Loan Workout Arrangements

advertisement

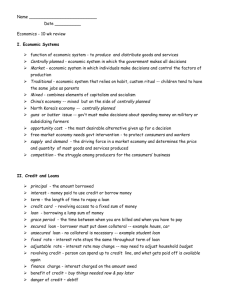

COMMERCIAL LOAN AUDITING FOR INTERNAL AUDITORS June 15, 2011 Presented by: Robin D. Hoag, CPA, CMC Robert M. Parks, CPA Objectives & Overview Solid Understanding of MBL’s Trends in Commercial Lending - MBL’s Regulatory Consideration Risk Management Implications Basic Underwriting Criteria MBL Audit Programs 2 Objectives & Overview Commercial loan workout arrangements Risk rating commercial loans Internal controls Resources Internal Audit Roles 3 Total Business Loans (NMBLB) 1 Total Del Loans - All Types (2 or more Mo) *Total MBL Charge Offs BUSINESS LOANS Member Business Loans (NMBLB) 1 Purchased Business Loans or Participations to Nonmembers (NMBLB) 1 Total MBL's Unfunded Commitments 1 TOTAL BUSINESS LOANS (NMBLB) LESS UNFUNDED COMMITMENTS 1 %(Total Business Loans (NMBLB) Less Unfunded Commitments/ Total Assets) 1 DELINQUENCY - MEMBER BUSINESS LOANS 1 to < 2 Months Delinquent 2 to < 6 Months Delinquent 6 to 12 Months Delinquent 12 Months & Over Delinquent MBL Delinquency MBL CHARGE-OFFS AND RECOVERIES: MBL Charge-offs *Total MBL Recoveries Data for Graphic Billions Total MBL's MBL Delinqucny % MBL Charge-off % 2006 2007 2008 2009 2010 18,891,446,077 21,459,363,443 25,531,770,716 28,279,415,320 30,413,271,788 3,915,871,018 22,807,317,095 1,938,867,620 4,929,242,985 26,388,606,428 1,852,703,145 6,360,143,424 31,891,914,140 1,701,806,459 6,789,563,211 35,068,978,531 1,612,294,689 6,765,768,251 37,179,040,039 1,593,523,144 20,868,449,475 24,535,903,283 30,190,107,681 33,456,683,842 35,585,516,895 2.93 3.25 3.72 3.78 3.89 129,438,460 71,522,982 25,771,636 12,602,739 109,897,357 207,709,817 229,183,178 179,446,067 49,100,897 457,730,142 387,226,608 409,178,047 149,168,321 125,981,018 684,327,386 537,092,843 596,008,756 363,045,974 292,012,289 1,251,067,019 579,835,938 592,237,431 383,528,489 420,137,828 1,395,903,748 25,269,178 4,709,215 37,922,077 3,482,536 131,876,705 7,065,554 223,995,934 6,544,607 289,271,389 7,394,203 22.81 0.48% 0.11% 26.39 1.73% 0.14% 31.89 2.15% 0.41% 35.07 3.57% 0.64% 37.18 3.75% 0.78% Regulatory Considerations Policy – Board Reviewed and Approved Experience in commercial lending - MBL Loan Limits Capital Limitations Concentration risk Credit Risk Insiders Member Business Loans Proceeds used for commercial, corporate, investment, agricultural purposes Balances aggregated to member exceed $50,000 Participation loans, or purchased loans with the same origin from another credit union Regulatory Considerations Prohibited transactions for MBL’s CEO, COO, CFO, senior executives Family members of the above Loans in which the credit union will share profits of the sale Loans to compensated directors Regulatory Considerations Construction and Development Loans for Commercial or Residential Property Limitation of 15% of net worth Single family residences by individual with 25% equity interest are allowed Regulatory Considerations Policies – Written to manage the risk and loan types granted, board approved and annually reviewed NCUA Supervisory Letter: 2009 Current Risks in Business Lending and Sound Risk Management Practices – A Must Read Underwriting and MBL experience required -Two (2) years experience by your commercial lender at a minimum in the type of loans being approved and underwritten MBL Policy - Regulatory Minimums Required Trade areas, geography – knowledge of value Types of business loans to be offered Limitations in terms of MBL to assets and net worth; individual types and aggregate Individual member limits or concentrations Regulatory Considerations Analyze and Document borrowers ability to repay the loan; Underwriting Financial Statements, borrower history & credit Cash flow, interest rates, maturity structure Tax returns Collateral valuation Ownership Loan monitoring and servicing Collateral and Security - Reg Maximum LTV is 80%, unless a government guaranteed, insured or PMI type insurance, or subject to advance purchase by a federal or state agency. With guarantee the maximum is 95% Must provided personal guarantee of the borrower (except is Reg flex qualified) Maximum Loans – Reg. 723.7 Net member business loan maximum One member or group of associated members Greater of these two values below 15% of net worth or $100,000 Unsecured MBL limitations