manual journal entry policy

advertisement

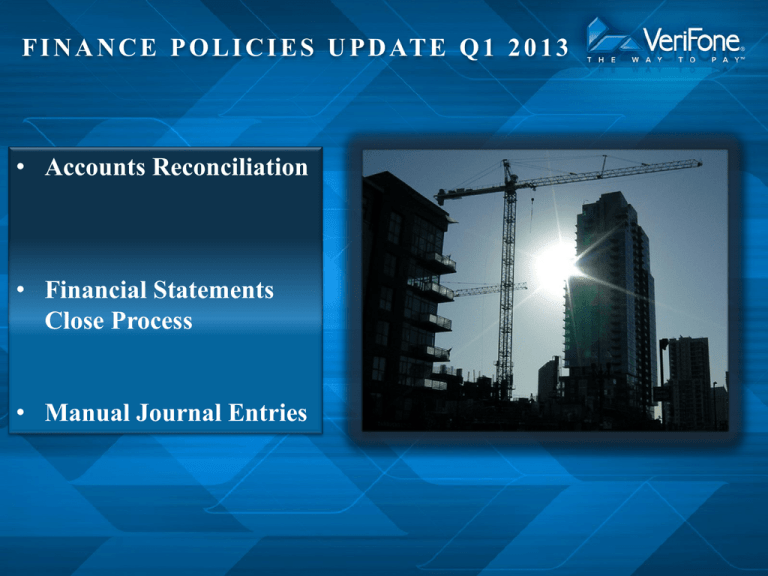

F I N A N C E P O L I C I E S U P D AT E Q 1 2 0 1 3 • Accounts Reconciliation • Financial Statements Close Process • Manual Journal Entries AGENDA 1 ACCOUNT RECONCILITATION POLICY 2 FINANCIAL STATEMENTS CLOSE PROCESS 3 MANUAL JOURNAL ENTRY POLICY 2 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y ACCOUNT RECONCILITION POLICY 3 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y The following are key updates made to the accounts reconciliation policy: • Regional controllers are responsible for the financial statements of their region and must design and implement procedures to review the financial statements to ensure accuracy; • Quarterly checklist of all balance sheet accounts reconciliation must be reviewed and signed by the local and regional controller and uploaded to SharePoint with the reconciliations file; 4 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Example of quarterly checklist 5 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y • Each local controller must review the quarterly flux analysis and identify and investigate all unusual and unexpected amounts and fluctuations; • Account reconciliations must be reviewed by a supervisor/manager who did not prepare the reconciliation. Regional controllers are no longer required to review all the account reconciliations with balances over $750K. 6 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Why the updates?: • We want to remind all local and regional controllers, you are responsible all the numbers in your trial balance. It is your responsibility to understand and ensure you and your team have done enough review to ensure the accuracy of the financial statements. • It is now a requirement that local controllers review and sign the quarterly checklist of account reconciliations, as this is another crucial step in the review process and help you identify your potential risks. 7 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y • We have changed the requirement that controllers must review all reconciliations over a threshold, but rather allow you to decide the level of review of your accounts. However, we now require local and regional controllers to review the quarterly checklist of all balance sheet reconciliation to make sure you have adequate review(s) by the appropriate member(s) of your team. • In addition, we require that the local and regional controller state what procedures you have performed, if any. We expect you to review material and non-routine balances. 8 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Other Areas of Emphasis: • We had many instances in prior years where it wasn’t clear who is responsible and who is doing reconciliations of certain balances. This is not acceptable. Regional teams own the trail balance. You must reach out to the corporate team and confirm they are doing the reconciliation. In addition, you are required to get a basic understanding of what the balance is and how it interacts with the rest of your trial balance. Example: acquisition defer revenue adjustments, these are calculated at corporate. However, the subsequent amortization is based on the consumption pattern which is local operations. Changes in the consumption pattern has to be communicated to corporate so they change the amortization which affects your numbers. 9 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Other Areas of Emphasis (continued): 10 • All reconciliations must be reviewed before submitting to corporate as per the close schedule and have evidence of review and all supporting documentation. • Proper evidence of the review are i) Signature on the reconciliation or ii) Email stating the approver and that the reconciliation been approved. A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Other Areas of Emphasis (continued): • BS reconciliation is not a download of Oracle journals posted in the account for the period • If there is a sub-ledger then it is a reconciliation of GL to the sub-ledger, which we can go to the sub-ledger to get what the balance sheet amount is made up of, such as AR listing. • If there is no –sub-ledger, then the reconciliation must include a listing of the amounts that make up the balance sheet amounts. Having the number of journals that make up the balance is also not enough, for material amounts, there must be enough details in the reconciliation to allow the reviewer to conclude whether the accounting is correct, e.g. is the amount still recoverable or should it be expensed already, is it in the correct GL account. 11 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Other Areas of Emphasis (continued): • 12 Procedures for preparing and reviewing a reconciliation should be documented in the reconciliation. This allows new staff to do a better job and reduce the chance of something not been done right. In addition, if there were issues identify in the review of a reconciliation, the cause of the issue should be documented so it won’t happen again. For example, balance from last period that should be reversed in the next period should be documented or manual deferral of revenue should have reminders to check that the COGS associated with the order is been accounted for correctly. A C C O U N T S R E C O N C I L I AT I O N P O L I C Y Other Areas of Emphasis (continued): • 13 Your team members doing the reconciliation has to understand what they are doing and what they should be looking for. If your team is small and you do not have enough time, please let the Global Finance Process team know and we can help train your staff. We have seen cases where staff just makes sure the amounts agree to GL and that is it. Example, bank reconciliation, GL amount agrees to bank statement so it is done. However, the bank statements says this is a Restricted Cash account. A C C O U N T S R E C O N C I L I AT I O N P O L I C Y • General format (per the company’s