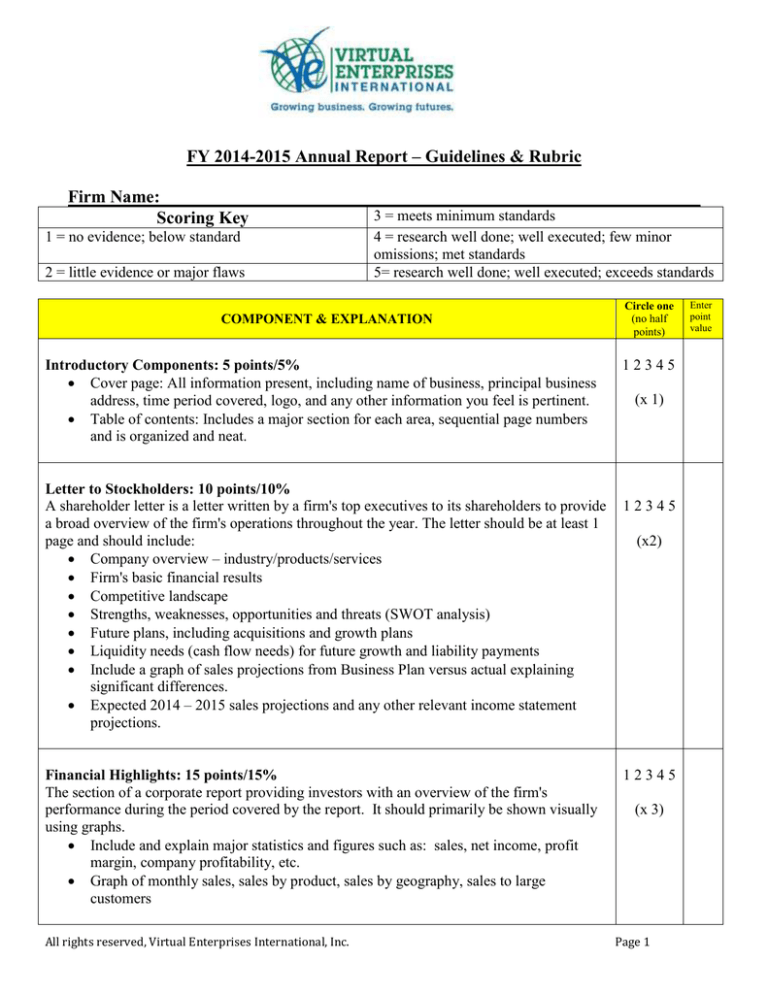

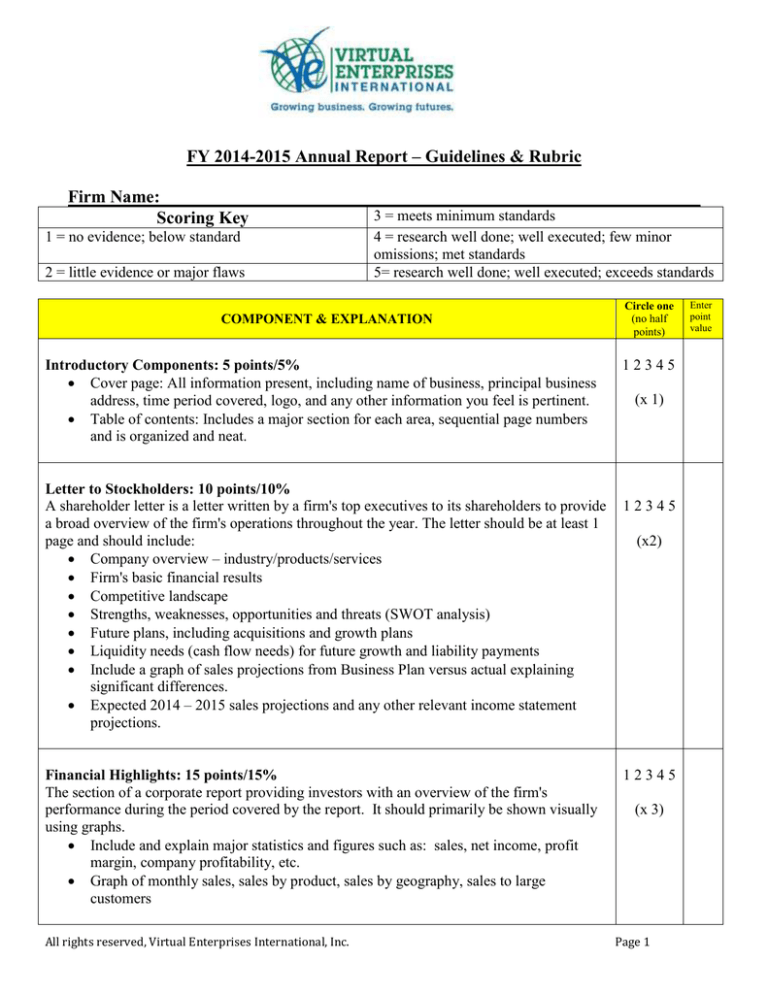

FY 2014-2015 Annual Report – Guidelines & Rubric

Firm Name: _____________________________________________________________

3 = meets minimum standards

Scoring Key

1 = no evidence; below standard

2 = little evidence or major flaws

4 = research well done; well executed; few minor

omissions; met standards

5= research well done; well executed; exceeds standards

COMPONENT & EXPLANATION

Introductory Components: 5 points/5%

Cover page: All information present, including name of business, principal business

address, time period covered, logo, and any other information you feel is pertinent.

