Overview of Financial Statement Analysis

advertisement

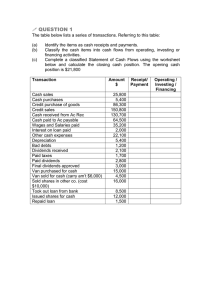

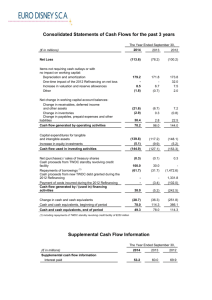

Understanding the Statement of Cash Flows Chapter 4 Contents • Understand the cash flow statement and how it relates to other financial statements • Direct and indirect methods of presenting operating cash flows • Investing and financing activities • Disclosure of noncash transactions • Free cash flow and analysis Ch 4 2 Importance of cash flows • Accrual-based accounting requires reporting revenues when earned and expenses when incurred – not when cash is exchanged. • A company cannot pay employees, creditors and others with accrual-based net income. • Valuation models used in financial analysis are often based on projections of future cash flows. Ch 4 3 Statement of Cash Flows • Summarizes all activity in the cash accounts of the firm via three categories: • Operating – Indirect format – Direct format • Investing • Financing Ch 4 4 Motorola, Inc. and Subsidiaries Years Ended December 31 (in millions) Net cash provided by (used for) operating activities Net cash provided by (used for) investing activities Net cash provided by (used for) financing activities Effect of exchange rate change on cash and cash equivalents NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR CASH AND CASH EQUIVALENTS, END OF YEAR Ch 4 2001 1,976 2,477 (1,820) 2000 (1,164) (4,091) 5,119 1999 2,140 (960) 788 148 (100) (33) 2,781 3,301 6,082 (236) 3,537 3,301 1,935 1,602 3,537 5 Nokia Cash flow summary (EURm) 2001 2000 1999 Operating 6,547 3,509 3,102 Investing (2,679) (2,531) (1,359) Financing (1,895) (1,034) (574) Ch 4 6 Operating activities • Primarily captures – Income statement items – Short-term/operating assets – Short-term/operating liabilities • Methods of presentation – Indirect – Direct Ch 4 7 Cash Flows from Operating Activities Indirect method • Reconciles accrual-based net income with cash generated via operations • Begin with accrual-basis net income – Adjust accrual items to reflect cash basis • Noncash items (depreciation and amortization) • Changes in working capital (current assets, current liabilities) • Reclassify nonoperating items – Appear in other sections of the Statement • Gains/losses on sales of fixed assets or debt extinguishment Ch 4 8 Adjustments on Net Income to Derive Operating Cash Flows Add back noncash expenses – Depreciation and amortization Add working capital decreases – – Decreases in current assets Increases in current liabilities Subtract working capital increases – – Increases in current assets Decreases in current liabilitie Adjust nonoperating items (e.g., gain from sale of fixed assets) •Accruals = Operating Income – Operating cash Flows Ch 4 9 Motorola, Inc. and Subsidiaries Consolidated Statements of Cash Flows Years Ended December 31 (in millions) 2001 OPERATING Net earnings (loss) (3,937) Adjustments to reconcile net earnings (loss) to net cash provided by (used for) operating activities: Depreciation and amortization 2,552 Charges for reorganization of businesses and other charges 5,998 Acquired in-process research and development charges 40 Gains on sales of investments and businesses (1,931) Deferred income taxes (2,273) Changes in assets and liabilities, net of effects of acquisitions and dispositions: Accounts receivable 2,445 Inventories 1,838 Other current assets 249 Accounts payable and accrued liabilities (3,030) Other assets and liabilities 25 Net cash provided by (used for) operating activities 1,976 Ch 4 2000 1999 1,318 891 2,527 2,371 1,483 332 (1,570) 239 1,893 67 (1,180) (443) (1,471) (2,305) (532) (666) (519) (1,164) (135) (678) (16) 361 (991) 2,140 10 Nokia Consolidated Cash Flow Statements, IAS Financial year ended December 31, 2001 2000 EURm EURm Cash flow from operating activities Net profit 2,200 3,938 Adjustments, total 4,132 2,805 Net profit before change in net working capital 6,332 