Financial Statements

IAS 1

Wiecek and Young

IFRS Primer

Chapter 2

Related Standards

2

FAS 130 Reporting Comprehensive Income

Related Standards

3

IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations

IFRS 7 Financial Instruments: Disclosures

IAS 8 Accounting Policies, Changes in

Accounting Estimates and Errors

Purpose and Components of

Financial Statements

4

Comparable statements more useful

IAS 1 looks to enhance comparability

Applies to general purpose financial

statements

–

Meets the needs of most users

–

“Financial statements are a structured

representation of the financial position and

financial performance of the entity.”

IAS 1 - Overview

5

Statement of financial position

Statement of comprehensive income (this may be

augmented by a separate income statement)

Statement of changes in equity

Statement of cash flows

Notes including significant accounting policies and

explanatory information

Statement of financial position at the beginning of

the earliest comparative period when an entity

applies an accounting policy retrospectively or

makes a retrospective restatement

Fair Presentation and Compliance

with IFRSs

Should present fairly - faithful representation

Entity must:

–

–

–

6

select and apply appropriate accounting policies keeping in

mind the GAAP hierarchy,

present the information such that it provides, relevant,

comparable and understandable information, and

provide additional disclosures where necessary.

Note disclosures are not a substitute for proper

accounting

May depart from GAAP

Going Concern and Accrual Based

Accounting

7

Accrual basis

Going concern assumed

If not – new basis of accounting

Materiality

8

Omissions or misstatements of items are

material if they could, individually or

collectively, influence the economic decisions

of users taken on the basis of the financial

statements. Materiality depends on the size

and nature of the omission or misstatement

judged in the surrounding circumstances.

The size or nature of the item, or a

combination of both, could be the

determining factor.

Presentation

Identify what is included

Must display the following

1.

2.

3.

4.

5.

9

the name of the entity

whether the financial statements are

consolidated or not

the date of the balance sheet or period covered

the reporting currency and

the level of rounding (e.g. $000s)

Frequency of reporting,

comparability and consistency

10

At a minimum – annual statements

Comparative required unless IFRS permits or

requires otherwise

At least two statements and a third if

retrospective application or restatement

Presentation and classification should

generally stay the same

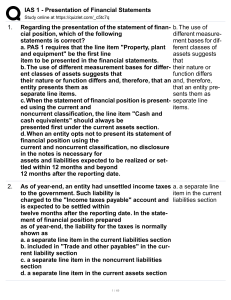

Statement of Financial Position

Information to be Presented in the

Statement of Financial Position

–

Sufficiently different

–

–

–

11

Based on size, function, nature and liquidity, nature,

timing

Different measurement bases

Specific items to be presented separately

May present relevant subcategories

Details re share capital

Current Assets and Liabilities

12

Segregate current versus non

Order of liquidity

Combined

Amounts beyond 12 months

Current Assets

An entity classifies assets as current assets

when:

(a) it expects to realize the asset, or intends to sell or consume it, in its

normal operating cycle;

(b) it holds the asset primarily for the purpose of trading;

(c) it expects to realize the asset within twelve months after the reporting

period; or

(d) the asset is cash or a cash equivalent (as defined in IAS 7) unless

the asset is restricted from being exchanged or used to settle a

liability for at least twelve months after the reporting period.

13

Current Liabilities

14

An entity classifies liabilities as current

liabilities when:

Statement of Comprehensive Income

15

(a) revenue;

(b) finance costs;

(c) share of the profit or loss of associates and joint ventures accounted for using

the equity method;

(d) tax expense;

(e) a single amount comprising the total of:

(i) the post-tax profit or loss of discontinued operations and

(ii) the post-tax gain or loss recognized on the measurement to fair value less

costs to sell or on the disposal of the assets or disposal group(s)

constituting the discontinued operation;

(f) profit or loss;

(g) each component of other comprehensive income classified by nature (excluding

amounts in (h));

(h) share of other comprehensive income of associates and joint ventures

accounted for using the equity method; and

(i) total comprehensive income.

Total comprehensive income

16

…the change in equity during a period

resulting from transactions and other events,

other than those changes resulting from

transactions with owners in their capacity as

owners.

includes all components of profit or loss and

of other comprehensive income as noted

above

Other Comprehensive Income

1.

2.

3.

4.

5.

17

changes in the revaluation surplus for property,

plant and equipment and intangible assets,

certain actuarial gains/losses on defined benefit

plans,

gains/losses arising on translation of financial

statements of foreign operations,

gains/losses arising from remeasuring available for

sale securities and

gains/losses on cash flow hedges.

(IASCF, IAS 1.7)

Presentation of Income Statements

Nature of Expense presentation

Revenue X

Other income

X

Changes in inventories of finished goods and work in progress

Raw materials and consumables used X

Employee benefits expense X

Depreciation and amortization expense X

Other expenses

X

Total expenses

(X)

Profit before tax

X

18

X

Presentation of Income Statements

19

Function of Expense presentation:

.

Presentation

of Income Statements

Which one?

–

–

20

Either may be issued

Survey - 55% presented the statement by function

of expense and 45% by nature of expense

Statement of Changes in Equity

1.

2.

3.

21

This statement presents the following:

total comprehensive income

for each component of equity, the effects of

retrospective application/restatement

reconciliation between the carrying amount

of each component of equity at the

beginning and end of the period.

Statement of Changes in Equity

Notes:

–

–

–

–

–

–

–

22

augment the basic statements

include information about the way they have been

prepared

provide additional descriptive and supportive

information

should be cross-referenced

accounting policies

key sources of estimation uncertainty

nature and structure of an entity’s capital and how

it is managed

Samples of and Excerpts from

Selected Statements

23

Samples of and Excerpts from

Selected Statements

24

Statement of Comprehensive Income

25

Statement of Changes in Equity

26

Looking Ahead

27

Part of MoU

Phase A complete

Phase B – in progress

Discussion paper issued in 2009

Phase B

28

consistent principles for aggregating information in

each financial statement

the totals and subtotals that should be reported in

each financial statement

whether the direct or the indirect method of

presenting operating cash flows provides more

useful information

whether components of other comprehensive

income should be reclassified to profit or loss and, if

so, the characteristics of the transactions and events

that should be reclassified and when reclassification

should be made

Phase B

(taken from Summary of tentative preliminary views (IASB and FASB))

29

Copyright © 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

by Access Copyright is unlawful. Requests for further

information should be addressed to the Permissions

Department, John Wiley & Sons Inc., 111 River Street, Hoboken,

NJ 07030-5774, (201) 748-6011, fax (201) 748-6008, website

http://www.wiley.com/go/permissions. The purchaser may make

back-up copies for his or her own use only and not for

distribution or resale. The author and the publisher assume no

responsibility for errors, omissions, or damages caused by the

use of these programs or from the use of the information

contained herein.