File - BSC Economics

advertisement

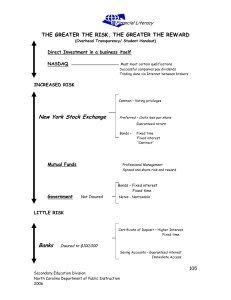

INSTITUTE OF MANAGEMENT SCIENCES HAYATABAD – PESHAWAR Programme: Course Title: Course Code: Nature of Course: BBA, BSc (Eco.) (Honours) Financial Markets & Institutions BSc.(Eco.) Core Course, 3 Credit-Hours Course Objectives: This course will able students to understand the financial institutions, services of the financial institutions, capital, types of capital, types of capital market and about investment in the financial institutions; the role of financial market in the economic growth and environment and different capital market instruments. Course Outline Topic OVERVIEW OF FINANCIAL SYSTEM Subtopics MEASURING INTEREST RATE CENTRAL BANK COMMERCIAL BANKING Overview Of Financial System Financial Institutions Structure Of Financial Market Function Of Financial Intermediaries Characteristics And Types Of Financial Markets Asset Liability Management Asymmetric Information Distinction Between Real And Nominal Interest Rate Distinction Between Interest Rate And Return Determinant Of Asset Demand Supply And Demand In The Bond Market Functions of central bank Credit control Monetary policy and its tools, goal and objectives Functions And Regulations Portfolio Management Regulation Of Commercial Banks PRIMARY MARKETS Traditional Process for Issuing New Securities Investment Bankers Variations in Underwriting o Bought Deal o Auction Process o Preemptive Rights Offering o Private Placements SECONDARY MARKETS Functions of Secondary Markets Trading locations Market Structures Role of Brokers and Dealers MONEY MARKET Why Do We Need Money Market? Characteristics Of Money Market Money Market Instruments o Treasury Bills o Federal Funds o Repurchase Agreements o Negotiable Certificate of Deposit CAPITAL MARKET Purpose Of Capital Market Capital Market Participants Types Of Bonds o Treasury Bonds o Municipal Bonds o Corporate Bonds NON-BANK THRIFT INSTITUTIONS AND OTHER FINANCIAL FIRMS The Mutual Fund (Investment Companies) o Benefits Of Mutual Funds o Mutual Funds Structure o Investment Objective Class Insurance Companies o Fundamental Of Insurance o Types Of Insurance Recommended Book: Text book: Fredricks S. Mishkin, Stanley G. Eakins; Financial Market & Institutions; 5th ed Reference book: