externality - TeacherWeb

advertisement

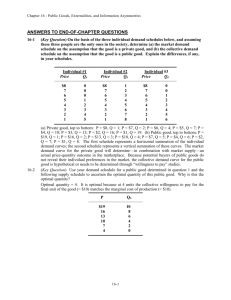

Externalities as Market Failures & the “Fixes” Copyright©2004 South-Western Mod 74-75 MARKET INEFFICIENCY/FAILURES • Recall: Adam Smith’s “invisible hand” of the marketplace leads self-interested buyers and sellers in a market to maximize the total benefit that society can derive from a market. But market failures can still happen. Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • An externality refers to the uncompensated impact of one person’s actions on the wellbeing of a bystander. • Externalities cause markets to be inefficient, and thus fail to maximize total surplus. Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • An externality arises... . . . when a person (or firm) engages in an activity that influences the well-being of a bystander and yet neither pays the cost nor receives any compensation for that effect. Think of an externality as a spill-over or side effect of a transaction—affecting others NOT involved in the actual market transaction. Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • When the impact on the bystander is harmful, we label it an external cost or a negative externality. • When the impact on the bystander is beneficial, we label it an external benefit or a positive externality. Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • Negative Externalities • • • • Pollution Cigarette smoking Barking dogs (loud pets) Loud stereos in an apartment building Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • Positive Externalities • Immunizations • Restored historic buildings • Research into new technologies Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • Negative externalities lead markets to produce a larger quantity than is socially desirable. • Why? B/c something “bad” is being produced but a firm is not having to pay for it!! • Positive externalities lead markets to produce a smaller quantity than is socially desirable. • Why? B/c something “good” is being produced but a firm is not being paid for it!! Copyright © 2004 South-Western NEGATIVE EXTERNALITIES • In analyzing Negative Externalities, we use an S & D graph of the market • We call the Demand curve the MSB (Marginal Social Benefit) curve • We call the Supply curve the MPC curve, representing the Private cost • To “treat” or “remedy” the negative externality, we show a shift in the Supply curve to show the lesser amount of Supply of this good that we want, and call that new Supply curve the MSC (Marginal Social Cost) curve Copyright © 2004 South-Western Aluminum as a Polluting good and the Social Optimum Price of Aluminum Marginal Social Cost--MSC Cost of pollution Supply Optimum Equilibrium Demand 0 QOPTIMUM QMARKET Quantity of Aluminum Copyright © 2004 South-Western Negative Externalities Left alone, the market produces a greater quantity than is socially desirable. • So…we want to “fix” this market failure • The intersection of the demand curve and the new social-cost curve—the MSC curve—determines the optimal output level. • For a negative externality, the socially optimal output level is ALWAYS less than the market equilibrium quantity. • The social cost of the good is higher than the private cost of the good. Copyright © 2004 South-Western Aluminum as a Polluting good and the Social Optimum Price of Aluminum Marginal Social Cost--MSC Cost of pollution Supply Optimum Equilibrium Demand 0 QOPTIMUM QMARKET Quantity of Aluminum Copyright © 2004 South-Western SOLUTIONS TO NEGATIVE EXTERNALITIES • Internalizing an externality involves altering incentives so that people take account and bear the cost of the external effects of their actions. Copyright © 2004 South-Western PUBLIC POLICY TOWARD EXTERNALITIES When negative externalities are significant there are two ways to “fix” the market failure: 1. Public Policy through Government action 2. Private solutions through use of the Coase Theorem Copyright © 2004 South-Western PUBLIC POLICY Through GOVERNMENT ACTION There are 2 types of Government Actions: 1. command-and-control policies. 2. market-based policies. Copyright © 2004 South-Western GOVERNMENT PUBLIC POLICY TOWARD EXTERNALITIES 1. Command-and-Control Policies • Usually takes the form of regulations: • Forbid certain behaviors. • Require certain behaviors. • Examples: • Requirements that all students be immunized. • Laws on pollution emission levels • Limits on fish allowed to be caught Copyright © 2004 South-Western GOVERNMENT PUBLIC POLICY TOWARD EXTERNALITIES 2. Market-Based Policies There are 2 types: A. Pigouvian taxes are taxes enacted to correct the effects of a negative externality. Copyright © 2004 South-Western Pigouvian Taxes Pigouvian Tax Price of Pollution Pigovian tax P 1. A Pigouvian tax sets the price of pollution . . . 0 Demand for pollution rights Q 2. . . . which, together with the demand curve, determines the quantity of pollution. Quantity of Pollution Copyright © 2004 South-Western Copyright © 2004 South-Western GOVERNMENT PUBLIC POLICY TOWARD EXTERNALITIES 2. Market-Based Policies B.Cap and Trade permits allow the voluntary transfer of the right to create the negative externality from one firm to another—creating a market for the “right” to pollute! Copyright © 2004 South-Western Pollution Permits: An equivalent solution to taxation Pollution Permits Price of Pollution Supply of pollution permits P Demand for pollution rights 0 2. . . . which, together with the demand curve, determines the price of pollution. Q Quantity of Pollution 1. Pollution permits set the quantity of pollution . . . Copyright © 2004 South-Western GOVERNMENT PUBLIC POLICY TOWARD EXTERNALITIES EXAMPLE of CAP & TRADE PERMITS • Pollution Permits • allow the voluntary transfer of the right to pollute from one firm to another. • A market for these permits will eventually develop. • A firm that can reduce pollution at a low cost may prefer to sell its permit to a firm that can reduce pollution only at a high cost. Copyright © 2004 South-Western Cap and Trade Endorsement “We now believe that tradable permits are the most straightforward system of reducing emissions and creating the incentives necessary for massive reductions.” Kert Davies, research director, Greenpeace USA • Wall Street Journal - August 23, 2005 Copyright © 2004 South-Western COMPARING GOVERNMENT PUBLIC POLICY TOWARD EXTERNALITIES Regulation vs Pigouvian Tax vs Tradeable Permits If the EPA decides it wants to reduce the amount of pollution coming from a specific plant or industry, the EPA could… • tell the firm(s) to reduce pollution by a specific amount (Command/Control Regulation). This costs $ for admin of the agency and enforcement OR • levy a tax of a given amount for each unit of pollution the firm(s) emits (Pigovian Tax). This reduces number of firms in the market OR • create pollution permits that allow the voluntary transfer of the right to pollute from one firm to another. (Cap and Trade Permits). This creates a market for firms to continue in. Copyright © 2004 South-Western PRIVATE SOLUTIONS TO NEGATIVE EXTERNALITIES • Government action is not always needed to internalize a negative externality, or to solve the problem of externalities. Copyright © 2004 South-Western THE COASE THEOREM • The Coase Theorem (1960) is a proposition that if private parties can bargain over the allocation of resources, they can solve the problem of externalities on their own. • Cost/Benefit Analysis needs to include Transaction Costs • Transaction costs –the costs that parties incur in the process of agreeing to and following through on a bargain • Lawyer fees, surveying lands, monitoring equip, etc, are examples of transaction costs Copyright © 2004 South-Western WHEN THE COASE THEOREM FAILS • Sometimes the private solution approach fails because transaction costs can be so high that private agreement is not possible. Copyright © 2004 South-Western EXTERNALITIES AND MARKET INEFFICIENCY • Positive Externalities • Immunizations • Restored historic buildings • Research into new technologies Copyright © 2004 South-Western POSITIVE EXTERNALITIES • In analyzing Positive Externalities, we use an S & D graph of the market • We call the Supply curve the MPC curve, representing the Private cost • We call the Demand curve the MPB (Marginal Private Benefit) curve • We show a shift in the Demand curve to show the greater amount of Demand of this good that we want, and call that new Demand curve the MSB (Marginal Social Benefit) curve Copyright © 2004 South-Western Education and the Social Optimum Price of Education Supply Demand 0 QMARKET QOPTIMUM (Marginal Social Benefit—MSB) Quantity of Education Copyright © 2004 South-Western Copyright © 2004 South-Western Positive Externalities Left alone, the market produces a lesser quantity than is socially desirable. • The intersection of the supply curve—the MPC curve—and the social-value curve—the MSB curve— determines the optimal output level. • For a positive externality, the socially optimal output level is ALWAYS more than the market equilibrium quantity. • The social benefit or value of the good exceeds the private value of the good. Copyright © 2004 South-Western PUBLIC POLICY TOWARD EXTERNALITIES When positive externalities are significant and private solutions are not found, government may attempt to solve the problem through . . . Subsidies. Copyright © 2004 South-Western Achieving the Socially Optimal Output The government can internalize a positive externality by: Providing a subsidy for the production of more of the desired good Copyright © 2004 South-Western