Monthly Investment Commentary

advertisement

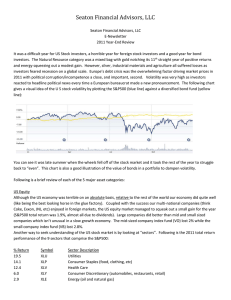

The Quarter in Review Time is certainly flying by, as we have moved past Benchmark Returns Ending 06/30/2012 the halfway point in 2012. The euphoria that Benchmark QTR YTD S&P 500* -2.5% 8.5% swept over the markets in the first quarter was Russell 2000 -3.6% 9.2% quickly replaced by the continued worries over MSCI EAFE* -6.3% 4.3% Europe’s sovereign debt crisis. While the markets MSCI Emerging Markets* -8.5% 5.6% held out hope that Europe would be able to right Barclays Domestic Aggregate Bond 2.1% 2.4% the ship, or that the Federal Reserve would ride to *Price Returns the rescue, this was replaced by the reality that the fundamentals of the global economy are showing signs of strain. Global economic growth has been revised lower for 2012 by the IMF. Investment analysts are beginning to lower their full year US GDP growth forecasts in light of recent earnings announcements from several major multi-national companies. Interest rates have reverted to their Greek crisis lows, with US 10 Year Treasury bonds trading below 1.5%. Additionally, as we theorized in last quarter’s letter, the US Dollar has been the beneficiary of the flight to safety, and is now trading at multi- year highs. As a result of the negative news, large company stocks finished the quarter lower by -2.5%, while small company stocks finished lower by -3.6%. International markets suffered under the continued news of Europe’s sovereign crisis. As a result, foreign large company stocks finished down -6.3%, while emerging markets stocks finished down -8.5%. Domestic bonds remained a safe haven, returning 2.1% for the quarter. The Quest for Yield For the better part of twenty years, investors have seen interest rates decline, as evidenced by the yields on the 10 Year US Treasury bond. There are a myriad of reasons as to why bond yields have declined: Federal Reserve policy, flight to safety during turmoil, low inflation expectations, etc. While this has benefited the US and corporations who borrow money, the results have been devastating to investors who require interest income to fund their retirement objectives. Increasingly, our clients are asking, “what, if anything, can be done to increase returns while preserving capital?” Unfortunately, there isn’t an easy answer to this question. When talking about increasing bond returns, typically there are two basic steps that can be taken: increase the maturity profile of the portfolio, or decrease the credit quality in order to earn a high coupon return. Given the current economic environment, both domestically and internationally, we believe that neither option is viable. With interest rates at multi-decade lows, just like a coiled spring, interest rates have only one way to go; higher. A comparison has been made between the US and Japan highlighting how Japan’s use of monetary policy to force interest rates lower in an attempt to jumpstart their economy led to the “lost generation” of growth. While the US has been experiencing below average interest rates for more than three years as a result of the Federal Reserve’s intervention into the markets, the structural differences in how the two governments of both countries borrow that renders that a moot comparison. The key however for fixed income investors in the US will be the timing of the first move higher in rates. When interest rates do begin to increase, bonds in the portfolio will begin to lose value. While it might be tempting to go out a bit farther on the maturity scale and buy longer-dated bonds, it’s important to remember that while there may be a need for higher levels of income to fund cash flow needs in retirement, the consequence of extending the maturities of the bond portfolio may lead to a decline in principal value. As for purchasing lower credit quality bonds to increase the coupon return, we believe that we are entering a new phase in the economic cycle that might make these investments less attractive. Typically referred to as High Yield bonds, these bonds are issued by companies that have ratings less than investment grade. As a result, their borrowing costs are higher, which means investors receive a higher coupon for the risk they are taking. However, these companies typically suffer the most when either the economy starts to show signs of weakness, or interest rates rise forcing their cost of borrowing higher. Given the recent release of economic data, we believe that the US economy has re-coupled with the rest of the developing world, and is now showing signs of strain and slowing. What to do? While we are certainly in a challenging environment for fixed income investors, there are opportunities to increase returns without resorting to the above mentioned steps. Municipal bonds continue to show strong performance on an after-tax adjusted basis. With the scheduled tax increases as part of the Affordable Healthcare Act beginning in 2013, municipal bonds should become even more attractive for their after tax returns. And while the recent news about defaults is worrisome, there are a number of high credit quality issuers that offer attractive returns. In an effort to anticipate higher interest rates in the future, shorter high quality bonds offer not only a hedge on rising interest rates, but also exhibit less volatility during market turmoil. As part of the broader asset allocation discussion, we continue to favor those asset classes that offer the potential to hedge expected US dollar weakness, specifically commodities. In the near-term, we expect the US dollar to strengthen due to continued uncertainty overseas. However, longer-term the structural fundamental weakness of the US economy will require a weak monetary policy to boost growth leading to high commodity costs and higher interest rates. Commodities provide a natural way to preserve future purchasing power with the potential for modest capital gains. Finally, within the equity space, we continue to favor large US companies, specifically those with stable or growing dividends. These companies typically have solid track records in growing their businesses and earnings and as a result, don’t exhibit the same kind of volatility when markets correct. If we are truly entering into a slowing phase of the economy, we would expect US companies to outperform their international counterparts as capital floods into the US markets to escape the uncertainty overseas.