft to 750,000 sq ft. NHS Liverpool CCG has taken a 10-year lease on 33,433 sq ft of office space at The Department, marking Liverpool’s largest office letting of 2015 to date. The quoting rent for the building, located in the former Lewis’ department store on Renshaw Street in the city, is £14.50/sq ft. The deal is is the first office pre-let in excess of 30,000 sq ft in the city centre since 2010 and sees NHS Liverpool CCG take floors three and four at the development on a new 10-year lease. NHS Liverpool CCG will relocate its staff from Arthouse Square to The Department by the end of the year, joining existing tenant Pure Gym which moved into the development in spring. The Department, which forms part of the Central Village scheme, is currently in the process of undergoing a comprehensive programme of refurbishment and will eventually provide 75,000 sq ft of Grade A office accommodation. Developer Worthington Properties has submitted plans for a new £70m office scheme on Manchester’s Deansgate. If approved, the scheme will replace current buildings at 123-127 Deansgate, delivering 113,500 sq ft of grade A office space along with 12,100 sq ft of retail space over two units. Construction is expected to start in summer 2016. Glenn Howells Architects, which designed One St Peter’s Square in the city, has been appointed as architect on the scheme, and Deloitte Real Estate provided planning advice Orchard Street Investment Management has secured a new 10-year lease with existing tenant Clear Channel at 33 Golden Square in London’s Soho, unlocking a refurbishment of the building. Global media owner Clear Channel has occupied the building since 1989 and uses it as its international headquarters outside of the US. Orchard Street acquired the property last year on behalf of St James’s Place Wealth Management. Following the agreement of the new lease, Orchard Street will provide funds towards a comprehensive upgrade of the 17,086 sq ft six-storey office building. The new lease will run from the completion of the refurbishment works, to be carried out by the tenant, at an average rent of £85/ sq ft following an initial rent free period of 12 months. Hanover Green advised Orchard Street throughout the purchase and new lease negotiations while Clear Channel was advised by Cushman & Wakefield which will also act as project manager on the refurbishment. BCFA NEWSFLASH Page 4 LEEDS - Phase 1, Plot J1 Kirkstall Forge, Abbey Road £19.79m Planning authority: Leeds Job: Reserved Matters Granted for office building Client: Kirkstall Forge Investment Property I Limited Developer: Cooper Cromar, Eagle Building, Bothwell Street, Glasgow, Strathclyde, G2 7ED Tel: 0141 332 2570 Styles & Wood Group has clinched a £17.7m revamp of a major office in Manchester, its biggest project for seven years. The renovation of Westminster House in Portland Street is due to complete in November 2016. Styles & Wood will complete strip out and refurbishment works to the building on a phased basis, allowing the ongoing use of the building around an existing tenant during the refurbishment. The 69-week project will include the complete refurbishment of the fabric and finishes together with mechanical and electrical upgrades across 160,000 sq ft of refurbished internal floor space. On completion of the project, Aviva Investors will be seeking tenants for circa 9,000m2 of newly refurbished Grade A office accommodation, through their retained leasing agents, Savills and Cushman and Wakefield. ISG has begun work on an £8.5m office refurbishment scheme at Heathrow Approach in Slough. The project involves the refurbishment of the seven-storey, 83,000 sq ft office building, including extensive remodelling of the entrance, atrium and main reception area. The client is Sampension KP International, one of Denmark’s largest pension management firms, which is developing the building speculatively. Internal enhancements include the upgrade of the buildings mechanical and electrical services infrastructure and the replacement of lifts. Within the atrium, ISG will replace the existing stone flooring and re-clad the walls with a combination of high-gloss lacquered panels, fabric covered panels and wood veneer. Willmott Dixon has bagged a £21m contract to build three schools in Milton Keynes as part of Scape Group’s £1.25bn national major works framework. The first phase of Milton Keynes Council’s £160m schools investment programme will see the contractor build Newton Leys, Fairfield and Whitehouse primary schools, all of which will be ready for a new intake of pupils in September 2016. The housebuilder is working with three architects: CORDE for Fairfield, ADP for Whitehouse and Synergy for Newton Leys. The full programme aims to create seven new schools and expand a further 12 by 2018. Liverpool John Moores University is believed to be close to signing a deal with Lendlease for a major new campus building in the city. Known as the Copperas Hill development, the £70m project will involve converting the disused postal sorting office near the Lime Street railway station into a central teaching, library and sports facility. The building extends to 300,000 sq ft over several floors. Its redevelopment will be pivotal in the regeneration of the surrounding area resulting in the creation of improved streetscapes, upgraded highways, landscaping and new open spaces. Work is expected to start on site early in 2016. The University plans to redevelop the site as part of a vision to develop a connected campus by locating all students and staff in the city centre. Copperas Hill will be the heart of the