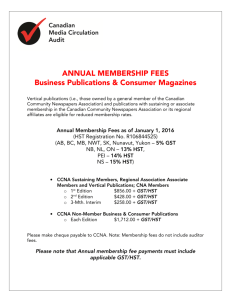

The Harmonized Sales Tax

advertisement

11 The Harmonized Sales TAX The Harmonized Sales Tax On July 1, 2010 the Harmonized Sales Tax (HST) took effect in Ontario replacing the federal goods and services tax (HST) and the provincial sales tax (PST). The seller of the goods or services is the one responsible for charging, collecting, and remitting the tax. The HST is not a simple tax. Only the basic rules are covered. Previously in Ontario, PST (also called RST) was applied at every step in the creation of a product. Hidden Charges Those multiple PST charges were embedded in the price you paid at the store – even though you couldn't see it. And of course, you paid PST on the final purchase price. Here's an example of how PST was hidden in the cost of a suit jacket. Under the old system, taxes were paid at every step in production and passed on to consumers. Under the new HST system, most of those embedded costs are removed and savings can be passed on: The Facts on the HST Businesses that were registered for GST are required to collect the HST. In general, businesses with sales under the threshold (taxable sales of $30,000) are not required to register and collect tax. Small suppliers that choose not to register are not required to file a tax return and cannot claim input tax credits. If a small supplier chooses to register, it is eligible to claim input tax credits related to its taxable supplies when it files its tax return. The HST -Two Aspects Sales and the HST The tax is added to the customer's invoice, collected from the customer, and remitted to the government. But the HST is a broad tax than the PST. With certain exceptions, it covers the sale of all goods. And it covers services as well. Purchases and the HST You should be aware of another important aspect of the HST. All businesses are entitled to recover the HST that they are charged by their suppliers. They are required to pay the tax to their suppliers, but are entitled to recover this tax from the government. Accounting for the HST By law, the tax payable (as a result of the company's sales) has to be accumulated. The tax recoverable (as a result of the company's purchases) has to be accumulated as well, both to comply with the law and in order to be reclaimed. You will now see how to account for both of these aspects of HST. Accounting for the HST The Accounts for HST There are two accounts for HST in the ledger- HST Recoverable and HST Payable. These two accounts are shown in T-accounts below. HST Recoverable No.225 HST Payable $$$$ $$$$ $$$$ Both HST accounts appear in the Liabilities section of the ledger. A minus (or contra) liability account used to accumulate the HST paid by the business for the reporting period. It is deducted from the amount of the liability-HST Payable. No.220 $$$ $$$ A liability account used to accumulate the HST amounts charged to customers during the reporting period. The business remits the difference between these two account balances. If the HST Recoverable is greater than the HST Payable, the business will claim a refund. In the Books of the Seller In the T-accounts, the transaction appears as follows: A/R M&R Publishing 1,695 Sales 1500 HST Payable 195 the HST owed to the government is accumulated during the reporting period. In the Books of the Purchaser In order to recover the HST added by the seller, the purchaser must account for it. The purchase invoice is the source document for the accounting entry. Office Supplies 849 HST Recoverable 110.37 A/P – The Supply House 959.37 Companies are entitled to recover the HST, so they keep track of amounts paid in a separate account. Remitting the HST Most businesses are required to file monthly or quarterly and must remit the net tax owed within one month following the end of their reporting period. HST Recoverable 110.37 HST Payable 195 Based on the ledger account balances, we must remit a dollar amount to the government The journal entry to record the HST remittance for the taxes for the month of March is as follows: Note the time period This journal entry has the effect of clearing out the balances in the two HST accounts for the reporting period and recording the payment of cash. The Canada Customs and Revenue Agency (CCRA), charges interest and a penalty if the HST is not paid by the due date. HST on the Balance Sheet The smaller account balance is subtracted from the larger. If the difference is a credit, it is shown in the Liabilities section. If the difference is a debit, it may be shown in the Assets section. However, most computer-generated balance sheets will simply show a debit balance as a negative number in the Liabilities section.