LKAS 7- Statement of cash flows

advertisement

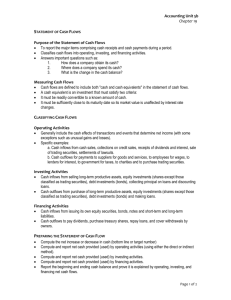

LKAS 7- Statement of cash flows The aim of LKAS 7 is to provide information to the users of financial statements about ability of an entity to generate cash & cash equivalents. The objective of LKAS 7 is to require the provision of information about the historical changes in cash & cash equivalents of entity by means of a statement of cash flows which classified cash flows during the period from Operating, investing & financing activities Definitions • Cash : Comprises of cash on hand & demand deposits • Cash equivalents: Short-term, highly liquid investments that are readily convertible to known amount of cash. • Cash flows: are inflows & outflows of cash & cash equivalents • Operating activities: principal revenueproducing activities; and those that are not investing or financing activities. • Investing activities: are the acquisition & disposal of non current assets and other investments not included in cash equivalents • Financing activities: activities that result in changes in the size & composition of the equity capital & borrowing s of the entity Operating activities • Cash receipts from sale of goods & rendering services • Cash receipts from royalties, fees, commissions & other revenues • Cash payments to suppliers for goods & services • Cash payments to & on behalf of employees Investing activities • Cash payments to acquire property plant & equipments, intangible & other non current assets • Cash receipts from sales of PPE, intangibles & other non current assets • Cash payments to acquire shares or debentures of other enterprises • Cash receipts from sales of shares or debentures of other enterprises Financing activities • Cash proceeds from issuing shares • Cash payments to owners to acquire or redeem shares of the enterprise • Cash proceeds from issuing debentures, loans, notes, bonds, mortgages & other short or long term borrowings • Cash repayments of amounts borrowed Preparation cash flow statement Reporting cash flows from operating activities • Direct method : disclose major classes of gross cash receipts & gross cash payments • Indirect method: Net profit or loss is adjusted for the effects of transactions of a non cash nature, any deferrals or accruals of past or future operating cash receipts or payments & items of income or expense associated with investing & or financing cash flows • Using direct method • Example: Rs ‘000 Cash flows from operating activities – Cash receipts from customers – Cash paid to suppliers & employees – Cash generated from operations – Interest paid – Income tax paid – Net cash flow from operating activities xxx (xxx) xxx (xx) (xx) xxx • Indirect method Rs ‘000 Profit before interest & tax* Add: Depreciation Loss/(Profit) on sales of non current asset (Increase)/Decrease in inventories (Increase)/Decrease in receivables Increase/(Decrease) in receivables Cash generated from operations Interest paid Income tax paid Net cash flows from operating activities * Note: If you PAT , interest should be add back xxx x x (x)/x (x)/x x/(x) xx (x) (x) xx • Components of cash & cash equivalents The components of cash & cash equivalents should be disclosed and reconciliation should be presented, showing the amounts in the statement of cash flows, reconciled with the equivalents items reported in the statement of financial position.