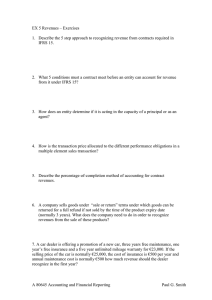

STANDARDS

advertisement