continued - Cengage Learning

advertisement

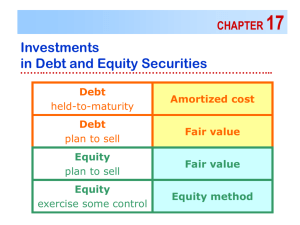

Chapter 14 18th Edition Investments in Debt and Equity Securities Intermediate Financial Accounting Earl K. Stice James D. Stice PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2012 Cengage Learning 14-1 Why Companies Invest in Other Companies • • • • • Safety cushion Cyclical cash needs Investment for a return Investment for influence Purchase for control 14-2 Cyclist Cash Needs • Some companies operate in seasonal business environments that need cyclical inventory buildups requiring large amounts of cash, followed by lots of sales and cash collections. Examples include: Toy stores Firework retailers Halloween retailers 14-3 Investment for Influence In general, companies can invest in other companies for many reasons other than to earn a return. Some reasons are: • to ensure a supply of raw materials (e.g., Coca- Cola) • • to influence the board of directors to diversify product offerings 14-4 Purchase for Control • When a company purchases enough of another company to be able to control operating, investing, and financing decisions, different accounting treatment is required for that acquisition. • For accounting purposes, a parent company is required to report the results of all of its subsidiaries of which it owns more than 50% as if the parent and subsidiaries are one company. 14-5 Classification of Investment Securities • Debt securities are financial instruments issued by a company that typically have the following characteristics: a maturity value representing the amount to be repaid to the debt holder at maturity, an interest rate that specifies the periodic interest payments, and a maturity date indicating when the debt obligation will be redeemed. (continued) 14-6 Classification of Investment Securities • Equity securities represent ownership in a company. These shares of stock typically carry with them the right to collect dividends and to vote on corporate matters. They are an attractive investment because of the potential for significant increases in the price of the security. (continued) 14-7 Classification of Debt and Equity Securities • Held-to-maturity securities are debt securities purchased by a company with the intent and ability to hold those securities until they mature. This category includes only debt securities because equity securities typically do not mature. The company must have the intention of holding the security until it matures. (continued) 14-8 Classification of Debt and Equity Securities • • Available-for-sale securities are equity securities that are not considered trading securities and are not accounted for using the equity method. Most of the typical company’s investment securities are classified as available for sale. (continued) 14-9 Classification of Debt and Equity Securities • • Trading securities are debt and equity securities purchased with the intent of selling them in the near future. Trading involves frequent buying and selling of securities, generally for the purpose of “generating profits on short-term differences in price.” (continued) 14-10 Classification of Debt and Equity Securities • Equity method securities are equity • securities purchased with the intent of being able to control or significantly influence the operations of the investee. A large block of stock (presumed to be at least 20% of the outstanding stock unless there exists evidence to the contrary) must be owned to be classified as an equity method security. (continued) 14-11 The Fair Value Option • • Under the fair value option, a company has the option to report, at each balance sheet date, any or all of its financial assets and liabilities at their fair values on the balance sheet date. The election of the fair value option for an investment security “trumps” the classification of the security as trading, available for sale, held to maturity, and equity method. 14-12 Classification of Investment Securities According to IFRS • The classification of investment securities • • under IFRS 9 is very similar to the classification categories under U.S. GAAP. The fair value option for financial assets also exists in IFRS under the provisions of IFRS 9. In May 2010, the IASB released an exposure draft proposing extension of the fair value option to financial liabilities. 