unicus advisors private limited - Pune West Study Circle of WIRC of

advertisement

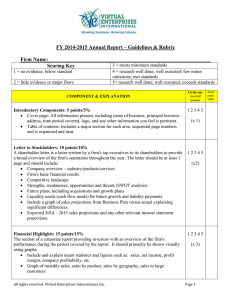

PREPARATION OF PROJECT REPORT AGENDA • What is a project report? • What are different types of bank finances available? • What are the typical steps in availing a debt? • What are the typical contents of project report? • How to make financial projections and bank proposals? PROJECT REPORT Project report is a document stating the existing facts about the organisation, projected business model, feasibility studies, lenders assistance required and own commitments. TYPES OF BANK FINANCES Fund based • Term Loan • Foreign currency loan • General Purpose Corporate Loan • Working Capital Term Loan • Working Capital Loan • Equipment Finance • Lease rental discounting • Various products for import and export financing • Collateral free unsecured loans • Structured transactions Non fund based • Bank guarantee and Letter of Credit limits UNDERSTANDING OF THE PROJECT • Understanding the project and finalizing the financial structure Setting up a plant Construction of a commercial or residential complex Funding for infrastructure project Funding for obtaining capital assets Working capital finance • Understanding the required end use of money Bank money cant be used for acquisition of land, capital market transactions and speculative businesses IDENTIFYING THE RIGHT BANK Every bank has created a niche in the current competitive market and the advisor should be capable of identifying the banks which will take up the proposal Examples: Infrastructure projects: Funding to SME’s: Established Manufacturing companies: Greenfield projects: Quasi equity fund raising: Transportation finance: Financing with high risk and less security cover but good business model: DOCUMENT VERIFICATION Before starting the credit appraisal process or preparation of a project report, one must obtain the following documents: a. Memorandum and Articles of Association b. List of directors and partners c. Revenue records of land d. Registration under Shop and Establishment Act e. Audited financial statements for atleast prior three years and unaudited financial statements as at the date of project appraisal f. List of securities the client will be offering PROJECT REPORT The typical contents of a project report are as under: a. Executive summary b. Proposal to the banks c. Project details d. Promoter details e. Details of proposed financial closure f. Financial projections and ratio analysis g. Sensitivity analysis h. Market and technical analysis PROPOSAL TO BANKS This is the wish list of the borrower and your negotiations should start based in this document Typically following points need to be covered in a proposal: a. Total amount of facility b. Purpose of loan c. Desired rate of interest d. Drawdown and repayment schedules e. Desired security to be offered f. Processing fees g. Financial covenants PROJECT DETAILS This portion should provide the complete details and operational feasibility of a project • Land details • Man, Machine and Material details • Product specification. Details of raw materials and end use of finished product • List of top vendors and suppliers • List of assets • SWOT analysis FEASIBILITY ANALYSIS Any proposal will be tested for feasibility by the bankers. Primarily two types of feasibility analysis are done: • Technical feasibility • Market feasibility FINANCIAL VIABILITY Following are the key drivers to prepare the financial projections. Bankers will look at these numbers at the time of credit appraisal. a. Sales volumes b. Growth pattern c. Efficiency in operation d. Short term survival e. Long term survival f. Safety of funds g. Earnings from the unit to the bank FINANCIAL PROJECTIONS • Financial closure. Debt equity ratio to be finalised • Projected financial statements including Balance Sheet, Profit and Loss Account and Cash Flow Statement • Computation of relevant ratios, especially DSCR and ICR. • Sensitivity analysis for major attributes to test financial closure • Detailed list of projected end use of funds incase of a term loan. QUESTIONS THANK YOU