F – E - Swansea University

advertisement

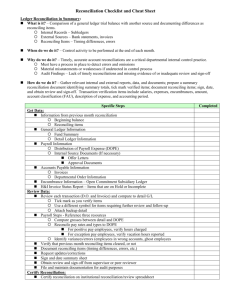

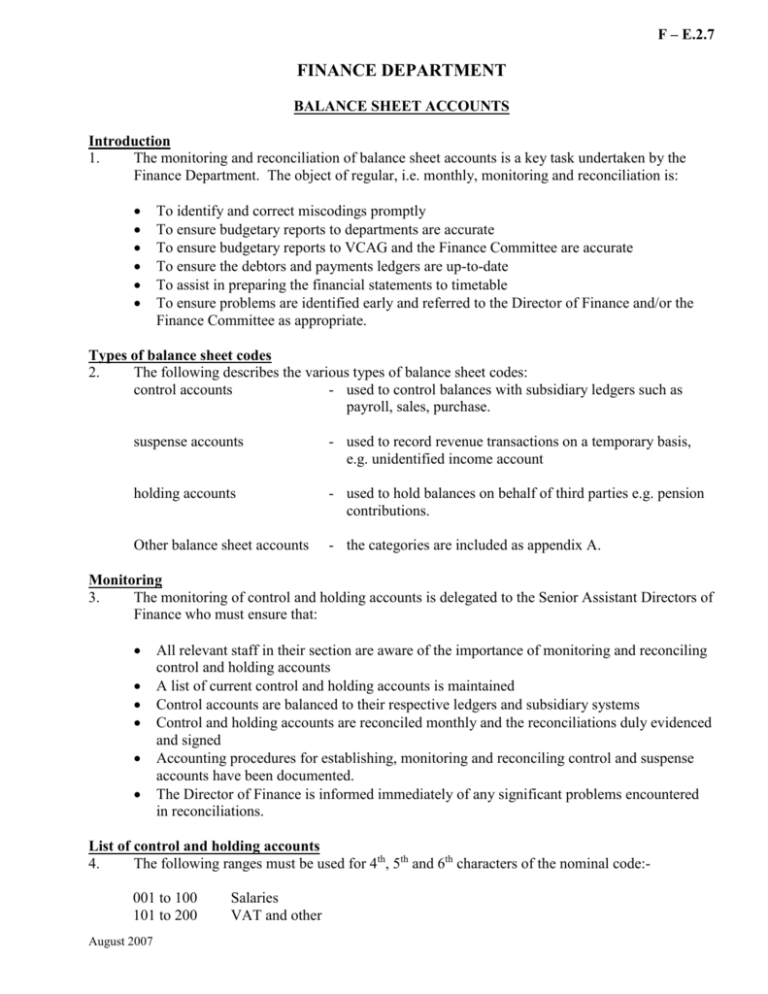

F – E.2.7 FINANCE DEPARTMENT BALANCE SHEET ACCOUNTS Introduction 1. The monitoring and reconciliation of balance sheet accounts is a key task undertaken by the Finance Department. The object of regular, i.e. monthly, monitoring and reconciliation is: To identify and correct miscodings promptly To ensure budgetary reports to departments are accurate To ensure budgetary reports to VCAG and the Finance Committee are accurate To ensure the debtors and payments ledgers are up-to-date To assist in preparing the financial statements to timetable To ensure problems are identified early and referred to the Director of Finance and/or the Finance Committee as appropriate. Types of balance sheet codes 2. The following describes the various types of balance sheet codes: control accounts - used to control balances with subsidiary ledgers such as payroll, sales, purchase. suspense accounts - used to record revenue transactions on a temporary basis, e.g. unidentified income account holding accounts - used to hold balances on behalf of third parties e.g. pension contributions. Other balance sheet accounts - the categories are included as appendix A. Monitoring 3. The monitoring of control and holding accounts is delegated to the Senior Assistant Directors of Finance who must ensure that: All relevant staff in their section are aware of the importance of monitoring and reconciling control and holding accounts A list of current control and holding accounts is maintained Control accounts are balanced to their respective ledgers and subsidiary systems Control and holding accounts are reconciled monthly and the reconciliations duly evidenced and signed Accounting procedures for establishing, monitoring and reconciling control and suspense accounts have been documented. The Director of Finance is informed immediately of any significant problems encountered in reconciliations. List of control and holding accounts 4. The following ranges must be used for 4th, 5th and 6th characters of the nominal code:001 to 100 101 to 200 August 2007 Salaries VAT and other 201 to 300 301 to 400 501 to 600 701 to 800 901 to 949 5. Income and Cash Office Payments Academic Support Technical Purchasing A list of control and holding accounts as at August 2000 is available from the Finance Department. Opening new codes 6. A form (F-E.1.6) should be completed for each new nominal code opened and authorised by the appropriate Senior Assistant Director of Finance Other accounts 7. All other balance sheet codes should be reviewed on a monthly basis to ensure that any miscodings are identified and corrected promptly. 8. Particular attention should be paid to the following categories:cash accounts (bank reconciliation) prizes and endowments short term deposits capital schemes work in progress loan accounts August 2007 BALANCE SHEET Fixed Assets 50 51 52 53 Freehold land and buildings Equipment Investment in subsidiary and associated companies Investments in CVCP Properties Endowment Asset Investments 54 Fixed interest stocks 55 Equities 56 Bank balances held by investment managers 57 Bank balances held by the University Current Assets 60 Stocks and stores in hand 61 Debtors 62 Prepayments and accrued income 63 Short term deposits 64 Cash at Bank and in hand Creditors: Amounts falling due within 1 year 70 Creditors 71 Social Security and other taxation payable 72 Accruals and deferred income 73 Bank loans for capital schemes 74 Bank overdraft Creditors: amounts falling due after more than 1 year 75 Bank loans for capital schemes Provisions for Liabilities and Charges 76 Early retirements Deferred Capital grants 77. Funding Council : Buildings 78 Funding Council : Equipment 79 Other : Buildings 80 Other : Equipment Endowments 81 Capital 82 Revenue Reserves 90 91 August 2007 Income and Expenditure Account Unexpended balances