14-13 Purchase of Debt Securities • On May 1, $100,000 in U.S. Treasury notes are purchased at 104¼, including brokerage fees. • Interest is 9%, payable semiannually on January 1 and July 1 (accrued interest of $3,000 would be added to the purchase price). (continued) 14-14 Purchase of Debt Securities • The debt securities are classified by the purchaser as trading securities because management will sell the securities if a change in the price will result in a profit. • The entries to record the transactions related to this purchased using the asset approach, then the revenue approach are shown in the following slides. (continued) 14-15 Purchase of Debt Securities Asset Approach May 1 Investment in Trading Securities Interest Receivable Cash July 1 Cash Interest Receivable Interest Revenue 104,250 3,000 107,250 4,500 3,000 1,500 (continued) 14-16 Purchase of Debt Securities Revenue Approach May 1 Investment in Trading Securities Interest Revenue Cash July 1 Cash Interest Revenue 104,250 3,000 107,250 4,500 4,500 14-17 Purchase of Equity Securities • Gondor Enterprises purchased 300 shares of Boromir Co. stock at $75 per share plus brokerage fees of $80 (as trading securities) and 500 shares of Faramir Inc. stock at $50 per share plus brokerage fees of $30 (as available-for-sale securities). • The journal entry to record the purchase is shown on Slide 14-34. (continued) 14-18 Purchase of Equity Securities Investment in Trading Securities— Boromir Co. 22,500* Investment in Available-for-Sale Securities—Faramir Inc. 25,000* Cash 47,500 *For securities accounted for using the fair value option, brokerage fees and other upfront costs are expensed when incurred. Computations: $300 x $75 = $22,500 $500 x $50 = $25,000 14-19 Recognition of Revenue from Debt Securities • Assume that on January 1, 2010, Silmaril Technologies purchased 5-year, 10% bonds with a face value of $100,000 and interest payable semiannually on January 1 and July 1. The market rate on similar bonds is 8%. • The first step is to calculate the market price of the bonds. (continued) 14-20 Recognition of Revenue from Debt Securities Present value of principal: FV = $100,000; N = 10; I = 4% Present value of interest payments: PMT = $5,000; N = 10; I = 4% Total present value of the bonds $ 67,556 40,554 $108,110 14-21 Interest Revenue for Debt Securities Classified as Trading When trading securities are purchased: Investment in Trading Securities Cash 108,110 108,110 When interest is received: Cash Interest Revenue 5,000 5,000 14-22 Interest Revenue for Debt Securities Classified as Held to Maturity The initial purchase: Investment in Held-to-Maturity Securities Cash 108,110 108,110 To determine the amount of premium to amortize each period, Silmaril would prepare an amortization table based on the effectiveinterest method of amortization. (continued) 14-23 Interest Revenue for Debt Securities Classified as Held to Maturity When the first interest payment is received: Cash 5,000 Interest Revenue Investment in Held-to-Maturity Securities (continued) 4,324 676 14-24 Interest Revenue for Debt Securities Classified as Held to Maturity When the second interest payment is received: Cash 5,000 Interest Revenue Investment in Held-to-Maturity Securities 4,297 703 14-25 Recognition of Revenue from Equity Securities • • In those instances where the level of ownership in the investee is such that the investor is able to control or significantly influence decisions made by the investee, the use of the equity method is appropriate. The ability of the investor to exercise significant influence over decisions as dividend distribution and operational and financial administration may be indicated in several ways, as listed in Slide 14-44. (continued) 14-26 Recognition of Revenue from Equity Securities Significant influence may be indicated by decisions affecting: • Representation on the investee’s board of directors • Participation in the policy-making process • Material Intercompany transactions • Interchange of management personnel • Technical dependency of investee on investor • Percentage of outstanding voting stock owned 14-27 Determining the Appropriate Accounting Method Account for as Equity method and trading or consolidation available-for-sale procedures Equity method Ownership Percentage No significant influence 0% 20% Significant influence Control 50% 100% 14-28 Revenue for Equity Securities Classified as Trading and Available for Sale When an investment in another company’s stock does not involve either a controlling interest or significant influence, it is classified as either trading or available for sale. Assume that Gondor Enterprises receives the following dividends from its investees: (continued) 14-29 Revenue for Equity Securities Classified as Trading and