Table of contents: Includes a major section for each area, sequential page numbers

and is organized and neat.

Letter to Stockholders: 10 points/10%

A shareholder letter is a letter written by a firm's top executives to its shareholders to provide

a broad overview of the firm's operations throughout the year. The letter should be at least 1

page and should include:

Company overview – industry/products/services

Firm's basic financial results

Competitive landscape

Strengths, weaknesses, opportunities and threats (SWOT analysis)

Future plans, including acquisitions and growth plans

Liquidity needs (cash flow needs) for future growth and liability payments

Include a graph of sales projections from Business Plan versus actual explaining

significant differences.

Expected 2014 – 2015 sales projections and any other relevant income statement

projections.

Financial Highlights: 15 points/15%

The section of a corporate report providing investors with an overview of the firm's

performance during the period covered by the report. It should primarily be shown visually

using graphs.

Include and explain major statistics and figures such as: sales, net income, profit

margin, company profitability, etc.

Graph of monthly sales, sales by product, sales by geography, sales to large

customers

All rights reserved, Virtual Enterprises International, Inc.

Circle one

(no half

points)

12345

(x 1)

12345

(x2)

12345

(x 3)

Page 1

Enter

point

value

Board of Directors and Management: 5 points/5%

A list of the names and position titles of the company’s Board of Directors and top

management team.

List board members alphabetically by last name.

All NYC Boards of Directors include Iris Blanc, Nick Chapman, John Jastremski,

school principal, VE coordinator, and corporate mentors (if the firm has one)

List top management of the company.

Corporate Message: 10 points/10%

This should not be a section in your annual report, but pervades the entire report. Can be

captured through visuals (pictures). Please refer to company annual reports such as:

McGraw Hill, Coca Cola, Disney, etc. Typically included is the following:

Corporate mission: Mission statements usually include the company’s mission as it

relates to its products, services and customer philosophy.

Management philosophy: How do your managers make decisions? Include an

organization chart.

Product/Service: What is the company selling and what is the product (or key

products) including product features that will satisfy customer needs?

Revenue and Profitability: Describe by product.

Corporate Culture: What are the values, visions, norms, etc. of your organization?

Financial Statements and Footnotes: 20 points/20%

Include all financial statements which should show all financial activities of your business

and provide information on the company’s financial performance. This will include a:

Financial statements comparing projected to actual numbers showing percentage

changes and explaining significant differences. Statements that must be included:

o Income Statement

Actual vs. Projected

o Balance Sheet

Actual vs. Projected

o Cash Budget

Actual vs. Projected

Ratio analysis: Current Ratio and Quick Ratio, Gross Profit Margin Ratio, Net Profit

Margin Ratio, Debt to Asset Ratio

Explanation of balances in ‘Other’ categories such as Other Assets, Other Liabilities,

etc.

Footnotes to the financial statements

Financial Write-up. Your write-up can include the following:

o A written summary/explanation/interpretation of the financial data.

o Discuss cash flows.

o Discuss corporate debt levels. Break out the Current Loan Payable (due over

next 12 months) from the Long-Term Loan Payable on your balance sheet.

All rights reserved, Virtual Enterprises International, Inc.

12345

(x1)

12345

(x 2)

12345

(x 4)

Page 2

Management Discussion and Analysis: 20 points/20%

Include a narrative discussion analyzing the company’s performance, financial condition and

result of operations and cash flows for the fiscal year. Management should also discuss the

upcoming year, growth expectations, future goals and growth strategies. Management

should include the following in its analysis and include visuals wherever possible:

Financial performance: A brief discussion of the financial statements highlighting

important data. The financial statements are the most important part of the company's

annual report because they allow an investor or stakeholder the ability to better

understand and see what is going on with the company’s finances.

Company goals: Both financial and non-financial goals and how they were achieved.

These can be broken out by department.

Marketing and Advertising Plan: What actually happened versus what you planned

and why was it different?

Market Research: What market research has your company performed and what data

was collected? Graph this data if possible.

Advertising campaign: Which did you choose and did it work? How do you know?

Target Markets: Who are they and include any concentration in a particular market

or geography. Include a graph.

Trade Show Research: Why did your company design its booth the way it did? How

did you promote yourself prior to and at the trade show? Show your actual trade

show sales versus budgeted and include a graph showing this data.

Corporate website: Did your website increase sales? Include a graph comparing web

visits to sales.

Internet Sales Plan: What actually happened month-to-month versus what you

planned and why was it different. Include a graph.

Brand Awareness: How did you make your customers aware of your brand? What

image did you create in your customer’s mind?

Risk: What were the risks you expected? Did those turn out to be your actual risks?

How did you handle them?

Strategic Direction: Discuss plans for future growth such as new products, etc.

12345

Additional VE Supporting Documentation for Year-End Reporting Requested:

15 points/15%

1. Annual Report – should include all above components

2. Bank Statement showing beginning balance at 5/1/14 and ending balance at 4/30/15

3. Loan Amortization Table – for loan that indicates key terms of loan, length, interest

rate, etc.

4. Loan Payment Table (if applicable) – shows what your company actually paid

5. Copy of contract used for sales to non-virtual entities with required contact

information (if applicable) with breakout of sales and tax.

6. Form 1120 VE – corporate tax return

7. Any additional supporting documents including April 2015 Payroll Register, 20142015 Asset Log, Sales Journals, etc.

12345

All rights reserved, Virtual Enterprises International, Inc.

(x 4)

(x 3)

Page 3