Policies and Procedures

advertisement

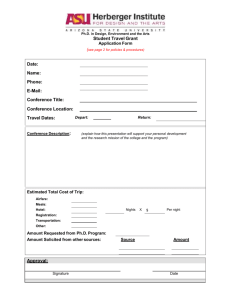

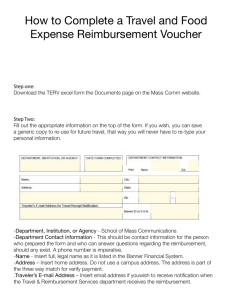

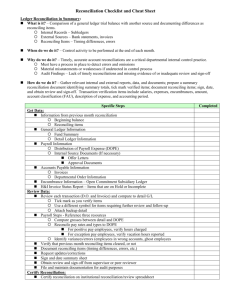

Policies and Procedures Learning Objective In this section, we will describe and discuss the administrative policies and procedures, and related documentation, required for CNCS grantees. General Policies and Procedures Policies and procedures provide an operational framework for an organization. They provide guidance to employees so they can perform their duties in the strategic manner that management had envisioned. A well-written and comprehensive set of policies and procedures can help your organization run more efficiently and effectively, while also ensuring compliance with regulatory requirements. While all the policies and procedures identified below are not required, they will assist the organization in developing an internal control system that will help ensure that assets are safeguarded and operations are conducted in accordance with Generally Accepted Accounting Principles (GAAP). The need for, and the level and extent of policies and procedures can vary considerably from organization to organization. Some factors that influence the variance include: statutory guidelines and restrictions, size of organization, type of organization, number of funding sources, complexity of reporting requirements, size of staff, number of locations, and number of transactions. Some policies and procedures are necessitated by Congressional appropriation language or the original title for CNCS for both DVSA (Domestic Volunteer Service Act of 1973, amended 1999) and NCSA (National and Community Service Act of 1990) awards. OMB circulars, known as common rules, also require that certain administrative requirements or controls be in place. Some of the written policies that should be in place and specific aspects that should be addressed include: Approval Documentation Payroll: Compensation Travel Policies Authority chain and levels of delegated authority Time/attendance process, expectations and reconciliation Travel authorization Authorization of contracts, budgets, proposals Payroll deductions Reimbursement policies Approval of financial reports Administrative processing Approval process Authorization of checks Paycheck distribution Meal reimbursement or per diem Purchase approvals Reconciliation of payroll documents to general ledger Mileage reimbursement rates Consultants Advances Examples of additional policies that should be in place and aspects that should be addressed include: Accounts Receivable Procurement Policies Financial Reporting Cash draw downs, frequency, and reconciliation Purchase orders/vouchers/requests for payment Document what reports are needed Billing (if applicable) Petty cash, amount limits, reconciliation, and replenishment How often reports are needed, e.g., quarterly A/R aging/collections Approval amounts (items under or over a specific amount) Reports by funding source Fee establishment Check processing (who prepares, reviews, and authorizes) Review/approval process Cash receipts (who opens mail, deposits receipts, and so on) Purchasing Audits/compliance Bank reconciliation, (who, when, and other controls) Guardianship of void/unused checks federal/state filings, including taxes and other regulations Finally, each organization should have written policies and procedures, including any needed forms and documents for the following situations or circumstances: Organizational charts; Personnel action forms; Job descriptions; Voucher/check requests; Purchase orders; Travel reimbursement; Travel policies and procedures that include such things as pre-approval, advances, and use of federal per diem rates; List of board members, types of committees, frequency of meetings, and meeting minutes; Organizational documents, e.g., IRS Determination Letter and Articles of Incorporation; Conflict of interest policy for board, management, and staff; Sub-contracts/cooperative agreements, if there is a monetary relationship with community partners or others; and Records, equipment, and property management and disposition.