6,743 Change in net working capital 978 (1,377) Cash generated from operations 7,310 5,366 Interest received 226 255 Interest paid (155) (115) Other financial income and expenses 99 (454) Income taxes paid (933) (1,543) Net cash from operating activities 6,547 3,509 Ch 4 1999 EURm 2,577 1,928 4,505 (21) 4,484 189 (212) (113) (1,246) 3,102 11 Cash Flows from Operating Activities Direct method • • • • • Cash from customers Cash to suppliers Cash for wages Cash for SGA Cash for interest… Ch 4 12 Calculating Cash from customers + Beginning balance in Accounts Receivable + Revenues - Ending Accounts Receivable = Cash received from customers Beginning A/R + Sales – Payments received = Ending A/R Ch 4 13 Calculating Cash paid to suppliers + Cost of (sales) revenue +/- Increase (decrease) in inventory -/+ Increase (decrease) in accounts payable = Cash paid to suppliers The cost of what was sold adjusted for changes in inventory and payments made. Ch 4 14 Motorola’s Cash from Operating Activities in Direct Method Format Cash received from customers 32,449 Cash paid to suppliers (22,637) Cash paid for S, G & A (1,998) Cash paid for research and development (4,318) Cash paid for interest (844) Cash paid for taxes (676) Cash from operating activities Ch 4 1,976 15 Nokia’s Cash from Operating Activities in Direct Method Format Cash received from customers 30,905 Cash paid to suppliers (18,156) Cash paid for S, G & A (2,556) Cash paid for research and development (2,558) Cash paid for interest (155) Cash paid for taxes (933) Cash from operating activities Ch 4 6,547 16 Cash Flows from Investing Activities • Typically involves noncurrent capital (longterm) assets • Cash acquisitions of investments, property • Cash generated upon disposal of assets • Noncash acquisitions/disposals are reported as Supplemental Information rather than in the body of the Statement of Cash Flows Ch 4 17 Motorola, Inc. and Subsidiaries Years Ended December 31 (in millions) 2001 INVESTING Acquisitions and investments, net (512) Proceeds from dispositions of investments and businesses 4,063 Capital expenditures (1,321) Proceeds from dispositions of property, plant and equipment 14 Sales (purchases) of short-term investments 233 Net cash provided by (used for) investing activities 2,477 Ch 4 2000 1999 (1,912) 1,433 (4,131) 174 345 (4,091) (632) 2,556 (2,856) 468 (496) (960) 18 Nokia Consolidated Cash Flow Statements, IAS Financial year ended December 31, 2001 2000 EURm EURm Cash flow from investing activities Acquisition of Group companies, net of acquired cash (131) (400) Purchase of non-current available-for-sale investments (323) (111) Additions in capitalized development costs (431) (393) Long-term loans made to customers (1,129) (776) Proceeds from (payment of) other long-term receivables 84 Proceeds from (payment of) short-term receivables (114) 378 Capital expenditures (1,041) (1,580) Proceeds from disposal of share in Group companies, net of disposed cash 4 Proceeds from sale of non-current available-forsale investments 204 75 Proceeds from sale of fixed assets 175 221 Dividends received 27 51 Net cash used in investing activities (2,679) (2,531) Ch 4 1999 EURm (178) (37) (271) (171) 128 (1,302) 27 121 318 6 (1,359) 19 Cash Flows from Financing Activities • Long-term liabilities – Cash from borrowing – Cash used for repayment of principle – Under IAS cash interest payments may be here • Equity – Cash from stock issuance – Cash used to purchase treasury shares – Cash used for dividend payments Ch 4 20 Motorola, Inc. and Subsidiaries Years Ended December 31 (in millions) 2001 FINANCING Net proceeds from (repayment of) commercial paper and short-term borrowings (5,688) Net proceeds from issuance of debt 4,167 Repayment of debt (305) Issuance of preferred securities of subsidiary trust Issuance of common stock 362 Payment of dividends (356) Net cash provided by (used for) financing activities (1,820) Ch 