University and a front door to the Knowledge Quarter of the city. It will be pivotal in the regeneration of the area surrounding Lime Street resulting in the creation of improved streetscapes, upgraded highways, landscaping and new open spaces. Copperas Hill scheme professional team Project Managers, Christal Management Architects, BDP with lead architect Sue Emms Cost Consultants & Employers Agent, Sweett Group Developer Guildhouse UK has submitted plans for a 17-storey student housing block in Plymouth. The complex is to be built close to Plymouth University in the city centre as part of the redevelopment of The Northern Triangle, which has already been partly redeveloped for student accommodation. Further regeneration is planned in the area with a 23-storey 500-bed development scheme proposed for Beckley Court. The upper 14 floors of the building would contain 528 student bedrooms, a mixture of eightbedroom flats and individual studio apartments. The lower part will be used as retail space. A roof-level sky lounge will offer panoramic views across Plymouth. If the scheme goes ahead the 1950s built 5-storey Mayflower House will be demolished on Armada Way. Student accommodation specialist Unite Group has acquired two development sites in central Bristol. The firm said it will now invest around £85m building digs for around 900 students, subject to obtaining the necessary approvals, including planning consents. The sites are well located to house students from both of the Universities in the city and provide Unite with an opportunity to further strengthen its relationships with two long term partners. Unite has been targeting development sites in major regional cities, after land costs in London rose to a level that made it difficult to achieve Unite’s set return rates. Interserve has bagged its first construction contract with the University of York on its £16m Heslington West campus development. The deal will see the contractor design and build a new three-storey Bioscience Complex at the university. The project, slated for completion in autumn 2016, will feature wet laboratories, interactive spaces for students and a student services and administration centre, as well as an atrium linking it with the nearby Biomedical and Natural Sciences building. Cambridge University has selected Morgan Sindall to deliver its new student services centre on the New Museum site in the city. The job involves a mix of restoration, alterations and new buildings, working with both new-build and existing listed buildings. BCFA NEWSFLASH Page 5 Morgan Sindall will demolish the Examinations Halls Building to provide a major new building in its place and refurbish the Grade 2 listed Arts School and ground floor of the Old Cavendish Labs (East and Raleigh Wings). Work is expected to start before the end of the year on the project which will cost an estimated £39m including demolition. It is architect Bennetts Associates first job for the University. Morgan Sindall has won an £8.9m contract to build the new Ermine Street Church Academy near Huntingdon. The project for Cambridgeshire County Council is the first school in Urban & Civic’s new Alconbury Weald development, where 5,000 homes are being built on a former airfield near Huntingdon. The school will occupy a key location. The academy will be run by the Diocese of Ely Multi-Academy Trust, and the first phase of the single-storey school is due to open in September 2016. It will eventually accommodate 630 pupils following a second phase of construction. ABERDEEN £2.85M Depot and Garage, 36 Willowbank Road Planning authority: Aberdeen Job: Detail Plans Granted for 43 student cluster flats Client: Crucible Alba Aberdeen Ltd Developer: Michael Laird Architects, 5 Forres Street, Edinburgh, Lothian, EH3 6DE Tel: 0131 226 6991 INVERNESS £0.45M Site 60M NW Of Rose St Car Par, Rose Street Planning authority: Highland Job: Detail Plans Granted for 30 student flats & retail units Client: Inverness Properties Ltd Developer: G H Johnston Building Consultants Ltd, Willow House, Stoneyfield Business Park, Inverness, Highlands, IV2 7PA Tel: 01463 237229 EXETER £5.51M Clifton Garage, Bonhay Road Planning authority: Exeter Job: Detail Plans Granted for 10 student town houses Client: Rougemont Town Houses Limited Developer: Grainge Architects, The Boat Shed, Michael Browning Way, Exeter, Devon, EX2 8DD Tel: 01392 438051 SWINDON £1.454M Defence Academy of the UK, Shrivenham Planning authority: Vale Of White Horse Job: Detail Plans Granted for defence teaching facility building Client: Defence Academy of the United Kingdom Developer: Roberts Limbrick Ltd, The Carriage Building, Bruton Way, Gloucester, GL1 1DG Tel: 03333 405 500 A North East developer has won a place on a framework that will deliver up to £650 million worth of projects in North Yorkshire. Galliford Try Partnerships North is one of six organisations that will now have the opportunity to work in partnership with the county council, to bring extra care accommodation to every major town in North Yorkshire, in line with the ‘Care and Support Where I Live’ strategy. The Partnerships Division in the North East is already working in North Yorkshire on a £10 million, 64 bedroomed extra care facility and 26 two bedroomed bungalows for Tristar Housing; a £24 million project with Redcar and Cleveland Council and Coast and Country Housing to develop 200 supported housing units and an extra care facility in the borough; the development of an £8.7 million 79 bed extra care facility for Riverside in Washington, Tyne and Wear and a similar £5 million 58 bed project in Alnwick, Northumberland, for Isos Housing. Veterinary services group CVS saw profits leap 35pc this year on the back of a buying spree. CVS acquired 29 surgeries in the financial year to July, and has bought another eight since then, bringing its total in the UK to 298. The group also bought the Whitley Brook Crematorium in Cheshire. As well as achieving growth through acquisitions, CVS saw like-for-like sales at its existing sites increase by 6.8pc, while its Healthy Pet Club scheme saw membership rise 32pc to 213,000 customers. The group is the UK’s biggest employer in the industry, with 3,400 staff and 822 vets. Revenues shot up 17pc to £167.3m while pre-tax profits increased 34.8pc to £8.5m. Sandwell Borough Council has given the thumbs up to plans to build the £450m Midland Metropolitan Hospital. Health trust chiefs said the go-ahead meant the final hurdle of signing a contract with preferred bidder Carillion to deliver the UK’s first PF2 hospital was now just a few months off. It is hoped work will start early next year on a brownfield site in the heart of Smethwick with the aim of completing the 670 beds hospital in mid-2018. Dementia specialist care provider Kingsley Healthcare whose head office is based in Suffolk has announced that building work has begun on the 62-bedroom purpose-built dementia care home in Partington, Trafford, Greater Manchester and is due for completion in June 2016. Facilities at the new home in Wood Lane, will include a cinema, library and a dementia café. BCFA NEWSFLASH Page 6 Canadian property investor Ivanhoé Cambridge has got the go-ahead to build a two-tower office development in Paris’s Rive Gauche district. The 1.16m sq ft Tours Duo development will include two office towers of 27 and 39 storeys (pictured), as well as a hotel, an auditorium and its own bus and streetcar station within the complex. More than 50% of space in the towers has already been pre-let ahead of its opening, which is scheduled for 2020. Fairmont Hotels & Resorts has announced the development of a new 270-room luxury hotel in the Nigerian capital city of Abuja. With a planned opening in 2019, Fairmont Abuja will be situated in the heart of the city's central business district and only 30 km from the Nnamdi Azikiwe International Airport. Minor Hotel Group (MHG) announced its continued expansion in the GCC with the development of Anantara Durrat Al Bahrain Resort in partnership with Bahrain Mumtalakat Holding Company (Mumtalakat), the investment arm of the Kingdom of Bahrain. The resort will be in Durrat Al Bahrain, the Kingdom's second largest island development, which has been created across a cluster of 15 spectacular islands. The hotel will be the first hospitality component in Durrat Al Bahrain, and will be an integrated destination project for leisure, business, and MICE guests visiting the Kingdom of Bahrain. The 21 square kilometre master development is located on the south east coast of Bahrain and will include 2,000 beachfront villas, 3,600 executive apartments and offices, parks and entertainment precincts, premier retail malls and restaurants, along with a 400-berth marina. 1,000 luxury waterfront villas have already been completed as part of Phase 1 of the development. Slated to open in 2018, Anantara Durrat Al Bahrain Resort will offer a total of 220 keys, including Lagoon View and Lagoon Access rooms, Beach Pool Villas and Overwater Pool Villas. Additional facilities will include a selection of restaurants, meeting rooms, a state-of-the-art ballroom, a gym, a kid's club, a teen centre, and an impressive Anantara Spa. Four Seasons continues to expand its global footprint with twelve new openings currently scheduled for late 2015 and 2016, including several debuts in countries new to the brand. All set to open by the end of 2015, Four Seasons will add three more destinations to its portfolio, with developments in Seoul, Casablanca, and Bogotá. For 2016, Four Seasons has revealed upcoming properties across the world, from Hawaii to Tianjin. The fifth resort in the Four Seasons Hawaiian Collection, the 358-room Resort O’ahu at Ko Olina, will be a beachfront property with a multi-level spa, multiple pools and high capacity event spaces. In contrast to this beach development, the 259-key Hotel Tianjin is located in China’s fourth most populous city, and will be part of a mixed complex tower with office space and retail stores. A completely new country in their portfolio, Four Seasons Hotel Kuwait at Burj Alshaya will be situated in the central business district. Boasting 263 rooms and interiors designed by Yabu Pushelberg, the project will also have five F&B options and a specially designed indoor pool. Combining a hotel offering and private residences, the first Four Seasons in the Emirati capital will be 200-room Hotel Abu Dhabi at Al Maryah Island, in the heart of the new business centre. The new building, situated on a prime stretch of waterfront adjacent to the new ADGM Square complex, will also house 124 private and serviced residences. The far-reaching plans for 2016 see projects forthcoming in Dubai, Japan, New York, Florida, and another hotel in Bogotá, with each development individually tailored to its new location. UKTI Alert India – Business opportunities in six smart township projects A state government in India is planning six smart township projects. This market pointer is aimed at providing information on possible opportunities coming out of these projects. This full online edition with links is available at: http://www.businessopportunities.ukti.gov.uk/uktihome/item/939400.html BCFA NEWSFLASH Page 7