Available for Sale The journal entry to record receipt of the dividends would be: Cash Dividend Revenue 2,475 2,475 [(300 × $2.00) + (500 × $3.75) = $2,475] 14-30 Revenue for Securities Classified As Equity Method Securities • Under the equity method, the investment is initially recorded at cost. • The investment account is periodically adjusted to reflect changes in the underlying net assets of the investee. Increased to reflect a proportinate share of the earnings of the investee or decreased to show any losses reported. Preferred dividends declared reduce the investment account; dividends received also reduce the investment account. (continued) 14-31 Revenue for Securities Classified As Equity Method Securities BioTech Inc. purchased 40% of the outstanding stock of Medco Enterprises on January 1 of the current year by paying $200,000. During the year, Medco reported net income of $50,000 and paid dividends of $10,000. Investment in Medco Enterprise Stock: Investment in Medco Enterprise Stock Cash To record the purchase of 40% of Medco stock. 200,000 200,000 (continued) 14-32 Revenue for Securities Classified As Equity Method Securities Recognize a percentage of net income: Investment in Medco Enterprise Stock 20,000 Income from Investment in Medco Enterprises Stock ($50,000 × 0.40) To record the recognition of revenue from investment in Medco. 20,000 Record receiving a dividend: Cash ($10,000 × 0.40) Investment in Medco Enterprises Stock To record the receipt of dividend on Medco stock. 4,000 4,000 14-33 Comparing the Provisions of FASBS ASC Topics 320 and 323 • To contrast and illustrate the accounting entries under various methods, assume that Powell Corporation purchased 5,000 shares of San Juan Company common stock on January 2 at $20 per share, including commissions and other costs. • San Juan has a total of 25,000 shares outstanding. Compare the two methods in Exhibit 14-10 on Slide 14-53. (continued) 14-34 Equity Method: Purchase for More than Book Value • On January 2, 2013, the net assets of Stewart Inc. was $500,000 at the time Phillips Manufacturing Co. purchased 40% of the common shares for $250,000. • Based on the ownership interest, the market value of the net assets of Stewart Inc. would be $625,000 ($250,000/0.40), which is $125,000 more than the book value. Only $50,000 of this is attributed to depreciable assets. The remaining $75,000 is attributed to a special operating license. (continued) 14-35 Equity Method: Purchase for More than Book Value • The average remaining life of the depreciable assets is 10 years and the license is to be amortized over 20 years. Phillips Manufacturing Co. would adjust its share of Stewart Inc.’s net income as follows: Additional depreciation ($50,000 × 0.40)/10 License amortization ($75,000 × 0.40)/20 $2,000 1,500 $3,500 (continued) 14-36 Equity Method: Purchase for More than Book Value Each year for the first 10 years, Phillips would make the following entry in addition to entries made to recognize its share of Stewart Inc.’s income and dividends. Income from Investments in Stewart Inc. Stock Investment in Stewart Inc. Stock 3,500 3,500 To adjust share of income on Stewart Inc. common stock for proportionate depreciation on excess of market value of depreciable property, $2,000, and for amortization of the unrecorded license, $1,500. (continued) 14-37 Equity Method: Purchase for More than Book Value • After the 10th year, the adjustment would be for $1,500 until the license amount is fully amortized. • Stewart Inc. declared and paid dividends of $70,000 during 2013 and reported net income of $150,000 for the year. The investment would be shown on Phillip’s balance sheet at $278,500, computed as shown on Slide 14-58. (continued) 14-38 Equity Method: Purchase for More than Book Value The adjustments for additional depreciation and intangible asset amortization are needed only when the purchase price is greater than the underlying book value at the date of acquisition. 