Must be Well Capitalized Lesser of $100,000 or 2.5% of net worth Maximum of all unsecured borrowers 10% of net worth; non-natural person credit card members for routine purchasing???? MBL Maximum Exposure Lesser of 1.75 times credit union net worth or 12.25% of credit union total assets Aggregate limitation will include nonmember loan participation balances outstanding State MBL Regualtions Ten states have approved MBL regulations. COMMERCIAL LOAN UNDERWRITING 17 Credit Worthiness Credit worthiness for the business and sponsor/guarantors is heavily scrutinized Loans get paid somehow Start-up businesses Risk, collateral, management Owner-occupied property 18 Include Five Cs of Credit (P) Character Purpose Capacity Conditions Capital Collateral Basics of Commercial Underwriting Cash flow analysis Loan to value (LTV) Credit worthiness Property / collateral analysis Secondary guarantees Loan structure and covenants 20 Essential Component Details Character Purpose Capacity Conditions Capital Collateral Identify participants Reasons for transaction & client benefit Revenues, earning & cash flow – primary source of repayment Industry trend & analysis, market position, SWOT analysis Equity, sub-debt & retained earnings Type, quality, & coverage (value) – secondary source of repayment Capacity Section Overview Perhaps the most important issue Explain: What is borrower’s capacity to bear burden of proposed debt while still making necessary investments to remain competitive and or viable? Cash Flow Analysis Most important component Debt service coverage (DSC) ratio Minimum requirements Riskier loan types 23 Capacity Components Revenue stability & growth Margin protection – Gross Margin/Sales Less: COGS Cost of Goods Sold Cash flow Fixed charge coverage What is the hurdle? What is pro forma (forecast or porjected)coverage? How much cushion is implied Perform a sensitivity analysis Cash Flow/Fixed Charge Analysis Fixed Charge Coverage Ratio (FCCR) EBITDA / P+I+T+C+D Forward looking analysis Can they repay the proposed debt? NOT a historical review of the performance, cash flows or loan structure covenants Conditions General Define Specific Assess the industry the industry Market position Client specific General Industry Conditions Define and industry – General Cyclical or Seasonal Where are they now? Growth, mature, declining, consolidating Competitive threats Legislative or political threats Specific Industry Conditions Assess the industry – Specific Barriers to entry Competition Customers Suppliers Substitutes Market Position Conditions Market Position – Client Specific Market share Leader / follower RMA statistics (resource & reference in materials) SWOT analysis Strengths Weaknesses Opportunities Threats Capital Member’s “skin in the game” Owner’s investment in the business Paid in capital/Other equity Retained earnings Cushion to withstand disruption Capital Measurements Minimum net worth (tangible NW) Dollar Capital to capitalization Equity / (FD + equity) Debt to equity Debt to enterprise value (FD / (funded debt + equity) Debt to capitalization FD value / (FD + market value equity) Debt to EBITDA Collateral Secondary source of repayment Specify what secures the loan Identify any competing claims Summarize important aspects What is the primary collateral? Quality of collateral (specialized, sing purpose, or active market) Coverage rate or air ball percentage Recovery costs and expectations Collateral Summary Collateral Analysis Example Company ($ in thousands) Actual 12/31/10 Accounts Receivable Inventory ST Assets Collateral $ 33,828 $ 33,828 - Property, Plant, & Equipment - NBV LT Asset Collateral $ 20,885 $ 20,885 - Ineligible/ Foreign Eligible Domestic $ 75.0% 30.0% $ 33,828 33,828 $ $ 20,885 20,885 50.0% Total ST Collateral Total LT Collateral Total Collateral Senior Debt Revolving Credit ($55.0MM) Letters of Credit Senior Term Loan Total Long Term Debt Advance Rate Commitment $ 55,000 $ $ 60,450 115,450 Discounted Value $ $ 25,371 25,371 $ $ 10,443 10,443 $ $ $ 25,371 10,443 35,814 Outstanding $ 1,536 $ 17,226 $ 60,450 $ 79,212 Total Discounted Collateral $ 35,814 Total Collateral Surplus/ (Deficit) - Outstanding Airball Percentage - Outstanding Collateral / Total Outstanding $ (43,398) 54.8% 0.45 x Total Collateral Surplus / (Deficit) - Commitment