Required Supplemental Information Reconciliation of

advertisement

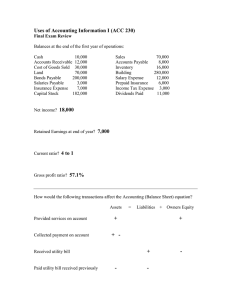

Statement of Cash Flows: Direct Method Chapter 13 McGraw-Hill/Irwin © 2009 The McGraw-Hill Companies, Inc. THE BOSTON BEER COMPANY, INC. CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) Three months ended In thousands March 31, 2007 Cash flows from operating activities: Cash collected from customers $ 70,481 Cash collected from interest 1,132 Cash payments to suppliers (37,363) Cash payments for expenses (32,499) Cash payments for income taxes (3,882) Net cash provided by operating activities $ (2,131) Remember that when we prepared the operating section using the indirect method, we also arrived at net cash inflow of $2,131. Process of Determining Cash Flows Directly • Start with the Income Statement and account for each item on the income statement. • Example: Look at the Income Statement for P13-1 Income Statement for 2011 Sales $195,000 Cost of Goods Sold $ (92,000) Depreciation Expense $ (13,250) Other Expenses $ (43,000) Net Income $ 46,750 Process of Determining Cash Flows Directly • Convert each item on the income statement to Cash flow • Start with SALES: convert to Cash Received From Customers Sales + Beginning A/R – Ending A/R Process of Determining Cash Flows Directly • Cost of Goods Sold to Cash Paid to Suppliers • What were purchases of Inventory? Recall: BI + Purchases – EI = COGS You know BI, EI and COGS so you can calculate Purchases Purchases = COGS +EI –BI • Convert Purchases to CASH PURCHASES: Purchases + Beg A/P – End A/P Process of Determining Cash Flows Directly • ALL Other Expenses – If the Expense is different from the Cash Payment, there will be an associated Payable or Prepaid Expense. – If there is a related Payable Account, you assume you pay the beginning balance with cash and do not pay the ending balance. So… – Cash Payment for Expense = Expense + Beg payable – End Payable – If there is a related PREPAID Account, any cash you paid for the expense is the amount of the cash flow (look for increases to the account). The use of prepaid expense is not a cash expense. • This information would need to be described in the ADDITIONAL INFORMATION. Process of Determining Cash Flows Directly • Other Revenues (Dividends and Interest) – Determine the amount paid for dividends (should be given in the additional information). – You can assume interest revenue is equal to interest received unless you see interest receivable. If there is interest receivable, assume you receive the beginning balance and do not receive the ending balance of the receivable. Additional Cash Flow Disclosures Required Supplemental Information 1. Reconciliation of net income to cash flow from operations. 2. Cash paid for income taxes and interest. 3. Significant noncash investing and financing activities. Significant noncash investing and financing transactions do not involve cash. Example: Purchase of a building with a mortgage.