CHAPTER 13: INTERNAL CONTROL

advertisement

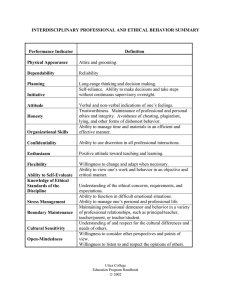

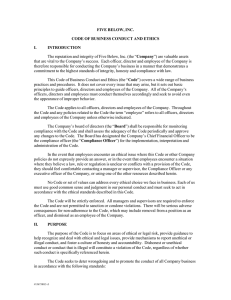

CHAPTER 13: INTERNAL CONTROL J.L. Boockholdt, Ph.D., C.P.A., C.M.A. By: Dr. Dyah Nirmala A.J., M.Si. Learning Objectives: • To understand the components of an organization’s internal control structure. • To know the objectives and limitations of internal control. • To discover which characteristics of a control environment promote an effective accounting system. Learning Objectives: • To learn how an accounting system aids in communicating information • To describe effective control activities. INTRODUCTION Accounting systems provide information for people both internal and external to an organization. The users of this information rely on the accuracy of the system’s reports and displays. Organizations adopt internal control policies and procedures to maintain accurate information and reliable operations. In this chapter you will learn about the components of an organization’s internal control, its limitations, and some basic policies and procedures. FEATURES OF INTERNAL CONTROL Definition Internal control is a process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of the objectives in the following categories: • Effectiveness and efficiency of operations • Reliability of financial reporting • Compliance with applicable laws and regulations. Features 1. Process 2. People 3. Objectives: 1. Accounting controls: 1. 2. Safeguarding assets Ensuring accurate and reliable accounting data 2. Administrative controls: 1. 2. Promoting operational efficiency Encouraging employees to follow management’s policies 4. Reasonable Assurance. A concept applied to internal controls stating that the costs of a control policy or procedure should not exceed its benefits. Absolute assurance is impossible, because: • Limitations of Internal Control – Errors – Collusion: Conspiracy by two or more people to steal from an organization. – Management Override: The ability of managers to overcome control policies or procedures that are effective with operations-level employees. • Costs and Benefits Threats to Accounting Data • Errors An accidental act, that arise from lack of knowledge (misjudgment) or lack of attention /fatigue (carelessness) • Irregularities An intentional act, such as defalcation or management fraud, that may misstate accounting data. – Defalcation: the theft of assets from an organization. – Management fraud: management’s deliberate distortion of financial information. COMPONENTS OF INTERNAL CONTROL Internal Control Components are: 1. An organization’s control environment, 2. risk assessment procedures, 3. control activities, 4. information and communication methods, and 5. monitoring activities. CONTROL ENVIRONMENT Control environment are those circumstances surrounding an organization’s accounting system that either improve or limit the effectiveness of control procedures. Factors Affecting the Control Environment: 1. Integrity and ethical values. 2. Commitment to competence. 3. Board of directors or audit committee participation. 4. Management philosophy and operating style 5. Organizational structure. 6. Assignment of authority and responsibility. 7. Human resources policies and practices. 1. Integrity and Ethical Values As management creates, administers, and monitors the system of internal control, its effectiveness is limited by management attitudes toward integrity and ethical values. 2. Commitment to Competence Competence means that employees have the knowledge and skills they need to perform theirs tasks. When management has a commitment to competence, the system of internal control is more likely to achieve its objectives. Otherwise, both errors and irregularities are more likely to occur. 3. Board of Directors and Audit Committee Participation Active and involved board of directors who have an appropriate amount of technical and management knowledge, and audit committee are critical to effective internal control. 4. Management Philosophy and Operating Style These include management’s approach to taking business risks, attitudes toward the accuracy of accounting data, and emphasis on meeting budget and operating goals. They have a significant influence on the effectiveness of organization’s control activities. 5. Organizational Structure It provides an overall framework for planning, executing, controlling, and monitoring activities performed by management. Objectives are more easily achieved in an organization whose structure reflects its management functions and that assigns authority and responsibility appropriately. 6. Assignment of Authority and Responsibility Management assigns authority and responsibility for operating activities and establishes reporting relationships and methods of authorization. The control environment is influenced by the extent to which employees recognize that they will be held accountable. 7. Human Resources Policies and Practices They send messages to employees about what the organization expects in the way of integrity, ethical behavior, and competence. They also describe how the organization hires, trains, evaluates, promotes, and compensates employees.