Airball Percentage - Outstanding Collateral / Total Outstanding $ (79,637) 69.0% 0.31 x Loan to Value (LTV) LTV ratio Loan Amount / Appraised Value = LTV Key risk factor Valuation of property Maximum LTV ratio Property types influence LTV 34 Property / Collateral Analysis Property or collateral analysis is the valuation of assets pledged against a loan Fair market value Investment property collateral Non real estate collateral Forced sale of collateral 35 Internal Controls Separation of functions is critical Credit and Underwriting Approval Process Sales and Relationship Management Collections and Workout Actions RISK RATING COMMERCIAL LOANS 37 Loan Risk Rating System Primary indicator of credit exposure Used for a variety of purposes Approval requirements Portfolio management Identifying problem loans Loan pricing Loan loss reserve calculations An important element No one correct rating system 38 Structure of Rating System Four minimum categories 1. Pass 2. Substandard 3. Doubtful 4. Loss Additional categories 1. Watch list 2. Special mention 39 Pass ratings At least three categories 1. Exception Risk Unquestioned primary source of loan repayment; no apparent risk 2. Very Good or Good Quality Primary source of repayment very likely to be sufficient, with secondary sources readily available; strong financial position; minimal risk; profitability, liquidity and capitalization are better than industry norms 40 Pass ratings At least three categories 3. Acceptable or Standard Primary source of loan repayment is satisfactory, with secondary sources very likely to be realized if necessary; loan within normal credit standards; requires average amount of Loan Officer attention; company is of average size within its industry and may have difficulty accessing or does not have access to public markets for short term or capital needs 41 Marginal Rating Risk rating systems should have a transitory or marginal risk rating classification A credit union should have at least one of the following categories: Watch List Loans having potential weaknesses that deserve management’s attention; these loans don’t go on the special mention list. Not adversely classified and don’t expose an institution to significant risk. 42 Marginal Rating A credit union should have at least one of the following categories: Special Mention Special mention loans are commercial loans needing close operating attention or action to mitigate possible weakness. These commercial loans have emerging identifiable problems. 43 Adversely Classified Risk Ratings Loans with some impairment Fall into three categories 1. Substandard (least severe) Defined weaknesses or negative trends meriting close monitoring 2. Doubtful Vital weaknesses exist where collection of principal is highly questionable 3. Loss (most severe) Uncollectible and of such little value the continuance as an asset is not warranted 44 Substandard Definition Asset inadequately protected by the current sound worth and paying capacity of the obligor or by the collateral pledged, if any. Assets so classified must have well-defined weakness or weaknesses that jeopardize the liquidation of the debt. Categorized by the distinct possibility that the institution will sustain some loss if the deficiencies are not corrected. Non-Interest accrual status has been attained 45 Doubtful Definition An asset having all the weaknesses inherent in one classified substandard with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently known facts, conditions, and values, highly questionable and improbable. 46 Loss Definition Asset is considered uncollectible and of such little value that its continuance on the books is not warranted. This classification does not mean the asset has absolutely no recovery or salvage value; rather it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future. 