5_M3286_Fin

advertisement

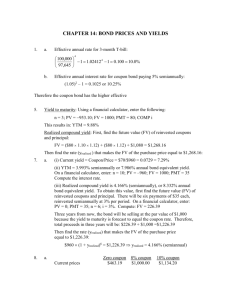

Chapter 5 BONDS • Price of a Bond • Book Value • Bond Amortization Schedule • Other Topics 5.1 Price of a Bond • Bonds • certificates issued by a corporation or government • are sold to investors • in return, the borrower (i.e. corporation or government) agrees: – to pay interest at a specified rate (the coupon rate) until a specified date (the maturity date) – and, at that time, to pay a fixed sum (the redemption value) • Usually: – the coupon rate is a nominal rate convertible semiannually and is applied to the face (or par) value stated on the front of the bond – the face and redemption values are equal (not always) • Thus we have: – regular interest payments – lump-sum payment at the end Example of a bond • Face amount = 500 • Redemption value = 500 • Redeemable in 10 years with semiannual coupons at rate 11%, compounded semiannually • Then in return investor receives: • 20 half-yearly payments of (.055)(500) = 27.50 interest • a lump-sum payment of 500 at the end of the 10 years Notations • F = the face value (or the par value) • r = the coupon rate per interest period (we assume that the quoted rate will be a nominal rate 2r convertible semiannually) • Note: the amount of each interest payment (coupon) is Fr • C = the redemption value (often C = F, i.e. bond “redeemable at par”) • i = the yield rate per interest period • n = the number of interest periods until the redemption date (maturity date) • P = the purchase price of a bond to obtain yield rate i redemption value C coupon (interest) Fr Fr Fr ….. 0 1 2 Note: time is measured in half-years n purchase price P Equation to find yield rate i P ( Fr )an|i C (1 i) Note: often C = F n Examples (p. 94 – p. 96) • A bond of 500, redeemable at par after 5 years, pays interest at 13% per year convertible semiannually. Find the price to yield an investor – 8% effective per half-year – 16% effective per year • Remarks – P < C since the yield rate is higher than the coupon rate, i > r – therefore the investor is buying the bond at a discount – otherwise (if i < r) we would have P > C and then the investor would have to buy the bond at a premium of P - C • A corporation decides to issue 15-years bonds, redeemable at par, with face amount of 1000 each. If interest payments are to be made at a rate of 10% convertible semiannually, and if George is happy with a yield of 8% convertible semiannually, what should he pay for one of these bonds? • A 100 par-value 15-year bond with coupon rate 9% convertible semiannually is selling for 94. Find the yield rate. 5.2 Book Value • The book value of a bond at a time t is an analog of an outstanding balance of a loan • The book value Bt is the present value of all future payments • At time t (the tth coupon has just been paid) we have: Bt ( Fr )ant| Cv n t • Remarks – Usually C = F – In the last formula, an-t and v are computed using the yield rate i – P = B0 < Bt < Bt+1< Bn = C or P = B0 > Bt > Bt+1 > Bn = C Examples (p. 96 - 97) 1. Find the book value immediately after the payment of 14th coupon of a 10-year 1,000 par-value bond with semiannual coupons, if r =.05 and the yield rate is 12% convertible semiannually. 2. Let Bt and Bt+1 be the book values just after the tth and (t+1)th coupons are paid. Show that Bt+1 = Bt (1+i) – Fr 3. Find the book value in 1) exactly 2 months after the 14th coupon is paid. How do we find the book value between coupon payment dates? Assume simple interest at rate i per period between adjacent coupon payments Example Find the book value exactly 2 months after the 14th coupon is paid of a 10-year 1,000 par-value bond with semiannual coupons, if r =.05 and the yield rate is 12% convertible semiannually. Alternative approach • • • • Since Bt+1 = Bt (1+i) – Fr we can view Bt (1+i) as the book value just before next (i.e. (t+1)th) coupon is paid Book value calculated using simple interest between coupon dates is called the flat price of a bond Using linear interpolation between Bt+1 and Bt we obtain the market price (or the amortized value) of the bond Clearly market price ≤ flat price at any given moment (1+i) Bt Fr Bt Bt+1 t t+1 Example (p. 98) Find the market price exactly 2 months after the 14th coupon is paid of a 10-year 1,000 par-value bond with semiannual coupons, if r =.05 and the yield rate is 12% convertible semiannually. 5.3 Bond Amortization Schedule • Goal: trace changes of the book value • Bond amortization schedule – table, containing the following columns: Time Coupon Interest Principal Book Value – time adjustment – coupon 0 1037.17 – interest 1 40 31.12 8.88 1028.29 – principal adjustment 2 40 30.85 9.15 1019.14 – book value 3 40 30.57 9.43 1009.71 Example 4 40 30.29 9.71 1000.00 1000 par value two-year bond which pays interest at 8% convertible semiannually; yield rate is 6% convertible semiannually Algorithm • • • • Book value at time t is Bt Amount of coupon at time t+1 is Fr The amount of interest contained in this coupon is iBt Fr – iBt represents the change in the book value between these dates Time Coupon Interest Principal Book Value adjustment 0 1037.17 1 40 31.12 8.88 1028.29 2 40 30.85 9.15 1019.14 3 40 30.57 9.43 1009.71 4 40 30.29 9.71 1000.00 Example (p. 99) • Consider 1000 par-value 10-year bond with semiannual coupons, r = .05 and the yield rate i = 0.06 effective semiannually. Find the amount of interest and change in book value contained in the 15th coupon of the bond. Example (p. 99) • Construct a bond amortization schedule for a 1000 par-value two-year bond which pays interest at 8% convertible semiannually, and has a yield rate of 6% convertible semiannually Time 0 1 2 3 4 Coupon Interest Principal Adjustment 40 31.12 8.88 Book Value 1037.17 1028.29 5.4 Other Topics • Different frequency of coupon payments • Increasing or decreasing coupon payments • Different yield rates • Callable bonds Examples (p. 101 – p. 102) • (Different frequency) Find the price of a 1000 par-value 10-year bond which has quarterly 2% coupons and is bought to yield 9% per year convertible semiannually • (Increasing coupon payments) Find the price of a 1000 par-value 10-year bond which has semiannual coupons of 10 the first half-year, 20 the second half-year,…, 200 the last half-year, bought to yield 9% effective per year • (Different yield rates) Find the price of a 1000 par-value 10-year bond with coupons at 11% convertible semiannually, and for which the yield rate is 5% per halfyear for the first 5 years and 6% per half-year for the last 5 years Callable bonds • A borrower (i.e. corporation, government etc.) has the right to redeem the bond at any of several time points • The earliest possible date is the call date and the latest is the usual maturity date • Once the bond is redeemed, no more coupons will be paid possible redemption Purchase Date Call Date Maturity Date Examples (p. 103 – p. 105) • Consider a 1000 par-value 10-year bond with semiannual 5% coupons. Assume this bond can be redeemed at par at any of the last 4 coupon dates. Find the price which will guarantee an investor a yield rate of – 6% per half-year – 4% per half-year • Consider a 1000 par-value 10-year bond with semiannual 5% coupons. This bond can be redeemed for 1100 at the time of the 18th coupon, for 1050 at the time of the 19th coupon, or for 1000 at the time of 20th coupon. What price should an investor pay to be guaranteed a yield rate of – 6% per half-year – 4% per half-year