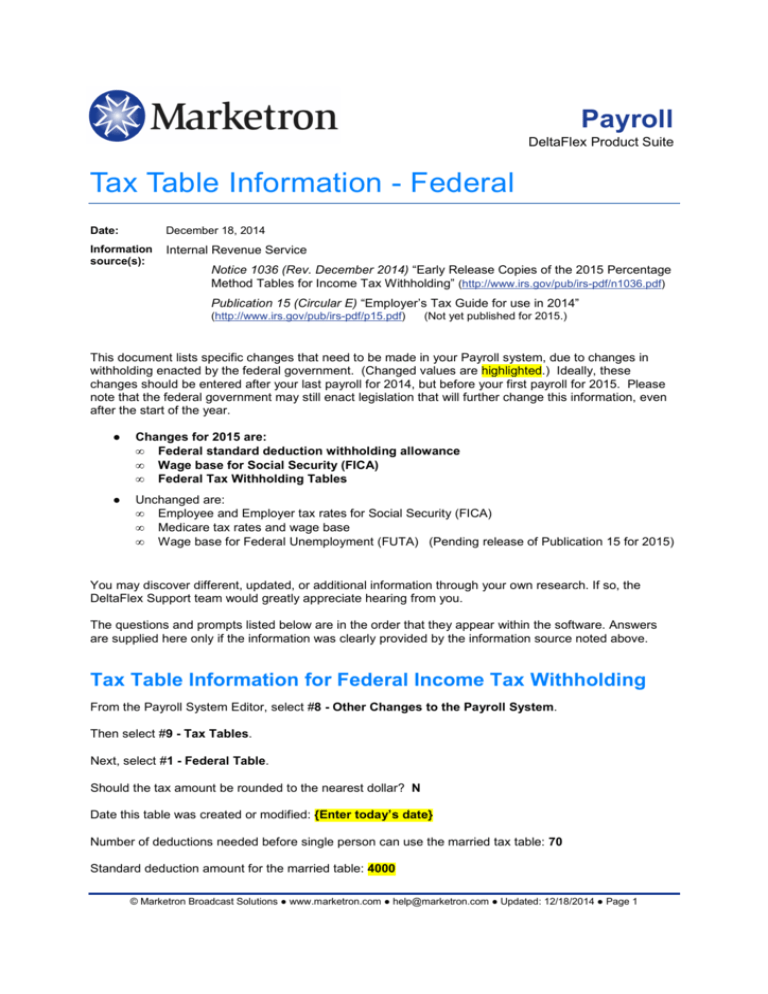

Tax Table Information - Federal

advertisement

Payroll

DeltaFlex Product Suite

Tax Table Information - Federal

Date:

December 18, 2014

Information

source(s):

Internal Revenue Service

Notice 1036 (Rev. December 2014) “Early Release Copies of the 2015 Percentage

Method Tables for Income Tax Withholding” (http://www.irs.gov/pub/irs-pdf/n1036.pdf)

Publication 15 (Circular E) “Employer’s Tax Guide for use in 2014”

(http://www.irs.gov/pub/irs-pdf/p15.pdf)

(Not yet published for 2015.)

This document lists specific changes that need to be made in your Payroll system, due to changes in

withholding enacted by the federal government. (Changed values are highlighted.) Ideally, these

changes should be entered after your last payroll for 2014, but before your first payroll for 2015. Please

note that the federal government may still enact legislation that will further change this information, even

after the start of the year.

●

Changes for 2015 are:

• Federal standard deduction withholding allowance

• Wage base for Social Security (FICA)

• Federal Tax Withholding Tables

●

Unchanged are:

• Employee and Employer tax rates for Social Security (FICA)

• Medicare tax rates and wage base

• Wage base for Federal Unemployment (FUTA) (Pending release of Publication 15 for 2015)

You may discover different, updated, or additional information through your own research. If so, the

DeltaFlex Support team would greatly appreciate hearing from you.

The questions and prompts listed below are in the order that they appear within the software. Answers

are supplied here only if the information was clearly provided by the information source noted above.

Tax Table Information for Federal Income Tax Withholding

From the Payroll System Editor, select #8 - Other Changes to the Payroll System.

Then select #9 - Tax Tables.

Next, select #1 - Federal Table.

Should the tax amount be rounded to the nearest dollar? N

Date this table was created or modified: {Enter today’s date}

Number of deductions needed before single person can use the married tax table: 70

Standard deduction amount for the married table: 4000

© Marketron Broadcast Solutions ● www.marketron.com ● help@marketron.com ● Updated: 12/18/2014 ● Page 1

Tax Table Information - Ohio

Standard deduction amount for the single table: 4000

Does this table have a maximum limit on the taxable gross in any 1 year? N

Maximum taxable gross amount for FICA (social security): 118500

Percent FICA tax rate for Employer: 6.2

Percent FICA tax rate for Employee: 6.2

Maximum taxable gross amount for Medicare: 999999

Percent Medicare tax rate for Employer: 1.45

Percent Medicare tax rate for Employee: 1.45

Maximum taxable gross amount for unemployment: 7000

FEDERAL Tax Table for Employees filing MARRIED

Brk

Maximum $

Amount

Base $

Amount

Tax %

Brk

#1

8,600.00

0

0

#2

27,050.00

0

10.0

#10

#3

83,500.00

1,845.00

15.0

#11

#4

159,800.00

10,312.50

25.0

#12

#5

239,050.00

29,387.50

28.0

#13

#6

420,100.00

51,577.50

33.0

#14

#7

473,450.00

111,324.00

35.0

#15

#8

999,999.99

129,996.50

39.6

#16

Maximum $

Amount

Base $

Amount

Tax %

#9

FEDERAL Tax Table for Employees filing SINGLE (including head of household)

Brk

Maximum $

Amount

Base $

Amount

Tax %

Brk

#1

2,300.00

0

0

#2

11,525.00

0

10.0

#10

#3

39,750.00

922.50

15.0

#11

#4

93,050.00

5,156.25

25.0

#12

#5

191,600.00

18,481.25

28.0

#13

#6

413,800.00

46,075.25

33.0

#14

#7

415,500.00

119,401.25

35.0

#15

#8

999,999.99

119,996.25

39.6

#16

Maximum $

Amount

Base $

Amount

Tax %

#9

© Marketron Broadcast Solutions ● www.marketron.com ● help@marketron.com ● Updated: 12/18/2014 ● Page 2