4 2000 3,884 1,190 (5) 383 (333) 5,119 1999 (403) 501 (47) 484 544 (291) 788 21 Nokia Consolidated Cash Flow Statements, IAS Financial year ended December 31, 2001 2000 EURm EURm Cash flow from financing activities Proceeds from share issue 77 72 Purchase of treasury shares (21) (160) Capital investment by minority shareholders 4 7 Proceeds from long-term borrowings 102 Repayment of long-term borrowings (59) (82) Proceeds from (repayment of) short-term borrowings (602) 133 Dividends paid (1,396) (1,004) Net cash used in financing activities (1,895) (1,034) Ch 4 1999 EURm 152 (25) 28 (6) (126) (597) (574) 22 Statement of Cash Flows Additional Disclosures 1. Cash paid for interest 2. Cash paid for taxes • Presented at end of statement (GAAP) or in body of statement (IAS) • May also highlight significant noncash transactions Ch 4 23 Motorola, Inc. and Subsidiaries Years Ended December 31 (in millions) Effect of exchange rate change on cash and cash equivalents 2001 148 2000 (100) 1999 (33) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR CASH AND CASH EQUIVALENTS, END OF YEAR 2,781 3,301 6,082 (236) 3,537 3,301 1,935 1,602 3,537 844 676 529 130 323 301 Supplemental Cash Flow Information CASH PAID DURING THE YEAR FOR: Interest Income taxes Ch 4 24 Nokia Consolidated Cash Flow Statements, IAS Financial year ended December 31, 2001 2000 Foreign exchange adjustment (43) 80 1999 99 Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 1,930 4,183 6,113 24 4,159 4,183 1,268 2,891 4,159 Change in net fair value of current Available-forsale investments As reported on balance sheet 12 6,125 4,183 4,159 Ch 4 25 Cash analysis • Determine and examine all sources and uses of cash • Determine 2 definitions of free cash flows – To the Firm, available to both debt and equity holders – To Equity, available to equity holders only – Important for valuation (present value of expected future free cash flow) Ch 4 26 Free Cash Flow to the Firm Operating cash flow Plus: Interest Paid Times (1-tax rate) Less: Investments in Fixed Capital Free Cash Flow to the Firm (to both debt holders and stock holders) Ch 4 27 Free Cash Flow to Equity Operating cash flow Less: Investments in Fixed Capital Plus: New Debt Borrowing Less: Debt Repayment Free Cash Flow to Equity Ch 4 28 Earnings before Interest, Taxes, Depreciation and Amortization EBITDA Net income (loss) Plus: Interest expense Plus: Tax expense Plus: Depreciation & Amortization expense Free Cash Flow Estimate (to firm) Ch 4 29 Relevance of Cash Flows and Income over a Company’s Life Cycle + Financing cash flow Inception Free cash flow Operating cash flow Income Growth Maturity Decline Investing cash flow Ch 4 30 Earnings and Cash Flow, which is more value relevant? • If you could trade stocks based on perfect foresight of next year’s --earnings --cash flow which will help you earn higher returns? • The power to predict future cash flows Ch 4 31 Financial Accounting Relevance of Accounting Numbers Percent of Stock Price Explained Relation between Accounting Numbers and Stock Prices 100% 80% Book Value 60% Earnings 40% Combined 20% 0% 65 70 75 80 85 90 95 Year Ch 4 32 Accruals--The Cornerstone Percent of Price Explained Relation between Stock Prices and Various Income and Cash Flow Measures for a Large Sample of Companies 70.00 60.00 57.62 44.36 50.00 40.00 33.02 32.62 30.00 20.00 10.00 1.00 0.00 NIBX NI OCF FCF NCF NIBX = Net Income before Extraordinary Items and Discontinued Operations; NI = Net Income; OCF = Operating Cash Flow; FCF = Free Cash Flows; NCF = Net Cash Flow (Change in Cash). Ch 4 33 Accruals--The Cornerstone Relation between Stock Returns and both Income and Operating Cash Flows for Different Horizons of a Large Sample of Companies . 45.00 40.26 Percent of Stock Returns Explained 40.00 35.00 30.00 25.00 OCF NI 20.00 16.20 15.00 10.88 10.00 3.24 5.00 3.18 0.10 0.00 Quarter Annual Four-Year Time Horizon Source: Dechow, P Ch 4 34