The International Lender of Last Resort for Emerging Camila Villard Duran

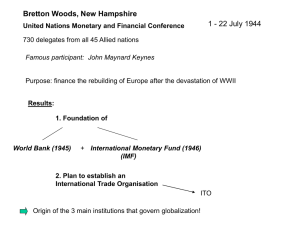

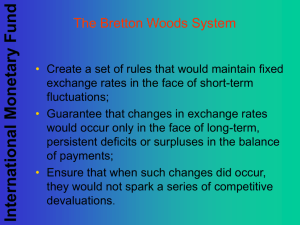

advertisement