14-39 Equity Method: Joint Venture • • • A joint venture is a form of off-balancesheet financing. Joint ventures are accounted for using the equity method. Even if the joint venture does not have a 50%–50% ownership structure, the minority interest will still account for the joint venture using the equity method. (continued) 14-40 Equity Method: Joint Venture Owner A Company and Owner B Company each own 50% of Ryan Julius Company, which does research and marketing for the products of both Owner A and Owner B. Ryan Julius has assets of $10,000 and liabilities of $9,000. Owner A Balance Sheet Investment in Ryan Julius [($10,000 – $9,000) x 0.50] $500 Owner B Balance Sheet Investment in Ryan Julius [($10,000 – $9,000) x 0.50] $500 14-41 Equity Method Accounting According to IFRS • Equity method accounting under IFRS is the same, in all important aspects, as under U.S. GAAP. • • The relevant standard is IAS 28. Under IFRS, the term “associate” is used for what is called an “equity method investee” under U.S. GAAP. 14-42 Accounting for Temporary Changes in the Fair Value of Securities Eastwood Incorporated purchased five different securities on March 23, 2011. Their fair value is shown as of December 31, 2013. (continued) 14-43 Accounting for Temporary Changes in the Fair Value of Securities Initial Purchase Entry—2013 Investment in Trading Securities 11,000 Investment in Available-for-Sale Securities 17,000 Investment in Held-to-Maturity Securities 20,000 Cash 48,000 (continued) 14-44 Trading Securities At the end of 2013, the value of the trading securities decreased from $11,000 cost to $10,500 fair value. As a result, the following entry would be made: December 31, 2013: Unrealized Loss on Trading Securities Market Adjustment—Trading Securities 500 500 14-45 Available-for-Sale Securities At the end of 2013, the available-for-sale portfolio had increased from $17,000 to $17,600. This increase in fair value of the securities above their cost would be recorded as follows: Market Adjustment—Available-for-Sale Securities Unrealized Increase/Decrease in Value of Available-for-Sale Securities 600 600 14-46 Accounting for the Change in Value of Securities Trading Securities—2014 By the end of 2014, trading securities have increased in value from $10,500 to $11,300. (continued) 14-47 Accounting for the Change in Value of Securities The account, “Market Adjustment—Trading Securities” should have a debit balance of $300. The “Before Adjustment Balance” is a 500 credit; a carry over from 2013. The adjusting entry is as follows: The adjusting entry is as follows: Market Adjustment—Trading Securities 800 Unrealized Gain on Trading Securities (continued) 800 14-48 Accounting for the Change in Value of Securities The balance in Market Adjustment—Trading Securities would be added to Investment in Trading Securities and reported on the balance sheet. The $800 unrealized gain would be included in the computation of net income for 2014. (continued) 14-49 Accounting for the Change in Value of Securities Available-for-Sale Securities—2014 At the end of 2014, the fair value of the available-for-sale securities has decreased from $17,600 to $17,200. (continued) 14-50 Accounting for the Change in Value of Securities The market adjustment account should have a $200 debit balance. The adjusting entry is as follows: Unrealized Increase/Decrease in Value of Availablefor-Sale Securities ($17,600 ─ $17,200) Market Adjustment—Available-for-Sale Securities (continued) 400 400 14-51 Accounting for “Other-Than-Temporary” Declines in the Fair Value of Securities If a decline in the fair value of an individual security is judged to be other than temporary, regardless of whether the security is debt or equity and regardless of whether it is being accounted for as a trading, available-for-sale, held-to-maturity, or equity security, the cost basis of that security should be reduced by crediting the investment account. (continued) 14-52 Accounting for “Other-Than-Temporary” Declines in the Fair Value of Securities In Staff Accounting Bulletin No. 59, the SEC staff suggest that one consider the following in determining whether a decline in fair value is other than temporary: • How long has the fair value of the security been below its original cost? • What is the current financial condition of the investee and its industry? • Will the investor’s plans involve holding the security long enough for it to recover its value? 14-53 Sale of Securities • A realized gain or loss occurs when an arm’slength transaction has occurred and a security has actually been sold. The gain or loss is recognized on the income statement. • An unrealized gain or loss arises when the fair value of the security changes, yet the security is still held by the investor. Unrealized gains or losses may or may not be recognized, depending upon the security’s classification or whether the company has elected the fair value option. (continued) 14-54 Sale of Securities For Silmaril Technologies (Slides 14-36 to 1442), assume that the debt securities are sold on April 1, 2014, for $103,000, which includes accrued interest of $2,500. The carrying value of