Foundations of Personal Finance

advertisement

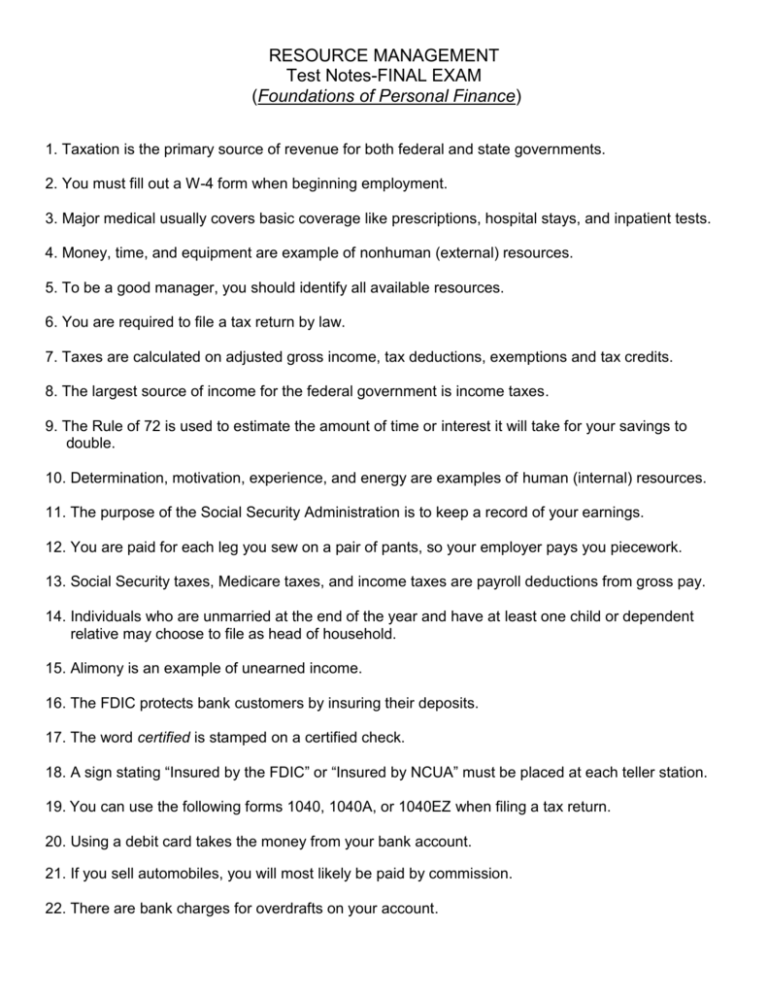

RESOURCE MANAGEMENT Test Notes-FINAL EXAM (Foundations of Personal Finance) 1. Taxation is the primary source of revenue for both federal and state governments. 2. You must fill out a W-4 form when beginning employment. 3. Major medical usually covers basic coverage like prescriptions, hospital stays, and inpatient tests. 4. Money, time, and equipment are example of nonhuman (external) resources. 5. To be a good manager, you should identify all available resources. 6. You are required to file a tax return by law. 7. Taxes are calculated on adjusted gross income, tax deductions, exemptions and tax credits. 8. The largest source of income for the federal government is income taxes. 9. The Rule of 72 is used to estimate the amount of time or interest it will take for your savings to double. 10. Determination, motivation, experience, and energy are examples of human (internal) resources. 11. The purpose of the Social Security Administration is to keep a record of your earnings. 12. You are paid for each leg you sew on a pair of pants, so your employer pays you piecework. 13. Social Security taxes, Medicare taxes, and income taxes are payroll deductions from gross pay. 14. Individuals who are unmarried at the end of the year and have at least one child or dependent relative may choose to file as head of household. 15. Alimony is an example of unearned income. 16. The FDIC protects bank customers by insuring their deposits. 17. The word certified is stamped on a certified check. 18. A sign stating “Insured by the FDIC” or “Insured by NCUA” must be placed at each teller station. 19. You can use the following forms 1040, 1040A, or 1040EZ when filing a tax return. 20. Using a debit card takes the money from your bank account. 21. If you sell automobiles, you will most likely be paid by commission. 22. There are bank charges for overdrafts on your account. 23. To earn top dollar on your savings, you should look for highest APY, frequent compounding of interest and short interest periods. 24. Contents of safe deposit boxes are not insured under the FDIC. 25. The Federal Deposit Insurance Corporation insures your money up to $250,000.00. 26. A mutual savings and loan is a savings and loan owned by and operated for the benefit of their depositors. 27. An account holder can transfer money between accounts, review account history and pay bill with online banking. 28. An ATM card will not allow you to purchase merchandise at a POS terminal. 29. Individuals who do not have a bank account can pay their bills with a money order, cashier’s check and traveler’s check. 30. A check is a written order for a bank to pay a specific amount to someone. 31. A tax credit is an amount subtracted from the taxes you owe if you are eligible. 32. A Social Security number is required by banks to open an account. 33. Seals of approval are a common from of testing and rating. 34. A title loan requires you to give your car as collateral. 35. Electronic Funds Transfer (EFT) systems use electronic impulses to activate financial transactions instead of cash, checks, or paper records. 36. Your credit report largely determines whether you can get credit when you need it. 37. Carry only the credit cards you really need and use. 38. Overspending is easy with a credit card. 39. An amount you must pay toward your medical expenses before insurance pays is the deductible. 40. Credit can make it possible for you to spend more than you earn. 41. Pawnshops give customers high interest loans with collateral. 42. Experian, Equifax, and TransUnion, LLC., are examples of credit reporting agencies. 43. Loans that require collateral are secured loans. 44. There are laws that regulate and govern labeling, marketing, clothing and textiles. 45. The total amount you pay for credit is based on interest rate charged, amount of credit used and length of the repayment period. 46. Your credit score changes as your financial history and obligations change. 47. The Truth in Lending Act requires contract to include penalties for late payment, description of collateral, and amount financed. 48. A collection agency’s main purpose is to collect debts. 49. A Visa card is an example of a revolving credit account. 50. The main purpose of insurance is to provide financial protection in the event of illness, injury, accidents, property losses and death. 51. Disability insurance may replace 60-70% of income loss. 52. Renters insurance will cover the loss of electronics. 53. Credit cards, debit cards, and ATM cards are all different. 54. An insurance coverage that protects you when you cause an auto accident with injuries is bodily injury liability. 55. HMOs force you to pick a doctor from a list. 56. Double indemnity provides for double benefits if a death is accidental. 57. Food packages must have nutritional information. 58. The Fair Labor Standards Act is used by the government to set minimum wage. 59. If you are hurt on the job, you are covered by law under workers’ compensation insurance. 60. You took a cash advance when you obtained a loan against the available credit on your account.