policy) - cash, AP, accrued expenses, other assets and liabilities. • Specific reconciliations which require more details - AR, Inventory, warranty reserve, deferred revenues &COGS, tax accounts. • Rollforward and waterfall- fixed assets, assets held for rentals, prepaid expenses, intangibles, goodwill, deferred revenues. Please contact consolidations team if you are not familiar with the correct recon format to be used 14 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y FINANCIAL STATEMENTS CLOSE PROCESS 15 F I N A N C I A L S TAT E M E N T S C L O S E P R O C E S S The Balance Sheet and Income Statement Monitoring policy and Financial Statement Close Process Policies have been combined into one. The key changes in the final Financial Statements Close Process policy are as follows: • The global accounts owner and the consolidated group will no longer be required to review account reconciliations of all accounts with balances greater than $200,000. However, global accounts owners are still responsible for reviewing their respective accounts for reasonableness and ensure it is not materially misstated. The global account owner’s plan procedures have to be reviewed and approved by the SVP Corporate Controller. • Corporate will no longer be required to review all journal entries booked against inventory accounts for reasonableness. 16 F I N A N C I A L S TAT E M E N T S C L O S E P R O C E S S What to consider when doing the flux: • Although the policy states that you must provide explanations on variances for accounts with balances over $200K and variance of 10% and $100K. This is the MINIMUM requirement. The key to a flux isn’t just about variances. You have to understand the numbers and form an expectation of what the balance should be then look at the variance to ensure it’s inline with your expectation. Example: an order was deferred in Q1 because of a delay in acceptance hence a manual defer revenue and COGS entry was recorded. Next quarter the acceptance was received, however, the defer revenue balance sheet flux shows no movement at all. This is incorrect and the deferred revenue and COGS should have been released once the acceptance received. 17 F I N A N C I A L S TAT E M E N T S C L O S E P R O C E S S What to consider when doing the flux (continued) : • We ask you (the controller) to review the flux since you are responsible of your trial balance and have your fingers on the pulse of the operations to know about key events and to be able to set the right expectations of what balances should be and detect any large variances or lack of variance. 18 F I N A N C I A L S TAT E M E N T S C L O S E P R O C E S S What to consider when doing the flux (continued): • For the P&L flux, we encourage you to not just compare prior period numbers to current period but also compare your current results to your budget since your forecast has better seasonality and headcount fluctuations built in. 19 A C C O U N T S R E C O N C I L I AT I O N P O L I C Y MANUAL JOURNAL ENTRY POLICY 20 MANUAL J OURNAL ENTRY POLICY The key changes in the Manual Journal Entry Policy are increases in the approval threshold associated with the manual journal entry authority matrix: • Local controllers increased from $100K to $250K; • Regional controllers increased from $500K to $750K; • Assistant corporate controller / International controller / VP of Supply Chain increased from $1 million to $2 million; • SVP Corporate controller increased from over $1 million to over $2 million. 21 MANUAL J OURNAL ENTRY POLICY What is a manual journal entry? Manual journal entry is an entry where the journal been posted does not come from the Oracle system. The numbers come from a spreadsheet calculation, a Business Object report or other reports outside of the financial system (Oracle). 22 MANUAL J OURNAL ENTRY POLICY Why do we need to have approval? Numbers coming from a non-Oracle source have many possibilities of errors, some key ones include: • Spreadsheets – wrong formula used in a cell or the numbers been used in the spreadsheet were transfer incorrectly from another source or the person picked up the number from the wrong cell; • BO reports – a standard BO report was used but GL accounts changes but the BO report was not so the report is now incomplete or the period for the report was entered incorrectly when running the report or the report was incomplete; 23 MANUAL J OURNAL ENTRY POLICY Why do we need to have approval? (continued) • Information transfer mistakes – wrong numbers; • The GL accounting codes been used may be entered into Oracle as per the source document, but the GL account code chosen was inappropriate in the first place; The point is every time, there is a manual journal entry, there is a chance of mistake and the probability of error is not as low as you think. Therefore, every manual journal needs to be reviewed and approved. 24 MANUAL J OURNAL ENTRY POLICY Manual journal entry review The 1st reviewer is the detail reviewer. It is your responsibility to check the numbers including re-calculation and checking every source data and ensure the GL accounts to be used are appropriate. If an error was noted, the control failed at the 1st level reviewer, you did not conduct a proper review. Evidence of review and approval is either a manual signature or an email approval. 25 MANUAL J OURNAL ENTRY POLICY Non-Oracle entities • The approval process is the same, if you are a non-Oracle entity, every single journal that is not automated, is a manual journal entry. Every time there is a manual input to transfer a number there is a potential for error, it needs to be reviewed and approved. • The VFI policy on required additional approval for manual journal entry is clear, you must follow it. There are no exceptions. • If the regional controller is not at the same location, you email the journal with support and ask them to review and approve, an email approval is in compliance with the policy. 26