the debt security on January 1, 2014, is $105,240. Interest revenue of $2,105 (105,240 x 0.08 x 3/12) would be recorded, and a receivable relating to interest of $2,500 would be established. To go to Slide 14-36, left click on the button using your mouse. To return, type “78” and press “Enter.” (continued) 14-55 Sale of Securities To record accrued revenue and amortize premium: Interest Receivable Investment in Held-to-Maturity Securities Interest Revenue 2,500 395 2,105 Entry to record sale: Cash Realized Loss on Sale of Securities Interest Receivable Investment in Held-to-Maturity Securities 103,000 4,345 2,500 104,845 14-56 Impact of Sale of Securities on Unrealized Gains and Losses At the beginning of Year 1, Levi Company purchased a portfolio of trading securities for $10. At the end of Year 1, the securities had a value of $12. At the end of Year 2, the same securities are sold for $9. Unrealized Loss— Trading 2 Market Adjustment— Trading 2 (continued) 14-57 Impact of Sale of Securities on Unrealized Gains and Losses When the securities are sold at the end of Year 2 for $9, the entry will reflect only a $1 loss. Year 2 Cash Realized Loss—Trading Investment Securities—Trading 9 1 10 Realized loss is the difference between the selling price and the original cost of the securities. 14-58 Derecognition According to FASB ASC Topic 860, a transfer of a financial asset is accounted for as a sale (resulting in derecognition—transferring assets and corresponding liabilities from the balance sheet) when the transfers satisfy each of the following three conditions listed on Slides 14-83 and 14-84. (continued) 14-59 Derecognition 1. Legal control: The transferor has given up legal claim to the assets, meaning that even if it declares bankruptcy its creditors cannot go after the transferred assets. 2. Actual control: The transferor cannot prevent the transferee from using the transferred assets however desired, such as selling them or pledging them as collateral for a loan. (continued) 14-60 Derecognition 3. Effective control: The transferor does not have the right to force the transferee to return the assets, such as with a repurchase agreement. 14-61 Transferring Debt and Equity Securities Between Categories The Eastwood Inc. example used earlier will serve to demonstrate transferring securities between categories. As of December 31, 2014, Eastwood Inc. had the following securities: Left click the button with your mouse to review the Eastwood Inc. material. Type “87” and press “Enter” to return. 14-62 (continued) Transferring Debt and Equity Securities Between Categories During 2015, Eastwood Inc. elects to reclassify certain of its securities. The category being transferred from, and to, along with the fair value for each security on the date of the transfer, is as follows: 14-63 From the Trading Security Category Eastwood Inc. elects to reclassify security 2 from a trading security to an available-for-sale security. Investment in Available-for-Sale Securities Market Adjustment—Trading Securities Unrealized Gain on Transfer of Securities Investment in Trading Securities 3,800 600 200 3,000 14-64 Into the Trading Security Category Eastwood Inc. elects to reclassify security 4 from an available-for-sale security to a trading security. Investment in Trading Securities 10,300 Market Adjustment—Available-forSale Securities 1,300 Unrealized Loss on Transfer of Securities 1,700 Unrealized Increase/Decrease in Value of Available-for-Sale Securities 1,300 Investment in Available-for-Sale Securities 12,000 14-65 From the Held-to-Maturity to the Available-for-Sale Category Eastwood Inc. has elected to reclassify security 5 from a security being held until maturity to one that is available to be sold. The security’s fair value on the date of transfer is $20,400. Investment in Available-for-Sale Securities Unrealized Increase/Decrease in Value of Available-for-Sale Securities Investment in Held-to-Maturity Securities 20,400 400 20,000 14-66 From the Available-for-Sale to the Held-to-Maturity Category Eastwood Inc. elects to reclassify security 3 from one that is available to be sold to a security that will be held until maturity. The fair value on the date of the transfer is $5,900. Investment in Held-to-Maturity Securities 5,900 Unrealized Increase/Decrease in Value of Available-for-Sale Securities 600 Investment in Available-for-Sale Securities 5,000 Decline in value since Market Adjustments—Available-forlast balance sheet date Sale Securities 1,500 14-67 Cash Flows from Gains and Losses on Available-for-Sale