47 Risk Rating Example Resource MBL Risk Rating Example Document Key Points When are ratings assigned? How often are ratings reviewed? Segregation Examiners 49 MBL AUDIT PROGRAMS & SCOPE CONSIDERATIONS FOR INTERNAL AUDIT See Handout Materials MBL Audit Workpapers ACCT # MEMBER NAME LOAN O/S DATE BALANCE UNFUNDED PRESENT COMMITMENT INT. PMT RATE TERM LOAN COLL. CREDIT TYPE TYPE SCORE DSC RISK RATING LTV CU DM LOAN LOAN INSIDER OFFICER CLOSER Member Business Loans 1234-1 Company A 10/28/2009 675,000.00 - 675,000.00 5,233.27 7.00% 60 CREM Apartments 795/767 1.39x 69.6% 2 2 N RDH Title Co. 1234-2 Company B 06/10/2009 945,485.53 - 945,485.53 8,362.63 6.50% 60 CREM Restaurant 784/744 1.40x 59.1% 2 2 N RDH Title Co. 1234-3 Company C 06/17/2009 1,042,071.30 - 1,042,071.30 7,891.63 6.50% 60 CREM Retail 753 1.55x 56.9% 2 2 N RDH Title Co. 1234-4 Company D 12/10/2008 937,275.44 - 937,275.44 6,563.66 6.75% 84 CREM Church n/a 2.88x 30.1% 2 2 N RDH Title Co. 1234-5 Company E 02/04/2009 803,074.93 - 803,074.93 7,141.36 6.40% 84 CREM Retail 808/791 2.46x 38.1% 1 1 N RDH Title Co. 1234-6 Company F 08/06/2009 889,345.84 - 889,345.84 10,377.62 6.75% 60 CREM Grocery Store 798/640 1.59x 66.1% 2 2 N RDH Title Co. 1234-7 Company G 09/11/2009 2,650,000.00 - 2,650,000.00 20,545.42 7.00% 120 CREM Retail 716/755 2.13x 48.2% 1 1 N RDH Title Co. 1234-8 Company H 03/27/2009 2,097,862.03 - 2,097,862.03 14,424.11 6.50% 60 CREM Apartments 677 1.35x 79.2% 2 2 N RDH CUSO 1234-9 Company I 10/19/2009 120,000.00 - 120,000.00 1,051.76 6.50% 60 CREM Apartments 772/772 1.59x 40.3% 2 2 N RDH Title Co. 1234-10 Company J 08/20/2009 4,034,489.30 - 4,034,489.30 28,234.08 6.75% 60 CREM Retail 735/727 1.25x 73.6% 2 2 N RDH Title Co. 1234-11 Company K 05/13/2009 145,438.21 - 145,438.21 1,747.05 7.00% 60 CREM Office 672/700 2.45x 55.9% 3 3 N RDH CU 1234-12 Company L 09/21/2009 100,000.00 Int. Only 6.75% 12 Gas Station 751/786 1.70x 52.8% 3 3 N RDH CU 1234-13 Company M 04/27/2009 708,239.22 708,239.22 4,751.44 6.25% Restaurant 591/598 1.45x 79.2% 3 3 N RDH CU 1234-14 Company N 09/02/2009 45,000.00 350,000.00 Int. Only 7.00% All Assets 787/704 n/a 2 2 N RDH CU 1234-15 Company O 08/12/2009 142,277.05 142,277.05 1,137.82 7.25% Bar/Tavern 672/795 3.12x 79.2% 2 2 N RDH Title Co. - 100,000 305,000 - LOC 180 CREM 12 LOC 120 CREM 14.09x Credit Report Approval Collateral/Mortgage Agreement Commercial Loan Agreement Guarantees Evidence of Lien Placement Title Policy / Search Monitoring of Real Estate Taxes Evidence of Insurance Review and Analysis of Borrower's Cash Flow Review and Analysis of Borrower's Leverage Review and Analysis of Guarantors' F/S Debt Service Ratio Calculation Loan-to-Value (LTV) Financial Statement Monitoring Loan Covenant Monitoring Underwriter's Recommendation Strengths and Weaknesses Identified Policy Exception Indentified Appraisal/Collateral Valuation Environmental Quest. / Phase 1 Risk Rating Specific Loan Loss Reserves ACCT # POLICY, RISK, & PROCEDURES Note EXISTENCE 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Member Business Loans 1234-1 x x x x na x t t na x x x x x x x x x x na x x x na 1234-2 x x x x na x x x na x x x x x x x x x x na x x x na 1234-3 x x x x x x x na x x x x x x x x x x na x x x na 1234-4 x na x x na na x x na x x x na x x x x x x na x x x na 1234-5 x x x x na x x x na x x x x x x x x x x na x x x na 1234-6 x x x x x x e1 na x x x x x x x x x x na x x x na 1234-7 x x x x na x x x na x x x x x x x x x x na x x x na 1234-8 x x x x x x x x na x x na x x x x x x x na x x x na 1234-9 x x x x x x t t na x x x x x x x x x x na x x x na 1234-10 x x x x x x e1 e1 na x x na x x x x x x x na x x x na 1234-11 x x x x x x x x x x x x x x x x x x x na x x x na 1234-12 x x x x x na t t na x x x na x x x x x x na x x x na 1234-13 x x x x x x x x x x x x x x x x x x x na x x x na 1234-14 x x x x x x x na na na x x x x na x na x x na x na x na 1234-15 x x x x x x x e1 na x x x x x x x x x x na x x x na x x Legend x e1 e2 ew na Tested without exception Procedure and Process Exception Best Practice Exception Exception waived by authorized personnel Not applicable ACCT # COMMENTS Member Business Loans 1234-1 1.20x DSC Covenant 1234-2 1.20x DSC Covenant 1234-3 1.20x DSC Covenant 1234-4 1.20x DSC Covenant 1234-5 1.20x DSC Covenant; 15 yr amort - DSC = 3.19x with 25 yr amort 1234-6 1.20x DSC Covenant; no final title policy 1234-7 1.20x DSC Covenant; 100% Occupancy 1234-8 1.20x DSC Covenant; 100% Occupancy 1234-9 1.20x DSC Covenant; 100% Occupancy 1234-10 1.25x DSC Covenant; 100% Occupancy - a 5% vacancy factor was included; no recorded mortgage and final title policy 1234-11 1.20x DSC Covenant; two quarterly loan reviews in file. 1234-12 1.20x DSC Covenant (for CREM) 1234-13 1.20x DSC Covenant; two quarterly loan reviews in file. 1234-14 Partically secured by securites at brok er/dealer ($285thd @5/31/09) 1234-15 1.20x DSC Covenant; no final title policy; LTV includes a $104thd SBA loan, without SBS LTV is under 50% Existence Assertion Testing Trace loan amount, date, payment, interest rate, and type from loan subsidiary system to loan note. Examine current credit report. If lender uses risk-based underwriting and/or pricing system, vouch credit score/grade to credit report. Examine documented approval within loan policy limits. Policy, Risk & Procedures Testing Trace loan amount, date payment, interest rate and type from loan subsidiary system to executed collateral documents Trace loan covenant and financial statement requirements to executed business loan agreement Trace guaranty amounts and type of guarantees from loan approval document to executed guaranty documents Review evidence of lien placement, such as UCC filing statements, a recorded mortgage, or final title policy Review final title policy; verify (1st Mtg.) or title search verify (2nd Mtg.) Review evidence that taxes are monitored and paid current Policy, Risk & Procedures Testing Review evidence of hazard insurance naming lender as beneficiary for proper amount. Examine approval/credit file to verify borrower's cash flow position is reviewed and analyzed from the most recent F/S. Examine approval/credit file to verify borrower's leverage position is reviewed and analyzed from most recent F/S Examined approval/credit file to verify guarantor’s recent F/S are reviewed and analyzed Verify DSC ratio was accurately calculated and within lender's policy guideline Verify LTV ratio is within lender's policy and supported by acceptable invoice, sales receipt, or appraisal Policy, Risk & Procedures Testing Examine credit file for f/s monitoring Examine credit file for covenant monitoring Examine approval for underwriter's recommendation Examine approval for deal's strengths and weaknesses Examine approval for deal's policy exceptions Examine appraisal; trace amount and valuation date to requirement in the approval, such as if a new appraisal ordered prior to funding Examine environmental due diligence Verify loan is properly risk rated in accordance to institution’s risk rating policy Assess loan loss reserve for loan if there is a specific reserve COMMERCIAL LOAN WORKOUT ARRANGEMENTS 58 Elements for Loan Workouts Manage workout activity Document financial condition Identify and track performance and risk Regulatory reporting Loan collection procedures Adherence to lending limits 59 Loan Workout Arrangements Workouts can take many forms Should improve lender’s prospects for repayment Need to analyze repayment capacity and collateral Maximize recovery Credit unions should not be criticized Concessions require ALLL recognition 60 Analyzing Repayment Capacity Primary focus of examiner’s Borrower character Nature and degree of protection Market conditions that influence repayment Prospects for guarantor support 61 Evaluating Guarantees Guarantees may improve the prospects for repayment Financially responsible guarantor Financial capacity Adequate support for repayment Legally enforceable Guarantor’s global financial condition Willingness to fulfill all current and previous obligations 62 Assessing Collateral Ongoing procedure for monitoring value A new or updated appraisal or evaluation Market Value vs. Fair Value Current “as is” condition Use the market value conclusion What examiners will look at 63 FORECLOSED AND OREO MBL ASSETS See Handout Materials Cash Flow Analysis Cash Flow Analysis Cash Flow Analysis Cash Flow Analysis Cash Flow Analysis 2603 Augusta Drive Suite 1100 Houston, Texas 77057 www.doeren.com 755 West Big Beaver Road Suite 2300 Troy, Michigan 48084 Thank You! Robin D. Hoag, CPA, CMC Director, Financial Institutions Group Phone: (248) 709-1270 Email : hoag@doeren.com Robert Parks, CPA Director, Financial Institutions Group Office: (248) 244-3049 Cell : (248) 709-1046 Email : parks@doeren.com Financial Institutions Group Services Audit Mergers & consolidations IT assurance Controls reviews Vulnerability assessments Penetration testing Commercial loan review Loan loss & delinquency control Regulatory compliance services 71 Resources The Risk Management Association: Annual Statement Studies – Financial Ratio Bookmarks 2010/2011 (www.rmahq.org)