Securities Caesh Company came into existence with a $1,000 investment by owners on January 1, 2013, and entered into the following transactions during 2013. Cash sales $ 1,700 Cash expenses (1,400) Purchase of investment securities (600) Sale of investment securities (costing $200) 170 (continued) 14-68 Cash Flows from Gains and Losses on Available-for-Sale Securities The investment securities are classified as available for sale. The market value of the remaining securities was $500 on December 31, 2013. Caesh Company’s net income for 2013 can be computed as follows: Sales Expenses Operating income Realized loss on sale of investment securities ($200 – $170) Net income $1,700 (1,400) 300 (30) $270 (continued) 14-69 Cash Flows from Gains and Losses on Available-for-Sale Securities The statement of cash flows for Caesh Company for 2013 can be prepared as follows: 14-70 Cash Flows from Gains and Losses on Trading Securities If the investment securities purchased by Caesh Company are classified as trading securities and are deemed to have been acquired for operating purposes, the unrealized gain appears in the Operating Activities section. Net income is $370 instead of $270 because the $100 unrealized increase in the fair value of the portfolio is reported as an unrealized gain on the income statement. 14-71 Equity Method Securities and Operating Cash Flows • When a company owns equity method securities, an adjustment to operating cash flow must be made to reflect the fact that the cash received from the securities in the form of dividends is not equal to the income from the securities included in the computation of net income. • Daltone Company owns 30% of the outstanding shares of Chase Company. Chase Company’s net income for the year was $100,000, and cash dividends were $40,000. (continued) 14-72 Equity Method Securities and Operating Cash Flows • Daltone would include $30,000 ($100,000 x 0.30) in its income statement as income from the investment. • Daltone received $12,000 ($40,000 x 0.30) in cash dividends from its investment in Chase. Daltone would report a subtraction in the Operating Activities section for the $18,000 ($30,000 – $12,000) difference between the income reported and the cash dividends received. 14-73 Required Additional Disclosures 1. Trading securities The change in net unrealized holding gain or loss that is included in the income statement. 2. Available-for-sale securities Aggregate fair value, gross unrealized holding gains and gross unrealized holding losses, and amortized cost basis by major security type. (continued) 14-74 Required Additional Disclosures The proceeds from sales of availablefor-sale securities and the gross realized gains and losses on those sales and the basis on which cost was determined in computing realized gains and losses. The change in net unrealized holding gain or loss on available-for-sale securities that has been included in stockholder’s equity during the period. (continued) 14-75 Required Additional Disclosures 3. Held-to-maturity securities: Aggregate fair value, gross unrealized holding gains and gross unrealized holding losses, and amortized cost basis by major security type. 4. Transfer of securities between categories: Gross gains and losses included in earnings from transfer of securities from available-for-sale into the trading category. (continued) 14-76 Required Additional Disclosures For securities transferred from held-tomaturity, the company should disclose the amortized cost amount transferred, the related realized or unrealized gain or loss, and the reason for transferring the security. 14-77 Measurement of Impairment • • A creditor shall measure for impairment for loans with no market value at the present value of expected future cash flows discounted at the loan’s effective interest rate. The impairment is recorded by creating a valuation allowance account and charging the estimated loss to bad debt expense. (continued) 14-78 Measurement of Impairment • If a loan agreement is restructured in a troubled debt restructuring, the interest rate to be used to discount the new modified contract terms is based on the original contract rate. 14-79 Nature and Classifications of Paid-In Capital • • • A corporation is a legal artificial entity separate from its owners. Individuals contribute capital for which the corporation issues stock certificates evidencing ownership interests. Stockholders elect a board of directors whose members oversee the strategic and long-run planning of the corporation. 14-80 Chapter 14 ₵ The End $ 14-81 14-82